What are the new investment preferences of wealthy family offices?

According to Citigroup Private Bank's "Global Family Office 2024 Survey Report," the investment preferences of 338 family offices have changed. The survey shows that family offices no longer consider cash as their top choice, but have increased their investments in fixed income, public, and private equity. Respondents' optimism towards private equity has significantly increased, with almost unanimous expectations of positive returns in their investment portfolios over the next 12 months. Nearly half of the respondents anticipate a return rate exceeding 10%

Recently, Citibank Private Bank released the "Global Family Office 2024 Survey Report", which was conducted from June 4th to July 15th, receiving responses from 338 family offices, providing us with insights into the mindset and behavior of the world's most sophisticated investors.

According to reports, 21% of the respondents are from the Asia-Pacific region, 28% from Europe, the Middle East, and Africa, 14% from Latin America, and 36% from North America. Half of the respondents have assets under management exceeding $500 million, while the other half have assets under management below $500 million.

This survey consists of 50 questions aimed at understanding the investment sentiment and portfolio positioning of family office clients in 2024. In this article, Family Office New Wisdom has selected the essence of the report in the hope of inspiring you.

I. Investment Strategy and Sentiment

Key Points:

-

Cash is no longer king, as surveyed family offices are shifting their liquid assets towards fixed income, public, and private equity.

-

Recently, the main concerns affecting the financial markets are the outlook for interest rates, US-China relations, and stock market valuations.

-

Since 2021, inflation is no longer the top concern for the first time, with minimal impact from conflicts in the Middle East and Russia-Ukraine.

-

Bullish sentiment is prevalent. Family offices are most optimistic about private equity - whether through direct investment or fund investment, and the sentiment towards global developed stocks is significantly more positive than last year.

-

Almost unanimously expect positive returns for their investment portfolios in the next 12 months, with nearly half of the respondents expecting a return rate of over 10%.

- Changes in Asset Allocation in the Past Year

From a global perspective, family offices have made significant adjustments to their investment portfolios since last year, putting cash to use.

Nearly half of the respondents have increased their allocation to fixed income as yields approach multi-year highs. At the same time, 43% have increased their exposure to the recovering public equity markets, compared to 20% in 2023.

They have also shown interest in private equity, with 42% increasing their allocation to private equity, compared to 38% last year.

Nearly half of the respondents allocated more funds to cash in 2023, but less than a third did so in 2024. Meanwhile, about 37% have reduced their cash allocation. In addition, family offices have maintained a stable allocation to real estate, with 55% keeping it unchanged, remarkably similar to last year's results.

From an AUM perspective, both family offices with AUM exceeding $500 million and those below $500 million have generally shifted from cash to fixed income, public equity, and private equity. While over half of the surveyed family offices have kept their real estate allocation unchanged, larger family offices are more likely to increase their real estate allocation compared to smaller ones From a regional perspective, family offices in the Asia-Pacific region are leading in public equity investments, with two-thirds of family offices reporting an increase in allocation. In Latin America, about 45% of family offices have increased their public equity investment allocation, while in the other two regions, approximately one-third of family offices have increased their public equity investment allocation.

The weight of fixed income has seen the largest increase in Europe, the Middle East, and Africa, with 59% of family offices increasing their allocation. In Latin America and North America, the numbers are 55% and 42% respectively.

Among the surveyed family offices, nearly 40% have reduced the weight of cash, with North America at 30%. Real estate is the asset class with the least changes in allocation among family offices in various regions.

- Main Concerns of Family Offices

Since 2021, inflation is no longer the top concern for surveyed family offices in the economy and financial markets. 52% of respondents now consider the outlook for interest rates as the main concern. Concerns about US-China relations, market overvaluation, and inflation follow closely.

30% of surveyed family offices mentioned concerns about the stability of the global financial system. Coupled with concerns about overvaluation of risk assets, this may explain why family office investors have a strong interest in fixed income and equities. Additionally, concerns about the Middle East conflict are more prominent than concerns about the Russia-Ukraine conflict.

