Guangfa Strategy: Gold needs a "monthly level correction," which is a necessary return process after the previous short-term driving factors have been overstretched

Guangfa Strategy pointed out that gold prices experienced significant fluctuations after the implementation of tariff policies in April 2025, mainly influenced by the tariff tensions between China and the United States, pressure on the US dollar, and a shift in Federal Reserve policies. Long-term supporting factors include safe-haven demand and geopolitical instability. Central bank gold purchases and ETF increases have driven gold prices up, with gold gradually becoming an alternative to the US dollar system. In the medium to long term, the structural bull market for gold will continue, but short-term price adjustments need to be monitored

Core Viewpoints

After the tariff policy takes effect in April 2025, gold prices have shown a volatile trend of rising and falling sharply. Overall, this round of significant increase is mainly driven by the escalation of tariff tensions between China and the United States, pressure on the dollar, a cautious shift in Federal Reserve policy expectations, and high global risk aversion. The underlying logic is:

The long-term supporting factor is risk aversion demand; tariffs and geopolitical instability will support gold prices.

After the end of the U.S. exceptionalism narrative, the U.S. stock market has entered a bear phase, leading to strong asset allocation demand for gold from European and American funds. In a certain sense, gold is the biggest beneficiary of the recent decline in the U.S. stock market.

The macro narrative refers to the collapse of dollar credit, with the structural aspect being the depreciation of the dollar (gold is the only major asset, besides Bitcoin, that can benefit from dollar depreciation). Central bank gold purchases are also a concrete manifestation of this reason.

Why has the TIPS pricing framework failed?

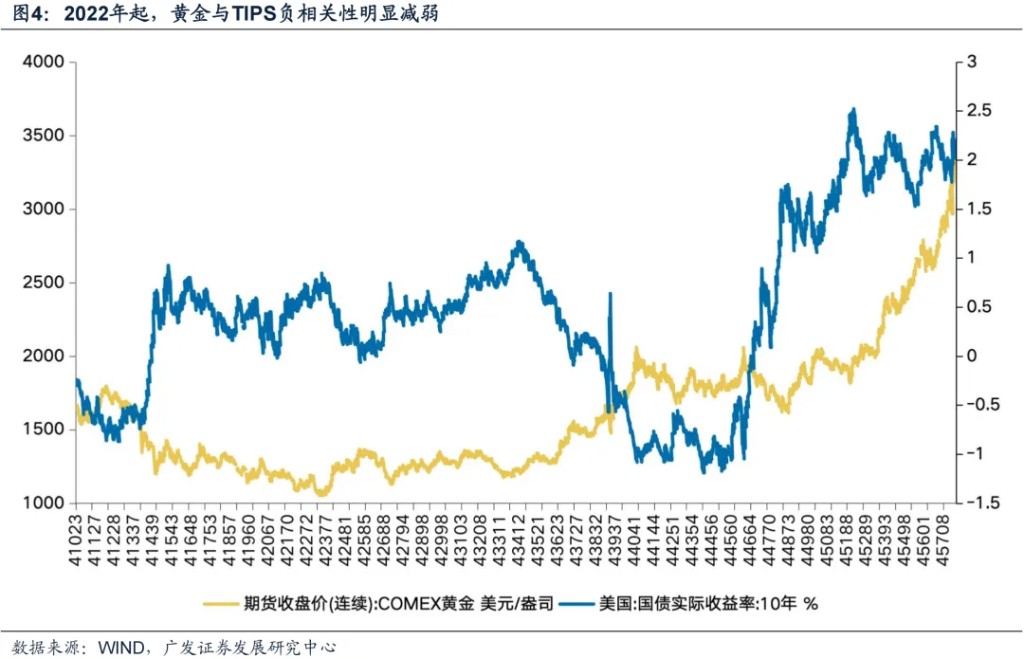

Gold can be approximated as a long-term inflation-protected zero-coupon bond, while the level of real interest rates constitutes its implicit holding cost. However, from the trend perspective: the correlation began to weaken around 2022. Possible reasons include: market risk aversion dominating gold pricing, restructuring of the dollar credit system, changes in central bank gold purchasing behavior altering supply and demand structure, and ETF fund flows reshaping market structure.

