2024 Europe and America T1 Market Casual Mobile Game Research Report (Part 2)

In 2024, the T1 market for casual 3D matching mobile games in Europe and America achieved a 97% annual growth, with revenue nearly doubling. The emergence of new games drove this growth, particularly Peak Games' "Match Factor!", which reached a revenue of $158 million in 2024, accounting for 42% of the total revenue in this category. Meanwhile, Boombox Games' "Triple Match 3D" saw a gradual decline in revenue, dropping from $10.6 million in December 2023 to $6 million in December 2024

Image source: Ideogram

Author: AppMagic

In the 2024 Research Report on Casual Mobile Games in the T1 Market of Europe and America (Part 1), we analyzed the match-3 fusion gameplay and merge gameplay in the T1 market. Next, this article will study the remaining three categories: 3D Matching, Sort Puzzle, and Gambling Fusion Gameplay (Casual Casino).

3D Matching Category: Transitioning from Hyper-Casual to Casual

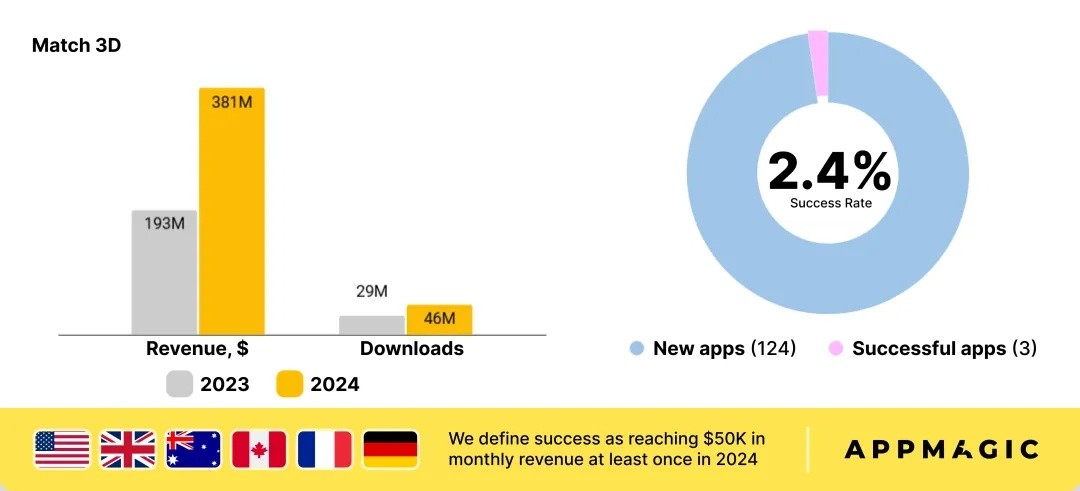

Bar chart of revenue and downloads for the 3D Matching category in the T1 market of Europe and America; pie chart of new game success in 2024

In 2024, the 3D Matching category in the T1 market of Europe and America achieved the most remarkable annual growth rate, with revenue nearly doubling and a year-on-year increase of 97%. Similar to the previous two categories, revenue growth once again outpaced the growth in downloads. However, unlike the match-3 fusion and merge fusion categories, the growth of the 3D Matching category is not driven solely by established games increasing revenue, but rather by the emergence of new games.

In fact, the only game that has consistently contributed to in-app purchase revenue and dominated this category over the past 18 months is Boombox Games' "Triple Match 3D," but this game is gradually losing market share, with its revenue in the T1 market of Europe and America dropping from $10.6 million per month in December 2023 to $6 million per month in December 2024.

Comparison of revenue for 3D Matching games in the T1 market of Europe and America

In March 2024, Peak Games' "Match Factor!" replaced "Triple Match 3D" as the new leader in this category. This game generated $158 million in revenue for 2024 and currently accounts for 42% of the total revenue in this category, showing outstanding performance.

Part of the success of "Match Factor!" lies in its expansion of the original "Triple Match 3D" model. The game introduces deeper fusion gameplay (Meta mechanics) and social mechanisms, such as families, leaderboards, and goal setting, which enhance long-term retention, while its core gameplay remains very casual In addition, there is another factor that is difficult to ignore and even harder to articulate: the unique style that Peak Games brings to its games. This is reflected in the top-notch visual quality and unique gaming experience, and we believe that readers who have played the game will certainly agree with our viewpoint.

