Raise your head and breathe freely, "Super Xiaomi" has arrived

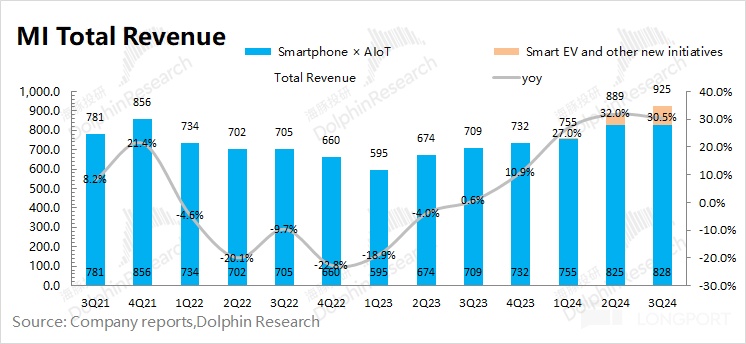

Xiaomi Corporation released its third-quarter financial report on November 18, 2024, with revenue of 92.5 billion yuan, a year-on-year increase of 30.5%, exceeding market expectations. The mobile phone and IoT businesses showed significant growth, with the mobile phone business increasing by 13.9% year-on-year and the IoT business growing at a rate of 26.3%. The gross profit margin was 20.4%, a decline of 2.3 percentage points year-on-year. The automotive business performed well, with revenue of 9.7 billion yuan. The overall ARPU value remained stable in the range of 12-12.5 yuan

Xiaomi Group (1810.HK) released its Q3 2024 financial report (ending September 2024) after the Hong Kong stock market closed on November 18, 2024, Beijing time. The key points are as follows:

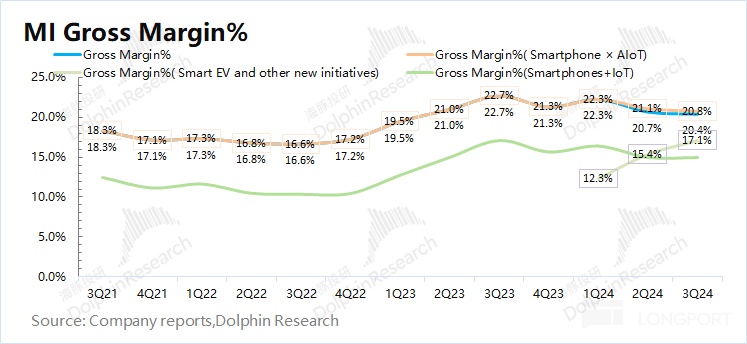

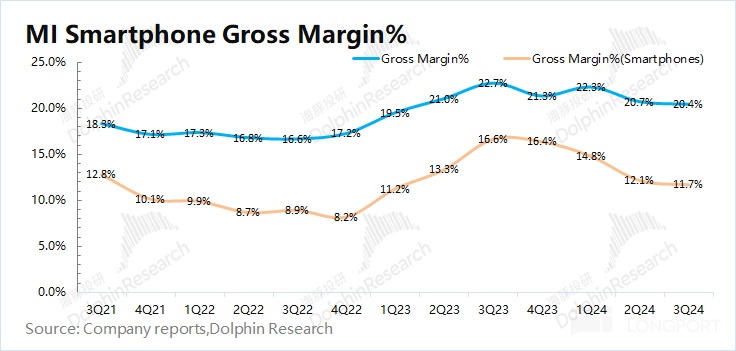

1. Overall Performance: Revenue & Gross Margin, both better than expected. Xiaomi Group's total revenue for this quarter was 92.5 billion yuan, a year-on-year increase of 30.5%, better than market expectations (90.4 billion yuan). The revenue growth this quarter was mainly driven by the growth of traditional mobile phone and IoT businesses, as well as the growth of the automotive business. $Xiaomi Corporation (ADR).US The gross margin for this quarter was 20.4%, a year-on-year decline of 2.3 percentage points, in line with market expectations (20.2%). Although the gross margin of the mobile phone business saw a significant decline due to rising costs of some components, the overall gross margin was still maintained above 20%;