Central Bank Gold Purchases & Gold ETF Increases:

For central banks, gold is a substitute for the dollar, and geopolitical factors are driving pricing. Gold is a direct beneficiary of "de-globalization" and "de-dollarization." For the global market, concerns over weak U.S. stocks and a weak dollar driving gold prices up are the direct reasons for the recent global ETF increases.

Reconstruction of Gold Asset Prices and Future Outlook:

-

The pricing logic of gold is likely changing: the gold system is no longer a vassal of the dollar system but is gradually becoming a counterpart to the dollar, or even replacing it.

-

The true signal of asset price revaluation is not in the RMB against the dollar or in the interest rate path, but in gold—the RMB gold price is the true monetary anchor for China.

-

The current RMB gold price is closer to being "Shanghai-led" rather than the previous "dollar gold price and exchange rate" triangular conversion result.

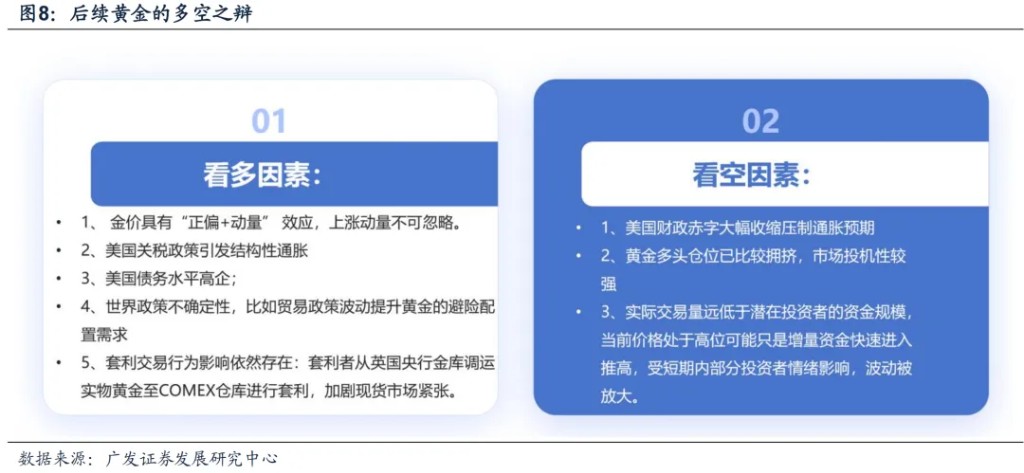

From a medium to long-term perspective, we maintain the judgment of a structural bull market in gold, with the momentum for breaking through historical peak valuations still being sustainable. However, in terms of short-term trading, although current prices have retreated, there is still the possibility of further decline: the technical aspect is overbought, the net long position of COMEX gold speculation has broken through the threshold range, and market sentiment is significantly overheated. Based on the mean reversion principle, we believe that gold will complete liquidity premium rebalancing through monthly price corrections, which is also a necessary return process after the previous short-term driving factors were over-leveraged

Report Text

I. What Information is Reflected by the Severe Fluctuations in Gold Prices?

(A) Review of Gold Price Trends in April

After the implementation of the tariff policy in April 2025, gold prices surged and then retreated, showing a recent trend of severe volatility. The spot gold price began to rise from $3,024 per ounce on April 4 and broke through the $3,200 mark on April 11. It then climbed again to about $3,330 on April 16, and after breaking through the $3,400 resistance level on April 21, it briefly reached a historical high of $3,500 on April 22. Entering this week, due to profit-taking and optimistic expectations for negotiations, gold prices have short-term retreated to about $3,326. Overall, this round of significant increase is mainly driven by the escalation of tariff tensions between China and the U.S., pressure on the dollar, a cautious shift in Federal Reserve policy expectations, and heightened global risk aversion.

