The stock price rebounded nearly 33%. Can DMALL rely on "Ruitong" for redemption?

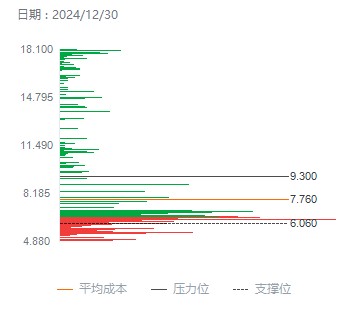

DMALL's stock price rebounded nearly 34% after experiencing consecutive declines, closing at HKD 6.48 on December 30, with an increase of 6.23%. Although it is still below the listing price, market expectations for its inclusion in the Hong Kong Stock Connect are heating up, which could be key to the stock price recovery. The current support level is HKD 6.06, and the resistance level is HKD 7.76. If trading volume increases, the stock price is expected to rise further

After a continuous decline in stock prices, DMALL (02586) has welcomed a three-day rebound. As of the close on December 30, DMALL reported HKD 6.48, with an increase of 6.23%, and a total market capitalization of HKD 5.746 billion.

Although it has significantly shrunk compared to the listing price of HKD 30.21, the stock has rebounded nearly 34% from its low of HKD 4.78.

Is this rebound for DMALL a signal for the sprint towards the Stock Connect?

Is the average daily market capitalization of HKD 6.119 billion standing at the entry threshold?

The Stock Connect has increasingly become a key pillar of liquidity in the Hong Kong stock market, with its trading volume share rising again in November, highlighting the importance of entering the Stock Connect. Take Longpan Technology as an example; on November 25, the day it was officially included in the Stock Connect, its stock price soared over 80%, primarily driven by buying power from the Stock Connect.

Therefore, for DMALL, which has seen a sharp decline in stock prices, inclusion in the Stock Connect may become a crucial opportunity for a turnaround.

According to observations from the Zhitong Finance APP, after a sharp drop in the first two days post-listing, DMALL's stock price remained in a downward state for a long time. In the nearly 12 trading days from December 11 to December 30, the top chips of DMALL gradually decreased, with a large number of chips accumulating at the bottom, and the moving cost distribution concentrated at low levels forming a single peak. As of December 30, 70% of the company's chips were concentrated in the range of HKD 5.9 to HKD 9.94. Compared to December 11, when 70% of the chips were concentrated in the range of HKD 6.48 to HKD 14.7, both the cost and concentration have significantly improved.

Once the stock price breaks through the single peak concentration with increased volume, it will be a sign of an upward trend. Currently, DMALL's support level is HKD 6.06, with an average cost of HKD 7.76, and a resistance level of HKD 7.76. Although there is still a certain gap in the formation of the single peak low concentration, the trend has already formed. Once the trading volume and turnover rate increase, the stock's upward trend is expected to begin.

It is noteworthy that, from the capital distribution perspective, on December 30, there was a significant inflow of large and extra-large orders, with inflows of 469,800 and 1,651,100 respectively. The net inflow of extra-large and large orders was 1,197,000, accounting for 54% of the total net inflow. Overall, the total capital inflow was 5,305,000, with outflows of 3,107,200, indicating a recovery in market sentiment.

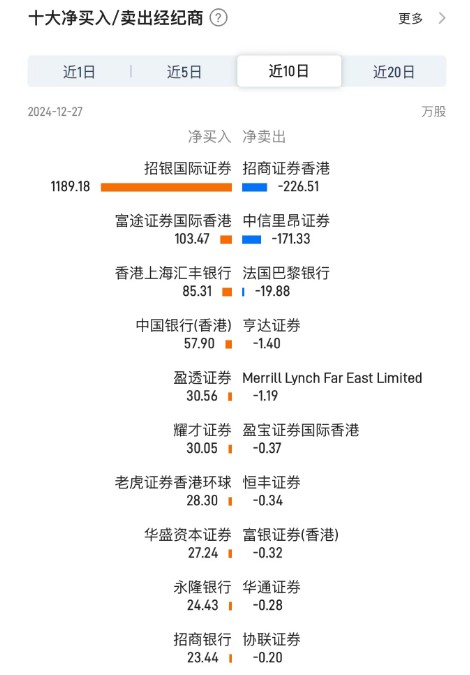

Who is continuously buying? From the trading seats, the top three buying brokers in the past 10 days were China Merchants International Securities, Futu Securities International Hong Kong, and HSBC Hong Kong, buying 11.8918 million shares, 1.0347 million shares, and 853,100 shares respectively; during the same period, the top three sellers were China Merchants Securities Hong Kong, CITIC Lyon Securities, and BNP Paribas, selling 2.2651 million shares, 1.7133 million shares, and 198,800 shares respectively.

Who is continuously buying? From the trading seats, the top three buying brokers in the past 10 days were China Merchants International Securities, Futu Securities International Hong Kong, and HSBC Hong Kong, buying 11.8918 million shares, 1.0347 million shares, and 853,100 shares respectively; during the same period, the top three sellers were China Merchants Securities Hong Kong, CITIC Lyon Securities, and BNP Paribas, selling 2.2651 million shares, 1.7133 million shares, and 198,800 shares respectively.

As of December 27, China Merchants International Securities, HSBC Hong Kong, Huatai Securities, and Guosen Securities (Hong Kong) were the top four brokerage firms holding shares in the company, with holding ratios of 8.9%, 4.36%, 2.85%, and 2.57% respectively. In addition, the increase in holdings by Guosen Securities (Hong Kong) came from a change in warehouse on December 9, when 22.7346 million shares were deposited with Guosen Securities (Hong Kong), with a warehouse market value of HKD 400 million.

