A new record outside the epidemic period! The US government's deficit for the 2024 fiscal year exceeded $1.8 trillion, with debt interest expenses exceeding a trillion

美國政府 2024 財年預算赤字創第三高紀錄,僅次於新冠疫情期間兩年,連續兩財年赤字超過 6% 的 GDP;美聯儲的高利率是赤字主要推手,2024 財年,政府的債務利息支出同比增加 2540 億美元,增長 29% 至 1.1 萬億美元,佔 GDP 之比創 1998 年來新高;Social Security 支出一年增超千億美元;全財年政府收入 4.9 萬億美元創新高,一年增收 4790 億美元,半數增幅來自個税。

官方數據顯示,剛剛過去的一個財年,美國政府入不敷出的形勢極為嚴峻,在美國 200 多年的歷史上,2024 財年的年度赤字是不計新冠疫情期間的最高水平,主要源於美聯儲加息並保持高利率導致政府債務利息的成本負擔更重,社會保障項目的費用以及軍費開支增加。

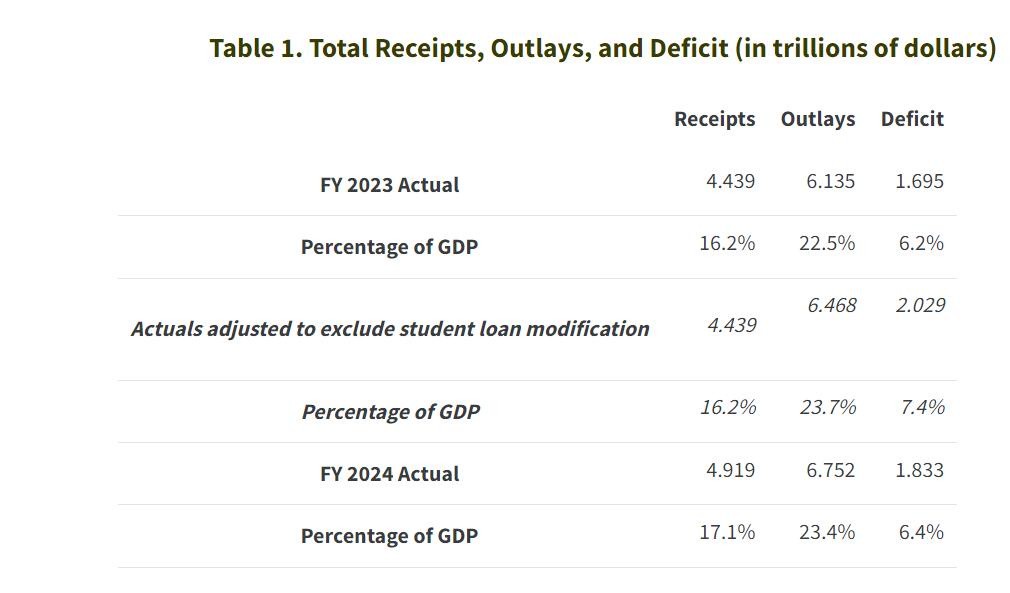

美東時間 10 月 18 日週五,美國財政部公佈,截至 2024 年 9 月 30 日的 2024 財年,美國聯邦政府的財政赤字達到 1.833 萬億美元,為有紀錄以來第三高,僅次於新冠疫情期間 2020 財年的 3.132 萬億美元和 2021 年財年的 2.772 萬億美元。

2024 財年的預算赤字較 2023 財年的將近 1.7 萬億美元又擴大了逾 8.1%,而且赤字與 GDP 之比連續第二年超過 6%,佔比為 6.4%,略高於 2023 財年的佔比 6.2%。

全財年公債利息支出增長 29% 至 1.1 萬億 佔 GDP 比重 1998 年來最高

美國財政部官員稱,此次公佈的財年預算赤字已經比今年 3 月發佈 2024 年預算時披露的基準預期赤字 1.91 萬億美元低 1440 億美元。這主要源於拜登政府取消了學生貸款減免計劃。

儘管已經相比前預期有所下降,實際的政府赤字與 GDP 之比還是達到了經濟衰退和世界大戰以外期間罕見的高位。債務利息越滾越大是赤字擴大的主要推手。

華爾街見聞曾提到,9 月財政部公佈數據顯示,2024 財年的前 11 個月,美國政府的利息成本史上首次突破 1 萬億美元大關,達到 1.049 萬億美元,同比猛增 30%。

本次財政部又公佈,整個 2024 財年,美國政府公債的利息支出達到 1.1 萬億美元,也是年度利息支出首次超過 1 萬億美元,較 2023 財年同比增加 2540 億美元,增幅 29%。以此計算,債務利息的支出約佔 GDP 的 3.93%,佔比創 1998 年來新高。

不過,美聯儲已經於 9 月開始降息,啓動了寬鬆週期。未來美國政府的利息支出壓力有望緩和。

截至 9 月末,未償還美國聯邦債務的加權平均利率為 3.32%,約為 15 年來最高水平。路透社援引一名美國財政部高管的表態稱,這一債務成本的加權平均利率 9 月開始下降,這是自 2022 年 1 月以來該利率首次下行。

Social Security 支出一年增超千億 政府年收入半數增幅來自個税

2024 財年另外兩個主要支出增長源是,聯邦政府幫補老年人和殘障工作者的社會保障項目 Social Security,以及國防。

2024 財年,美國聯邦政府合計支出 6.8 萬億美元,同比 2023 財年增加 6170 億美元,增幅 10.1%,與 GDP 之比從 22.5% 升至 23.4%。其中,Social Security 項目的支出增加 1030 億美元,增幅 7%,國防支出增加 500 億美元,同比增長 6%,聯邦政府最大醫療保險計劃 Medicare 的支出增加 280 億美元,增幅 3%。

以同比支出增加金額看,2024 財年增幅最大的支出來自 Social Security,而如果以百分比增幅看,政府債務利息成本的增速遠超 Social Security。

在收入方面,2024 財年也有兩位數增長,全年收入 4.919 萬億美元創財年收入最高紀錄,佔 GDP 的 17.1%,同比增長 4790 億美元,增幅 10.8%。

財政部稱,收入增長主要來自個税收入增加 2500 億美元,企業所得税增加 1100 億美元。以此計算,個税收入的增幅佔全年收入增幅的 52%,企業所得税約佔 23%。

總統候選人面臨赤字挑戰

媒體普遍認為,預算赤字問題會給 11 月就要大選 “決戰” 的美國總統候選人帶來挑戰。之前分析稱,無論是 “哈里斯經濟學” 還是 “特朗普經濟學”,都有一個共同點:赤字。哈里斯和特朗普都表示討厭通貨膨脹,可他們提出的經濟政策可能都會導致美國物價上漲,財政赤字擴大。

財政智庫 the Committee for a Responsible Federal Budget 本月稍早估算,哈里斯的經濟計劃將導致十年內政府債務增加 3.5 萬億美元,特朗普的經濟計劃將使債務飆升 7.5 萬億美元。