S&P 500 is expected to rise another 10%! Two well-known Wall Street strategists are bullish on US stocks in unison

華爾街兩位頂級策略師對美國股市的看法變得更加樂觀,認為標普 500 指數有望上漲 10%。摩根士丹利的 Michael Wilson 和高盛的 David Kostin 指出,美國勞動力市場強勁、經濟彈性以及利率下調是主要原因。Wilson 上調了對週期性股票的看法,而 Kostin 則提高了對標普 500 成分股公司明年盈利增長的預期,將目標從 6000 點上調至 6300 點。

智通財經 APP 獲悉,華爾街兩位頂級策略師對美國股市的看法變得更加樂觀,原因是有跡象顯示,美國勞動力市場強勁、經濟具有彈性,而且利率正在下調。

在 2024 年年中之前還是華爾街最悲觀的策略師之一、摩根士丹利的 Michael Wilson 表示,上週五公佈的就業數據井噴式增長,以及美聯儲將進一步降息的預期,提高了他對相對於更安全的防禦性股票的所謂週期性股票的看法。

與此同時,高盛首席執行官 David Kostin 也上調了他對標普 500 指數成分股公司明年盈利增長的預期,因為穩健的宏觀前景推動了利潤率的增長。這位策略師將該基準指數的 12 個月目標從 6000 點上調至 6300 點,這意味着該指數將較當前水平上漲約 10%。

Wilson 在一份報告中寫道:“就股市對就業/經濟增長數據的反應而言,我們仍然認為我們處於一個 ‘好就是好’ 的環境中。債券市場對軟着陸結果的懷疑正在減少,這對股票投資者來説是一個重要信號。”

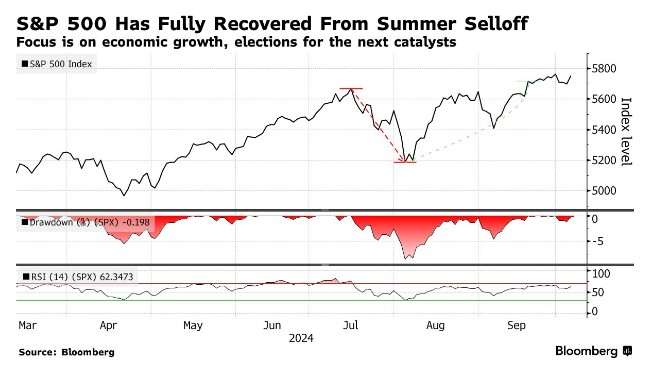

由於對經濟衰退的擔憂減弱以及美聯儲放鬆政策,美股在夏季遭遇拋售後持續反彈。根據掉期數據,交易員預計美聯儲在明年 5 月前將再降息 100 個基點。上週五公佈的就業數據遠強於預期,也提振了市場情緒。

Wilson 表示,這對美國小型股來説是個好兆頭,它們將受益於商業活動和情緒的改善,以及投資者倉位的減少。這位策略師降低了對大盤股的長期押注,理由是短期內風險回報減弱。

在各板塊中,Wilson 將金融類股評級上調至 “增持”,並下調了醫療保健和消費必需品的評級。

摩根大通 (JPM.US) 預計將於週五公佈最新業績,提供銀行盈利能力的最新情況,並正式拉開財報季的序幕。