Morgan Stanley "tears up the report"! From short to long: expects the S&P 500 to rise to 6,500 points next year

JP Morgan's stock strategy team has turned bullish on U.S. stocks, predicting that the S&P 500 index will rise to 6,500 points by 2025, exceeding the average strategist forecast of over 6,300 points, which represents an approximate 8.35% increase from Wednesday's closing price of 5,999 points. Chief Global Equity Strategist Dubravko Lakos-Bujas believes that factors such as a healthy U.S. labor market, interest rate cuts, and a surge in capital expenditures will drive the stock market higher. Despite facing geopolitical uncertainties, the team believes that opportunities outweigh risks

According to Zhitong Finance, JP Morgan's equity strategy team has turned bullish on U.S. stocks. JP Morgan's Chief Global Equity Strategist Dubravko Lakos-Bujas expects the S&P 500 to reach a target of 6,500 points by the end of 2025, exceeding the average strategist forecast of about 6,300 points.

JP Morgan's new forecast implies that the index will rise approximately 8.35% from Wednesday's closing price of 5,999 points. Lakos-Bujas's optimistic prediction is based on favorable factors such as a healthy U.S. labor market, interest rate cuts, and a surge in capital expenditures in the competition for leadership in artificial intelligence technology.

In a report to clients on Wednesday, Lakos-Bujas wrote, "Geopolitical uncertainties are increasing, and the policy agenda is evolving, bringing unusual complexity to the outlook, but the opportunities may outweigh the risks."

Marko Kolanovic led the team for many years before leaving in early 2024; he announced his departure in July. Kolanovic has been bearish on U.S. stocks since the end of 2022. Under Kolanovic's leadership, the firm set a target of 4,200 points for the S&P 500 index, which lasted nearly two years. Nevertheless, U.S. stock indices broke this level in 2023 and climbed above 6,000 this year, prompting Wall Street peers to raise their outlooks. Lakos-Bujas took over the company's market research work this summer.

This view marks a stark contrast to the warnings issued by JP Morgan strategists for most of the past two years. As 2024 approaches, the team warned that they expect an economic slowdown to pressure corporate earnings. They also noted that high valuations, crowded positions, and low volatility make the stock market "very fragile."

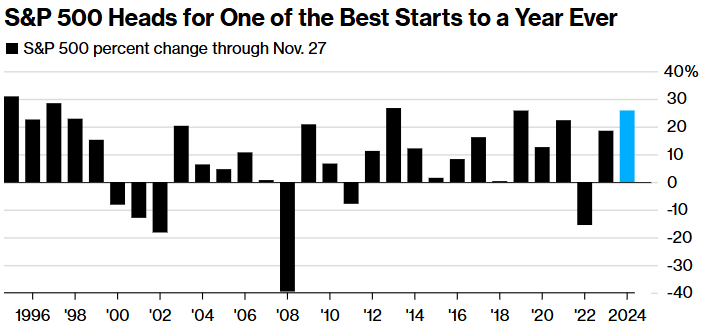

In reality, the S&P 500 index has risen about 26% in 2024. With a strong economy, enthusiasm for artificial intelligence, and monetary easing driving stock prices up, the U.S. stock market is poised to achieve its first consecutive annual gain of over 20% this century. This shift in perspective has made JP Morgan no longer one of the few contrarian investment banks on Wall Street.

For the coming year, predictions from major banks and analysts are relatively optimistic and concentrated: forecasts from Goldman Sachs, Morgan Stanley, and Bank of America are around 6,600 points, while Deutsche Bank and Yardeni Research have forecasts as high as 7,000 points.

However, at this moment of optimism, the U.S. stock market is at a crossroads, with the S&P 500 index's 12-month expected earnings price-to-earnings ratio exceeding 22 times, while the average price-to-earnings ratio over the past 10 years has been 18 times. There are also concerns that the policies promised by U.S. President-elect Trump, ranging from tariffs to mass worker deportations, could reignite inflation, push up bond yields, and put pressure on the stock market.

Lakos-Bujas stated in the outlook report: "The timing, scope, and multiple impacts of policy actions and executive orders remain unknown factors affecting corporate profits. However, despite the risks posed by potentially disruptive policies and their downside risks to the stock market, Trump's focus on the market, the Federal Reserve's interest rate cuts, and China's stimulus measures should provide support for the market."

In other expectations for 2025, JPMorgan strategists indicated that the Trump administration's energy agenda poses downside risks to oil prices due to deregulation and increased U.S. production, while stronger capital market activity may occur under a low-interest-rate and more favorable regulatory environment.

At the industry level, JPMorgan recommends overweighting financials, communication services, and utilities; underweighting energy and consumer discretionary; and maintaining a neutral rating on the remaining six sectors of the S&P 500 index. From a regional perspective, the bank prefers U.S. stocks over European and emerging market stocks and continues to overweight Japanese stocks. The bank stated that Japanese stocks will benefit from improvements in real wage growth, accelerated stock buybacks, and ongoing corporate reforms.

Meanwhile, JPMorgan strategist Mislav Matejka also stated that unless geopolitical and trade policy risks diminish, the U.S. stock market's dominance over the rest of the world is unlikely to weaken. This year, driven by technology stocks and the AI boom, the U.S. stock market has continued to outperform international markets, while the U.S. economy remains resilient, and the Federal Reserve has entered a rate-cutting cycle against the backdrop of declining inflation.

Matejka and other strategists wrote: "The current situation of polarized performance in regional markets may persist, as international markets' price-to-earnings ratios do not appear high, while the U.S. market remains elevated, but relative spreads may remain high for some time."