Gold prices decline, Trump delays tariffs on the EU, and holiday trading keeps market activity subdued

Gold prices fell by more than 0.50% as improved market sentiment weakened the inflow of safe-haven funds. Trump postponed tariffs on the European Union until July 9, easing concerns over the trade war. Nevertheless, strong gold imports from China and geopolitical risks still support a bullish outlook for gold. Holiday trading is light, and market activity is sluggish. U.S. economic data will include durable goods orders and the core personal consumption expenditures price index

Gold prices fell more than 0.50% as improved market sentiment weakened safe-haven inflows, following a 4.86% surge last week.

Trump postponed 50% tariffs on the EU until July 9, easing short-term trade war concerns.

Strong Chinese gold imports and the ongoing Russia-Ukraine tensions maintained a bullish outlook.

Gold prices dropped more than 0.50% on Monday due to U.S. President Donald Trump's postponement of tariffs on the EU. Meanwhile, trading remained thin as financial markets in the UK and the U.S. were closed for holidays. As of the time of writing, gold was trading at $3,336 per ounce.

Trump's statement on Sunday improved market sentiment by delaying tariffs on EU products until July 9. Consequently, gold faced pressure after last week's increase of over 4.86%, the largest gain since the week of April 7.

On Friday, gold continued its bullish trend as Trump pressured Apple Inc. (AAPL) to produce iPhones in the U.S. Otherwise, a 25% tariff would be imposed. At the same time, he intensified his verbal threats against the EU, threatening to impose 50% tariffs on its goods. This caused gold prices to rise from $3,287 to a peak of $3,365 last week.

Despite the pullback, gold prices are still expected to continue rising, with Reuters revealing that "China's net gold imports through Hong Kong in April doubled compared to March, reaching the highest level since March 2024."

Additionally, geopolitical risks remain high, with Russia attacking Ukraine for the third consecutive night, provoking an angry response from Trump.

This week, the U.S. economic calendar will include April durable goods orders, the Federal Open Market Committee (FOMC) meeting minutes, the second estimate of GDP for the first quarter of 2025, and the release of the core Personal Consumption Expenditures (PCE) price index, which is the Fed's preferred inflation gauge.

Daily Gold Market Dynamics: Improved Risk Appetite Pressures Gold Prices

U.S. Treasury yields remained stable. The 10-year Treasury yield fell two basis points (bps) to 4.509% on Friday. Meanwhile, U.S. real yields also declined, dropping four basis points to 2.179%.

Considering the fragile market sentiment towards U.S. assets triggered by the growing fiscal deficit, the outlook for gold prices remains optimistic, prompting Moody's to downgrade the U.S. government's debt rating from AAA to AA1.

The fiscal plan approved by the U.S. House of Representatives is expected to raise the debt ceiling by $400 billion.

The U.S. dollar index (DXY), which tracks the dollar's value against six currencies, dipped 0.10% to 99.00, providing a tailwind for dollar-denominated precious metals.

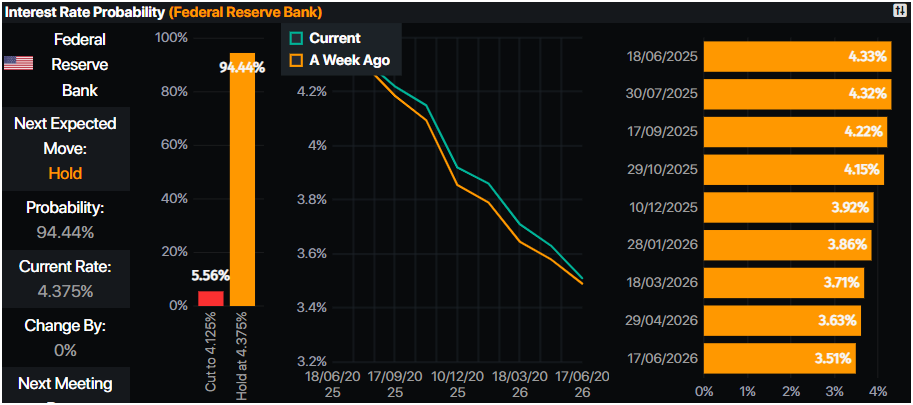

The money market indicates that traders expect a 47.5 basis point easing by the end of the year, according to data from Prime Market Terminal.

Source: Prime Market Terminal

XAU/USD Technical Outlook: The Uptrend in Gold Will Continue to $3,400

Gold prices have slightly retreated, as traders seem to be locking in profits due to thin liquidity and low volatility during the holiday period. Inconsistencies in Trump's trade policies may lead to significant price fluctuations when trading resumes on Tuesday.

From a technical perspective, the bullish trend in gold remains intact. If buyers can achieve a daily close above $3,300, they may test last week's high of $3,365. If a breakout occurs, the next target will be $3,400, followed by the high of $3,438 on May 7 and the all-time high (ATH) of $3,500.

On the bearish side, if gold falls below $3,300, it is expected to move towards the daily low of $3,204 on May 20, followed by the 50-day simple moving average (SMA) of $3,199.