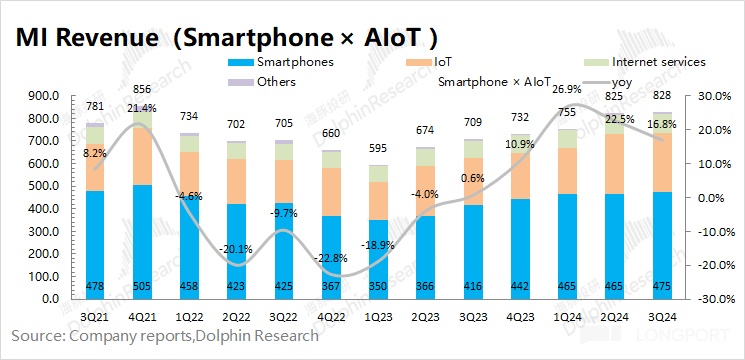

2. Traditional Hardware Business: Double-digit growth in mobile phone & IoT business, traditional hardware gross margin maintained at 14.9%.

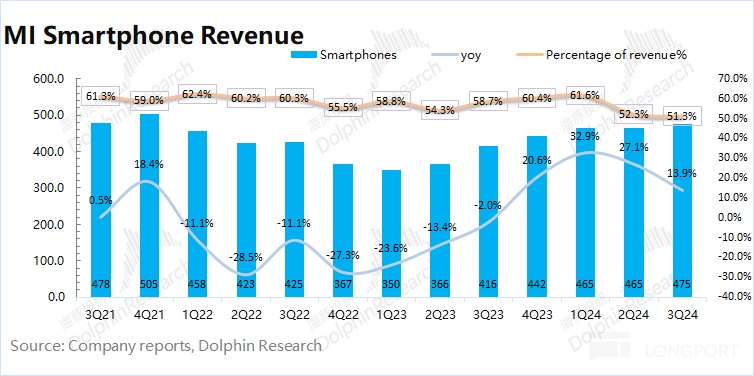

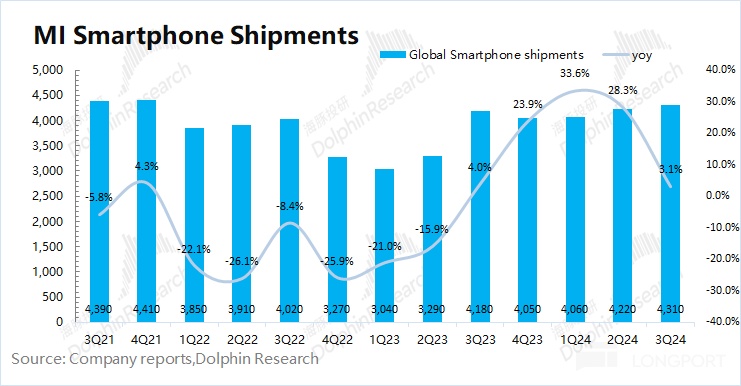

1) Mobile Phone Business Continues to Grow: The mobile phone business grew by 13.9% year-on-year this quarter, mainly due to a slight increase in Xiaomi phone shipments, with the average selling price remaining above 1,100 yuan;

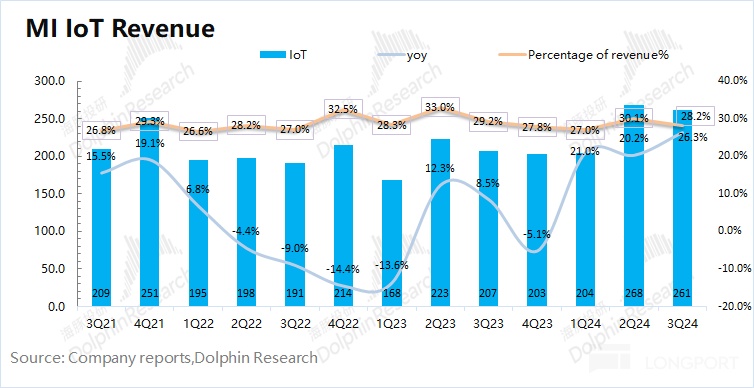

2) IoT Business Growth Accelerates: The IoT business achieved a growth rate of 26.3% this quarter. The main growth this quarter came from other IoT product businesses, including tablets, smart home appliances, and wearable products, which saw growth of over 30%;

