The new round of US stock earnings season kicks off, these five major themes are worth paying attention to

隨着新一輪財報季已拉開帷幕,美股今年以來的強勁漲勢可能面臨最大考驗。

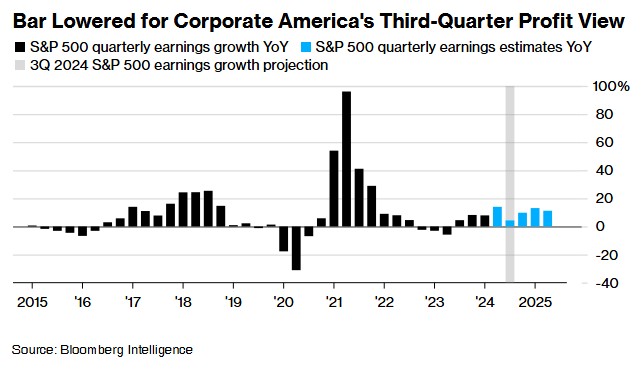

智通財經 APP 獲悉,隨着新一輪財報季已拉開帷幕,美股今年以來的強勁漲勢可能面臨最大考驗。Bloomberg Intelligence 的數據顯示,策略師們預測,標普 500 指數成分股公司將公佈過去四個季度以來最疲弱的業績,第三季度利潤將僅同比增長 4.3%。

儘管盈利預期有所下降,但標普 500 指數還是在上週五再創新高,20204 年迄今累計上漲 22%。那些看多美股的投資者或許是有道理的,因為如果這些下調後的預期被證明過於悲觀,那麼似乎還有盈利意外上升的空間。這種情況發生在第一季度,當時的盈利預期是同比增長 3.8%,結果則是同比增長 7.9%。

Baird 投資策略師 Ross Mayfield 表示:“分析師下調每股收益預期的幅度比通常情況下要大,這可能會導致超出預期的概率上升,股市表現也會更好。”

以下是第三季度財報季中值得投資者關注的五個關鍵主題:

1、科技巨頭盈利增長減速

標普 500 指數成分股公司盈利的大部分增長仍然來自大型科技公司,這些公司被視為人工智能發展的主要受益者。所謂的 “美股七巨頭”——蘋果、微軟、Alphabet、亞馬遜、英偉達、Meta 和特斯拉——第三季度利潤預計將增長 18%。不過,Bloomberg Intelligence 的數據顯示,問題在於這些科技巨頭的盈利增速正在放緩,低於 2023 年的 30% 以上。

此外,數據顯示,除 “美股七巨頭” 之外的標普 500 指數其他成分股公司在第三季度的利潤預計將增長 1.8%,這是連續第二個季度增長,儘管增幅很小。Bloomberg Intelligence 的數據顯示,標普 500 指數中其餘 493 家成分股公司的盈利增長預計從現在開始大幅加速,到 2025 年第一季度預計將實現兩位數的增幅。

2、選股者的天堂

投資者可能預料到某些個股會出現一些大幅波動,而這些波動不會反映在大盤指數中。期權市場正在單一股票水平上定價自 2021 年美國銀行開始收集數據以來最大的平均業績隱含波動。不過,美銀股票策略師 Ohsung Kwon 表示,指數層面的隱含波動率相對較低,這表明本財報季可能是 “選股者的天堂”。

標普 500 指數的 11 個板塊中,有三個板塊——科技、通信服務和醫療保健——預計利潤增幅將超過 10%。另一方面,能源板塊預計將公佈逾 20% 的跌幅。英國商業銀行 (BI) 首席股票策略師 Gina Martin Adams 表示,由於上季度原油價格暴跌,能源板塊的利潤預期在 11 個板塊中降幅最大。

3、利潤率

華爾街專業人士將密切關注利潤率,這是衡量企業盈利有效程度的一個關鍵指標。數據顯示,第三季度利潤率預計將下滑至 12.9% 左右,低於第二季度的 13.1%,但略高於 2023 年第三季度的 12.8%。這種輕微的下降反映了一些企業在將投入成本轉嫁給消費者方面面臨的挑戰,因為在一些難以實現自動化的低生產率行業,工資壓力仍然存在。

Bloomberg Intelligence 的數據顯示,能源和房地產類股的利潤率將是最低的,但從更廣泛的角度來看,預計未來幾個季度將出現反彈。

4、動盪的歐洲市場

在歐洲,新一輪財報季可能標誌着泛歐斯托克 600 指數的轉折點,該股指目前徘徊在歷史高點附近。由於歐元區經濟增長乏力,分析師下調了對該指數成分股公司的盈利預期。

雖然下調盈利預期降低了超越預期的門檻,但對 2025 年的預期仍然很高,任何有關消費者需求走弱的指引都將迫使這些預測下調,這將進一步影響公司股價。包括瑞典服裝零售商 Hennes & Mauritz AB 和大眾汽車在內的許多知名公司近幾周都發布了盈利預警。

5、選舉焦點

距離美國大選只有幾周時間,投資者將傾聽企業高管對經濟和貿易政策風險以及其他政治問題的觀點。美國銀行的數據顯示,約有 110 家公司在第二季度的財報電話會中提到了 “選舉” 一詞,較四年前增加了 62%。

美銀股票策略師 Ohsung Kwon 表示,歷史表明,企業投資活動在美國大選後會加速,這可能是企業在未來幾個季度釋放資本的催化劑,尤其是在利率下降的情況下。

然而,企業也可能推遲一些擴張計劃和其他支出。LPL Financial 首席股票策略師 Jeff Buchbinder 表示:“如今,如此多的資本投資都與人工智能有關,大選不太可能抑制這一點。然而,現在我們離大選如此之近,由於政治上的不確定性,一些更傳統的資本承諾可能會推遲。”