As the gold price remains high and demand is under pressure, can LAOPU GOLD rely on the concept of "ancient method gold" to withstand the lifting of the ban in 3 months?

老鋪黃金股價在上市不足三個月內上漲 184%,最高達到 115 港元。公司中期財報顯示,營收和淨利均大幅增長,淨利同比增長近 200%。然而,預計 2024 年 12 月 27 日的解禁潮將對股價造成下跌回調風險,尤其在公司估值已高的情況下。老鋪黃金專注於古法金產品,目標客户為高淨值人羣。

上市不足三個月,老鋪黃金 (06181) 的股價又迎來了一波顯著漲幅:9 月 13 日,公司盤中最高達到 115 港元,相較招股價 40.5 港元漲幅已達到驚人的 184%。

近日,消息面上,公司發佈中期財報,營收、利潤雙雙高速增長,其中淨利更是同比增長近 200%;9 月 10 日,港股通標的名單調整正式生效,老鋪黃金獲納入港股通名單,未來公司流動性的改善有望帶動股價進一步上漲。

數據顯示,老鋪黃金將於 2024 年 12 月 27 日迎來一波限售解禁,本次解禁股數共 1080.16 萬股,佔全球發售 48.28%。據公司此前披露,作為一致行動人,徐高明、徐東波父子合計持有老鋪黃金 78.27% 的股份,紅喬金季 (徐高明、徐東波分別持股 70%、30%) 持股 45.84%,紅喬金季作為普通合夥人的天津金橙持股 6.51%。另外,在董事會成員中,營業部總經理徐鋭、質檢部總監蔣霞,分別為徐高明的侄子和外甥。

可以看出,公司在治理結構上實則是一家股權集中的家族企業。考慮到目前公司估值已處於高位,隨着解禁期到來,股價也存在了一定的下跌回調風險。

中期盈利激增 200% 創新高

據瞭解,老鋪黃金前身成立於 2009 年,2014 年 “老鋪黃金” 商標正式註冊,是國內率先推廣古法黃金概念的品牌。定位於中國古法手工金器專業第一品牌,公司核心目標客羣為高淨值人羣,全系列產品均採用古法金。

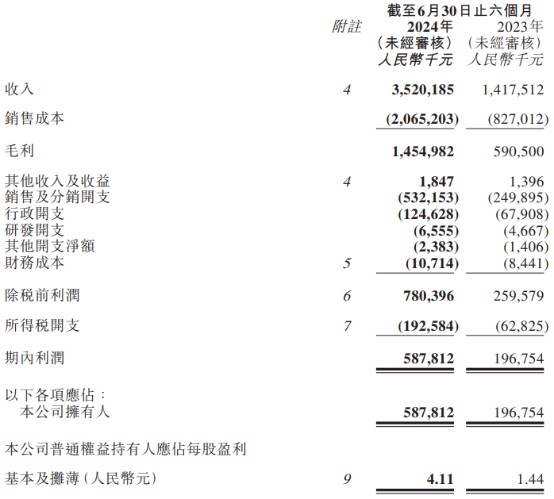

2024 年上半年,公司營收、利潤雙雙高速增長,錄得收入 35.2 億元 (單位為人民幣,下同),同比增加 148.34%;公司擁有人應占利潤 5.88 億元,同比增加 198.75%。公司方面稱,報告期內收入及毛利增加主要是由於集團品牌影響力擴大,帶來店鋪營收存量包括線上線下整體營收的增長。

上半年,公司毛利率略有下滑,毛利率為 41.3%,同比下滑 0.32 個百分點。銷售費用率和管理費用率均有明顯改善,銷售費用率為 15.1%,同比下降 2.5 個百分點,管理費用率為 3.5%%,同比下降 1.25 個百分點,銷售淨利率為 16.7%,同比增加 2.8 個百分點。

據瞭解,老鋪黃金所有門店均為直營,店均收入和客單價遠高於同行。公司目前的渠道主要在一線和新一線城市的高端購物中心中,截止 2024 年 6 月末,公司共有 33 家門店,同比淨增 6 家,覆蓋 14 個城市,包括 SKP 系 4 家門店和萬象城系 10 家門店。

分渠道來看,上半年公司線下收入約為 31.3 億元,同比增加 150%,線上收入 3.9 億元,同比增長 139%,均錄得較快增速。分地域來看,上半年中國大陸和港澳台地區分別實現收入 32.33 億元和 2.88 億元,同比增長 138% 和 376%。根據弗若斯特沙利文數據,截至 2024 年 6 月 30 日,老鋪黃金於全國排名前十高端百貨中心的入駐覆蓋率在所有黃金珠寶品牌中排名第一。

展望未來,老鋪黃金國際化戰略加速,東南亞市場將成為公司今後的重要發展方向。根據此前招股書披露,在上市完成之後的兩年之內,公司會在東南亞市場拓展 5 家新店,打造具備國際競爭力的中國高端黃金珠寶品牌。

金價持續上行 產業鏈業績明顯分化

2024 年上半年,金價一路快速攀升,黃金價格屢創新高。中國黃金協會數據顯示,截至 6 月底,倫敦現貨黃金定盤價為 2330.90 美元/盎司,較年初 2074.90 美元/盎司上漲 12.34%。6 月末,上海黃金交易所 Au9999 黃金收盤價為 549.88 元/克,較年初開盤價 480.80 元/克上漲 14.37%。