This kind of success has also reshaped the revenue Top 10 of this category. Four new games have entered the rankings, replacing older games, marking a significant shift in the competitive landscape of this category.

Top 10 Revenue of 3D Matching Games in the T1 Market of Europe and America for 2023/2024

Interestingly, among the top ten games, two games, "Match Villa: Makeup ASMR" and "Match Frenzy - ASMR Tycoon," adopt the popular "disgusting" aesthetic style, which revolves around removing exaggerated flaws, such as popping pimples or cleaning dirt. This design perfectly aligns with the ASMR theme, enhancing that peculiar "satisfying" experience. Additionally, it is very helpful for creative expression and can improve click-through rates (CTR), which is why this aesthetic style frequently appears in many casual game types.

The same aesthetic style is also present in one of the other three games that successfully broke the $50,000 revenue threshold, "Match Rush 3D: ASMR Care" (developed by AlphaPlay Games). Among the newly released games in 2024, it has the highest cumulative revenue, reaching $575,000, but by the end of the year, its performance declined, with monthly revenue in December 2024 dropping to $30,000.

The other two games that met the success criteria are "Match Party - Tile 3D" and "Triple Pile 3D." However, both began to decline in January 2025, and without improvements, they may repeat the fate of "Match Rush 3D: ASMR Care," which saw rapid initial growth but then stagnated, facing the risk of being eliminated from the market.

The most likely reason for the decline of these games is the difficulty in player retention. This highlights an important issue: in today's highly competitive market, relying solely on refined core gameplay and low-cost user acquisition is no longer sufficient. To succeed, developers need to establish clear short-term and long-term player retention strategies from the very beginning, which is precisely the lesson we learned from the previous game category!

3D Matching Category: Key Insights

Over time, this category has shifted from hyper-casual to casual. Initially, a unique and well-designed core gameplay was enough for hyper-casual games to achieve success through ad monetization. However, as the category has evolved, developers have begun to introduce meta features, adjust difficulty curves, and optimize monetization strategies Many top works today incorporate a simplified version of the "Royal Match" fusion gameplay, an item system inspired by match-3 fusion gameplay, and activity mechanisms borrowed from casual casino games. Additionally, developers often innovate in level design and difficulty curves to enhance long-term playability. Overall, 3D matching remains a category full of potential, especially with room for innovation in long-term retention optimization and regular operational strategy upgrades.

However, entering this track today is much more difficult than it was a year ago. But don't worry, the next emerging category opportunity is always waiting for you!

Sorting Puzzle: The Hottest Category of the Year

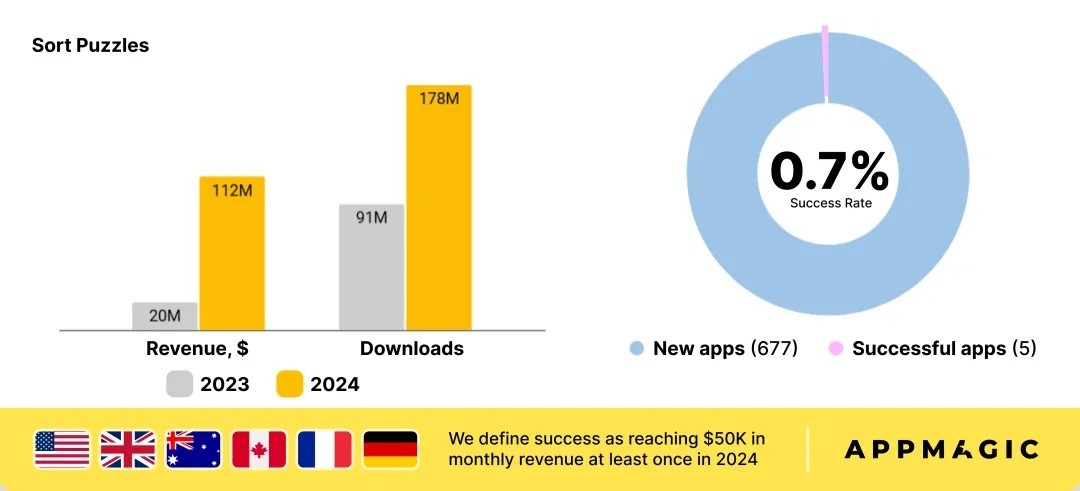

Bar chart of revenue and downloads for the sorting puzzle category in the T1 markets of Europe and America; pie chart of new game success in 2024

