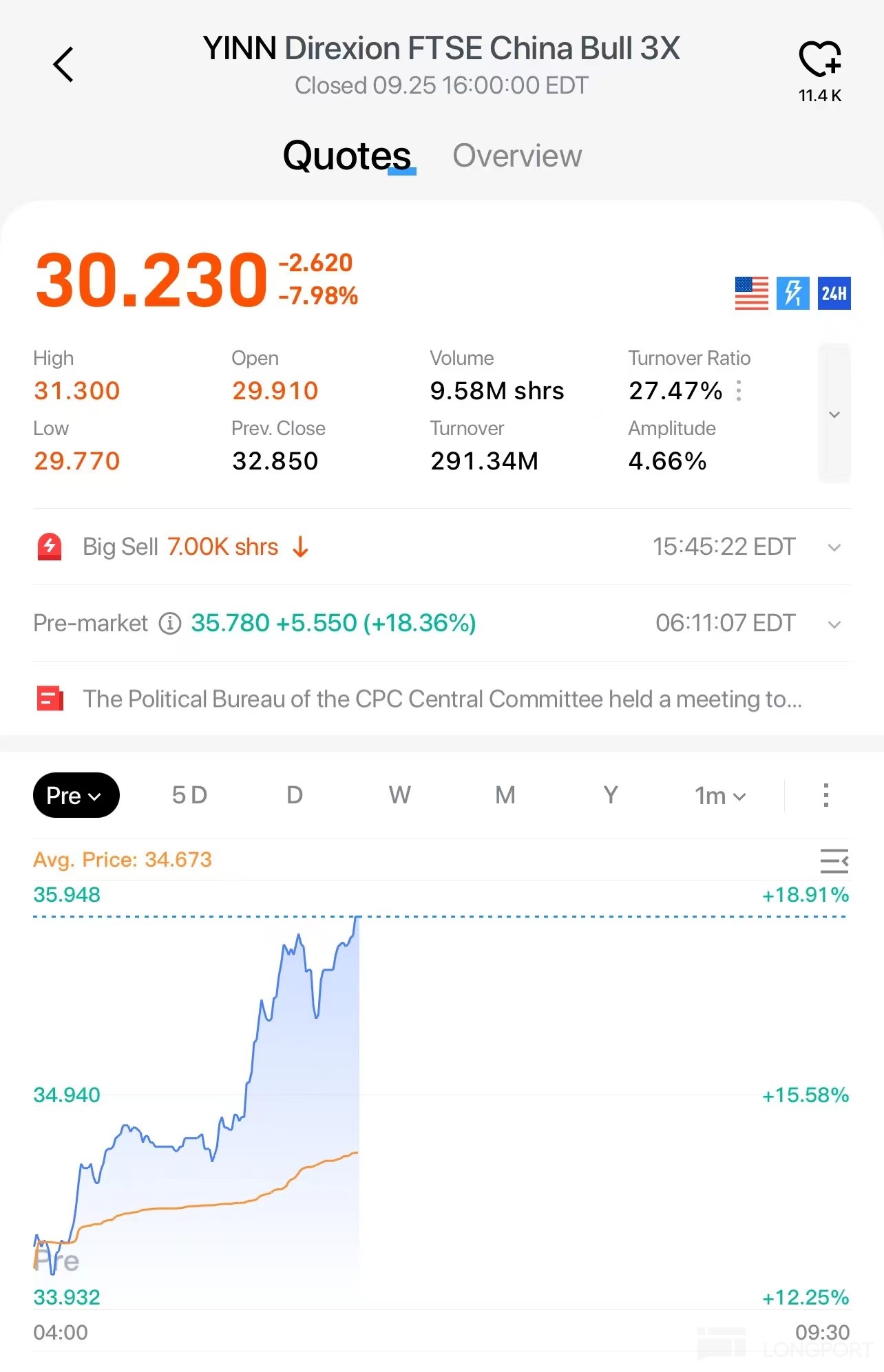

Can't stop at all! Chinese concept stocks soar before the market, with YINN surging 18%

Beike, BOSS, and other stocks surged by more than 12%, Miniso, New Oriental, and others surged by more than 10%, Bilibili, TAL Education Group, and others rose by over 9%, JD.com, Pinduoduo, Li Auto, and others rose by 8%

This afternoon, on September 26, the Central Political Bureau of the Communist Party of China held a meeting to analyze and study the current economic situation and to plan the next steps for economic work.

In previous years, the high-level meetings in September rarely discussed the economy. However, this year there was a significant focus on economic issues, which in itself is a very positive signal.

The meeting indicated that the issuance and effective use of ultra-long-term special government bonds and local government special bonds should be promoted to better leverage government investment. It also called for a reduction in the reserve requirement ratio and the implementation of substantial interest rate cuts. Efforts should be made to stabilize the real estate market, strictly control the increase in new housing projects, optimize the existing stock, improve quality, increase loan issuance for "whitelist" projects, and support the activation of idle land.

As a result, Chinese assets continued to surge, with the Shanghai Composite Index returning to 3000 points, recovering all losses for the year; Hong Kong tech stocks soared, with the Tech Index rising more than 7%.

After the rise in A-shares and Hong Kong stocks, U.S.-listed Chinese stocks also surged:

Beike, Gaotu, and BOSS rose more than 12%, Miniso, Yum China, and New Oriental rose more than 10%, Bilibili, TAL, and iQiyi rose more than 9%, and JD.com, Pinduoduo, and Li Auto rose 8%.

The triple leveraged China ETF (YINN) surged 18%, hitting a one-year high based on pre-market prices:

It is worth noting that on the morning of September 24, the People's Bank of China, the China Securities Regulatory Commission, and the National Financial Regulatory Administration issued a "big gift package." This includes reducing the reserve requirement ratio, lowering existing mortgage interest rates, creating new monetary policy tools to support the stable development of the stock market, further supporting Central Huijin Investment Ltd. to increase holdings and expand investment scope, and promoting the entry of medium and long-term funds into the market and mergers and acquisitions.

Confidence is more important than gold. Under the strong policy stimulus, the market has regained confidence, and the value of Chinese assets is being re-evaluated.

Goldman Sachs stated that the 300 billion yuan stock repurchase and special relending for increasing holdings are expected to continue the strong repurchase momentum in the onshore and offshore stock markets. Investors will continue to "tactically" trade Chinese equity assets, favoring the theme of "enhancing shareholder returns."

Bank of America believes that the series of measures introduced by regulators will immediately provide liquidity to the market, particularly benefiting the capital market. It is expected that the market will receive new liquidity from both banking and non-banking financial institutions, and if the market performs well and lasts long enough, the return of retail and overseas investors could further help stabilize the market.

Morgan Stanley believes that the People's Bank of China's unexpectedly strong policy support measures will help improve investor sentiment and liquidity, driving a positive response in both onshore and offshore markets in the short term. The scale and long-term sustainability of the rebound will depend on the bottoming out of macroeconomic recovery and corporate earnings growth. The upcoming interest rate cuts are likely to trigger market changes, with real estate and non-essential consumer stocks potentially entering a golden period!

More information:

Policy Interpretation|Why did the stock market surge? Some unusual points about this meeting