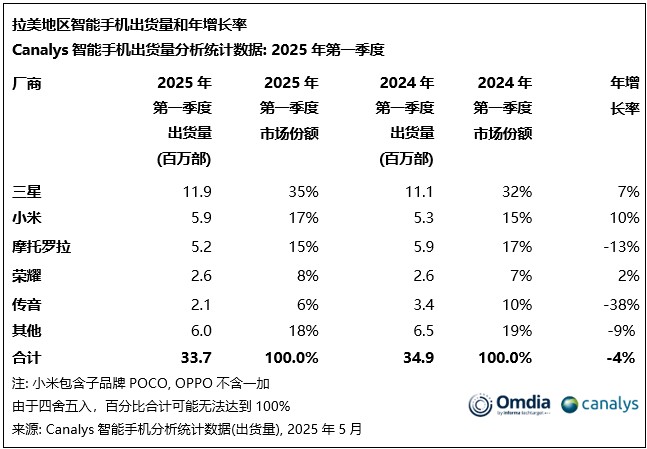

Canalys: In the first quarter, the total shipment volume of smartphones in the Latin American region was 33.7 million units, a year-on-year decrease of 4%

In the first quarter of 2025, the smartphone market shipment in the Latin America region was 33.7 million units, a year-on-year decrease of 4%, ending six consecutive quarters of growth. Samsung ranked first with 11.9 million units, while Xiaomi ranked second with 5.9 million units. Motorola's shipments were 5.2 million units, dropping to third place. Honor rose to fourth place with 2.6 million units, while Transsion saw a significant decline of 38% in shipments due to intensified competition, ranking fifth. Economic uncertainty and inventory adjustments affected market performance

According to the latest data from Canalys, the smartphone market in Latin America experienced a year-on-year decline of 4% in the first quarter of 2025, ending six consecutive quarters of growth, with total shipments reaching 33.7 million units. Samsung maintained its leading position with a shipment of 11.9 million units, a year-on-year increase of 7%. This was driven by strong demand for entry-level models A06 and A16, which accounted for nearly half of its total shipments, indicating its strategic focus on actively defending the low-end market and responding to emerging price-oriented competitors. Xiaomi ranked second for the second consecutive quarter with 5.9 million units shipped, a year-on-year increase of 10%, bolstered by the continued strong sales of the Redmi 14C 4G and Note 14 series, solidifying its market strategy in the $100 to $299 price range.

Motorola dropped to third place with shipments of 5.2 million units, a year-on-year decline of 13%. Its reliance on low-end products like G15 and G05 limited its competitiveness. Honor rose to fourth place with strong performance from the X series, achieving a year-on-year growth of 2% and shipments of 2.6 million units, maintaining its growth momentum. Affected by intense competition and channel inventory adjustments, Transsion ranked fifth with shipments of 2.1 million units, experiencing a significant year-on-year decline of 38%, marking its first drop in the region.

Canalys (Senior Analyst Miguel Pérez stated: "Economic uncertainty, particularly concerns over tariff increases, severely impacted the smartphone market in Latin America in the first quarter of 2025. Manufacturers tightened aggressive sales strategies, retailers reduced inventory, and consumers postponed non-essential device upgrades, extending replacement cycles. This adjustment was expected after manufacturers rapidly expanded into underdeveloped markets such as Central America and Ecuador. Manufacturers are facing a more challenging market environment characterized by weak demand, intensified competition, and rising inventory risks."

In the first quarter of 2025, the smartphone market in Latin America showed a clear polarization trend, with growth primarily concentrated in the entry-level and high-end segments. Despite rising costs, major brands continued to invest in the ultra-low price segment below $100 to attract price-sensitive users. Samsung and Apple continued to dominate the high-end market, benefiting from strong demand for the S25 and iPhone 16 series. However, the mid-range market, which accounted for 78% of total shipments, remains the main battleground, balancing cost-effectiveness and performance, attracting replacement users and mainstream consumers. As growth in the fringe market struggles to support the overall market, manufacturers will continue to intensify competition in the mid-range market in 2025, focusing on profits and long-term market positioning to cope with the increasingly tense market environment.

Brazil accounted for 28% of the total shipments in the region and was the only market among the top five in Latin America to achieve year-on-year growth in the first quarter of 2025, with shipments increasing by 3% to reach 9.5 million units. This growth was mainly attributed to increased investments by Chinese brands such as Honor, Xiaomi, and realme in the local market.

Brazil accounted for 28% of the total shipments in the region and was the only market among the top five in Latin America to achieve year-on-year growth in the first quarter of 2025, with shipments increasing by 3% to reach 9.5 million units. This growth was mainly attributed to increased investments by Chinese brands such as Honor, Xiaomi, and realme in the local market.

Mexico is the second-largest market in the region, accounting for 22% of total shipments. However, its shipments declined by 18%, marking a second consecutive quarter of decline. This drop was primarily due to intense competition in the local market, where domestic manufacturers drove a wave of upgrades in entry-level to mid-range models in 2024, leading to increased inventory and difficulties in quickly replenishing new devices in sales channels.

Central America consolidated its position as the third-largest market in the region in 2024, but shipments in the first quarter of 2025 experienced a decline for the first time in seven quarters, dropping by 7% year-on-year. This was mainly due to inventory buildup led by emerging brands such as Transsion, ZTE, and OPPO, as well as a slowdown in market demand.

Colombia and Peru ranked fourth and fifth, respectively. Despite some economic growth at the beginning of the year, these two markets continued the volatility trend seen since last year, experiencing a slight decline in the first quarter of 2025. However, as consumption gradually recovers, performance is expected to improve in the coming quarters.

Canalys predicts a slight decline of 1% in the Latin American smartphone market in 2025. Pérez added, "As an emerging market, Latin America is susceptible to global economic uncertainties, particularly the tensions between China and the United States, which could trigger inflation and currency fluctuations. Additionally, socio-economic uncertainties within the region and the potential impact of new tariffs from the U.S. will suppress consumer spending, especially in the entry-level market that constitutes the backbone of the Latin American smartphone market. This could lead to further inventory buildup, increasing pressure on manufacturers."

Pérez noted, "In the first quarter of 2025, observed behavioral changes have indicated a deep structural shift that manufacturers cannot ignore. The key to success this year lies in maintaining lean and flexible inventory management, particularly in the fast-moving consumer goods segment, while strengthening the value proposition of each product line. Manufacturers that can balance operational discipline with precise innovation will have a competitive edge in navigating market fluctuations. In an environment where traditional growth models are being redefined, optimizing product portfolios, precise marketing, and enhancing consumer experience will become core elements of maintaining competitiveness."