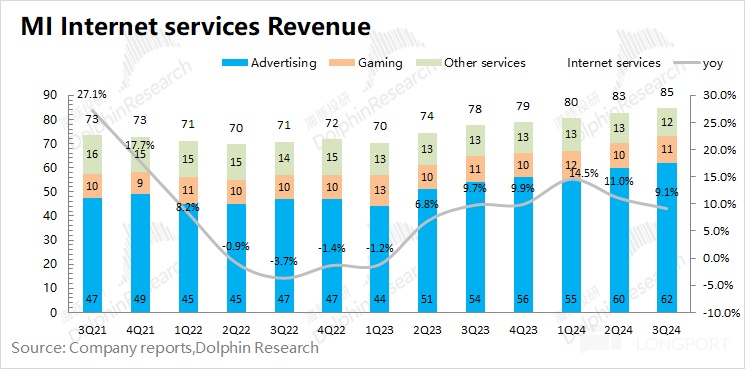

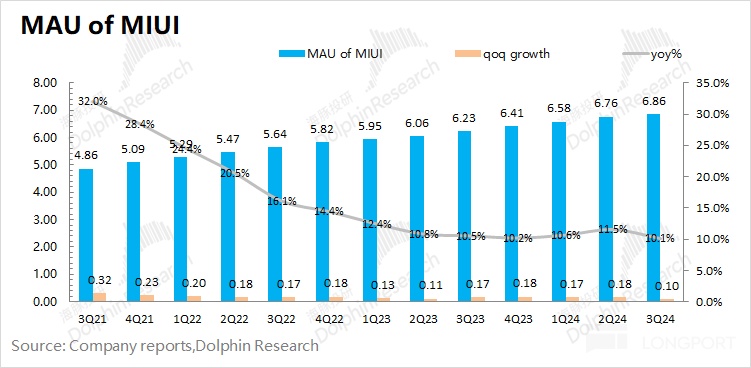

3. Internet Services: Continuous Monetization on the User Side. Internet services continued to grow this quarter, remaining the most stable part of $Xiaomi Group-W (01810.HK). Xiaomi's MIUI user base continued to increase this quarter, with the ARPU per user remaining relatively stable. According to calculations by Dolphin, the ARPU value for domestic users this quarter was 34.32 yuan, a year-on-year decline of 4.4%; while the ARPU value for overseas users was 5.21 yuan, a year-on-year increase of 6.8%. In terms of user monetization, the overall ARPU value of the company has begun to stabilize, remaining in the range of 12-12.5 yuan.

4. Automotive Business: Continuing to Improve. Xiaomi's automotive business achieved revenue of 9.7 billion yuan in Q3 2024, better than market expectations (8.9 billion yuan). The gross margin of the automotive business reached 17.1% this quarter, with a trend of increasing gross margin. Currently, Xiaomi's monthly vehicle shipments have exceeded 20,000 units, and with the increase in shipments, the automotive gross margin is expected to continue to improve.

Dolphin's Overall View: Xiaomi's latest financial report is quite good.

Dolphin's Overall View: Xiaomi's latest financial report is quite good.

From the data of this financial report, the company's revenue and profit performance for the quarter met market expectations. Beyond expectation management, it is more important to focus on the trend changes in the company's operations.

Dolphin believes that the biggest highlights of Xiaomi's financial report are: IoT business and automotive business.

