After the epidemic, a setback, radical investors holding $1 billion in shares seek to reorganize Pfizer's leadership

據知情人士向媒體透露,激進投資者 Starboard 認為輝瑞現任首席執行官 Albert Bourla 的領導下,公司已經偏離了其傳統的成本控制和對新藥投資的嚴謹結構,目前已經接觸了輝瑞前首席執行官 Ian Read 和前首席財務官 Frank D’Amelio。受此消息推動,輝瑞股價週一盤中一度漲超 4.4%。

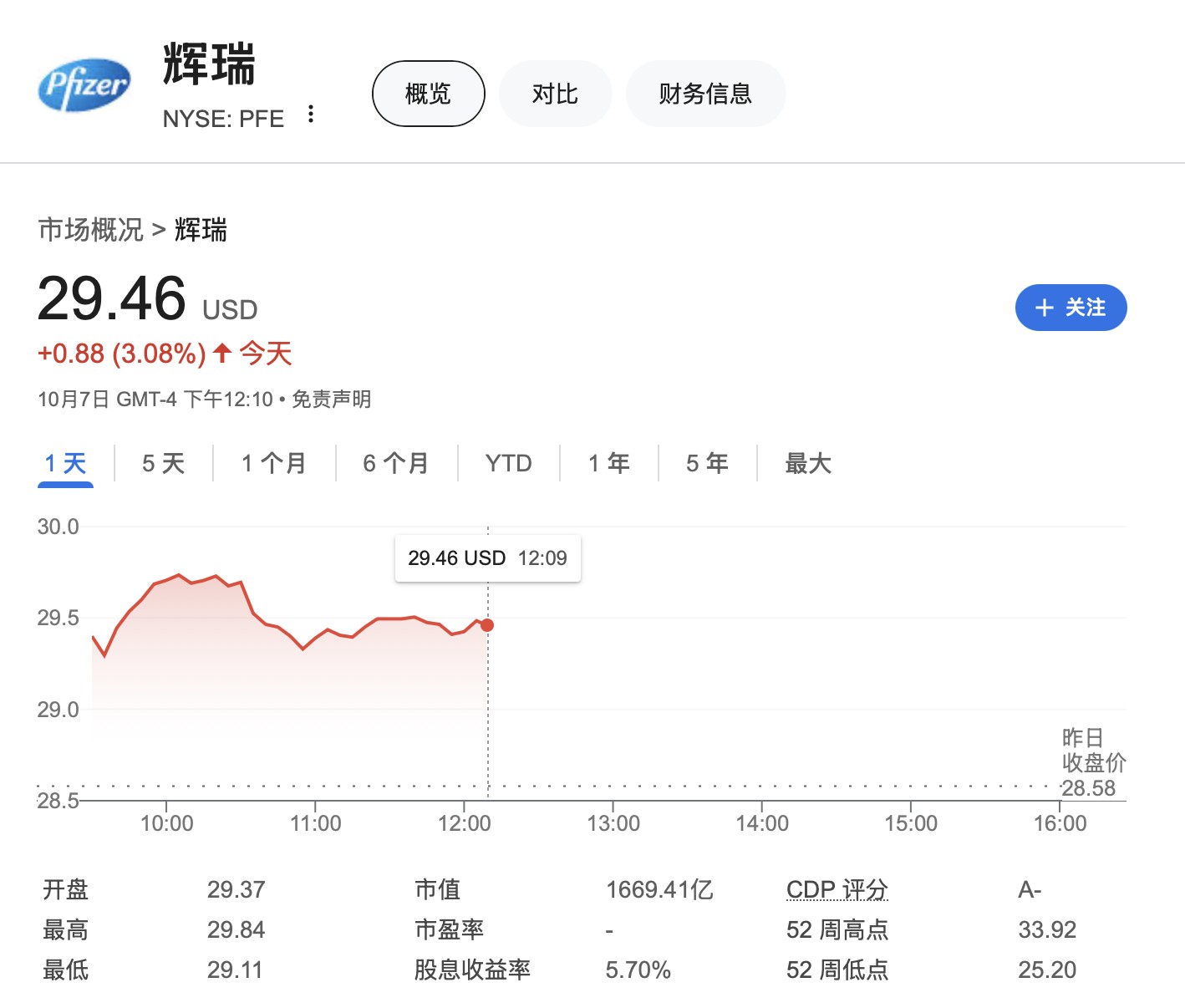

據知情人士向媒體透露,激進投資者 Starboard Value 已在輝瑞公司(Pfizer)持有約 10 億美元的股份,並希望對該公司進行變革以扭轉目前的困境。受此消息推動,輝瑞股價週一一度漲超 4.4%。

