Deep recession alarm sounded! U.S. credit card debt unexpectedly plummets

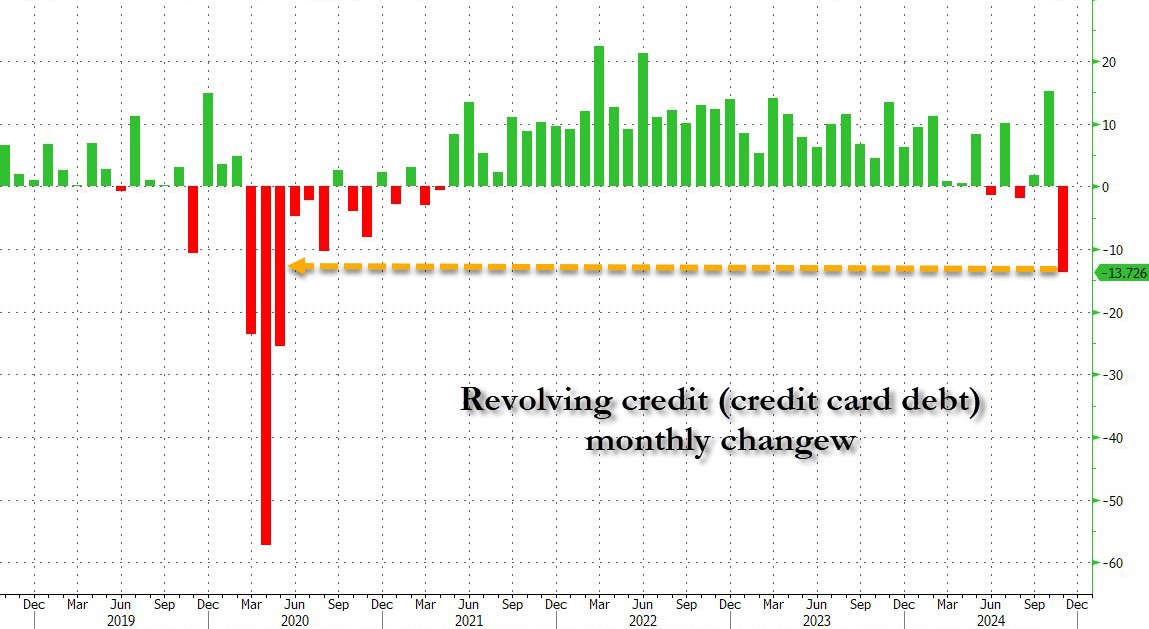

In November, the total consumer credit in the United States fell sharply by $7.5 billion, with outstanding credit card and other revolving debt balances plummeting by $13.8 billion, marking the largest monthly decline since the economic shutdown triggered by the COVID-19 pandemic. Analysts believe that whenever there is such a significant drop in revolving credit, the U.S. economy is often on the brink of recession or has already fallen into recession

Is the American love for "forward consumption" no longer appealing? U.S. credit card debt unexpectedly plummets, and a deep recession may really be on the way...

Yesterday, the latest consumer credit data released by the Federal Reserve showed that in November 2024, the total consumer credit in the United States dropped significantly by $7.5 billion, falling to $5.102 trillion, a year-on-year decline of 1.8%. This data typically only appears during the mid-point of an economic recession or worse.

The data also indicated a slight increase in non-revolving credit such as auto loans and tuition loans in November, while the balance of outstanding credit card and other revolving debts plummeted by $13.8 billion, setting the largest single-month decline since the economic shutdown triggered by the COVID-19 pandemic. Analysts pointed out:

"It is safe to say that historically, whenever there is such a significant decline in revolving credit, the U.S. economy is often on the brink of recession or has already fallen into one."

However, the sharp drop in credit card debt has indeed surprised analysts, as American consumers had previously relied on credit cards to maintain their consumption levels, purchasing things they currently "cannot afford" and expecting to repay them at a moderate interest rate sometime in the future. Some believe that this may be due to consumers' savings, especially "pandemic emergency savings," being exhausted or nearly exhausted, leading to the depletion of credit card limits, and that the previous surge in credit card debt was merely a "final spree."

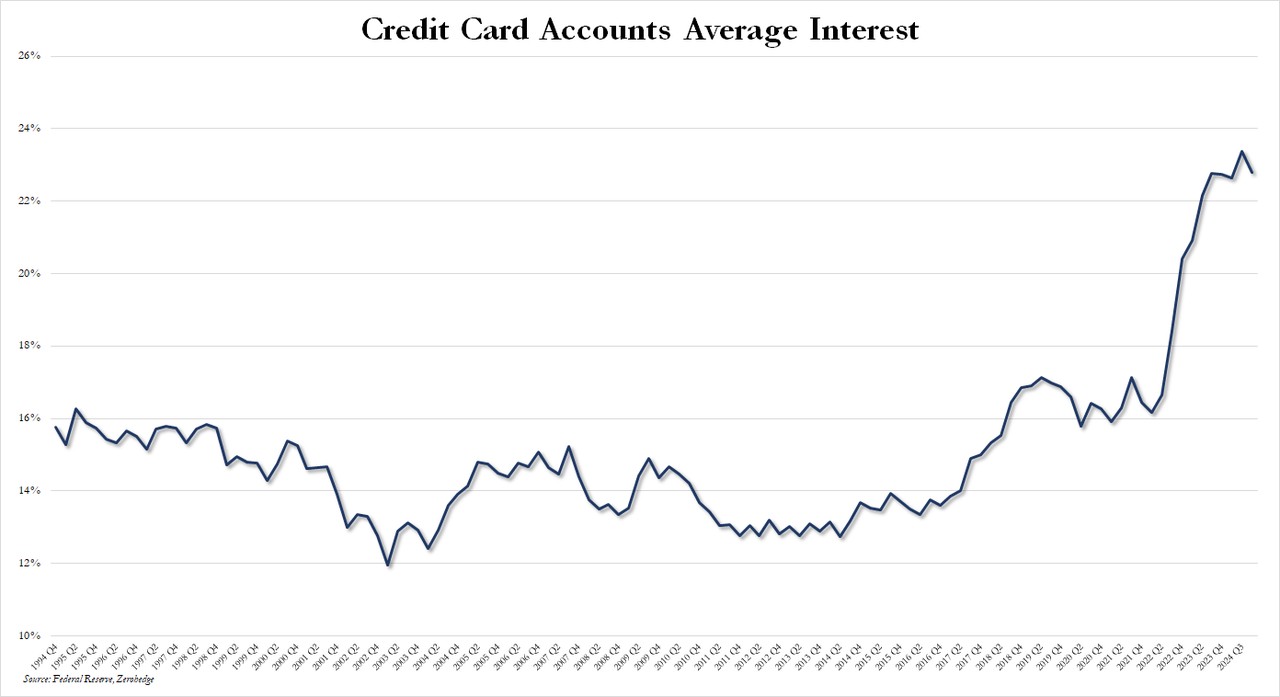

It is worth noting that although the Federal Reserve has cut interest rates by 100 basis points over the past three months, credit card rates remain high. According to Federal Reserve data, the average credit card account rate in the U.S. banking system still stands at 22.8%, just 0.57% lower than the historical high set in the third quarter of 2024. Analysts believe that the stable recovery of the U.S. economy is merely a false appearance.