Funds seem to be ready to go, so what standards must DMALL meet to enter the market? According to calculations by Zhitong Finance APP, the company's current average daily market capitalization is HKD 6.119 billion, which has crossed the entry threshold. As long as it maintains this level for half a trading day on December 31, the probability of the company entering the market will be even greater.

Continuous Losses Highly Dependent on Major Clients like Wumart

Behind the significant shrinkage of this IPO valuation, what is the actual quality of DMALL? Perhaps the prospectus can provide the answer.

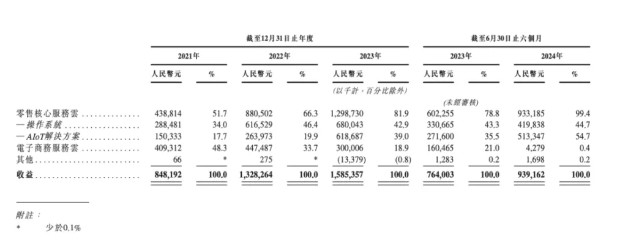

In terms of performance, from 2021 to the first half of 2024, DMALL's revenue was RMB 848 million, RMB 1.328 billion, RMB 1.585 billion, and RMB 939 million respectively, with year-on-year revenue growth rates of 56.59%, 19.36%, and 22.93% from 2022 to the first half of 2024. The net profits during the same period were -1.81 billion, -900 million, -750 million, and 480 million, showing a clear trend of narrowing losses.

Observing the three expense categories, the significant reduction in sales and marketing expenses is one of the important reasons for DMALL's continued loss reduction. From 2021 to 2023, the proportion of sales and marketing expenses was 58.2%, 20.5%, and 10.3% respectively, with the amount of sales and marketing expenses dropping sharply from RMB 607 million in 2021 to RMB 180 million in 2023.

In recent years, DMALL's revenue structure has undergone significant changes: the retail core service cloud, based on commission and order collection as its business model, has become the mainstay, with revenue climbing year by year, accounting for as much as 99.4% in the first half of this year. In contrast, the revenue from e-commerce service cloud has declined, with its proportion dropping sharply from 48.3% in 2021 to 0.4% in the first half of this year In addition, the revenue share from other businesses has long been below 1%.

It seems that under the current commission rate, it may still be quite difficult for DMALL to achieve profitability in the short term. After all, there is not much room for continued reduction in sales and marketing expenses, and if the company accelerates its business expansion, it will inevitably lead to an increase in sales and marketing expenses. Moreover, the potential for improving gross margins is also suppressed by the low-margin AIoT services, so short-term profit expectations for DMALL should not be too high.

In addition to the bleak outlook for breakeven or short-term profitability, a heavy reliance on major clients is also one of the potential risks for DMALL. According to the prospectus, from 2021 to 2023, the revenue share from the top five clients, including Wumart Group, accounted for 70.2%, 76.6%, and 81.7%, respectively. DMALL stated that although the company plans to expand and diversify its client base, it will still rely on major clients in the foreseeable future.

The data clearly shows that DMALL's dependence on the top five clients is on the rise. The number of clients in 2023 reached 677, but the top five accounted for 81.7% of the revenue share, with less than 20% of the revenue coming from the remaining 672 clients.

More critically, from 2021 to 2023, the revenue share from related entities for DMALL was 67.9%, 71.3%, and 74.9%, respectively, while the revenue share from independent clients showed a declining trend year by year, at 32.1%, 28.7%, and 25.1%, respectively. Moreover, the revenue growth from independent clients has significantly slowed down in 2023. Among the five related entities, Wumart Group and Metro China contributed the majority of the revenue, with their combined revenue share reaching approximately 68% in 2023. Expanding the perspective, the current cloud service market is not only highly competitive but also very capital-intensive, posing greater challenges for industry participants. For DMALL, while maintaining its moat within the Wumart ecosystem, it also faces dimensional attacks from internet giants in the industry.

Furthermore, this strong binding relationship may hinder DMALL's cooperation with leading supermarkets. After all, other supermarket brands can collaborate with pure online platforms like Meituan, Ele.me, and JD Instant Delivery without needing to disclose their operational data to the competitor Wumart through DMALL. The prospectus of DMALL also confirms this. The so-called "independent clients" refer to regional supermarkets and convenience stores such as Zhongbai Group, Guangdong 711, Pang Donglai, and Dennis Department Store, which are outside the Wumart sphere of influence, highlighting the industry's concerns about Wumart and DMALL "being both the referee and the player."

For DMALL, it may need to consider how to diversify its risks and adopt a multi-faceted approach.

In addition, tight liquidity cash flow is also a lingering consequence of continuous losses. As of the end of the second quarter of this year, DMALL's cash and cash equivalents amounted to 470 million yuan, while liquidity liabilities, primarily short-term borrowings, reached as high as 8.27 billion yuan, indicating significant short-term debt repayment pressure DMALL's cash flow is tight, stemming from its ongoing predicament of being continuously insolvent. According to the prospectus data, its net operating cash flow for the years 2021 to 2023 and the first half of 2024 was 1.275 billion yuan, 206 million yuan, 179 million yuan, and 56.743 million yuan, respectively, showing a downward trend.

During the same period, the company's total assets increased from 1.281 billion yuan to 1.378 billion yuan before slightly decreasing to 1.355 billion yuan, but the total liabilities continued to rise, increasing from 6.02 billion yuan to 8.409 billion yuan, far exceeding the total assets.

For DMALL, which cannot self-generate cash flow in the short term and requires substantial capital investment, investors' previous pessimistic expectations have already been reflected in the stock price. Whether the company can achieve a turnaround in the future remains to be seen