We believe the underlying logic may be as follows:

The long-term supporting factor is risk aversion demand; Trump, as the biggest unstable factor, will support gold prices through tariffs and geopolitical instability;

After the end of the U.S. exceptionalism narrative, the U.S. stock market has turned bearish, leading to a strong asset allocation demand for gold from European and American funds. In a certain sense, gold is the biggest beneficiary of this round of U.S. stock market decline;

The macro narrative refers to the collapse of dollar credit, with the structural aspect being the depreciation of the dollar (gold is the only major asset, apart from Bitcoin, that can benefit from the depreciation of the dollar). Central bank gold purchases are also a manifestation of this reason.

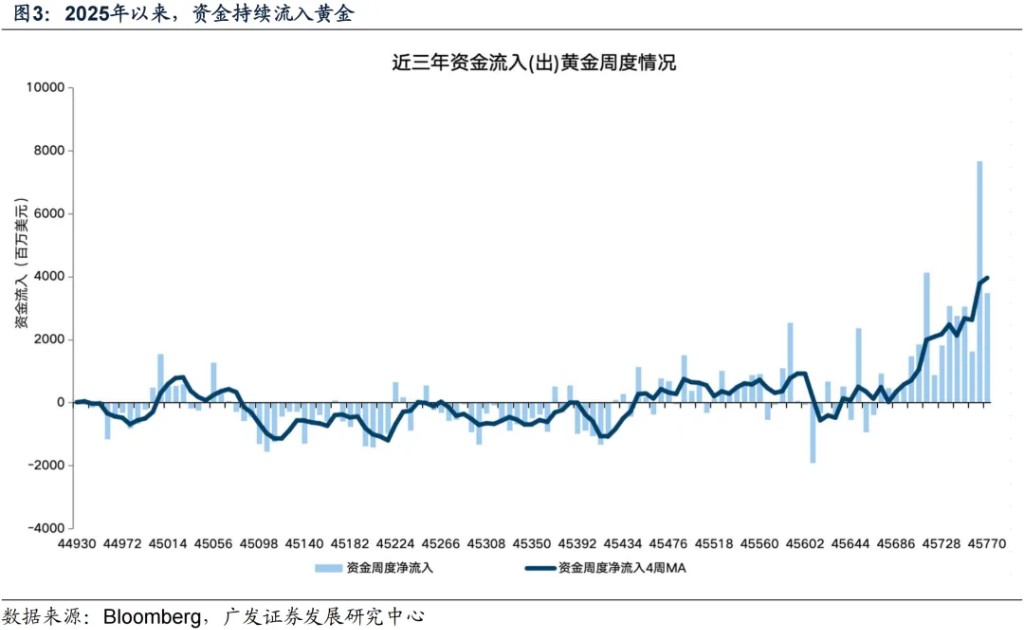

In terms of capital flow, since April 2025, gold inflows have exceeded $15 billion; and last week set a record for the largest weekly net inflow of $7.67 billion; from a rolling four-week perspective, recent gold fund inflows have shown a significant upward slope.

(B) Why Has Traditional TIPS Pricing Failed?

Gold can be approximated as a long-term inflation-protected zero-coupon bond, while the level of real interest rates constitutes its implicit holding cost, which essentially reflects the inflation-adjusted benchmark yield of dollar assets. Traditionally, it is understood that when real interest rates are in a downward cycle, the relative yield advantage of gold as a non-yielding asset will significantly increase, thereby enhancing its asset allocation attractiveness.

However, the notion that "real interest rates are the opportunity cost of holding gold, thus gold prices are negatively correlated with real interest rates" has failed since around 2022. Possible reasons include: market risk aversion demand dominating gold pricing, reconstruction of the dollar credit system, changes in central bank gold purchasing behavior altering supply and demand structure, and ETF capital flows reshaping market structure, etc. **

Central Bank Gold Purchases: For central banks, gold is an alternative to the US dollar, and geopolitical factors are driving pricing. Gold is a direct beneficiary of "de-globalization" and "de-dollarization."