- Sentiment on Asset Classes in the Next 12 Months

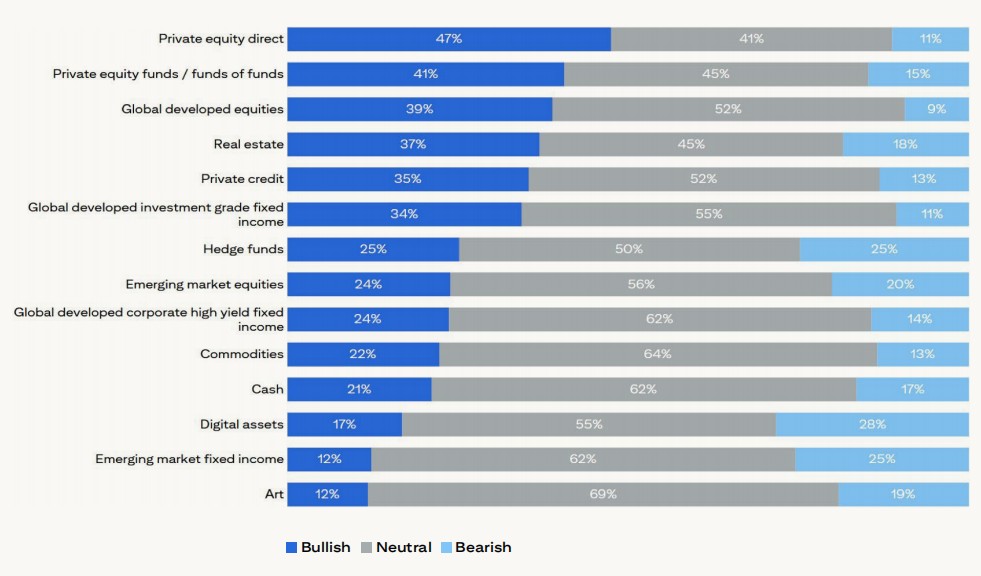

Family offices are more optimistic about the outlook for asset classes in the next 12 months compared to a year ago. They are most bullish on direct private equity investments, private equity, and global developed equities.

Public equities and some other risk assets have continued to rebound from the lows of October 2022. Real estate remains favored, with 37% of respondents expressing optimism. Interest in private credit continues to exist, although bullish sentiment has slightly declined from last year's levels.

In the sentiment on asset classes in the next 12 months, family offices' bullish sentiment on global developed investment-grade fixed income has slightly decreased from 45% in 2023 to a still bullish 34%. This may reflect an increase in risk appetite.

The net sentiment of surveyed family offices is most positive for direct private equity investments, global developed equities, and private equity funds. They are most negative towards emerging market fixed income and digital assets. Sentiment towards hedge funds is neutral, highlighting differing views among family offices on this asset class.

Regarding expected portfolio returns in the next 12 months, respondents almost unanimously expect positive returns for their portfolios. About half of the respondents expect returns between 5% to 10%, while another third expect returns between 10% to 15%.

II. Portfolio Construction and Management

Key Points:

-

The shift towards public equities and fixed income investments is noteworthy, as is the commitment to alternative investments.

-

While the global allocation to North America remains the highest, there is still a clear preference for domestic investments in North America.

-

Some institutions are still seeking ways to diversify risks, and the phenomenon of concentrated positions still exists.

-

Leverage usage remains low, but there is a greater willingness to pursue strategic acquisitions and mergers.

-

While there is widespread interest in investing in generative artificial intelligence, it has not yet been adopted by institutional managers.

- Asset Class Allocation

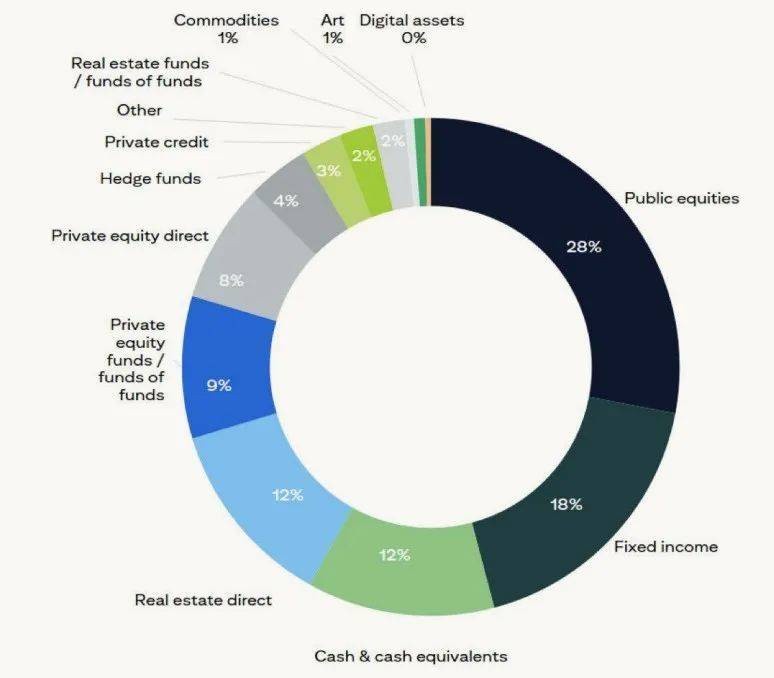

The weights of the two largest asset classes for institutions—public equities and fixed income—further increased in 2024. Public equities rose from 22% to 28%, and fixed income rose from 16% to 18%.

