Remitly Global, Inc. (NASDAQ:RELY) Major Shareholder Sells $272,391,000.00 in Stock

Remitly Global, Inc. (NASDAQ:RELY) major shareholder Naspers sold 11.9 million shares for $272.39 million at an average price of $22.89, reducing their ownership by 31.87%. Post-sale, Naspers holds 25.44 million shares valued at approximately $582.36 million. The transaction was disclosed to the SEC. Remitly's stock opened at $22.81, with a market cap of $4.65 billion and a PE ratio of -120.05. Analysts have mixed ratings on the stock, with price targets ranging from $21 to $30.

Remitly Global, Inc. (NASDAQ:RELY - Get Free Report) major shareholder Ltd Naspers sold 11,900,000 shares of the stock in a transaction that occurred on Wednesday, May 14th. The stock was sold at an average price of $22.89, for a total value of $272,391,000.00. Following the sale, the insider now directly owns 25,441,745 shares of the company's stock, valued at approximately $582,361,543.05. The trade was a 31.87% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Large shareholders that own at least 10% of a company's shares are required to disclose their sales and purchases with the SEC.

Remitly Global, Inc. (NASDAQ:RELY - Get Free Report) major shareholder Ltd Naspers sold 11,900,000 shares of the stock in a transaction that occurred on Wednesday, May 14th. The stock was sold at an average price of $22.89, for a total value of $272,391,000.00. Following the sale, the insider now directly owns 25,441,745 shares of the company's stock, valued at approximately $582,361,543.05. The trade was a 31.87% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Large shareholders that own at least 10% of a company's shares are required to disclose their sales and purchases with the SEC.

Remitly Global Stock Performance

- 3 Stocks Well Below 52-Week Highs With Strong Growth Projections

RELY opened at $22.81 on Friday. The business's 50-day simple moving average is $20.62 and its 200 day simple moving average is $21.67. Remitly Global, Inc. has a 52-week low of $11.60 and a 52-week high of $27.32. The firm has a market capitalization of $4.65 billion, a PE ratio of -120.05 and a beta of 0.16.

Remitly Global (NASDAQ:RELY - Get Free Report) last announced its quarterly earnings data on Wednesday, May 7th. The financial services provider reported $0.05 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.04) by $0.09. The company had revenue of $361.62 million for the quarter, compared to analysts' expectations of $347.81 million. Remitly Global had a negative return on equity of 6.10% and a negative net margin of 2.93%. The business's revenue was up 34.3% compared to the same quarter last year. During the same quarter in the prior year, the business posted ($0.11) EPS. On average, research analysts forecast that Remitly Global, Inc. will post -0.04 earnings per share for the current year.

Institutional Trading of Remitly Global

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Stifel Financial Corp grew its position in shares of Remitly Global by 10.4% in the 4th quarter. Stifel Financial Corp now owns 57,146 shares of the financial services provider's stock valued at $1,290,000 after acquiring an additional 5,390 shares during the period. Allspring Global Investments Holdings LLC acquired a new stake in Remitly Global in the 4th quarter valued at about $1,228,000. DHK Financial Advisors Inc. bought a new position in Remitly Global during the fourth quarter worth about $273,000. Robeco Institutional Asset Management B.V. increased its position in Remitly Global by 8.8% during the fourth quarter. Robeco Institutional Asset Management B.V. now owns 606,500 shares of the financial services provider's stock worth $13,689,000 after buying an additional 49,200 shares during the last quarter. Finally, Bank of Montreal Can raised its stake in Remitly Global by 3.6% in the fourth quarter. Bank of Montreal Can now owns 41,271 shares of the financial services provider's stock valued at $931,000 after buying an additional 1,435 shares during the period. 74.25% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on RELY shares. Wells Fargo & Company raised their price objective on shares of Remitly Global from $21.00 to $25.00 and gave the stock an "equal weight" rating in a report on Thursday, February 20th. JPMorgan Chase & Co. lifted their price target on Remitly Global from $21.00 to $30.00 and gave the company an "overweight" rating in a research note on Thursday, February 20th. KeyCorp upped their price objective on Remitly Global from $24.00 to $27.00 and gave the stock an "overweight" rating in a research report on Thursday, May 8th. Barclays lifted their target price on Remitly Global from $24.00 to $27.00 and gave the company an "overweight" rating in a research report on Monday. Finally, William Blair reaffirmed an "outperform" rating on shares of Remitly Global in a research report on Thursday, February 20th. One research analyst has rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $28.88.

Read Our Latest Report on Remitly Global

Remitly Global Company Profile

(Get Free Report)

Remitly Global, Inc provides digital financial services for immigrants and their families. It primarily offers cross-border remittance services in approximately 170 countries. The company was incorporated in 2011 and is headquartered in Seattle, Washington.

Featured Stories

- Five stocks we like better than Remitly Global

- How to Use Stock Screeners to Find Stocks

- CRSPR Stock Could Be Ready to Deliver on Its Massive Promise

- Retail Stocks Investing, Explained

- Analysts and Institutions Continue to Bet Big on Alphabet

- What is an Earnings Surprise?

- Walmart Stock Alert: Big Price Move Expected Soon

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Insider Buying or Selling at Remitly Global?

Sign-up to receive InsiderTrades.com's daily insider buying and selling report for Remitly Global and related companies.

More From MarketBeat

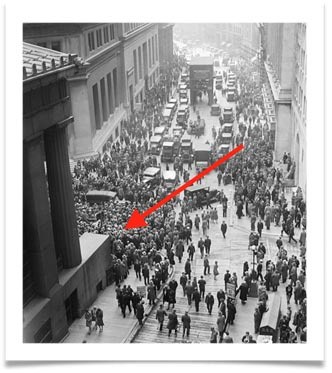

Take a look at this picture ...

A strange investment secret — discovered just a few short weeks before this image was taken — correctly predic...

Weiss Ratings

7 Stocks Under $20 That Could Double Your Money

Buying low and selling high is sound advice whether you're an active trader or a buy-and-hold investor. ...

MarketBeat

This Signal Only Flashes Once Every 4 Years – And It Just Triggered

This same signal has appeared twice before in the past 8 years — both times, it kicked off major moves in cryp...

Crypto Swap Profits

7 Large-Cap Stocks Poised for Strong, Steady Gains in 2025

Growth stocks have outperformed value stocks in 2024 and are likely to continue to do so in 2025. Two reason...

MarketBeat

Gold Hits New Highs as Global Markets Spiral

When Trump took office in 2017, gold was just $1,100 an ounce. By the time he left, it had soared to $1,839. ...

Premier Gold Co

7 Beaten-Down Stocks Ready to Mount a Comeback in 2025

It's a story that investors have seen play out many times. A stock that underperforms the market in one year...

MarketBeat

This Is The Moment You Betray Trump (Or Prove Them Wrong)

They said you wouldn’t last—that Bidenflation, Wall Street selloffs, and DEI funds would break your loyalty to...

Colonial Metals

20 Stocks Analysts Won't Stop Upgrading

As you know, a single upgrade from a Wall Street analyst probably won't be a major game-changer for any single...

MarketBeat