Alibaba leads the AI frenzy, analysts say Tencent may take over for a "highlight moment"

Alibaba has attracted investors due to its success in the field of artificial intelligence, while Tencent is waiting for its moment in the spotlight. Alibaba's stock price increase is more than double that of Tencent, and Tencent's upcoming financial report will reveal its investment plans in artificial intelligence. Analysts believe that Tencent's success could reignite investor confidence in Chinese tech stocks. The market is looking forward to Tencent announcing a large-scale capital expenditure plan for artificial intelligence, with particular attention on the performance of its gaming business

According to Zhitong Finance APP, as Alibaba (09988) attracts investors' attention due to China's success in the field of artificial intelligence, Tencent is still waiting for its own moment in the spotlight.

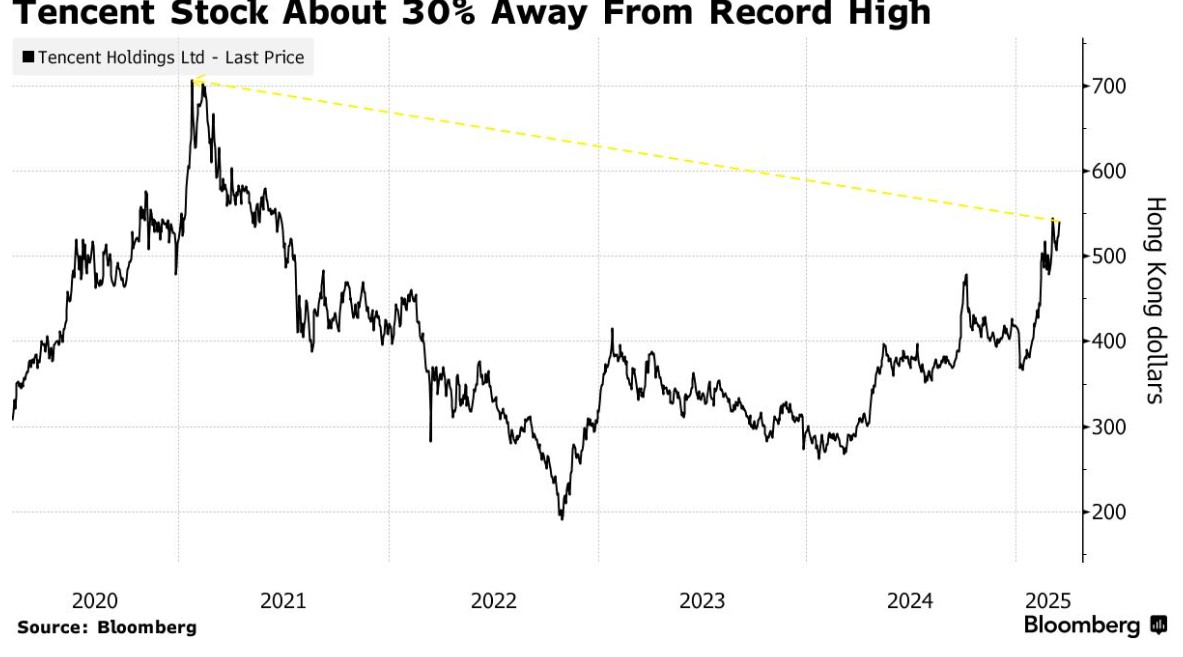

Driven by the excitement sparked by DeepSeek, Alibaba's stock listed in Hong Kong has seen a year-to-date increase more than double Tencent's 30% rise. Tencent's financial report, set to be released after Wednesday's market close, will provide important clues about its potential to catch up, including the planned investment scale in its artificial intelligence business.

Tencent's stock price is still over 30% away from its all-time high, a distance that is closer than many of its peers. As one of the long-standing leaders in the industry, if Tencent can reach a new high, it may symbolize a true return to form for the sector.

"Tencent's success in the field of artificial intelligence could reignite investor confidence in Chinese tech stocks," said David Chen, Chief Investment Officer of Tiger Securities Hong Kong Asset Management. This would "validate the significant investments being made across the industry and could trigger a revaluation of Chinese tech companies focused on artificial intelligence."

The Chinese government's latest commitment to boost consumption has further propelled the upward momentum of the Chinese stock market, dominated by tech stocks. This has also shifted investors' attention to Tencent, watching how it plans to commercialize artificial intelligence to complement its chat applications, gaming, and internet advertising businesses.

Specifically, Chen noted that after Alibaba announced plans to invest over 380 billion yuan (53 billion USD) over the next three years, the market is anticipating Tencent to announce a "large-scale artificial intelligence capital expenditure plan." He stated that the gaming business will be the focus of Tencent's financial report, particularly overseas growth and the performance of the new game "Delta Force."

The company is expected to report an 8.7% increase in sales for the quarter ending in December, marking its best performance in over a year. Analysts expect its gross margin to be 53.3%, close to an eight-year high.

The latest developments in artificial intelligence, along with announcements of financial reports and shareholder returns, are key factors influencing stock price performance. On Tuesday, Tencent launched a new artificial intelligence service based on its Hunyuan3D-2.0 large language model, capable of converting text or images into 3D visual effects and graphics.

Most major Chinese internet companies have integrated DeepSeek's economical artificial intelligence model into their products and services. HSBC analyst Charlene Liu stated that Tencent is one of the fastest-moving companies in this regard, using DeepSeek to support its search functionality and WeChat/Weixin applications.

"This open attitude should enhance Tencent's monetization potential, as it has strong application development capabilities, a large user base, and a unique WeChat ecosystem," she wrote in her report. "Artificial intelligence is expected to strengthen user stickiness on WeChat" and help it gain more customer advertising spending Options traders expect Tencent's stock price to fluctuate by 4.4% after the earnings report is released on Wednesday, while the average increase or decrease in the stock price after earnings reports over the past eight quarters has been 2.2%.

Although Tencent's stock performance has lagged behind some peers, the rising valuation has raised concerns among some investors. Currently, Tencent's stock price is about 20 times future earnings expectations, still higher than Alibaba's 15 times and close to Meta Platforms Inc.'s 22 times.

"Pure optimism may not be enough to drive further valuation expansion; Tencent needs to deliver actual data," said Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management. "After a unique year in 2024, investors need Tencent to guide towards normalized growth close to double digits and achieve margin expansion."

Nevertheless, Bao believes that given the current round of stimulus measures and the AI boom, Tencent's stock price "may still have room for revaluation," reaching its long-term earnings expectation of 23 times. "If we take the recovery story of China seriously, Tencent's stock price could return to historical highs."