-

In light of the conflict between Russia and Ukraine and the US sanctions against Russia using the dollar system, central banks around the world are considering the risks of sanctions, making it unsafe to hold dollar assets; if they reduce their dollar asset allocation, gold naturally becomes the best choice for foreign exchange reserves.

-

Emerging market central banks purchasing gold are not considering traditional factors such as interest rates and exchange rates, but rather long-term variables such as the safety of international reserves and political stability.

Since the third quarter of 2024, the central banks of Poland, Azerbaijan, India, Turkey, and China have increased their gold holdings, ranking in the top five with increases of: 82.4, 31.7, 30.0, 26.0, and 25.2 tons, respectively.

Gold ETF Increases: Since 2025, ETF funds have become an important force driving gold prices upward.

For the global market, concerns about weak US stocks and a weak dollar are the direct reasons for the recent increase in global ETF holdings of gold. US investors are increasingly worried about weak US stocks, a weak dollar, and the risk of economic stagflation, leading them to significantly increase their positions in gold ETFs. In 2025, the timing of the large-scale accumulation of gold ETFs (with holdings rising rapidly from 83 million ounces in mid-February to 86 million ounces) coincided with the start of a significant decline in US stocks. The WGC monthly report also indicates that this wave of global gold ETF accumulation is primarily driven by US funds (accounting for over 70%).

For the Chinese market, there is also an increase in gold ETF holdings, likely due to improved expectations among retail investors. Recently, many gold ETFs have experienced premium purchases, with 14 domestic gold ETFs reaching a scale of 160 billion, a 120% increase since the beginning of the year. Based on domestic gold prices (AU9999), domestic gold ETFs have added 76 tons of new holdings this year, surpassing last year's total increase. Retail funds are accelerating their inflow into the gold market.

(3) Reconstruction of Gold Asset Prices and Future Outlook

The pricing logic of gold is likely changing: the gold system is no longer a vassal of the dollar system, but is gradually becoming a counterpart to the dollar, or even replacing it. Currently, there is no significant expectation of depreciation for the CNY exchange rate (especially against the dollar), and the CNH-CNY spread is also within a normal range. However, the implied USDCNY exchange rate from the domestic and foreign gold price spread has rapidly risen above 7.4. This indicates that the rise in the implied exchange rate in the gold market is unrelated to exchange rate expectations, but rather a result of significant inflows of domestic capital.

The true signal of asset price revaluation is not in the RMB against the dollar, nor in the interest rate path, but in gold—the RMB gold price is the true monetary anchor of China. Releasing sufficient liquidity, conducting monetization operations, and creating monetary inflation are necessary to bring the "debt/liquidity ratio" back to a normal range. In this process, the depreciation benchmark for the RMB should not be the dollar exchange rate, but the purchasing power of real assets represented by gold—the fluctuations in gold prices essentially reflect the real depreciation level of currency against core assets. The upward movement of gold priced in RMB may indicate that China is systematically moving towards re-inflation.

Currently, the RMB gold price is closer to being "Shanghai-dominated" rather than a triangular conversion result of dollar gold prices and exchange rates. From the structural trading observed since the beginning of 2024, China is gradually gaining pricing power, and the RMB gold price is no longer merely a triangular conversion result of "dollar gold price + exchange rate."

From a medium to long-term perspective, we maintain the judgment that the structural bull market for gold has not reached its end, and its momentum for revaluation beyond historical peaks remains sustainable. However, in terms of short-term trading, although the current price has retreated, there is still a possibility of further decline: technically, it has reached the weekly overbought area, and the net long speculative position in COMEX gold has breached the threshold range, indicating significant market overheating. Based on the principle of mean reversion, we believe that gold will complete the liquidity premium rebalancing through monthly price corrections, which is also a necessary return process after the previous short-term driving factors were over-leveraged.

Note: This article has been abridged.

Authors: Liu Chenming, Chen Zhenwei, Source: Chenming's Strategic Deep Thoughts, Original Title: "【Guangfa Strategy】What Information Does the Volatility of Gold Reflect?"

Risk Warning and Disclaimer The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk