Funds rushing in! ICBC Securities Transfer Net Value Index hits a new high since 2021! Brokerage IT Department: May have to work overtime during the National Day holiday

近期 A 股市場表現強勁,個人投資者參與度顯著提升。根據中國工商銀行的數據,9 月 27 日的銀證轉賬淨值指數達到 7.04,創下 2021 年以來新高,顯示出大量資金湧入市場。儘管市場熱度持續,但仍有大量場外資金未入場,預示着後續可能存在上漲空間。與此同時,上交所出現交易異常情況,導致部分股票成交受阻。

A 股連日上漲,市場情緒被激活。

在一系列重磅政策的刺激下,本週(9 月 23 日至 9 月 27 日),股市出現了大漲行情,相關股票指數漲幅刷新多項歷史紀錄,激發了投資者的熱情,大量資金跑步入場。

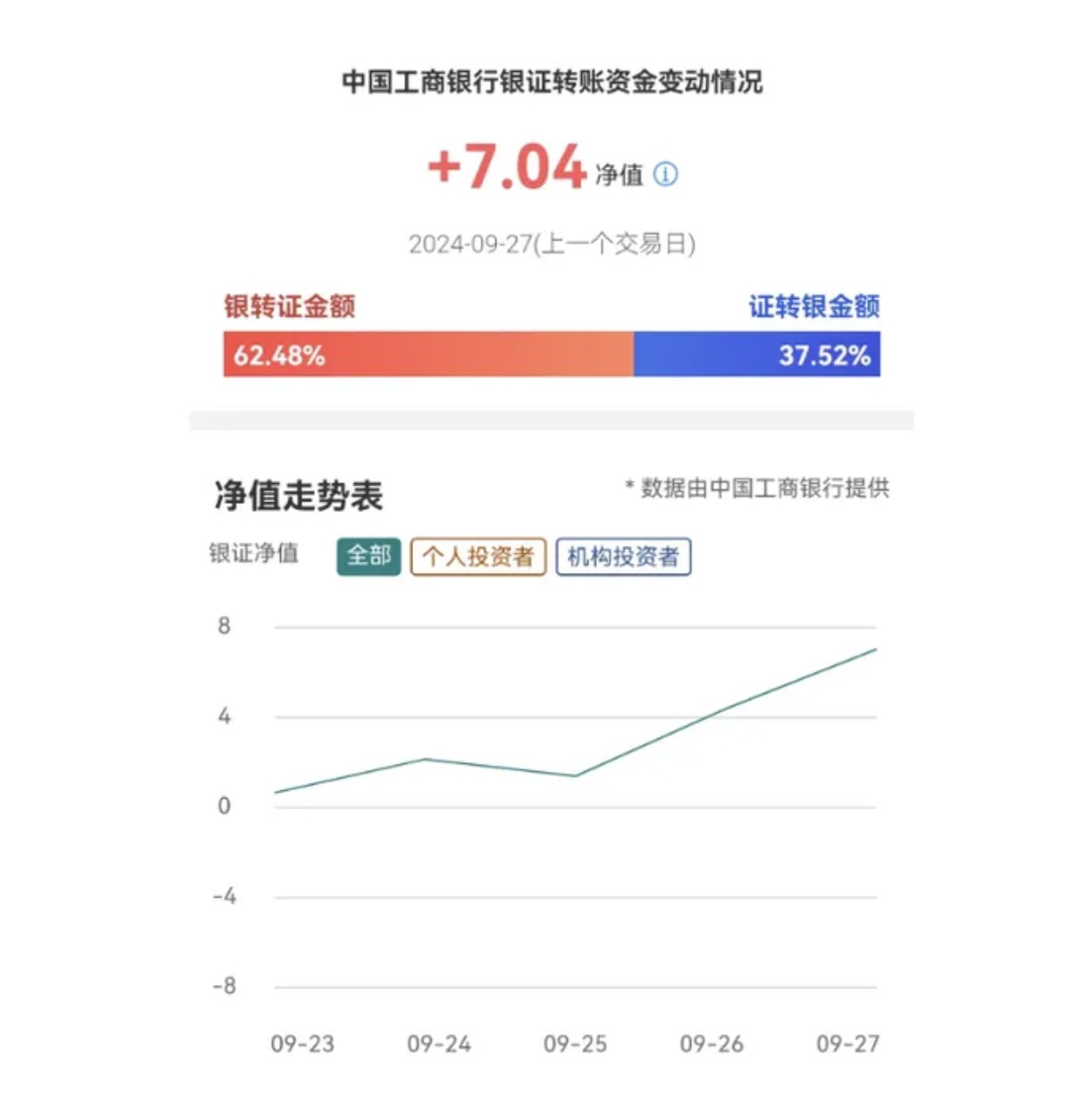

據中國工商銀行數據,該行 9 月 27 日投資者銀證轉賬資金變動情況淨值(以下簡稱 “工行銀證轉賬淨值指數”)飆升至 7.04,顯著高於前 4 個交易日的 0.66、2.15、1.4、4.4,周度均值為 3.13,創下 2021 年以來三年半的新高。

工行銀證轉賬淨值指數,定義為對應交易日工行賬户銀證轉賬淨轉入證券市場金額與 2017 年工行賬户銀證轉賬淨轉入證券市場資金量日均值的比值,直觀反映了交易日工行全部投資者淨轉入證券市場資金量的情況。

從結構數據上來看,個人投資者的參與度尤為突出。