以上海金交所 SHFE 黃金收盤價為觀測指標,3 月 4 日金價達到階段性高點 494.80 元/克,隨後漲勢不減,7 月 17 日更是達到 581.56 元/克。

2022 年以來,全球央行購金數量大幅上升,首次達到 1135.69 噸,創下歷史新高。據民生證券統計,2023 年前三季度全球央行黃金儲備淨增加 799.57 噸,同比 2022 年前三季度增長 14%。2023 年 12 月,中國的黃金儲備已增加至 2214.55 噸。

對此,開源證券指出,美國 7 月公佈 CPI 數據超預期回落在一定程度上提振降息預期,俄烏、中東等地緣政治因素頻發,加上各國央行持續儲備黃金,都將為金價帶來較強支撐。

金價高企之下,黃金產業鏈上市公司業績卻呈現明顯分化趨勢。在上游黃金礦業受益於金價上漲而業績集體猛增的同時,下游黃金珠寶企業業績卻遭遇顯著下滑。

數據顯示,2024 年上半年,全國黃金消費量為 523.753 噸,同比下降 5.61%。溢價較高的黃金首飾消費量為 270.021 噸,同比下降 26.68%;溢價相對較低的金條及金幣消費量則為 213.635 噸,同比增長 46.02%。

具體而言,周生生 (00116) 上半年營業額同比下降 13% 至 113.13 億港元,淨利潤更是大幅下降 36% 至 5.26 億港元;周大福 (01929) 第二季度公司整體零售額同比減少 20%,中國內地同店銷售額下降 26.4%,中國香港及澳門同店銷售額下降 30.8%,業績表現同樣不容樂觀。

相比之下,老鋪黃金能夠實現 “逆風” 增長,原因或許在於其獨特的 “古法黃金” 高端定位。

高端古法金龍頭 能否實現可持續高增長?

據瞭解,老鋪黃金是中國第一家推廣 “古法黃金” 概念的品牌,而古法黃金指的是一種將現代設計與中國古典文化相結合、應用中國傳統手工黃金製造工藝的純金珠寶製品,具有工藝精細、產品質感厚重、文化積澱深厚等特點。由於光澤暗沉內斂古樸、重工更顯精緻,古法黃金概念近年來受到許多消費者追捧,如周大福等綜合性珠寶品牌都紛紛推出了古法金系列產品。

老鋪黃金的品牌定位主要面向高淨值人羣,根據胡潤百富數據,2023 年老鋪黃金在中國高淨值人羣最青睞的珠寶品牌排名中首次進入前十,成為繼周大福之後第二個上榜的中國黃金珠寶品牌。區別於主流黃金珠寶品牌按克計價的模式,老鋪黃金的所有產品均為按件計價,定價邏輯更類似於奢侈品珠寶。

據披露,老鋪黃金的所有產品均為自主設計研發,2021 年以來保持每年百餘款產品的迭代、百餘款新品的更新頻率,2021-2023 年間迭代產品及新品穩定貢獻中高個位數的收入佔比。截至報告期末,公司已創作出超過 1800 項原創設計,擁有境內專利 243 項,作品著作權 1207 項以及境外專利 164 項。

分產品來看,上半年公司的足金黃金、足金鑲嵌產品分別實現收入 13.72 億元與 21.47 億元,同比增長 110% 和 182%;主要針對年輕人羣體的足金鑲鑽產品佔總收入的比例為 61%,同比提升 7 個百分點。

近年來,隨着 “國潮” 在年輕人中日漸流行,具備豐富傳統文化內涵、擁有吉祥寓意的古法黃金也吸引了更多年輕消費者偏愛。據瞭解,老鋪黃金的產品範圍廣泛,既提供日常佩戴的飾品,又包含文房文玩金器、日用金器等,全面覆蓋不同年齡和消費需求的消費者羣體。截至報告期末,公司忠誠會員人數達 27.5 萬人,消費人羣不斷擴大。

中商產業研究院數據顯示,按銷售收入計,2018 年至 2023 年間中國古法黃金珠寶市場規模已從 130 億元快速增長至 1573 億元,複合增長率高達 64.6%。預計 2024 年市場規模有望達 2193 億元,2028 年則將達到 4214 億元。

可以看出,老鋪黃金的品牌調性更像是一家奢侈品品牌,其模糊了黃金飾品與奢侈品之間的定位區分,主要聚焦價格相對不敏感的高淨值客户羣,且按件計價的模式也淡化了高金價帶來的負面影響,在黃金飾品這一賽道中賺得了更多的品牌溢價。

不過,擺在老鋪黃金面前的也並非一條通天坦途。數據顯示,目前老鋪黃金所佔的市場份額並不高,以 2023 年收入計,老鋪黃金在古法黃金珠寶市場排名第七,市佔率為 2%,而前 5 大古法黃金珠寶品牌佔據了 46.1% 的份額。放眼到整個黃金珠寶賽道,老鋪黃金的市場份額更是僅有 0.6%。

截止 2024 年 6 月末,老鋪黃金共有 33 家門店,但同期周大生與週六福門店數量超過 4000 家,周大福珠寶集團門店數量近 8000 家,老鳳祥約 6000 家。

儘管目前公司在古法黃金這一細分領域佔據先發優勢,但隨着其餘黃金品牌紛紛推出古法金產品,愈發激烈的競爭或將讓市場陷入同質化、低毛利、價格戰的漩渦,屆時老鋪黃金的設計、加工與品牌營銷能力將迎來更多考驗。