IoT Business: The company's year-on-year growth rate for this quarter reached 26.3%, achieving over 20% growth for three consecutive quarters, indicating that the company's IoT business has fully improved. With the implementation of subsidies such as "trade-in," major appliances and other products will significantly benefit, and the IoT business is expected to maintain continued high growth in the next quarter;

Automotive Business: The shipment data for Xiaomi's cars has basically been digested by the market, with a focus on the average price and gross margin of the vehicles. In this financial report, the company's automotive gross margin has increased to 17% as expected (a good level in the industry), and the average price of vehicles has further risen to 239,000. The cumulative shipment of Xiaomi SU7 has reached over 100,000 units, and the company has further raised its annual target to 130,000 units. Current monthly shipments have reached over 20,000 units, and the gross margin of the automotive business is expected to further improve.

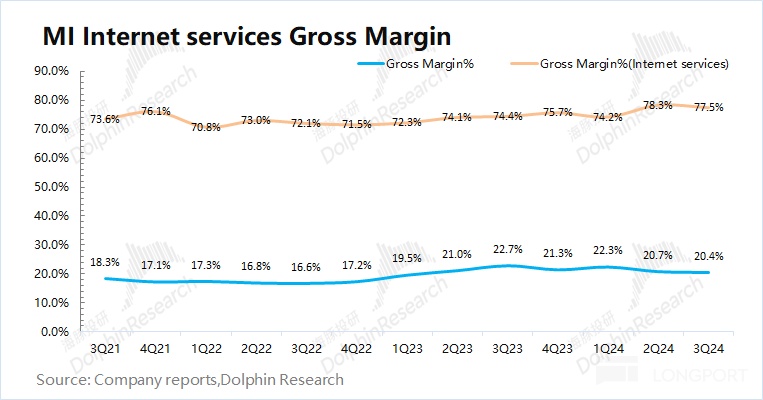

In addition, the company's smartphone base business remains stable, with a steady increase in domestic market share; the gross margin of internet services has stabilized around 78%. Overall, Xiaomi's performance growth in the next quarter has strong certainty.

Although the company's performance certainty for the next quarter is strong, it still needs to be viewed in conjunction with the company's stock price. The market's focus on the well-performing automotive business will bring an increase in the company's market value, but for the company's market value of several hundred billion, this is relatively small. Considering the current market's expectations for the company's shipments next year, it is expected to bring an incremental revenue of 60-70 billion. Based on the company's growth rate, average price, and profitability, a PS of 1.2-1.5 times is given, and the current automotive business is expected to bring about 80-100 billion in market value.

Therefore, the biggest factor affecting the company's stock price changes remains the traditional business segment. The recent continuous rise in the company's stock price is mainly driven by the significant improvement in the IoT business and increased subsidies. As for the company's traditional business segment, Dolphin expects the company's smartphone, IoT, and internet service businesses to continue to grow next year, with gross margins also expected to stabilize and rise. It is anticipated that the profit from traditional business operations next year could reach 28 billion yuan. Considering tax impact factors, the company's current market value (minus the valuation of the automotive business of about 90 billion) corresponds to a PE of around 25 times. Given the 30%+ growth rate of the company's traditional business recovery, the current PE is also recognized by the market. As the company's operations continue to improve, if the effects of this subsidy are significant next year or if new automotive products are launched next year, it is expected to further drive the company's performance improvement, and the company's performance certainty is strong. If after this financial report, the company's stock price shows a past pattern similar to "opening high and closing low" and experiences a decline, from a medium to long-term perspective, it provides a better opportunity The following is Dolphin's specific analysis of Xiaomi's financial report:

1. Overall Performance: IoT and Automotive Business Gaining Momentum

Due to the addition of the automotive business, Xiaomi has made corresponding adjustments to its financial report for this quarter, dividing the company's business into two main categories: "Mobile X AIoT" and "Automotive and Innovative Business."

