Japanese stocks are expected to receive the blessing of the "Stock God" again? Berkshire Hathaway plans to issue yen bonds for the second time this year

Berkshire Hathaway plans to issue yen bonds for the second time by 2024, sparking speculation that it may increase its investment in the Japanese stock market. Since 2019, Berkshire has been regularly issuing yen bonds, most recently raising 263.3 billion yen in April. The company has increased its holdings in Japan's five major trading houses, helping the Nikkei 225 index reach a historic high. Analysts believe that this is good news for the Japanese stock market and may provide momentum for investors. As a result of this news, shares of Japanese trading companies have risen

According to media reports on Tuesday, Warren Buffett, known as the "Stock God", is planning to issue yen bonds for the second time this year at Berkshire Hathaway.

This news has sparked speculation that Berkshire is seeking to increase its investment in the Japanese stock market.

Reports indicate that Berkshire has hired Bank of America Securities and Mizuho Securities to issue yen-denominated senior unsecured bonds.

Since 2019, Berkshire has been regularly issuing yen bonds, with the last issuance in April. At that time, Berkshire raised a total of 263.3 billion yen (approximately $1.71 billion) through the issuance of yen bonds, making it the second largest transaction in the company's history of eight yen bond issuances, second only to the 430 billion yen raised in the first bond issuance in 2019.

Japanese Stocks Expected to Receive Further Boost

Berkshire's fundraising plans are closely watched by stock market investors, as earlier this year the company purchased shares in Japan's five major trading companies, helping the Nikkei 225 index reach historic highs.

In February, Berkshire mentioned in its annual shareholder letter that the issuance of yen bonds provided most of the funding for investing in Japanese companies.

"There is still plenty of room for Berkshire to increase its stake in trading companies." said Takehiko Masuzawa, Head of Stock Trading at Phillip Securities in Japan.

He pointed out that for the entire Japanese stock market, "this is good news for those who want to buy, as it will give them the momentum they need."

In August 2020, Berkshire first announced that it held a 5% stake in Japan's five major trading companies (Itochu, Marubeni, Mitsubishi Corp, Mitsui & Co., and Sumitomo Corp). Since then, the company has increased its stake in the five major trading companies several times. In February this year, Buffett revealed that Berkshire held approximately 9% of the shares of the five major trading companies. Berkshire has expressed its hope to eventually own a 9.9% stake in each of the five major trading companies.

Following the above news, Japanese trading company stocks rose on Tuesday, with the index tracking the sector surging by as much as 2.8%. Itochu Corporation's stock price rose by 3.8% at one point, while Mitsui & Co.'s stock price rose by 4.2%.

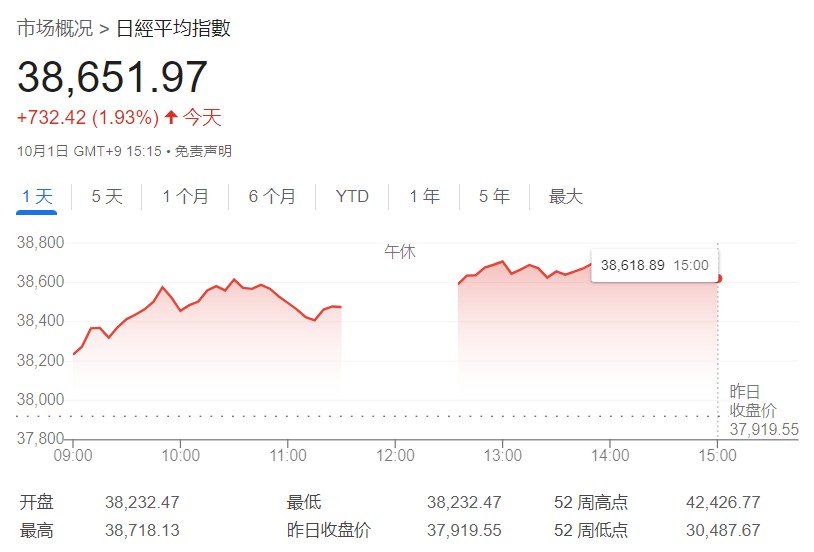

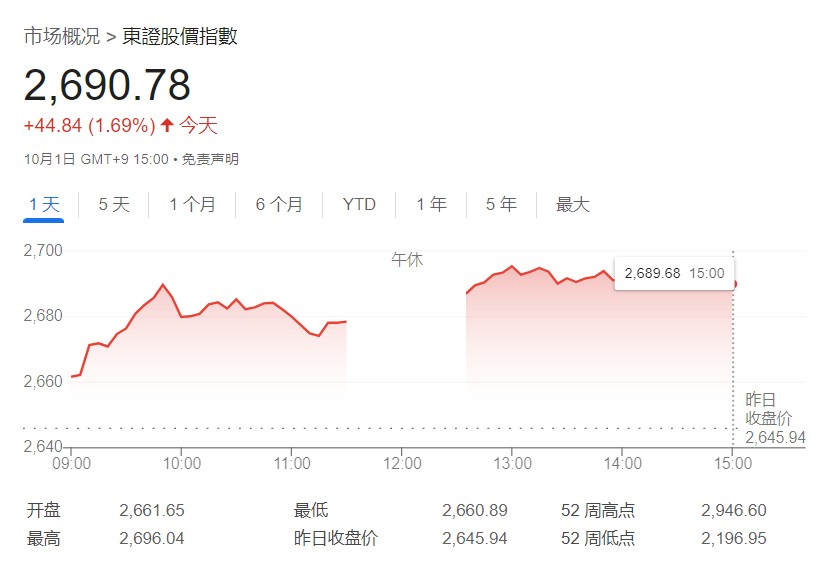

Meanwhile, Japanese stocks also received a boost, with the Nikkei 225 index closing up 1.93% at 38,651.97 points, and the TOPIX index rising 1.69% to 2,690.78 points at the close.

It is worth noting that following Fumio Kishida's victory as the leader of the Liberal Democratic Party of Japan, the Japanese stock market has been under pressure in recent days, with the Nikkei 225 index closing down 4.8% on Monday. As Kishida supports the gradual move away from ultra-low interest rate policies by the Bank of Japan, the market is once again speculating on the possibility of the Bank of Japan raising interest rates However, the minutes of the September monetary policy meeting announced by the Bank of Japan on Tuesday morning showed that the bank remains cautious about raising interest rates.

Against the backdrop of a global wave of interest rate cuts, the path of interest rates by the Bank of Japan has attracted much attention. The Bank of Japan's unexpected rate hike at the end of July once triggered a global yen carry trade unwinding, leading to a "Black Monday" for global stock markets in early August