Berkshire Hathaway, led by Buffett, Q3 holdings: significantly reduced positions in Apple and Ulta Beauty, established positions in Domino's and Pool Corp

Berkshire Hathaway, led by Warren Buffett, released its third-quarter holdings report as of September 30, 2024, with a total market value of $266 billion, a decrease of 5% quarter-on-quarter. During this period, Berkshire reduced its holdings in 6 stocks, completely sold out of 3 stocks, while adding and increasing its position in 2 stocks. Apple remains the largest holding, but the number of shares held has significantly decreased by 25% compared to the beginning of the year

According to the disclosure by the U.S. Securities and Exchange Commission (SEC), the "Oracle of Omaha" Warren Buffett's Berkshire Hathaway (BRK.A.US, BRK.B.US) submitted its third-quarter holdings report (13F) as of September 30, 2024.

Statistics show that the total market value of Berkshire Hathaway's holdings in the third quarter reached $266 billion, down 5% from the previous quarter's total market value of $280 billion. In the third quarter, Berkshire added 2 new stocks to its portfolio and increased its holdings in 2 stocks. At the same time, Berkshire reduced its holdings in 6 stocks and completely exited 3 stocks. The top ten holdings accounted for 89.68% of the total market value.

In the top five holdings, Apple (AAPL.US) remains in first place, holding 300 million shares with a market value of approximately $69.9 billion, accounting for 26.24% of the portfolio, with the number of shares down 25% from the previous quarter. Although Apple is still its largest holding, the number of shares has sharply decreased from 905 million shares at the beginning of the year to 300 million shares.

American Express (AXP.US) ranks second, holding approximately 152 million shares with a market value of about $41.1 billion, accounting for 15.44% of the portfolio, with no change in the number of shares from the previous quarter.

Bank of America (BAC.US) ranks third, holding approximately 766 million shares with a market value of about $32.3 billion, with the number of shares down 1.12% from the previous quarter.

Coca-Cola (KO.US) ranks fourth, holding 400 million shares with a market value of about $28.7 billion, accounting for 10.79% of the portfolio, with no change in the number of shares from the previous quarter.

Chevron (CVX.US) ranks fifth, holding approximately 119 million shares with a market value of about $17.5 billion, accounting for 6.56% of the portfolio, with no change in the number of shares from the previous quarter.

The other major holdings ranked sixth to tenth are: Occidental Petroleum (OXY.US), Moody's (MCO.US), Kraft Heinz (KHC.US), Chubb Limited (CB.US), and DaVita Inc. (DVA.US).

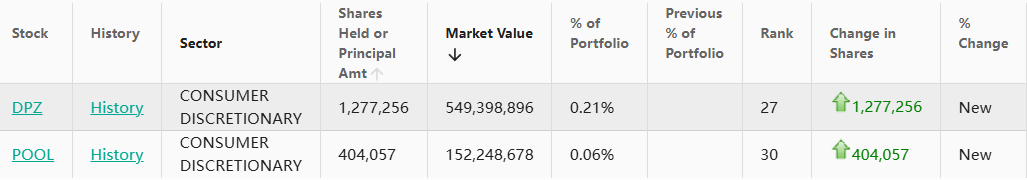

It is worth mentioning that the 2 new stocks added to Berkshire's portfolio in the third quarter are Domino's (DPZ.US) and Pool Corp. (POOL.US).

, Nu Holdings (NU.US), Charter Communications (CHTR.US), and Ulta Beauty (ULTA.US) in the third quarter. Among them, the number of shares held in Ulta Beauty decreased significantly by 96.49% compared to the previous quarter, while the number of shares held in Charter Communications decreased by 26.30% compared to the previous quarter.

From the changes in holding ratios, the top three buying targets are: Domino's, Pool Corp, and Heico Corporation (HEI.A.US).

The top five selling targets are: Apple, Bank of America, Liberty Sirius XM Group, Series C (LSXMK.US), Liberty Sirius XM Group, Series A (LSXMA.US), and Floor & Decor (FND.US).

Berkshire's third-quarter financial report released earlier this month showed total revenue of $92.995 billion in the third quarter, slightly lower than $93.210 billion in the same period last year; operating profit decreased by 6.2% year-on-year to $10.09 billion, falling short of market expectations of $10.9 billion; net profit was $26.25 billion, compared to a loss of $12.77 billion in the same period last year; investment income was $20.51 billion, compared to a loss of $29.78 billion last year. In addition, as of the end of the third quarter, Berkshire's cash reserves soared to $325.2 billion, a significant increase from $168 billion at the beginning of the year.