Sorting puzzle games are currently one of the fastest-growing categories in terms of revenue. This category experienced explosive growth in the second half of 2023 and is expected to continue this momentum into 2024, with a year-on-year revenue increase of 5.6 times! In fact, the sorting puzzle game category already has considerable download numbers in the T1 markets of Europe and America, so its recent success (surge in IAP revenue) is not solely due to an influx of new players, but rather a significant breakthrough in monetization strategies.

Comparison of revenue and downloads for sorting puzzle games in the T1 markets of Europe and America

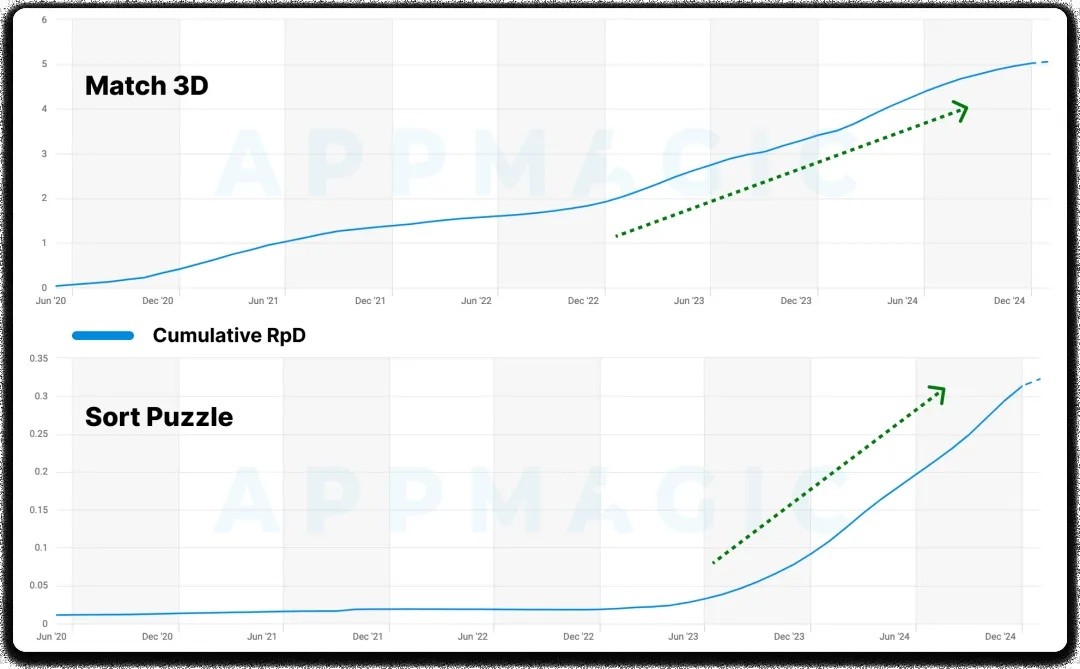

Let's compare the RpD (revenue per download) of sorting puzzles with that of 3D matching games. Both categories experienced a similar RpD growth transformation at the beginning of 2023 (with sorting puzzles growing at a faster rate). Since then, 3D matching has shown stable growth in the first half of 2024, but its growth rate has slowed in the second half. Meanwhile, the sorting puzzle category has yet to show any signs of slowing down, indicating that it is in a critical growth phase.

