Wall Street "Guessing the Intent": Cut interest rates by 50 or 25, the next 12 hours will tell?

當前市場飆升的 50 基點降息預期,來自上週被懷疑是 “放風” 的媒體報道。若美聯儲沒有新的放風來澄清,那這一預期可能會進一步升温。

當前,市場對美聯儲降息 50 基點的預期飆升。值得注意的是,此次市場情緒的轉變並非源於新的經濟數據或美聯儲政策轉向,而是來自上週被懷疑是 “放風” 的媒體報道。

當前,美聯儲正處政策發佈前的 “靜默期”,不會有官員自己出來講話。所以,向 “喉舌” 吹風就成了引導預期的 “利器”。

德銀全球經濟和專題研究主管 Jim Reid 認為,而如果接下來 12 小時美聯儲沒有通過媒體放風來澄清,那市場對於 50 基建降息預期將進一步走高:

“未來 12 小時的媒體動向至關重要,或將最終決定市場定價。"

媒體 “放風” 引導預期?華爾街 “揣摩上意”

安聯集團首席經濟顧問 Mohamed El-Erian 表示:

“市場對美聯儲本週降息 50 個基點的預期升温,並已成為交易員眼中的最可能結果,超過了降息 25 個基點的預期......

市場情緒主要受到《華爾街日報》和《金融時報》上週五 “知情人士報道” 的影響,而美聯儲官員在隨後的市場波動中也並未對此明確反駁。”

華爾街見聞提及,上週,“新美聯儲通訊社” Nick Timiraos 發表了一篇文章,認為 25 個基點和 50 個基點的降息是一個 “接近的抉擇”。無獨有偶,金融時報的 Colby Smith 也發表了類似觀點的文章。

而這兩篇文章,被華爾街認為是美聯儲向市場 “吹風”,進而引發了市場對降息幅度的重新評估,降息 50 個基點的概率大幅上升。

此外,15 日,《華爾街日報》資深央行記者 Greg Ip 根據當前的經濟形勢分析,認為美聯儲進一步降息的需求愈加明顯,他呼籲降息 50 個基點。

當前,美聯儲正處政策發佈前的 “靜默期”,不會有官員自己出來講話。所以,向 “喉舌” 吹風就成了引導預期的 “利器”。研究機構 Bianco 總裁 James Bianco 分析稱:

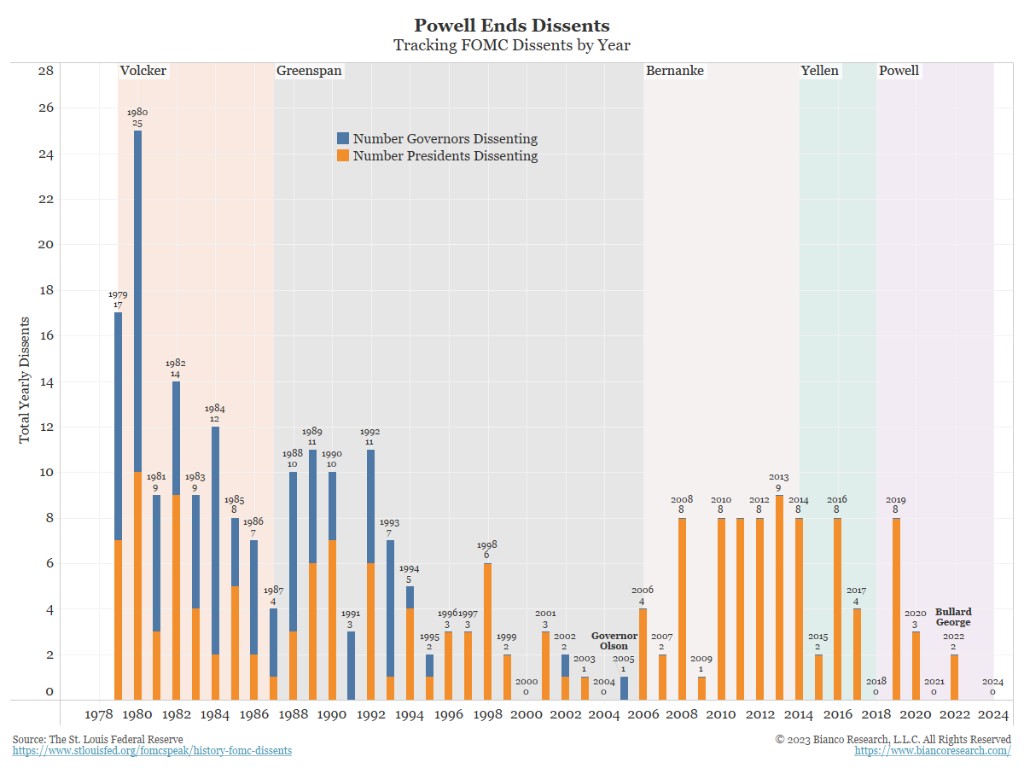

美聯儲主席鮑威爾一直致力於在每次政策決定中都獲得聯邦公開市場委員會(FOMC)12:0 的投票結果,以彰顯政策的權威性和可信度。

然而,這種追求 “完美共識” 的做法,實際上給了每個美聯儲成員 “一票否決權”。例如,最鷹派的克里斯·沃勒,在發表給只接受降息 25 個基點的講話後,便導致市場預期迅速轉向,降息 50 個基點的概率從 60% 大幅下降至 20%。

為避免市場持續動盪,預計鮑威爾將在最終決定前夕,通過 “美聯儲喉舌” 向市場釋放明確信號,以引導預期。

過去四年中,美聯儲內部僅出現過兩次異議,且均發生在 2022 年,創下 70 多年來的最低紀錄。

德銀:接下來 12 個小時就見分曉?

那麼,週三美聯儲究竟會降息 25 還是 50 個基點?

德意志銀行分析師 Matt Raskin 認為,未來有兩種可能性:要麼媒體引導市場預期迴歸至加息 25 個基點,要麼美聯儲在週三最終宣佈加息 50 個基點。

德銀全球經濟和專題研究主管 Jim Reid 強調,如果今日美聯儲官員繼續保持沉默,不對外放風,那麼週三加息 50 個基點的可能性將增加:

“未來 12 小時的媒體動向至關重要,或將最終決定市場定價。"