Is a down jacket costing tens of thousands of yuan becoming a standard? The surge in raw material prices makes it difficult to afford high winter costs

With the surge in raw material prices, the prices of down jackets have been continuously rising, becoming a luxury item that consumers find difficult to afford. In November 2023, the market share of down jackets with an average price between 500 and 1000 yuan was 65.6%, while the market shares for prices between 1000 and 3000 yuan and above 3000 yuan were 8.0% and 6.4% respectively. The high-end series of the well-known brand Bosideng even exceeded tens of thousands of yuan. Consumers widely feel the price increase of down jackets, reflecting the cost pressure behind the industry

For a long time, the fashion industry has generally believed that "stylish women do not wear down jackets".

In their view, bulky down jackets are a fashion insulator, contradicting the fashion rule of "opting for style over warmth".

A generation of "fashion gurus", Guo Jingming, also expressed the view through the character of Gu Li in "Tiny Times" that "stylish women in Shanghai do not wear long johns and are not afraid of the cold".

In the minds of many, down jackets are synonymous with "tacky", following a cost-effective route, unrelated to "high-end". But now they are becoming more and more expensive, appearing unattainable to consumers.

In November 2023, the market share of brands of large-scale retail enterprises nationwide with average down jacket prices between 500-1000 yuan was 65.6%, between 1000-3000 yuan was 8.0%, and above 3000 yuan was 6.4%.

In the well-known down jacket brand Bosideng's stores, their high-end series "Peak Series" is priced at over ten thousand yuan.

Why is it that down jackets, as a "popular" warm product, are becoming less affordable? Why are down jackets becoming more expensive now?

With these questions in mind, this issue of Micro Stories will delve into the down jacket industry to understand the reasons behind it.

Here are some real stories about the down jacket industry:

- The madness of duck down: From 20,000 yuan to 60,000 yuan

"This year might be a cold winter, because I can't afford a down jacket anymore," joked 26-year-old Beipiao Wei Yu.

Last year, Wei Yu bought a thin down vest for 210 yuan, and this year when he wanted to buy another one, the same down vest had risen to 269 yuan.

Although 50 yuan may not buy a decent piece of clothing in Beijing, the nearly one-fourth increase still put pressure on Wei Yu, "after all, salaries haven't increased that much".

Liu Hongwei also faced the same dilemma. He had bookmarked a down jacket on a shopping app in early September for 369 yuan, planning to purchase it when the weather turned cold.

However, when the temperature dropped as expected during the National Day holiday, he found that the price of that down jacket had soared to over 500 yuan, making him regret not buying it off-season.

Zhang Liang from Sichuan also shared his experience: "Buying off-season seems to be of no use."

Last winter, he had his eye on a down jacket priced at 488 yuan, but by the beginning of the year, the price had risen to 528 yuan, and by August, it had further increased to 558 yuan.

For consumers, these price fluctuations may come as a surprise, but for down jacket industry insiders like Xiang Zhi, this is not news. He foresaw the expensive trend of down jackets early this year, "and they will only get more expensive in the future".

Jiaxing Pinghu, where Xiang Zhi is located, is an important base for the down jacket industry. Every year, more than 300 million down jackets are produced here, accounting for 80% of the national output, serving as a benchmark for the down industry.

Jiaxing Pinghu, where Xiang Zhi is located, is an important base for the down jacket industry. Every year, more than 300 million down jackets are produced here, accounting for 80% of the national output, serving as a benchmark for the down industry.

According to Xiang Zhi, in recent years, the pressure of "price increases" looms over every manufacturer in Pinghu.

"Due to the slow supply speed of duck feathers and goose feathers used in down jackets farming cannot keep up with market demand, so now the raw materials have increased significantly," explained Xiang Zhi.

Last year, during the peak season, the price of a ton of new national standard white duck down was about 200,000 yuan. By the end of last year, the price had risen to 350,000 yuan. This year, it has soared all the way from 480,000 to over 600,000 yuan, and white goose down has even risen to 1.32 million yuan per ton.

