Counterpoint Research: Global smartphone shipments in the third quarter increased by 2% year-on-year, reaching 307 million units

根據 Counterpoint Research 的報告,2024 年第三季度全球智能手機出貨量同比增長 2%,達到 3.07 億部,連續第四個季度增長。全球智能手機收入同比增長 10%,平均售價增長 7%,均創歷史新高。儘管部分地區如拉丁美洲和東南亞實現增長,但西歐和中東非的出貨量下降。蘋果在市場中佔據 43% 份額,創下收入和出貨量歷史最高紀錄。

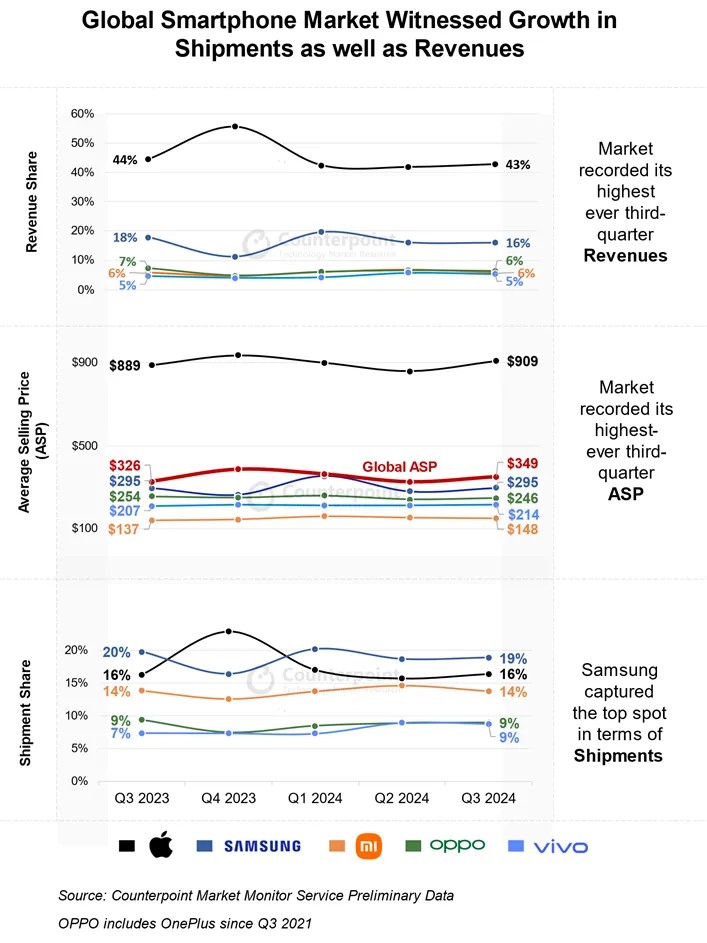

智通財經 APP 獲悉,根據 Counterpoint Research 全球第三季度市場監測智能手機追蹤報告,2024 年第三季度全球智能手機出貨量同比增長 2%,出貨量達到 3.07 億部。全球智能手機收入同比增長 10%,平均售價增長 7%,收入和平均售價均創下歷史新高。這是全球智能手機市場連續第四個季度增長。雖然智能手機市場在過去幾個季度實現了強勁的同比增長,但主要原因是宏觀經濟狀況和消費者需求的復甦。

分析師觀點在評論第三季度各地區智能手機市場的表現時,高級分析師 Prachir Singh 表示:“全球宏觀經濟危機基本已經過去,隨着過往對照基準的正常化,之前出現的復甦浪潮已開始放緩。拉丁美洲、日本、東歐和東南亞等一些市場在第三季度持續復甦,實現了同比增長。然而,由於經濟復甦放緩,西歐、中東非的出貨量同比下降,各自地區的持續衝突也繼續抑制消費者信心。”

全球最大的幾個市場,美國出貨量同比下降,因為創紀錄的低換機率持續影響市場。印度的手機品牌廠商比平時稍早開始在各銷售渠道為節日季鋪貨,助推了同比增長。隨着經濟和消費者需求持續改善,中國第三季度的出貨量也出現同比增長,其中華為的復甦是一個推動因素。