The growth in public equities is attributed to both cash inflows and the continued rebound of the market from the 2022 lows. Private equity fell from 22% to 17%. Compared to public equities, private equity valuations take longer to adjust upwards, which may be a contributing factor to this situation.

Real estate weight decreased from 17% to 14%. The industry challenges following a sharp interest rate hike cycle and the ongoing turbulence in some industries since the pandemic may help explain this phenomenon. Cash, hedge funds, and private credit remained stable at 12%, 4%, and 3% respectively.

In terms of AUM, large institutions show greater interest in illiquid assets and are willing to withstand market volatility.

From a regional perspective, institutional public equity allocations are similar globally, ranging between 26% and 30%. One of the main differences is fixed income, with Latin America and the Asia-Pacific region having significantly higher weights compared to Europe, the Middle East and Africa, and North America. North American institutions have a higher allocation to direct real estate holdings compared to institutions in other regions. In the Asia-Pacific region, the 15% cash allocation is higher than the average of 11% in the other three regions.

- Asset Allocation by Region

From a global perspective, North America has received the highest overall weighted allocation from institutions, followed by Europe and the Asia-Pacific region. Since last year, the allocation to China has almost halved from 8% to 5%. Driven by a strong stock market, the allocation share to North America has increased from 57% to 60% From the perspective of AUM, family offices with assets under management of $500 million or more will allocate more investment portfolios in North America. This may reflect that many large family offices are located in North America and tend to invest in their local regions.

From a regional perspective, family offices in the Asia-Pacific region report that the geographical distribution of their investment portfolios is the most diverse, followed by Europe, the Middle East and Africa, and Latin America. For global family offices, China accounts for 5% of the portfolio allocation, down from 8% last year.

- Concentrated Positions

From a global perspective, as in previous years, over two-thirds of respondents stated that they hold concentrated positions in public or private companies. While concentration is often an inherent feature of initial wealth creation, it may later pose a significant and unnecessary threat to wealth preservation. One-third of concentrated position holders indicated that they are considering risk management strategies.

In terms of AUM, family offices with assets under management of less than $500 million tend to hold concentrated positions in private companies, which is more common than in larger family offices. This may reflect that smaller family offices are often still in wealth creation mode, owning and managing family businesses.

The situation is the opposite for concentrated investments in public companies. Large family offices are more likely to hold concentrated positions than small family offices, possibly because they own more mature companies that have already IPO'd.

- Leverage Used

From a global perspective, family offices reported that the leverage ratio of their investment portfolios remains relatively low, with half not using any leverage at all. However, 29% of family offices used leverage as high as 10%, and 24% used leverage above this level.

In terms of AUM, half of family offices with AUM below $500 million used some leverage in their investment portfolios, as did 55% of large family offices. Large family offices using leverage are more likely to use more leverage. For example, the likelihood of them using leverage of over 20% is three times that of small family offices.

- Financing Needs

From a global perspective, over one-third of family offices have not explored financing opportunities in the next 12 months. Among those exploring financing opportunities, the main focus areas are real estate financing, private equity investments, and operational business.

From the perspective of asset management scale, both large and small family offices reported that real estate is their primary focus for financing. However, their second priorities differ, with family offices with assets under management exceeding $500 million mentioning private equity, while those with assets under $500 million mentioning operational business 6. Interest in Mergers and Acquisitions

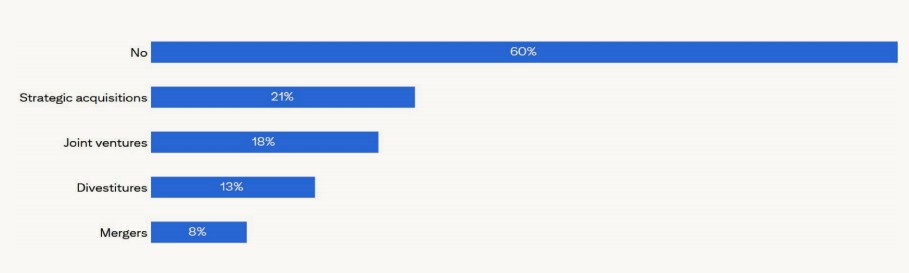

From a global perspective, about 40% of family offices that own businesses are considering engaging in merger and acquisition activities in the next 12 months, mainly through strategic acquisitions or joint ventures. The top three target regions are North America, Europe, and the Asia-Pacific region. Only 9% mentioned Latin America.

In terms of Assets Under Management (AUM), large family offices are slightly more likely to consider merger and acquisition activities compared to small family offices. They have a greater interest in joint ventures and asset divestitures. Large family offices seem to favor merger and acquisition activities in North America, Europe, the Middle East, and Africa, but this may reflect that many large family offices are located in these regions and tend to invest locally.

Regionally, Latin American family offices are the least likely to consider merger and acquisition activities in the next 12 months. Family offices in the Asia-Pacific region, Europe, the Middle East and Africa, as well as entities in North America, show strong interest in a wide range of activities in the merger and acquisition field. As expected, family offices tend to invest in merger and acquisition activities in their local regions, followed by North America.

- Artificial Intelligence Investments

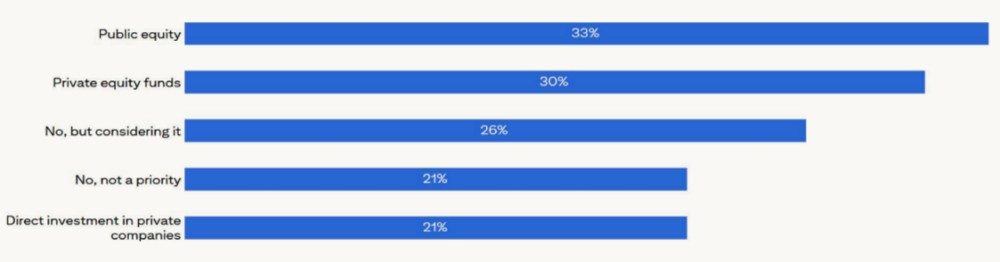

From a global perspective, over half of family offices have already introduced generative artificial intelligence technology into their investment portfolios, with another 26% considering it. Public equities, private equity funds, and direct private equity investments are the most popular asset classes for family offices in terms of deploying artificial intelligence investments.

Although there is a strong interest in artificial intelligence in investments, it has not been widely adopted in the operational aspects of family offices. Less than 15% of respondents stated that they are deploying artificial intelligence for tasks such as automation, presentation construction, or forecasting.

In terms of AUM, public equities and private equity funds are the main AI investment tools for family offices with AUM exceeding and below $500 million. Nearly 30% of family offices seek exposure through these means. However, large family offices show a stronger preference for direct investments in private companies compared to small family offices.

Regionally, family offices in Europe, the Middle East, and Africa show the highest commitment to artificial intelligence investments, with only 12% not considering it a priority. The Asia-Pacific region strongly favors investing in artificial intelligence through public equities.

- Digital Asset Investments

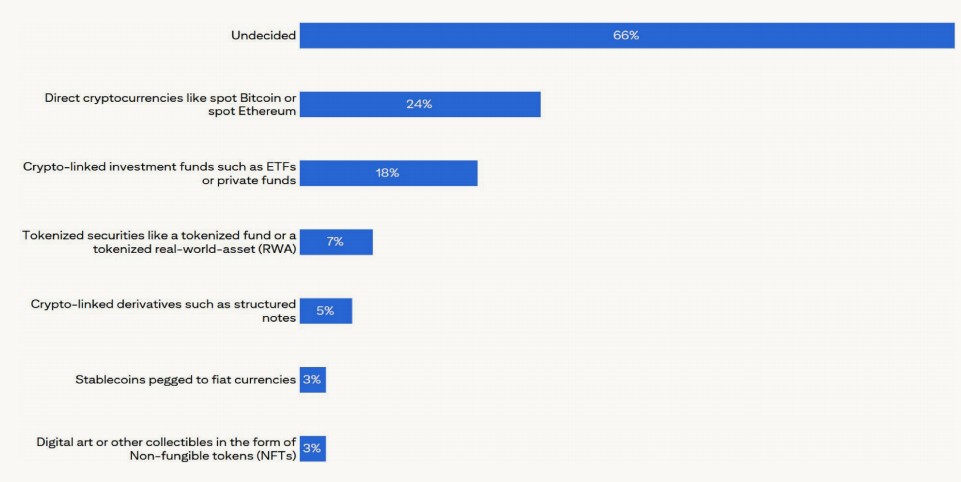

From a global perspective, about a quarter of respondents have already invested or plan to invest in digital assets. Another 10% of family offices are "curious about digital assets," meaning they are considering allocation but are still researching the topic or seeking advice In terms of asset types, direct cryptocurrency investments continue to attract the most interest, followed by investment tools related to cryptocurrencies such as exchange-traded funds. At the same time, two-thirds of the participants have not yet decided to explore which type of digital asset products, highlighting the ongoing educational needs of families for this emerging asset class.