數據顯示,截至上週五,輝瑞的市值約為 1620 億美元。自該公司推出全球首款新冠疫苗以來,其股價已從 2021 年底創下的歷史高點幾乎腰斬。今年以來,輝瑞的股價幾乎沒有變化,而標普 500 指數上漲了 21%。

據報道,Starboard 已經接觸了輝瑞前首席執行官 Ian Read 和前首席財務官 Frank D’Amelio,他們表示願意幫助 Starboard 實現其目標。Read 在 2010 年至 2018 年期間擔任輝瑞 CEO,並親自挑選現任 CEO Albert Bourla 作為繼任者。D’Amelio 則在 2007 年至 2021 年期間擔任輝瑞的 CFO。

知情人士對媒體表示,Starboard 認為輝瑞現任首席執行官 Albert Bourla 的領導下,公司已經偏離了其傳統的成本控制和對新藥投資的嚴謹結構。

受此消息推動,輝瑞股價週一盤中一度漲超 4.4%,後漲幅收窄至 3% 左右,報 29.46 美元。

Starboard 由 Jeff Smith 領導,跨行業進行投資,但在科技業尤為活躍,最近在 Salesforce 和 Autodesk 發起了行動。2019 年,Starboard 試圖阻止製藥巨頭百時美施貴寶(Bristol-Myers Squibb)以 740 億美元收購競爭對手 Celgene,但未能成功。同年,Starboard 在醫療技術公司 Cerner 贏得了董事會席位。

深陷困境

輝瑞首席執行官 Bourla 目前面臨投資者的壓力,該公司此前高估了疫情相關產品在疫後的需求,輝瑞的領導層一直在尋求解決問題的途徑。

疫情期間,輝瑞在創紀錄的時間內交付了新冠疫苗,鞏固了其家喻户曉的地位。2022 年,輝瑞的疫苗和新冠藥物 Paxlovid 推動公司銷售額突破 1000 億美元。

但隨着疫情被拋在腦後,輝瑞正面臨新冠銷售額的下滑,而公司的其他產品未能填補這一空缺。此外,在未來幾年,公司的一些暢銷藥物,如血液稀釋劑 Eliquis 和關節炎治療藥物 Xeljanz,也將面臨低價競品的競爭。

更糟糕的是,公司備受關注的減肥藥首次嘗試令人失望,而競爭對手如禮來(Eli Lilly)和諾和諾德(Novo Nordisk)卻取得了更大的成功。

輝瑞將未來押注於癌症藥物,認為這些藥物能夠帶來數十億美元的新銷售額。去年,輝瑞同意斥資 430 億美元收購生物技術公司 Seagen 及其開創性的靶向癌症藥物。輝瑞表示,預計到 2030 年,Seagen 的藥物(即抗體藥物偶聯物或 ADCs)將帶來 100 億美元的年銷售額。

此外,輝瑞還利用其疫情期間積累的資金進行了一系列較小的收購交易,包括以 67 億美元收購 Arena Pharmaceuticals,花費約 116 億美元收購 Biohaven Pharmaceutical Holding 部分股份。

其中一個特別令人擔憂的交易是輝瑞收購了 Global Blood Therapeutics。輝瑞在兩年前通過約 50 億美元的收購獲得了一個鐮狀細胞病藥物,但該藥物最近被撤回。輝瑞在 9 月份淡化了該決定的財務影響,表示該藥物 Oxbryta 去年僅帶來了略高於 3 億美元的收入。

削減成本

一些分析師批評稱,該公司在併購和其他業務管理方面缺乏紀律。相比之下,在 Read 從 2010 年到 2019 年擔任輝瑞的首席執行官期間,當時公司處於動盪之中。但在他的領導下,輝瑞以專注於核心業務(如疫苗和癌症)而聞名,股價翻了一倍多,管理層確立了以成本控制和核心業務為中心的文化,而這一文化現在顯然已被淡化。

而在 Bourla 接任後,大幅增加了公司的研發預算,並剝離了公司的仿製藥業務。輝瑞的股價目前低於 Bourla 2019 年成為 CEO 時的水平。

輝瑞在 2023 年底警告稱,其收入可能在今年下降,併發布了不盡如人意的 2024 年預期。公司還在去年年底宣佈了一項 35 億美元的成本削減計劃,預計在 2024 年底前完成。

今年 5 月,輝瑞宣佈啓動一項新的多年度成本削減計劃。7 月,公司上調了全年展望,部分收購產品和新商業產品的推出幫助推動了業務增長,抵消了新冠疫苗銷售的下滑。輝瑞在 7 月份發佈了其每日一次抗肥胖藥物 “danuglipron” 的 “令人鼓舞” 的數據,顯示其在不斷擴展產品管線上的努力。

“我們在各個方面都取得了進展,” Bourla 在 7 月接受媒體採訪時表示。