Comparison of RpD trends for 3D matching games and sorting puzzle games in the T1 markets of Europe and America

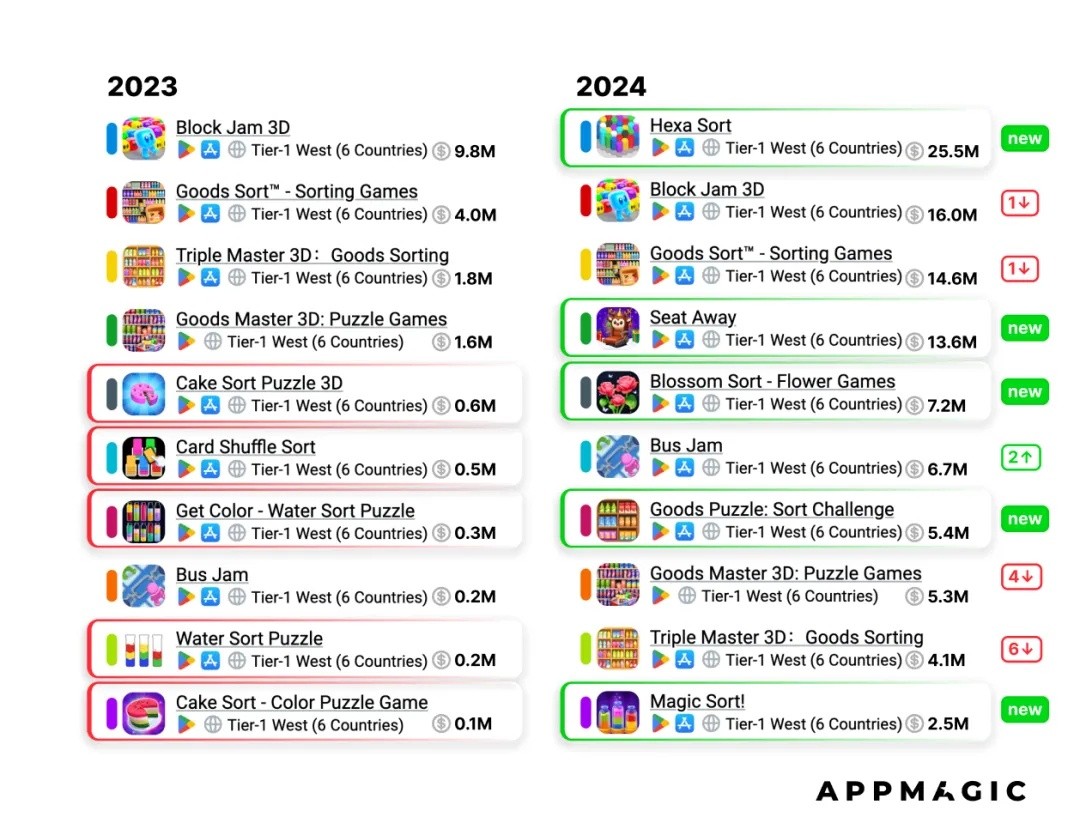

From the Top 10 rankings, the market has been flooded with a large number of new works, bringing a wave of fresh ideas and gameplay variants. Notably, 6 of the top 10 are new games, one of which is currently the leader in this category, "Hexa Sort" produced by Lion Studios, which has achieved global revenue of $28.5 million in 2024, with a staggering 90% of that revenue coming from the T1 markets of Europe and America! This game began to grow rapidly in January 2024, reaching the top spot in just 6 months, pushing "Block Jam 3D" (produced by VOODOO), which had dominated the charts for 15 consecutive months, to second place.

Ranking of Puzzle Games in the T1 Market of Europe and America for 2023/2024 Revenue Top 10

From the Top 10 rankings, it is clear that the highest-grossing games have undergone significant evolution in gameplay and themes. One of the most notable changes is the disappearance of water sorting games. If we look back to 2022, 6 of the top 10 in this category were water sorting games, with another 3 being reskinned versions of the same gameplay. By 2023, only 2 water sorting games remained. And by 2024, there are no traces of water sorting games in the category's Top 10.

However, the dominant trend of single themes remains evident in 2024: 4 of the top 10 games in this category have titles that include the word "goods." These games revolve around organizing household items and food, which aligns closely with the essence of the category based on "organizing and classifying items" gameplay!