Chart | Down jacket price market table (Data source: Down Gold Network)

In the production cost of down jackets, raw material costs account for about 75% of the total cost, with down feathers accounting for the majority, close to 50%. "So once the price of feathers rises, down jackets will immediately become more expensive."

Due to the rapid price increase, raw materials have at times appeared with real-time quotations like gold and the A-share market.

At the end of September, Xiang Zhi had ordered a batch of down feathers at a price of 550,000 yuan per ton. By the afternoon, the goods were no longer available at 550,000 yuan, and in less than a week, the price had reached 600,000 yuan. "If you hesitate again, the price will reach 620,000 yuan."

These costs will eventually be passed on to consumers, causing the prices of down jackets to continue to rise, leading to the expensive situation of down jackets this year.

Designer Qi Qi did some calculations. Taking a down jacket with an average down content of 380 grams as an example, when the price of a ton of 90 new national standard white duck down was 200,000 yuan last year, the cost of down used in one jacket was about 78 yuan. Including fabric costs, etc., the factory price of a jacket was only 200 yuan.

However, this year, the cost of down alone exceeds 200 yuan, and if white goose down is used, the cost is even higher, exceeding 450 yuan.

"This is just the cost price. Including other material costs, the factory cost will be close to 300 yuan, and the cost of a good down jacket exceeds 500 yuan. With additional markups in various circulation channels, down jackets this year are destined to be expensive," said Qi Qi.

II. Down jackets that even those with a monthly salary of 20,000 yuan dare not buy casually

In addition to the rise in raw material prices, the "expensiveness" of down jackets is also influenced by many other factors, with labor costs being one of them "However, this is not the core reason. Many down jackets on the market have a down filling weight of less than 250 grams. Taking into account losses, fabrics, down materials, accessories, processing, etc., the cost of a single down jacket only increases by about one hundred yuan. Calculated based on the apparel industry's gross profit margin of 50% to 70%, the pricing should also be around 500 yuan. However, it is rare to see down jackets at this price point on the market now, especially branded down jackets, where prices below a thousand yuan are scarce."

Qiu Lei, who used to work at a women's clothing company, explained that this is determined by the characteristics of the down jacket industry.

The clothing and textile industry is a high turnover industry, and businesses in the industry typically judge the business's performance by its "turnover rate."

This is because new clothing styles come out quickly, and if seasonal clothes cannot be sold out, they will be considered "out-of-season" products and will be heavily discounted. The slower the turnover, the more inventory will accumulate, putting greater pressure on the company's business.

As a typical seasonal product, down jackets have higher costs than clothing for the other three seasons. With lower purchase frequency and longer decision-making time for users, in order to recover costs, companies only have two options: either increase the "turnover rate" or cover costs by raising prices.

"The best way to clear inventory in the clothing industry is through live streaming," Qiu Lei explained, which has been the choice for many down jacket "white label" brands in the past few years.

However, as the live streaming boom peaked and more clothing categories and white labels joined the price war, the down jacket category gradually couldn't withstand it.

"In live streams, down jackets are often priced below 200 yuan. In the past, when raw materials were cheap, it was still manageable, but now it's not feasible. After raising prices, consumers are unwilling to buy," Xiang Zhi said. Moreover, many platforms have introduced a 7-day no-reason return policy to retain consumers, "and in some places where it's coldest for only a couple of months, some consumers buy clothes and return them at the last minute."

These returned clothes cannot be resold and become a cost for the merchants.

Therefore, since last year, Xiang Zhi and many of his friends have started to try transitioning towards the high-end direction. In their view, "as long as the profit margin is high enough, even with a lower turnover rate, money can still be made."

However, the path to high-end transformation is not easy.

"For high-end products, you need your own designs, right?" Qiu Lei said. In the past, everyone could create explosive products through a "borrowing" model, but with severe homogenization and intense price wars, to achieve "high-end," the first thing is to create some "differentiated" designs.

Currently, there are many styles in the clothing industry, and product styles are more prominent, so the requirements for a company's selection and product development capabilities have increased.

On the other hand, the high production cost of down jackets is a heavy burden for companies if they do not sell well.

Additionally, down jackets are not daily items used frequently, and consumers do not stock up in large quantities. Therefore, seasonal "traffic" is crucial for businesses, leading to soaring marketing costs for down jacket brands.

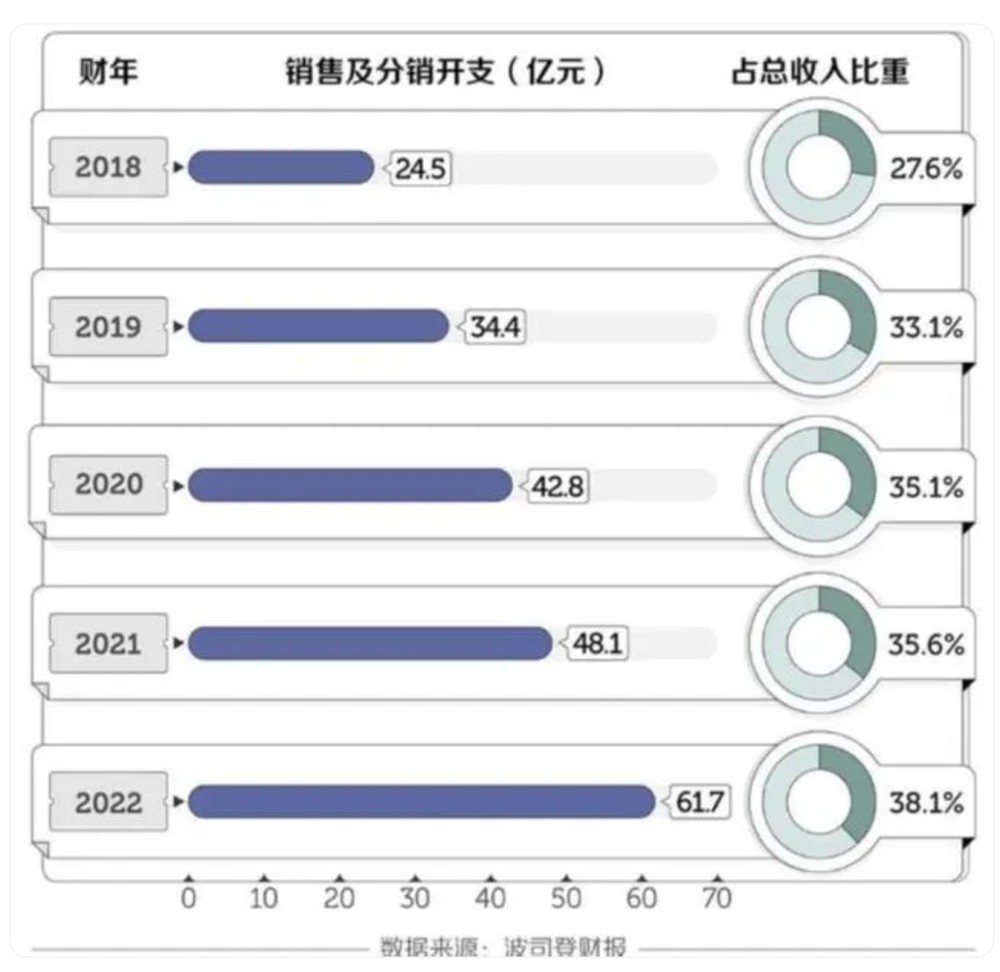

Taking the national brand Bosideng as an example, from the 2019 fiscal year to the 2023 fiscal year, Bosideng's sales costs have shown an overall upward trend, reaching 3.44 billion yuan, 4.276 billion yuan, 4.807 billion yuan, 6.171 billion yuan, and 6.125 billion yuan respectively." Over the past five and a half years, the cumulative sales cost has reached 26.849 billion yuan.

This is due to the continuous increase in marketing expenses.

BOSIDENG's financial report shows that over the past five fiscal years, BOSIDENG's distribution expenses, including advertising and promotional expenses, have increased from 2.45 billion yuan to 6.17 billion yuan. In the 2022 fiscal year, distribution expenses accounted for nearly 40% of total revenue.

"The fundamental reason lies in the fact that down jackets are not essential consumer goods, but rather an improvement-oriented consumption," explained Qiu Lei. Down jackets have proactively "become more expensive," just like luxury goods raising prices in a poor overall environment, essentially screening out the "capable" paying customer base.

"In the past two years, there have been many viral articles saying that those with a monthly salary of 20,000 yuan cannot afford to stay in budget hotels, play badminton, and now there will soon be news that those with a monthly salary of 20,000 yuan cannot even afford to wear down jackets," Qiu Lei said.

III. Price Increase! Internal Competition! Manufacturers are no longer laughing

Behind the rising prices of down jackets, many people have turned to purchasing inclusive-type warm clothing, and the sales of military coats have surged.

Many people have also chosen not to buy, or have dismantled their old down jackets and processed them themselves.

"The decline in consumers' demand for down jackets has also been transmitted to practitioners." Since August, fashion designer Qiqi has been plunged into a huge "unemployment panic."

In the field of fashion design, the design cost of down jackets is the highest. Qiqi used to charge per design, with the cost of one design around 1,500 yuan. In the past, August to October was the peak season for down jacket design, "many orders would come in during this time."

However, this year, after the rise in raw material prices, many down jacket manufacturers chose to wait and see, or switched to selling last year's inventory. The demand for designs plummeted rapidly, and the design cost also dropped to around 1,100 yuan per design.

Qiqi shrugged, "Consumers were already tight on money, with raw material price increases, bosses will definitely reduce the number of new arrivals to control costs, or directly develop some best-selling styles to ensure costs."

In addition to being conservative in new designs, bosses will also consider costs in various aspects.

For example, in the choice of down filling, they choose the more affordable old national standard 90% white duck down, 80% white duck down, or 70% white duck down for filling. The percentages of 90%, 80%, and 70% refer to the down content, with higher content providing more warmth but at a higher price.

"70% meets the standard, 80% is for cold resistance, and 90% is excellent," explained Xiang Zhi. Because winters in the south are relatively warm, even if the down jackets look the same, many "targeted" down jackets sold to the south will adopt 70% and 80% down content, making them considerably cheaper Fill power and fluffy degree are also key areas of concern.

"Fill power refers to the weight of all down feathers, the unit should be in grams, but many small businesses choose to confuse the public by writing '90% fill power; the higher the fluffy degree, the more expensive the price," Xiang Zhi said. In order to control costs, many legitimate manufacturers choose to introduce 'lightweight' down jackets, reducing the amount of down, while small manufacturers will choose to fake 'washing labels' to create a 'high-quality' image.

There are also many bosses who choose to come out and do 'sales' themselves.

"In the past, Pinghu was mainly wholesale, or supplying goods for live streaming. This year, many manufacturers have started their own accounts to avoid intermediate links," Qiu Lei said.

"But simply saving costs from a cost perspective is not a long-term solution," Xiang Zhi said. Essentially, this is still engaging in a 'price war', and many of his peers around him are trying other paths.

For example, looking for 'alternatives' for cold protection products, transitioning to making windbreakers or clothing for other seasons. "Sanmen County in Taizhou, Zhejiang, more than 200 kilometers away from Jiaxing, happens to be the hometown of windbreakers. Windbreakers are more down-to-earth than down jackets, and many peers have gone there to investigate business this year."

Some peers are trying to build a brand, or develop more 'black technology' fabrics, etc., to enhance the product itself.

Xiang Zhi doesn't know where the end of this trend is.

But at the end, Xiang Zhi suddenly made a 'self-introduction', "I used to work as a product manager, now I have come back to inherit the family business. Currently, we are preparing to start a technology company to see if we can innovate. I think the high-end field of the clothing industry will also be affected by this trend."

Then he said, "Many children of merchants in Pinghu are studying abroad, studying fashion design. I think this is also a future trend."

"Just like I said, our industry is not a necessity, so everyone is working hard to learn about luxury goods."