雖然最近幾個季度的出貨量增長有所放緩,但全球智能手機營收增長在 2024 年第三季度加速,同比增長 10%,達到歷史最高的第三季度水平。蘋果在智能手機營收方面領跑市場,佔據 43% 的份額,並創下了第三季度收入、出貨量和平均售價歷史最高紀錄。

分析師觀點針對蘋果 (AAPL.US) 的表現,研究總監 Jeff Fieldhack 表示:“蘋果在第三季度的成功主要是由於 iPhone 16 系列的推出時間較早,且產品組合更新越來越傾向於 Pro 版本,以及針對非核心市場的持續擴張。儘管如此,仍應保持謹慎,iPhone 16 系列在各個地區的表現好壞參半,與 15 系列相比,16 在美國等主要市場的銷量出現同比下降。但三到四年前 iOS 設備的龐大用户基數可能會幫助維持 iPhone 16 在未來幾個季度的的穩定銷量,尤其是隨着 Apple Intelligence 功能的不斷推出。”

三星的收入和出貨量同比下降 2%,主要是由於印度和拉丁美洲地區的下滑。小米 (01810) 的收入增長超過了其出貨量的增長,主要原因是以小米 14 系列為主的高端設備比例增加。8 月份,小米在銷量方面短暫成為全球第二。vivo 在前五大手機品牌廠商中增長最快,在第三季度,無論是在中國還是印度,在出貨量方面都是第一大手機品牌廠商。

OPPO 的出貨量和收入在第三季度同比下降。該品牌的全球銷售額在 9 月份恢復同比增長,其中拉丁美洲和 “亞太其他地區” 領漲。前五大手機品牌廠商以外的市場收入錄得兩位數的強勁同比增長,在第三季度顯著超過出貨量增長。華為、谷歌和摩托羅拉等安卓品牌推動了其他品牌的增長,摩托羅拉創下了該品牌自進入智能手機時代以來最高的季度出貨量。

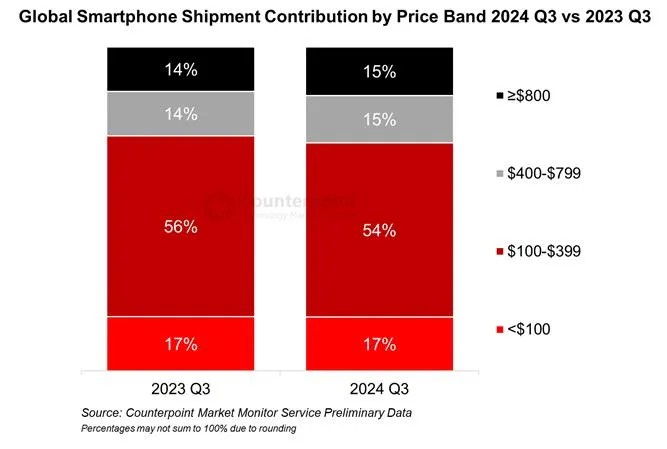

由於大多數主要品牌都實現了強勁的收入增長,≥400 美元的細分市場在 2024 年第三季度的淨份額同比上漲了 2%。各個地區持續的高端化浪潮激勵着手機品牌廠商重新考慮其高端產品組合和設備融資策略。預計高端化趨勢將在未來幾年繼續,預計全球智能手機平均售價將在 2023 年至 2028 年期間以 3% 的複合年增長率增長。

分析師觀點研究總監 Tarun Pathak 在評論智能手機前景時表示:“全球智能手機市場已經成熟,預計未來幾年出貨量將保持穩定。印度、中東非以及東南亞等新興市場可能會推動增長。預計隨着高端化趨勢在各個市場的持續,智能手機收入將在 2028 年繼續增長。隨着採用率的上升,GenAI 和摺疊屏手機等新技術也可能會推動平均售價增長。到 2028 年,預計出貨的智能手機中有一半以上將具備 GenAI 功能,隨着更廣泛的使用場景不斷湧現,這項功能將在不同價格區間普及”