數據顯示,在 9 月 23 日至 9 月 27 日期間,工行個人投資者銀證轉賬淨值指數持續保持正值,其中 9 月 27 日更是達到了 5.2,是工行機構投資者銀證轉賬淨值指數的 2.83 倍,凸顯了個人投資者對此次行情高漲的參與熱情。

業內人士指出,儘管近期市場熱度不減,但仍有大量場外資金尚未入場,這部分踏空資金的存在預示着市場後續可能仍有上漲空間。

此前,9 月 27 日開盤後,上交所股票競價交易出現成交確認緩慢的異常情況,並導致交易受到影響。經該所處置,股票競價交易於 11 點 13 分起逐步恢復。上交所 9 月 27 日晚公告稱,對於該異常情況的發生,深表歉意。

不少 A 股投資者反映,上交所部分股票仍有下單後無法成交且無法撤單的情況。

9 月 28 日,陸續有投資者反饋稱,自己在券商交易系統上看到了 “遲來的成交”。

據上海地區投資者王先生反饋,“我發現一個奇怪的情況。27 日我盤中委託了幾筆交易,有的是股票,有的是 ETF,都是在上交所掛牌的標的。27 日盤中幾次刷新,券商系統都顯示沒有成交,我以為可能是因為交易所的故障導致當天無法成交。”

“但是,我現在看了交割單顯示,27 日的這些委託基本都已經成交了。不過從券商系統的委託記錄來看,這些委託仍然處於未成交的狀態。” 王先生表示。

另外,在一些社交平台上,《每日經濟新聞》記者也看到有投資者表示了遇到類似上述這樣的情況。

就此異常現象,某券商 IT 人士分析指出,“這應該是 27 日交易所成交回報延遲到盤後才發到券商,所以交易時間投資者看不到成交,晚上券商根據交易所的實際成交數據清算後,投資者就能看到了。”