1.1 Revenue Side

Xiaomi Corporation's total revenue for the third quarter of 2024 was 92.5 billion yuan, a year-on-year increase of 30.5%, better than market expectations (90.4 billion yuan). The revenue growth this quarter was mainly driven by the growth of traditional mobile and IoT businesses as well as the automotive business.

1) This quarter, Xiaomi's Mobile X AIoT business (traditional business) achieved revenue of 82.8 billion yuan, a year-on-year increase of 16.8%. All three sub-segments of mobile, IoT, and internet services experienced varying degrees of growth this quarter;

2) This quarter, Xiaomi's smart automotive and innovative business (new business) achieved revenue of 9.7 billion yuan, accounting for 10.5% of total revenue, with approximately 9.5 billion yuan coming from vehicle sales.

1.2 Gross Margin

Xiaomi Corporation's gross margin for the third quarter of 2024 was 20.4%, a year-on-year decline of 2.3 percentage points, in line with market expectations (20.2%).

The decline in gross margin this quarter was mainly affected by the rising costs of components for hardware products such as mobile phones and the lower gross margin of the automotive business.

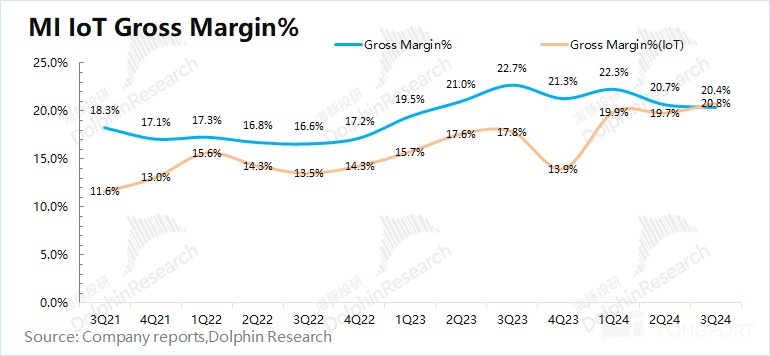

1) This quarter, Xiaomi's Mobile X AIoT business (traditional business) had a gross margin of 20.8%, mainly impacted by rising prices of core components and intensified competition. The gross margins for IoT business and internet services both improved year-on-year, especially the gross margin for internet services reaching 77.5%;

2) This quarter, Xiaomi's smart automotive and innovative business (new business) had a gross margin of 17.1%. Although still lower than the company's overall gross margin, the business's gross margin is rising with increased shipment volumes. Dolphin believes that considering the existing hardware (mobile + IoT), the gross margin of the automotive business (17.1%) has already surpassed the traditional hardware gross margin (14.9%). This has alleviated market concerns about the impact of the automotive business on profits to some extent.

II. Automotive Business: Annual Target Raised to 130,000 Units

II. Automotive Business: Annual Target Raised to 130,000 Units

The current market is most concerned about the progress of the company's automotive business. Looking solely at the automotive business, Xiaomi's automotive revenue in the third quarter of 2024 reached 9.7 billion yuan, better than market expectations (8.9 billion yuan).

In terms of quantity and price, the company's automotive shipments in the third quarter were 39,800 units, with an average price per vehicle reaching 239,000 yuan. After gradually ramping up shipments, the current monthly sales have stabilized at over 20,000 units, with annual shipments expected to reach 100,000 (as of November 13). The company has raised its annual target to 130,000 units. As of October 31, 2024, the company has opened 139 sales stores in 38 cities.

As the company's monthly shipments have climbed from 10,000 to over 20,000, the gross margin has also improved to a commendable industry level of 17.1%. Entering the fourth quarter, the company's quarterly shipments are expected to exceed 60,000 units, and the automotive gross margin is also expected to continue to rise.

III. Mobile Phone Business: Maintaining Stability

In the third quarter of 2024, Xiaomi's smartphone business achieved revenue of 47.5 billion yuan, a year-on-year increase of 13.9%. The growth of the company's smartphone business this quarter is mainly attributed to the year-on-year rebound in both shipment volume and average selling price.