From a regional perspective, the Asia-Pacific region is leading in the adoption of digital assets, with 37% of respondents already invested or intending to invest. In this region, one out of every 20 families reports that over 10% of investable assets are digital assets. In contrast, Latin America has the least interest, with 83% of families not prioritizing investments in this area.

- Family Office CIO Role

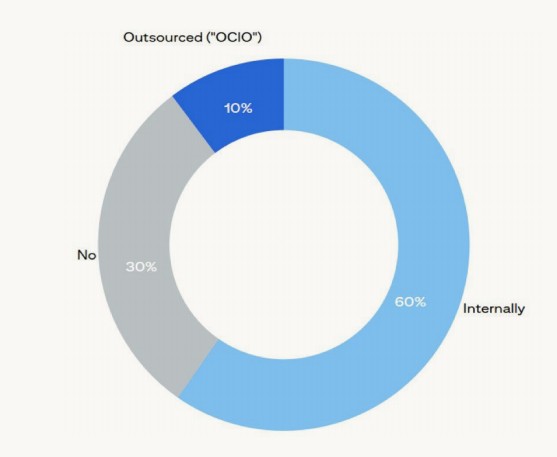

From a global perspective, most families indicate that they have an internal Chief Investment Officer (CIO) , while nearly one-third of families do not have an internal CIO, and 10% of families rely on outsourced CIO solutions.

From an Assets Under Management (AUM) perspective, about 39% of families with AUM below $500 million report not having a CIO, while this proportion is 22% for families with higher AUM. This makes sense as attracting and retaining a full-time CIO is a significant financial commitment that requires families to have a certain scale of fund management. Families with AUM below $500 million are more likely to outsource CIO services by over 50%.

From a regional perspective, families in the Asia-Pacific region are most likely to rely on the outsourced CIO model, with 16% of families reporting this choice. Europe, the Middle East, and Africa report the lowest proportion using this approach at 3%. Latin America and Europe, the Middle East, and Africa are most likely not to have a CIO, with proportions of around 38%.

From a generational perspective, when family wealth reaches the third generation or later since its creation, they are more likely to have an internal CIO compared to first and second-generation families.

Generally, first-generation families are usually keen on taking a hands-on approach to investment management and are therefore unwilling to relinquish control to professionals. However, as wealth and family dynamics grow increasingly larger and more complex over time, this situation often changes.

III. Firsthand Insights from CIOs

The surveyed families believe that the Middle East has attractive investment potential in the extensive reshaping of real estate, energy, and regional economies Japanese stocks are valued below their long-term average levels. The strong stock performance in the first half of 2024 is mainly driven by earnings growth rather than multiple expansion.

Furthermore, India's GDP growth rate is as high as 8%, which is attractive to many investors. India's physical infrastructure has made progress over the past 20 years. Its digital infrastructure has also improved, enabling the widespread use of smartphones, digital payments, and biometric technology.

- Seeking Alpha in Economic Slowdown

Family offices are optimistic about investment prospects, with their proactive investment portfolio positioning as evidence. Artificial intelligence and related technologies are expected to be as transformative as the internet since the late 1990s. While there may be temptations to dominate investment portfolios in this area, maintaining a dynamic globally diversified multi-asset class investment portfolio over time may prove to be the most effective approach.

It is worth pondering: "When to cut positions? It is important to honestly state why you are starting a position. Is the argument still the same? If so, doing nothing—at least for a while—may be the best strategy."

- Real Estate Revival

Post-pandemic potential real estate opportunities are a focus for family offices. Despite often discouraging news headlines, some indicators suggest that real estate values are bottoming out. Certain sub-sectors are indeed experiencing price dislocations, such as residential properties in China and many older, lower-quality, and poorly located offices in many countries.

However, there are also some bright spots, including residential properties in the United States and logistics facilities in Western Europe. It is worth pondering: "Step back and look. What are the major long-term trends in the world, and which real estate sub-sectors and regions may benefit or suffer?"

- Healthcare: Prescription for Growth

Healthcare may become increasingly personalized and focused on keeping people healthy rather than treating patients. In contrast, the proportion of care received by chronic disease patients in the United States has been increasing over the past few decades. If not addressed, this trend will bring a huge economic burden. Artificial intelligence has tremendous potential, especially in reducing management costs in the near term. Direct involvement of artificial intelligence in patient care may take longer.

It is worth pondering: "Will humanity reach escape velocity in the coming years, where life expectancy is expected to rise with each passing year rather than decline?"