Hasbro (HAS) Leverages Digital Gaming for Growth and Offers Enticing Dividend Yield

Hasbro (HAS) is shifting towards digital gaming, resulting in a 34% stock increase year-to-date and a 4.5% dividend yield. Despite a 15% revenue decline in Q3 2024, strong performance in gaming and licensing suggests potential for profitability. Analysts remain bullish, with a price target of $70.50, indicating a 24.21% upside. Management forecasts revenue drops in various segments but aims for significant cost savings by 2025, making HAS stock attractive for income-oriented investors.

Despite recent challenges, toy and entertainment company Hasbro (HAS) is embracing a significant strategic shift and garnering solid returns. The company’s pivot towards digital gaming and entertainment has propelled growth, with Q3 2024 earnings exceeding expectations due to improved business mix and lower costs. The stock is up over 34% year-to-date, offering an enticing dividend yield of 4.5%. With ongoing digital innovation and the potential for further conversion of its classic board games into engaging online experiences, future prospects in the digital gaming arena seem promising, making the stock an attractive option for income-oriented investors.

Hasbro’s Entertainment Empire

Hasbro is a multinational toy and game corporation that operates through four segments: Consumer Products, Wizards of the Coast & Digital Gaming, Entertainment, and Other segments.

The Consumer Products division is responsible for sourcing, marketing, and selling toy and game products. The Wizards of the Coast and Digital Gaming division promotes its brands through trading cards, role-playing games, and digital game experiences. The Entertainment division, on the other hand, develops, produces, and sells a variety of entertainment content, such as films, television, children’s programming, digital content, and live entertainment.

Products are sold to various retailers, distributors, wholesalers, and discount stores, as well as directly to customers through several e-commerce websites under different brand names, including Magic: The Gathering, Hasbro Gaming, PLAY-DOH, Transformers, Dungeons & Dragons, and Peppa Pig.

Hasbro’s Recent Financial Results

The company recently reported results for the third quarter. Revenue of $1.28 billion marked a 15% year-over-year decline while falling short of analysts’ expectations by $20 million. Despite the decline in revenue, the company’s robust performance in the gaming and licensing sectors highlighted its high-profit potential. In contrast, positive results from key strategies, including digital and licensing enhancements and product innovation, suggest the company has made progress toward an operational turnaround, forecasting improved profitability and cash flow. Operating profit stood at $302 million with a margin of 23.6%, with the non-GAAP earnings per share (EPS) of $1.73 surpassing estimates by $0.44.

In Q3, the company distributed its shareholders $98 million as cash dividends. Moreover, the Board of Directors has declared a cash dividend of $0.70 per common share, which equates to a dividend yield of 3.18%. It will be payable on December 4, 2024.

HAS’ management has issued guidance for 2024, anticipating a decrease in Consumer Products Segment revenue by 12-14% with an adjusted operating margin of 4-6%. The Wizards of the Coast and Digital Gaming Segment is expected to remain steady or decrease slightly by 1%, with an operating margin of about 42%. The Pro-Forma Entertainment segment revenue is forecasted to drop by $15 million with an adjusted operating margin of 60%. The total adjusted EBITDA of the company for the year is projected to be between $975 million and $1.025 billion. The company aims for gross savings of $750 million by the end of 2025.

What Is the Price Target for HAS Stock?

The stock has been trending upward, climbing over 55% in the past year. It trades in the upper end of its 52-week price range of $42.66 – $73.46, though it shows negative price momentum by trading below the 20-day (70.52) and 50-day (69.14) moving averages. With a P/S ratio of 2.15x, it trades at a slight premium compared to the Leisure industry average of 1.8x.

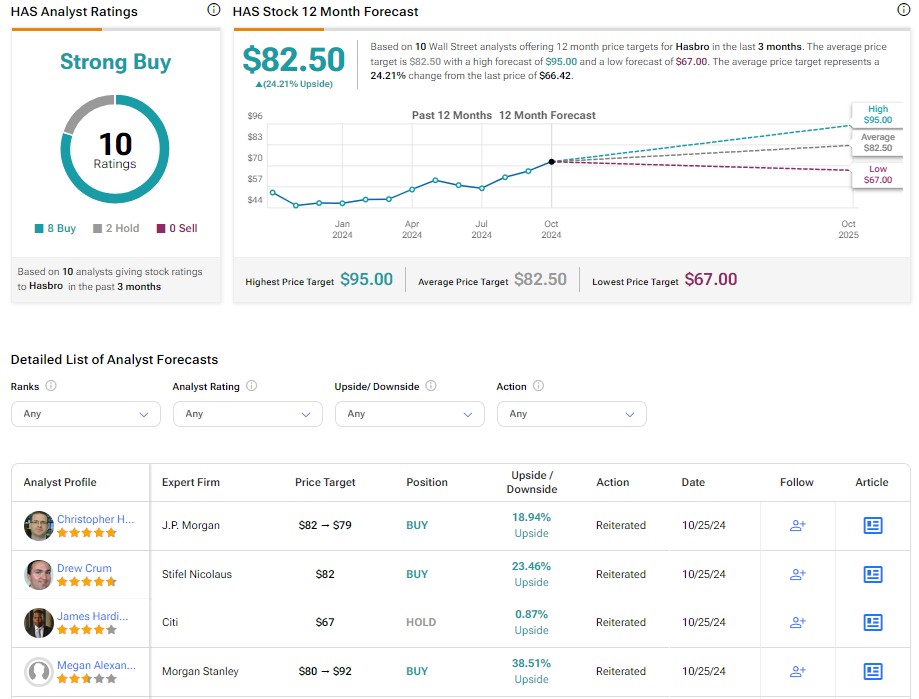

Analysts following the company have mostly been bullish on HAS stock. For example, DA Davidson has increased its share price target from $59 to $73 while maintaining a Neutral rating. On the other hand, JPMorgan (JPM) has decreased Hasbro’s price target from $82 to $79 while still keeping an Overweight rating.

Based on ten analysts ‘ recent recommendations, Hasbro is rated a Strong Buy overall. The average price target for HAS stock is $82.50, representing a potential upside of 24.21% from current levels.

See more HAS analyst ratings

HAS in Review

Hasbro has demonstrated adaptability by strategically shifting towards digital gaming and entertainment, yielding solid returns. The company continues to innovate in the digital realm and explore ways to digitize its classic board games, a move that holds promising prospects. Despite a 15% year-over-year revenue drop, Hasbro’s robust performance in gaming and licensing underlines the company’s high profit potential.

Management’s 2024 forecasts indicate expected revenue shifts across segments but a firm commitment to achieving gross savings of $750 million by 2025. The stock’s upside potential makes it an appealing choice for income-focused investors.

Disclosure