由於上述情形的出現,28 日和 29 日兩天,券商 IT(信息技術)部門忙不停。

華中地區某券商 IT 部門人士向《每日經濟新聞》記者表示,已經關注到了這些問題,目前正在公司加班處理。

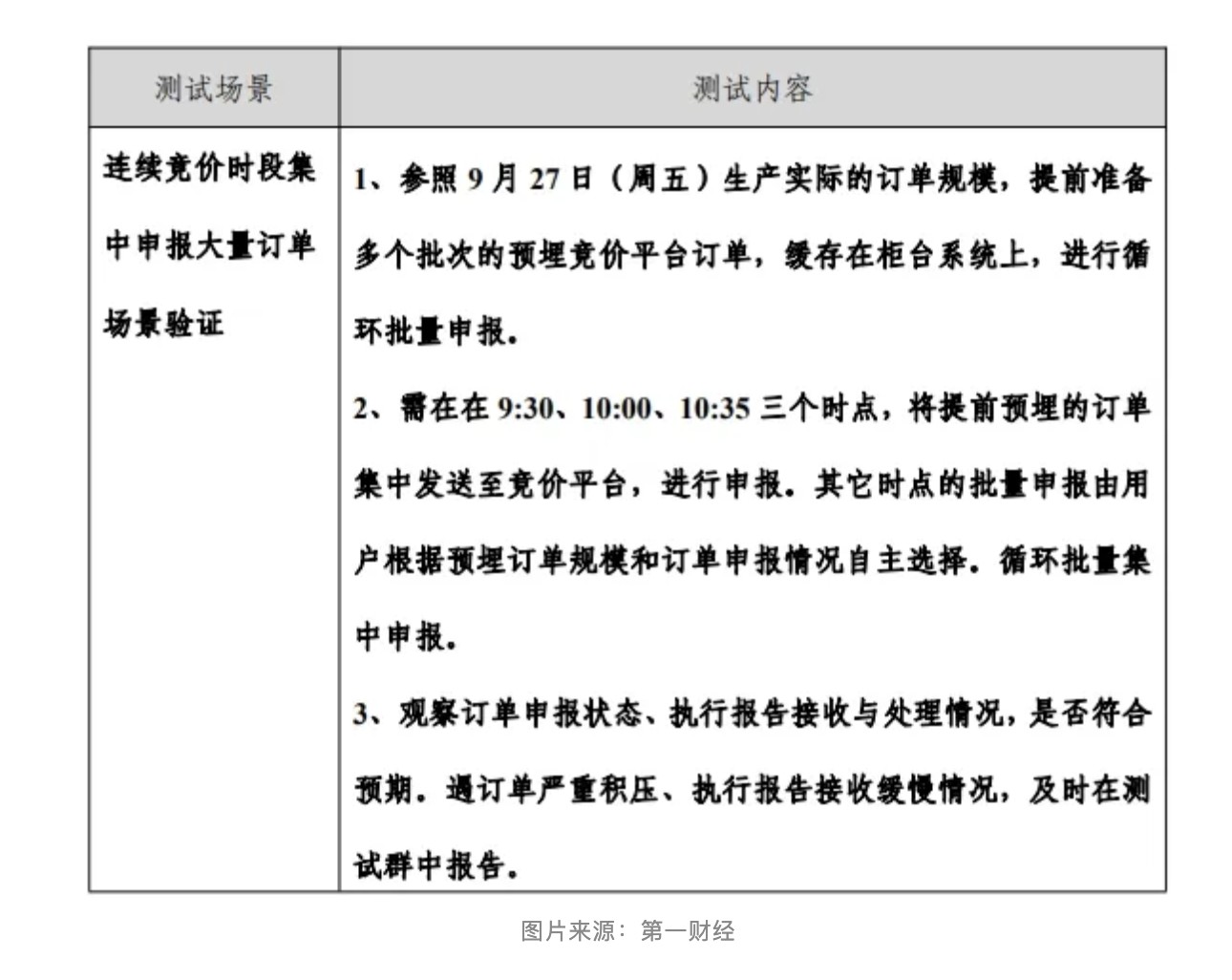

另據第一財經報道,上交所定於 9 月 29 日(週日),組織開展競價、綜業等平台相關業務測試,需在 9:30、10:00、10:35 三個時點,將提前預埋的訂單集中發送至競價平台。邀請全體市場參與人蔘加測試,主要驗證相關技術平台業務與技術調整的準確性。根據上交所的通知,測試內容為測試模擬 1 個交易日的交易和清算,測試主要有驗證連續競價時段集中申報大量訂單時,競價平台業務處理平穩運行。

在得知上交所進行業務測試後,上述某券商 IT 人士回應稱,“習慣了,我們一年中八成的週末都在加班配合各種測試。” 上述華中地區某券商 IT 部門人士則表示,“十一期間還要加班呢。十一假期之後第一個交易日,沒準成交量又要創新高了。”