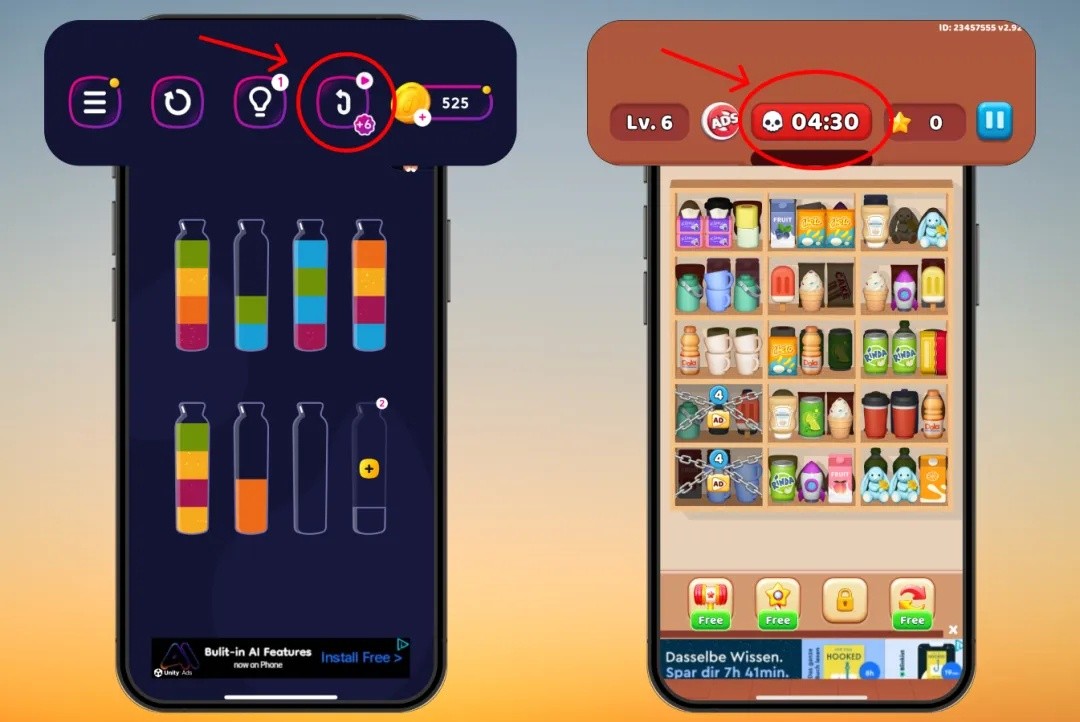

Screenshots of "Get Color - Water Sort Puzzle" and "Goods Puzzle: Sort Challenge"

However, the changes are not only reflected in this tangible aspect (simple theme changes) but also in significant adjustments in gameplay, specifically including:

Time pressure replacing puzzle challenges: In goods sorting puzzles, challenges typically arise from time constraints rather than finding the correct solution or correcting mistakes. Monetizing through time pressure is a proven strategy, often seen in Hidden Object and Time Management games.

Item system: Goods sorting games usually incorporate an item system similar to match-3 games, helping players respond to challenges more quickly. This not only enhances gameplay but also deepens monetization potential.

Simplified decoration fusion gameplay: Many goods sorting games integrate a basic decoration gameplay line, inspired by "Royal Match," which effectively drives players to set goals, thus aiding in player retention.

At the same time, mechanisms inherited from water sorting games, such as unlocking new sorting spaces and extensive use of ad monetization, also make goods sorting puzzle games lean more towards the hypercasual game category. This once again reminds us of the common occurrences in 3D matching games last year, such as redesigning difficulty, optimized monetization methods, and simplified decoration fusion gameplay In 2024, there were 227 new sorting puzzle games released in the T1 market of Europe and America, among which 6 games surpassed our set "success standard" of "monthly revenue of $50,000." Although a success rate of 2.6% seems low, it is important to move away from solely judging "success" based on IAP metrics. As previously mentioned, this category still largely relies on advertising monetization, and this revenue is not reflected in the data above.

For example, "Nut Sort: Color Sorting Game" produced by Zephyr Mobile has not yet reached $50,000 in monthly in-app purchase revenue, but the game has already garnered over 9.6 million downloads, so its advertising revenue must far exceed this standard!

For those games that have surpassed $50,000 in monthly in-app purchase revenue, their success largely depends on drawing inspiration from competitors. For instance, "Magic Sort!" and "Royal Sort" not only borrowed heavily from "Royal Match" in terms of UI/UX and art style but also imitated the core gameplay and meta gameplay. Other games, such as "Hexa Master 3D - Color Sort," have also improved upon the successful formula of "Hexa Sort" through innovative art styles.

