Disappointing sales, doubts about market size... Overseas weight loss drug stocks trading "retreat"

由於新藥臨牀試驗結果令人失望,以及連續兩個季度的銷售數據低於預期,諾和諾德和禮來兩家公司的股價已從歷史高點回落。諾和諾德錯失歐股 “老大” 的寶座,而減肥藥相關股票已進入熊市區域。

近年,新型減肥藥的興起讓諾和諾德一度成為歐洲市值最高的公司,美國禮來也躍升為全球最大的製藥集團。然而,這股熱潮似乎正在迅速退卻。

根據英國《金融時報》報道,由於新藥臨牀試驗結果令人失望,以及連續兩個季度的銷售數據低於預期,兩家公司的股價已從歷史高點回落。諾和諾德失去了歐洲市值最高公司的寶座,而減肥藥相關股票已進入熊市區域。

儘管分析師預測,未來十年,減肥藥市場規模將超過 1000 億美元,但一些投資者對此持懷疑態度。美銀的 Sachin Jain 指出,市場增長潛力是困擾投資者的主要未知因素之一。他表示:

"有一場'大辯論',這個市場是諾和諾德和禮來共享的 800 億美元,還是我們的討論方向錯了,實際規模要大得多?目前存在巨大分歧,沒人知道確切數字。"

禮來業績 “打水漂”,諾和諾德面臨降價考驗

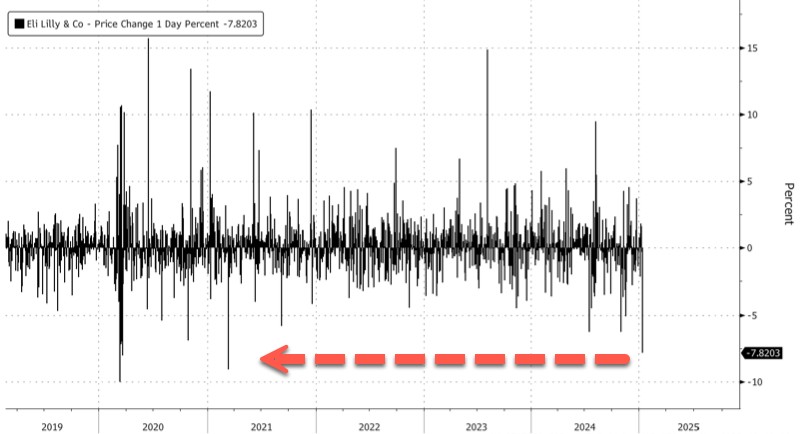

禮來上週公佈的 Q4 財報顯示營收不及預期,這已是禮來連續第二個季度未能準確預估出熱門減肥和糖尿病藥物的市場需求而表現不佳。公司股價一天內下跌 7%。

其中,公司重磅糖尿病藥物 Mounjaro 的第四季度營收約為 35 億美元,低於市場預期的 44 億美元。另一款減肥藥 Zepbound 第四季度營收約為 19 億美元,也未達到分析師預期的 22 億美元。

儘管短期業績略顯疲軟,禮來公司對 2025 年的前景仍然保持樂觀。公司預計 2025 年全年營收將達到 580 億至 610 億美元,高於分析師平均預期的 587.2 億美元。彭博行業研究分析師 John Murphy 指出:

“大家對禮來公司的增長期望非常高,因此他們在銷售上的任何小失誤都會被放大,他們幾乎沒有犯錯的餘地。”

目前,禮來的市盈率仍高達 55 倍。諾和諾德的市盈率為 27 倍。

上週,諾和諾德減肥藥 Wegovy 和糖尿病藥物 Ozempic被列入美國醫療保險談判清單,這意味着該公司可能從 2027 年起在美國大幅降價。消息公佈後,諾和諾德股價被 LVMH 超越,成為歐洲第二大上市公司。

Invesco 的全球市場策略師 Ashley Oerth 指出,自去年 10 月特朗普贏得美國大選的幾率上升以來,整個醫療保健行業表現不佳。她解釋道:

"特朗普因素是一個重要組成部分。我們看到市場傾向於週期性而非防禦性股票,而醫療保健屬於防禦性板塊。"

減肥藥 “黃金時代” 遇冷?

去年 12 月底,諾和諾德宣佈其備受期待的新一代減肥藥 CagriSema 在後期臨牀試驗中未能達到患者體重減少 25% 的目標。這一消息導致公司市值蒸發 900 億歐元。巴克萊分析師 Emily Field 表示,市場對諾和諾德沒有達到其設定的標準產生了 “情緒反應”:

“在某種程度上,沒有達到這個標準可能存在管理信譽問題。”

儘管如此,一些分析師和投資者認為,如果更多參與者選擇最高劑量,CagriSema 很可能達到 25% 的減重目標。今年晚些時候,投資者才能獲得更多試驗數據。

面對巨大的市場潛力,全球各地湧現出大量生物科技公司,希望能與兩大巨頭競爭。它們致力於開發更易生產、使用更方便(目前的藥物需要注射)、副作用更少的治療方案。

私人投資者最近對一些生物科技公司進行了大規模融資:Verdiva Bio 和 Kailera Therapeutics 各自籌集了超過 4 億美元,而已申請 IPO 的 Metsera 在 11 月獲得了 2.15 億美元的融資。大型製藥公司也在爭相收購減肥藥候選產品。

然而,這些新藥距離上市還有很長的路要走。