Dolphin 君 has broken down Xiaomi's smartphone business by volume and price:

Volume: In the third quarter of 2024, Xiaomi's smartphone shipments reached 43.1 million units, a year-on-year increase of 3.1%.

Among the 1.5 million additional smartphones year-on-year, approximately 1 million units were added in the domestic market, while the overseas market saw an increase of about 500,000 units. In the third quarter's segmented market, Xiaomi's market share in the domestic market rose to 14.8%, while its overseas market share remained at 13.5%;

Price: In the third quarter of 2024, Xiaomi's average selling price for smartphones was 1,101 yuan, a year-on-year increase of 10.5%.

The year-on-year increase in the average price of Xiaomi's smartphones this quarter is mainly due to the increased proportion of high-end smartphones. The overall performance of the average price is good, stabilizing above 1,100 yuan.

In the third quarter of 2024, Xiaomi's smartphone business gross profit was 5.55 billion yuan, a year-on-year decline of 19.9%. It accounted for 29.4% of the company's gross profit.

The gross profit margin of the smartphone business this quarter was 11.7%, a year-on-year decrease of 4.9 percentage points. The decline in the gross profit margin of the company's smartphone business this quarter was mainly affected by rising costs of core components and intensified competition.

Due to the price increase of components such as storage, the company's smartphone gross profit margin has decreased, but the company's market share remains stable. In particular, the market share of Xiaomi smartphones in China increased by 1.3% this quarter, with a gross profit margin better than past low periods. Although there will be promotional impacts in the next quarter, as prices of some storage products begin to decline, the company's smartphone gross profit margin is expected to remain above 11% in the next quarter.

Four, IoT Business: Increased Subsidies, the Biggest Highlight

In the third quarter of 2024, Xiaomi's IoT business achieved revenue of 26.1 billion yuan, a year-on-year increase of 26.3%. The IoT business continued to grow rapidly this quarter, mainly benefiting from the revenue growth of large home appliances in mainland China, overseas tablet business, and global wearable products.

In this quarter, the company still did not directly disclose data for major IoT products (TVs and laptops). According to the financial report, it is estimated that the company's main IoT revenue reached around 5.5 billion yuan, a year-on-year increase of 10.1%. The main incremental revenue for the company this quarter came from other IoT products, with revenue reaching 20.6 billion yuan, a year-on-year growth rate of 31.4%.

In other IoT businesses, the company's smart home appliance business grew by 54.9% year-on-year this quarter (due to increased air conditioner shipments in mainland China), the tablet business grew by 36.5% year-on-year (with the launch of the Redmi Pad SE 8.7 and Redmi Pad Pro series tablets), and revenue from wearable products grew by 40.2% year-on-year (due to increased shipments of TWS earphones and smartwatches), which are the main increments of the company's IoT business.

In the third quarter of 2024, Xiaomi's IoT business gross profit was 5.42 billion yuan, a year-on-year increase of 47%. The gross profit margin of the IoT business this quarter was 20.8%, a year-on-year increase of 3 percentage points. This is due to the increase in higher-margin segments such as wearable and smart home appliance products.

The IoT business is the most significant highlight for the company this quarter, with continuous growth of over 20% for three consecutive quarters. In particular, when viewed separately, the revenue growth rate of other IoT (excluding TVs and laptops) reached over 30% this quarter, indicating a trend improvement for the IoT business. With the increase in subsidies such as "trade-in for new," the company's IoT business is expected to continue achieving high growth in the fourth quarter.

V. Internet Services: Continuous Growth

In the third quarter of 2024, Xiaomi's internet services business achieved revenue of 8.46 billion yuan, a year-on-year increase of 9.1%, accounting for 9.1% of the company's total revenue.