This trend indicates that keeping up with market dynamics and drawing inspiration from leading works is crucial. This requires developers to not only focus on successful games within their category but also seek inspiration from the entire casual gaming field!

Sorting Puzzle Category: Key Thoughts

Similar to 3D matching games, sorting puzzle games are transitioning from hyper-casual to casual by introducing elements similar to match-3 fusion gameplay (such as props and simplified meta gameplay). However, it is still in the early stages of this journey, making it one of the most worthy categories to watch closely in 2025!

Gambling Fusion Gameplay (Casual Gambling): The Most Monopolized Category?

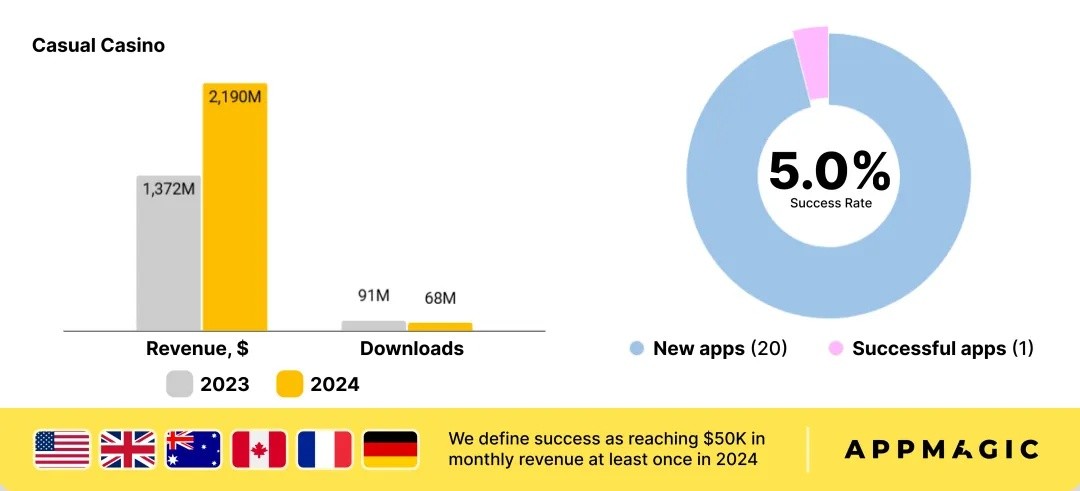

Bar chart of revenue and downloads for gambling fusion gameplay in the T1 market of Europe and America; pie chart of new game success in 2024

