HAIDILAO's net profit in 2024 increased by 4.6% year-on-year, with a continuous improvement in table turnover rate | Financial Report Insights

海底捞 2024 年实现总收入同比增长 3.1%,核心经营利润大幅增长 18.7%。这背后的关键驱动因素在于门店经营效率的提升。海底捞餐厅平均翻台率从 2023 年的 3.8 次/天上升至 2024 年的 4.1 次/天,全年接待顾客 4.15 亿人次,较上年增加 4.5%。

在餐饮行业竞争日益激烈的环境下,海底捞交出了一份相对稳健的业绩单。2024 年公司实现总收入同比增长 3.1%,核心经营利润大幅增长 18.7%。

这背后的关键驱动因素在于门店经营效率的提升。数据显示,海底捞餐厅平均翻台率从 2023 年的 3.8 次/天上升至 2024 年的 4.1 次/天,全年接待顾客 4.15 亿人次,较上年增加 4.5%。

周二晚间,海底捞发布 2024 年全年财报,以下是核心要点:

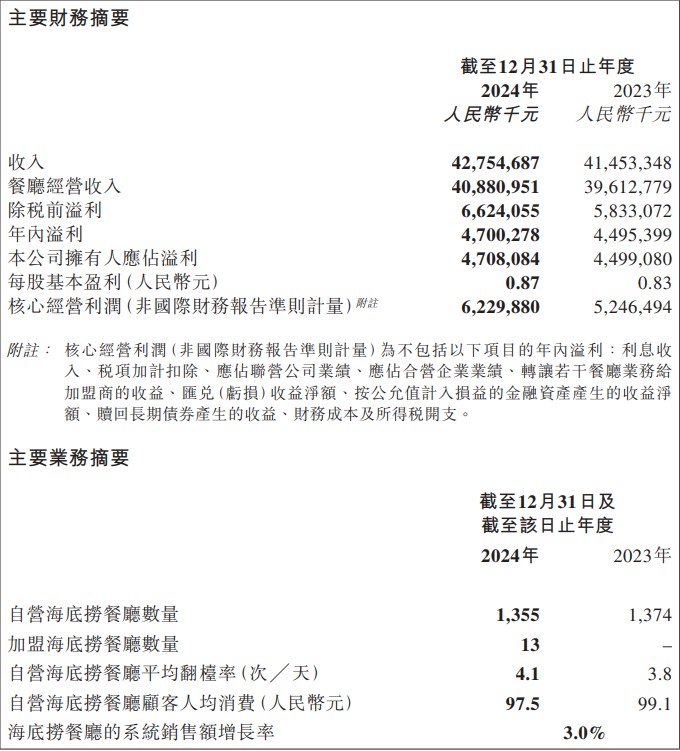

财务表现:2024 年营收同比增长 3.1% 至 427.5 亿元;全年核心经营利润同比增长 18.7% 至 62.3 亿元;全年溢利同比增长 4.6% 至 47 亿元;

经营数据亮点:平均翻台率由 3.8 次/天提升至 4.1 次/天;全年接待顾客 4.15 亿人次,同比增长 4.5%;

多元化战略:"红石榴计划"已孵化 11 个子品牌,覆盖正餐、简餐、快餐等场景;其他餐厅收入同比增长 39.6% 至 4.83 亿元。

加盟业务:截至 2024 年末已落地 13 家加盟餐厅,超 70% 加盟申请来自三线及以下城市;

此外,海底捞表示,将于 2025 年 6 月 19 日派发截至 2024 年 12 月 31 日止年度的末期股息每股 0.507 港元。

积极拓展多元化业务

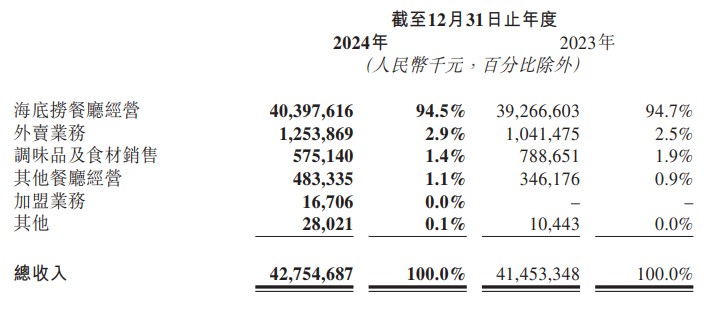

从收入构成来看,海底捞仍高度依赖主业,餐厅经营收入占总收入的 94.5%。但值得关注的是,公司正积极拓展多元化业务:

外卖业务收入增长 20.4% 至 12.5 亿元;

加盟业务虽然起步阶段,但已开始贡献收入;

而其他餐厅经营收入大幅增长 39.6% 至 4.83 亿元,主要得益于"红石榴计划"下推出的创新餐饮品牌。

差异化经营成效显著,高效提升翻台率

海底捞 2024 年的经营策略重点在于差异化,公司提出打造"不一样的海底捞"理念,将更多主动权交予一线餐厅,鼓励差异化经营以满足不同顾客需求。

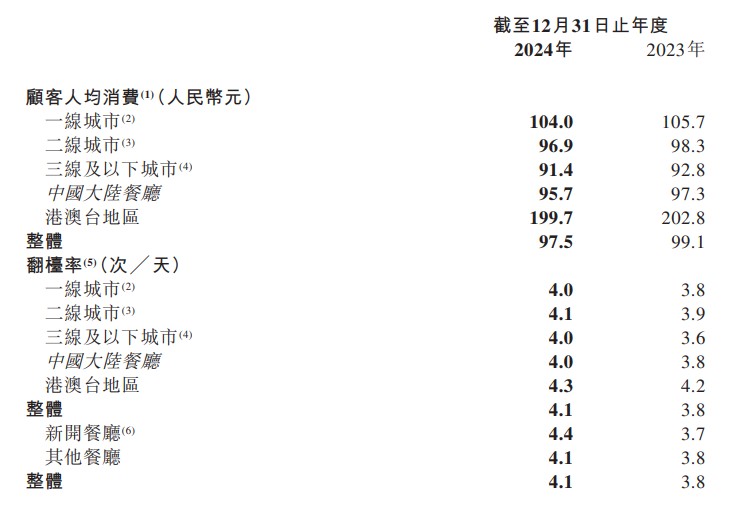

具体举措上,海底捞在产品、场景、价格三个方面做出灵活调整。产品方面,根据不同地区饮食习惯调整菜品和调料;场景方面,推出包间店、亲子主题店、夜宵主题店等特色场景;价格方面则采取"绝对好、相对便宜"的定价思路,让门店根据自身情况执行差异化定价策略。

这种差异化策略显著提升了餐厅运营效率,同店销售额从 2023 年的 363.3 亿元增长至 2024 年的 376.3 亿元,同店平均日销售额从 81.8 万元增至 84.4 万元,翻檯率从 3.8 次/天提升至 4.1 次/天。值得注意的是,三线及以下城市的翻台率提升最为明显,从 3.6 次/天提升至 4.0 次/天,表明海底捞的差异化经营策略在下沉市场取得了良好效果。

成本控制优化,原材料支出降幅明显

值得关注的是,海底捞在收入增长的同时,成本控制也取得成效。原材料及易耗品成本从 2023 年的 169.5 亿元减少 4.3% 至 2024 年的 162.1 亿元,占收入比例从 40.9% 降至 37.9%,主要得益于原材料采购价格的降低。

不过,员工成本有所上升,从 2023 年的 130.4 亿元增加 8.2% 至 2024 年的 141.1 亿元,占收入比例从 31.5% 增至 33.0%。这主要是因为公司提高了员工整体薪资福利水平,并增加了部分岗位人员配置,以更好地激励员工和提升顾客体验。

折旧及摊销费用显著减少,从 2023 年的 29.5 亿元下降 13.1% 至 2024 年的 25.6 亿元,这是因为部分餐厅物业、厂房及设备已提足折旧及摊销。这一因素也对公司整体毛利率提升起到了积极作用。

此外,2024 年公司正式启动"红石榴计划",旨在孵化和发展更多餐饮新品牌。截至年末,已孵化 11 个子品牌(包括"焰请烤肉铺子"、"火焰官"、"小嗨火锅"等),共计 74 家门店。同时,加盟业务也在稳步推进。截至 2024 年末,公司已完成 13 家加盟餐厅的审核与落地,初步验证了加盟模式在规模化布局中的可行性。值得注意的是,超 70% 的加盟申请来自三线及以下城市,表明海底捞品牌在下沉市场仍有较大发展空间。