Specifically, the situation of various segments of internet services is as follows:

1) Advertising Services: The largest component of the company's internet services. This quarter, Xiaomi's advertising services achieved revenue of 6.2 billion yuan, a year-on-year increase of 14.8%, mainly benefiting from the scale advantage, as the company further enhanced its content self-distribution and monetization capabilities;

2) Game Revenue: Remains stable. This quarter, Xiaomi's game revenue was 1.1 billion yuan, unchanged year-on-year;

3) Other Value-Added Services: This quarter, Xiaomi's other value-added services revenue was 1.2 billion yuan, with a slight decline in financial technology business.

From the performance of Xiaomi and Apple’s value-added services, companies occupying software entry points have relatively strong risk resistance, and the company's internet services business continued to grow this quarter.

Dolphin has broken down Xiaomi's internet services business by volume and price:

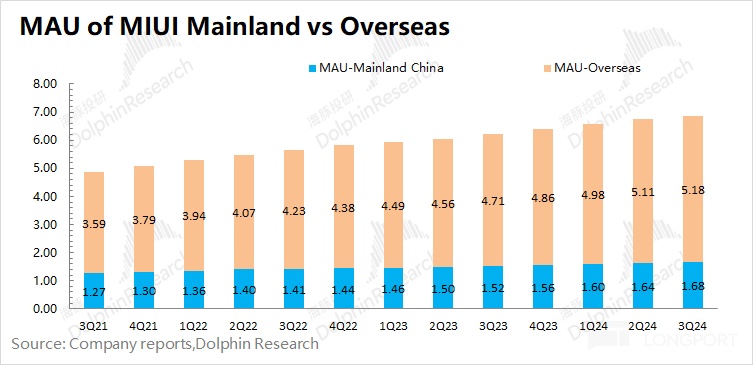

MIUI User Count: As of September 2024, the number of monthly active MIUI users reached 686 million, a year-on-year increase of 10.1%. The growth rate of MIUI users has slowed this quarter, but the user count maintains a double-digit expansion rate.

ARPU Value: Based on the number of MIUI users, the ARPU value for the quarter is estimated. This quarter, Xiaomi's internet services ARPU value was 12.3 yuan, slightly down year-on-year. For this quarter's Xiaomi ARPU value, the increase in overseas user ARPU roughly offset the decline in domestic ARPU, keeping the overall ARPU value within the range of 12-12.5.

In the third quarter of 2024, Xiaomi's internet services business gross profit reached 6.55 billion yuan, a year-on-year increase of 13.6%. This quarter, the internet gross profit margin increased by 3.1 percentage points year-on-year, mainly due to the continued increase in the proportion of the company's advertising business.

Compared to other companies in the advertising industry, Xiaomi, which has access to terminal entry points, maintains a high gross profit margin of over 70% in its internet business. In an era of intensified competition for traffic stock, the landscape of internet entry-type traffic has a good pattern and unique advantages. With the increase in the proportion of advertising business, the company's internet services gross profit margin is expected to continue to rise.

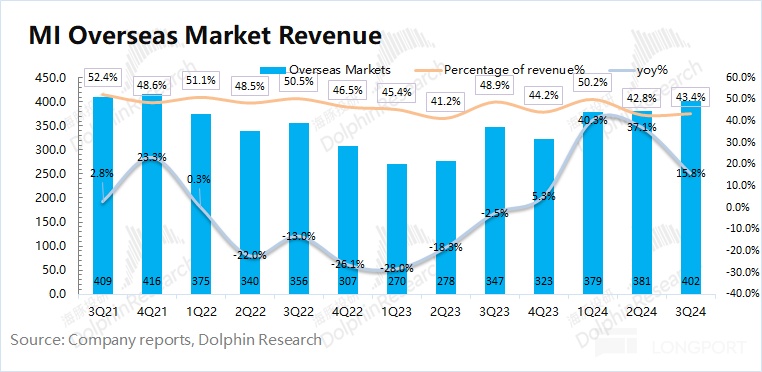

6. Overseas Market: Both hardware and service revenues have double-digit growth

In the third quarter of 2024, Xiaomi's overseas revenue reached 40.16 billion yuan, a year-on-year increase of 15.8%, with the revenue proportion falling to 43.4%. The decline in overseas revenue proportion this quarter is mainly due to the new addition of the automotive business in the financial report.