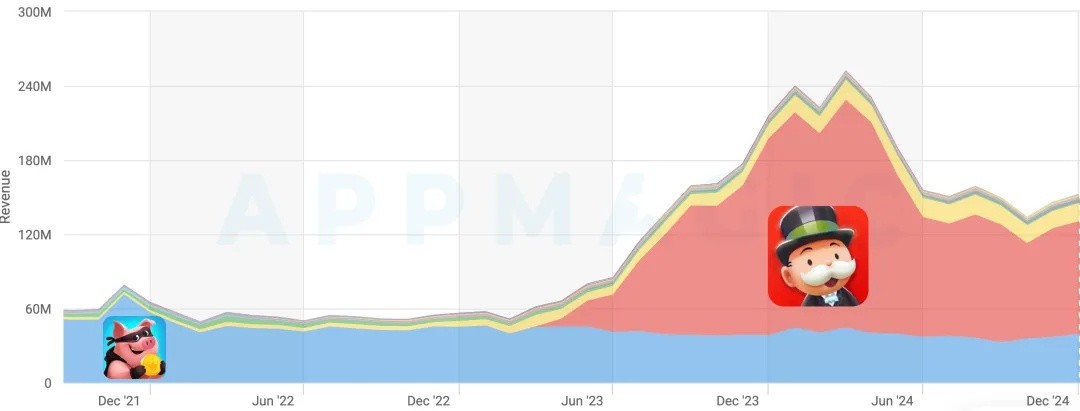

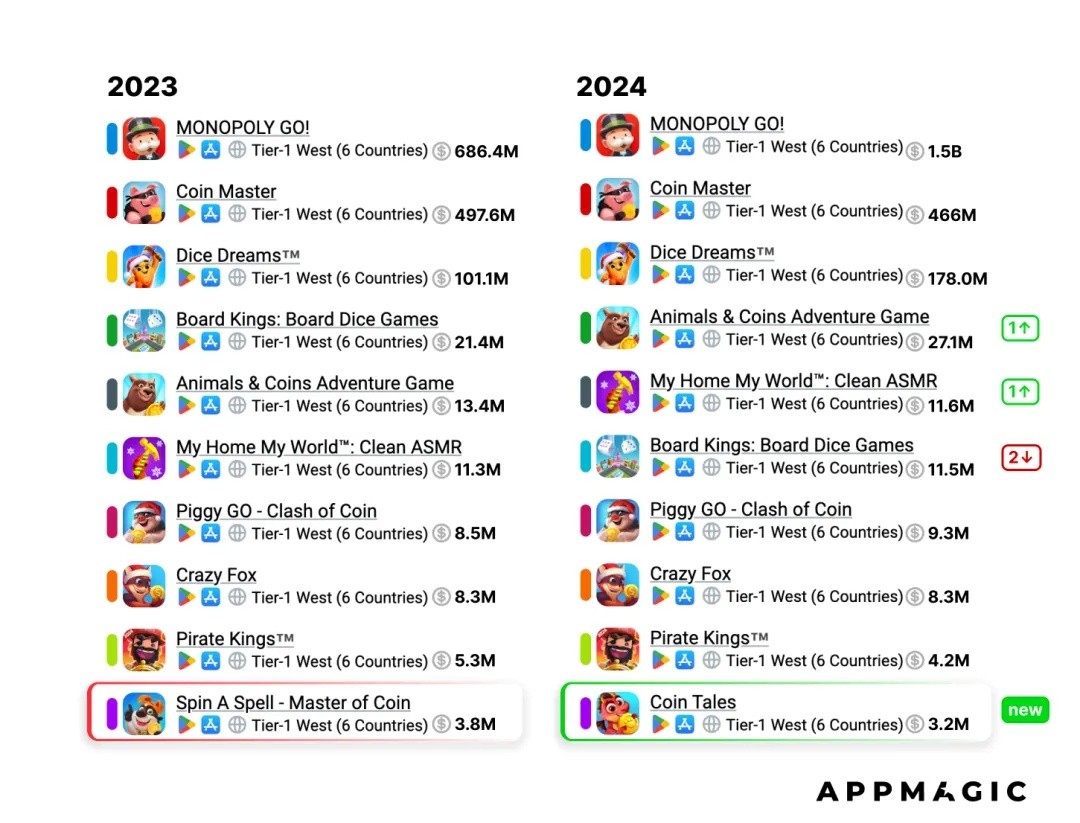

The story of "Monopoly GO!" disrupting the market and replacing "Coin Master" as the industry leader is one of the most noteworthy developments of 2023. In 2024, we were fortunate to witness the continuation of this story and how "Monopoly GO!" reshaped the market. This game, which has firmly established itself as the industry leader, is currently influencing not only its own sub-category but also other major casual game categories.

Scopely's "Monopoly GO!" has defined the casual gambling category to such an extent that discussing the trends in this category is essentially equivalent to studying the performance changes of this game In the second quarter of 2024, "Monopoly GO!" began to slow its expansion pace and shifted to the operational phase. This transition also explains why we saw a 146% year-on-year revenue growth in the casual gaming report for the first half of 2024, while the annual perspective shows a "mere" 60% year-on-year growth. In terms of downloads, the slowdown of "Monopoly GO!" led to a 24% decline in downloads across the entire subcategory.

Comparison of casual gambling game revenues in T1 markets of Europe and America

Another significant factor that may impact the casual gambling category in 2025 is Playtika's two major acquisitions over the past year:

In September 2024, this Israeli company acquired InnPlay Labs for $300 million, the developer of "Animals & Coins Adventure Game," which ranked 4th in the category in the T1 market of Europe and America in 2024.

In November 2024, Playtika acquired SuperPlay for $2 billion, the developer of "Dice Dreams," which ranked 3rd in the category in the T1 market of Europe and America in 2024.

