Report: The Bank of Japan is expected to raise interest rates this week, with the only unexpected factor being Trump

Analysis suggests that unless remarks made by Trump shake the financial markets, the Bank of Japan will resume interest rate hikes this Friday. The Bank of Japan is increasingly confident in wage growth and expects to make progress towards a stable inflation target exceeding 2%

The Bank of Japan's interest rate hike this Friday has become a consensus expectation on Wall Street, but before that, Trump remains the biggest uncertainty.

The Wall Street Journal reported on Monday that, according to sources familiar with the central bank's thinking, the Bank of Japan is expected to decide on an interest rate hike at this week's meeting unless Trump makes remarks that disrupt the financial markets during his inauguration speech on Monday.

On Monday local time, Trump did not mention tariff policies in his inauguration speech, but subsequently signed a series of executive orders, announcing a 25% tariff on goods imported from Canada and Mexico starting February 1.

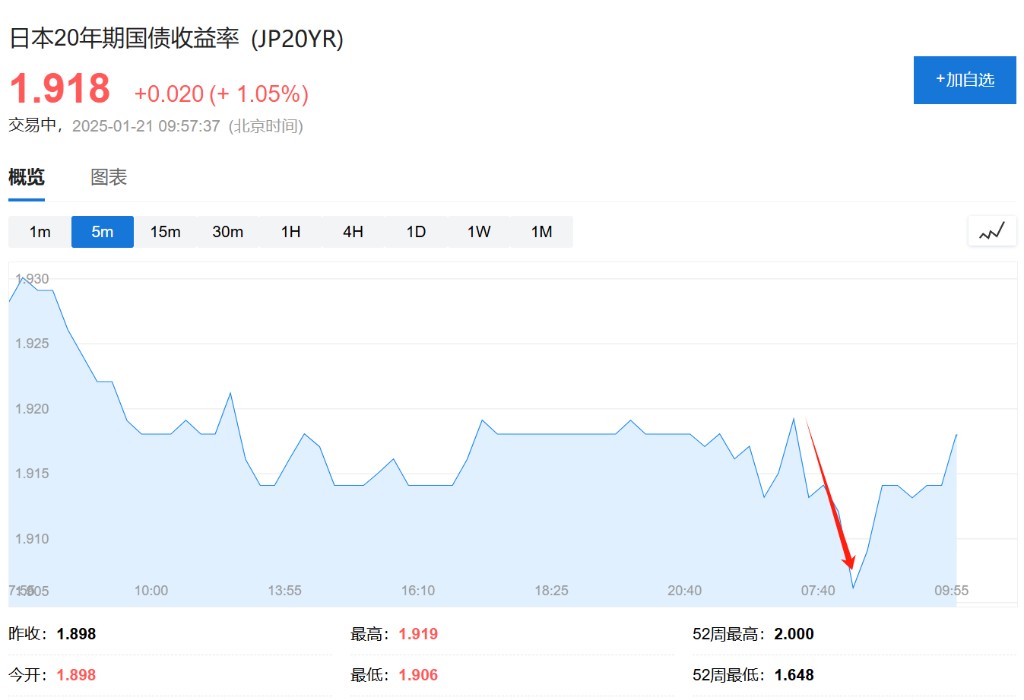

On Tuesday morning, Japan's 10-year government bond yield rebounded slightly after a small decline, suggesting that Trump does not seem to be viewed by the market as a destabilizing factor.

Barclays analysts noted in their latest report that President Trump may begin his second term with a "tough" tariff policy that could severely disrupt the global economy, but concerns have eased, and initial market turmoil has been avoided.

"Uncertainty remains, but we believe that the absence of significant market turmoil means that the Bank of Japan has currently dismissed Trump's warnings and will raise policy rates this Friday," the Barclays analysts wrote in the report.

Previously, Bank of Japan Governor Kazuo Ueda and Deputy Governor had promised to discuss whether to raise interest rates at the two-day meeting ending on Friday.

Since the monetary policy meeting at the end of December last year, Ueda has repeatedly stated that Japan's wage trends and U.S. economic policies will be important factors in deciding the next interest rate hike. He also expressed a desire to see "a bit more" positive data to make decisions with greater confidence.

Policymakers generally believe that the Japanese domestic economy is moving towards the central bank's 2% stable inflation target, supported by wage growth. The Wall Street Journal reported that sources familiar with the central bank's thinking indicated that policymakers are increasingly confident about wage growth, as recent feedback collected by the central bank has been very positive.

Japan's largest labor union organization, Rengo, is expected to seek a wage increase of over 5% this year, while some large companies, such as Uniqlo's parent company Fast Retailing and beverage manufacturer Suntory, have already committed to significant wage increases.

Reports indicate that some sources familiar with the central bank's thinking suggest that the central bank does not necessarily have to wait for the preliminary results of the "Shunto" wage negotiations in mid-March. "If the Bank of Japan waits too long, it may leave the market with an overly dovish impression," one of the sources stated