Due to a 17.4% growth in Xiaomi's overseas internet business this quarter, the company's overseas hardware revenue also saw double-digit growth. Combining with the fact that Xiaomi's smartphone shipments in overseas markets (excluding China) increased by 0.5% year-on-year this quarter, it is believed that Xiaomi's IoT business in overseas markets also experienced double-digit growth this quarter, mainly benefiting from the sales growth of related products such as tablets.

From the distribution of MIUI users, Xiaomi had 686 million MIUI users by the end of this quarter, of which 518 million came from overseas markets. In other words, although Xiaomi is based in mainland China, over 75% of its users are now overseas. Due to the company's large overseas user base, the monetization capability of the internet overseas will directly affect the company's performance, while the current per capita ARPU value of overseas users is still far lower than that of domestic users.

Dolphin Jun estimates that Xiaomi's domestic users' ARPU value this quarter is 34.32 yuan, a year-on-year decline of 4.4%; while the ARPU value for overseas users this quarter is 5.21 yuan, a year-on-year increase of 6.8%, which is also the main source of growth for the company's overseas internet business this quarter.

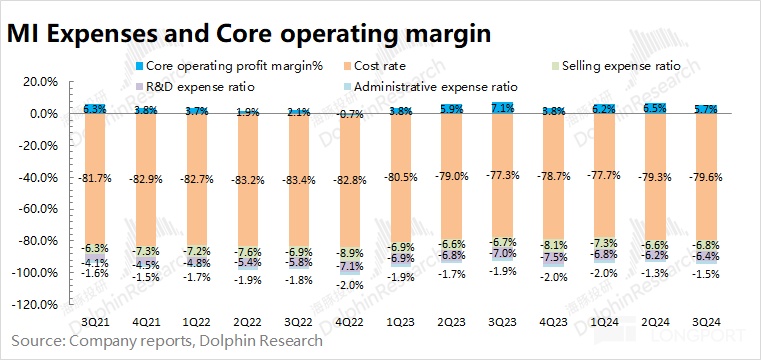

7. Expenses and Performance: Overall Stability

In the third quarter of 2024, Xiaomi's total expenses amounted to 13.65 billion yuan, an increase of 23.4% year-on-year. The increase in expenses this quarter mainly comes from the rise in all three types of expenses to varying degrees.

Research and Development Expenses: This quarter amounted to 5.96 billion yuan, a year-on-year increase of 19.9%, accounting for 6.4% of revenue. The increase in R&D expenses this quarter is mainly due to an increase of 2,146 R&D personnel. This is primarily attributed to increased investment in automotive and innovative business R&D;

Sales Expenses: This quarter amounted to 6.28 billion yuan, a year-on-year increase of 32.6%, accounting for 6.8% of revenue, mainly influenced by increased advertising and promotional expenses, overseas logistics costs, and the salaries of promotional personnel; among them, the number of Xiaomi automobile sales stores increased from 87 to 128 this quarter, which also increased sales expenses to some extent.

Administrative Expenses: This quarter amounted to 1.42 billion yuan, a year-on-year increase of 3.7%, accounting for 1.5% of revenue. It remained basically stable.

In the third quarter of 2024, the adjusted net profit was 6.3 billion yuan, a year-on-year increase of 4.4%. From the operational perspective of the company (excluding changes in the fair value of investments), the core operating profit for this quarter was 5.2 billion yuan, a year-on-year increase of 3.7%.

Although the gross margin of mobile phones has significantly declined year-on-year due to the rising costs of core components, the company's profit still achieved growth driven by IoT and internet services. The new automotive business added this year has not significantly dragged down the company's performance. With the increase in automobile shipments, it is expected to help maintain the overall gross margin of the company above 20%, providing significant assurance for the company's profit.