Playtika's control over these two games, which closely follow the long-term leaders, further solidifies an already highly concentrated market. If you think Playtika only has these, you are mistaken! In fact, Playtika also released 2 other games in the Top 10, "Board Kings: Board Dice Games" and "Pirate Kings."

In the T1 market of Europe and America in 2024, "Monopoly GO!" generated 55% of the revenue in this category, "Coin Master" accounted for about 18%, and "Dice Dreams" accounted for about 7%. This means that nearly 80% of the market revenue comes from the top three games, making casual gambling one of the most monopolistic categories in the industry!

The characteristic of market concentration is reflected in the Top 10 rankings of this category. Only one new game entered, while the remaining changes were mainly driven by the continuous decline in revenue.

Top 10 revenue of casual gambling games in the T1 market of Europe and America for 2023/2024

Due to fierce competition, only 17 new games were released in this category in 2024, with only one breaking through our success standard of $50,000 in monthly revenue, "Fishing Travel" produced by Ark Game This fishing-themed game features realistic graphics and casting actions. Unlike the common scrolling and throwing methods found in other games, this novel change seems to help attract more male players!

Integration of Gambling Gameplay (Casual Gambling): Key Thoughts

Since casual gambling remains one of the hardest categories to enter, it is best to avoid this field unless you have a strong budget and extensive expertise. Even for large publishers, entering this area is not easy, which is why giants like Playtika often acquire potential projects first and then leverage their more abundant resources and knowledge to further expand them.

Nevertheless, even if you do not plan to develop a casual gambling game, this category is full of innovations in operational event design and monetization strategies that are worth emulating. Games like "Monopoly GO!", "Coin Master," and "Dice Dreams" are excellent sources of inspiration to help you enhance your corresponding strategies.

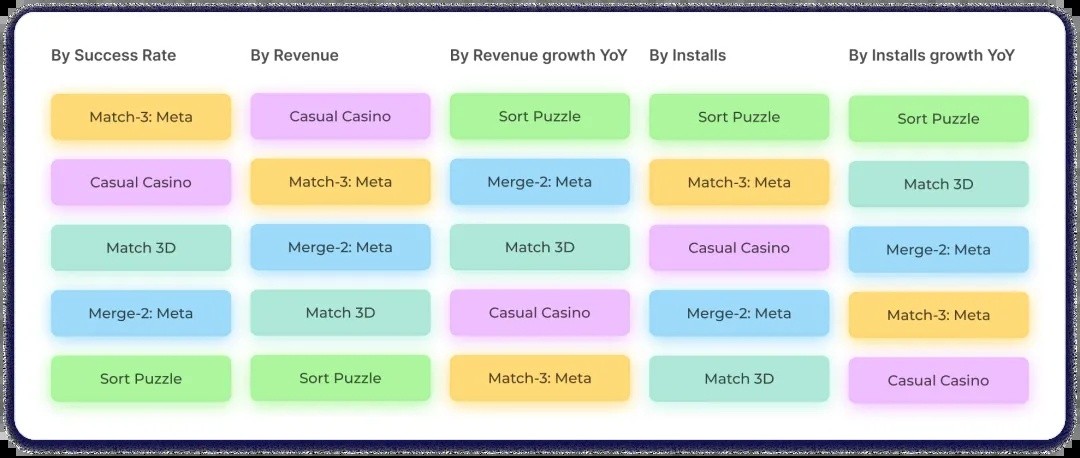

Summary of Key Points in This Report (Including Parts One and Two):

The emerging categories in 2024 focus on embracing hybrid casual and adding depth to hyper-casual games. Both established companies and emerging studios are combining the simple, easily engaging core gameplay of hyper-casual games with props, light integration gameplay, and more refined monetization strategies.

Although these emerging categories offer rich opportunities, the development story of 3D matching and sorting puzzle categories indicates that even in the early stages, startups need to pay more attention to refined operations and monetization strategy planning to stand out in long-term competition.

So, which will be the next big trending subcategory? While no one can be certain, we recommend paying special attention to hyper-casual subcategories, especially puzzle games, in 2025. After all, 3D matching and sorting puzzles originated from this field and have already carved out a niche in the casual category.