U.S. May Non-Farm Payroll Preview: Significant Risk of Employment Surprise, Unemployment Rate of 4.2% Hard to Maintain, Major Shock in U.S. Stocks?

The U.S. Bureau of Labor Statistics will release the May non-farm payroll report on June 6. Economists expect an increase of 125,000 non-farm jobs, with the unemployment rate holding steady at 4.2%, but there are upside risks. Recent data indicate that JOLTS job openings have grown more than expected, while ADP employment numbers unexpectedly declined, showing a cooling in economic activity. Analysts predict that non-farm employment may be only 90,000, below expectations. The market's volatility expectation for non-farm data is 0.9%, the lowest since February

TradingKey - On June 6th, Friday, the U.S. Bureau of Labor Statistics (BLS) will release the non-farm payroll report for May 2025. After the JOLTS job openings data released this week showed an unexpected increase and the small non-farm ADP employment numbers were unexpectedly halved, investors are closely watching for any signs of job growth or slowdown in this non-farm report.

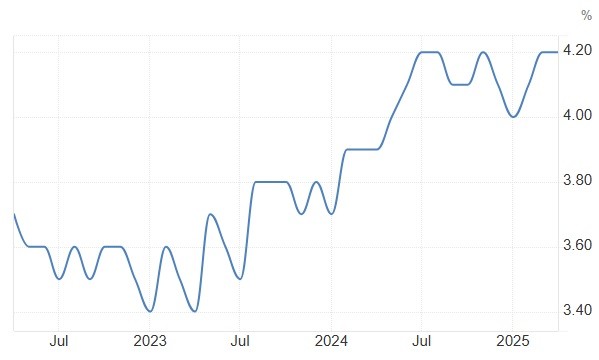

Economists expect an increase of 125,000 non-farm jobs in May, down from 177,000 in April; the unemployment rate is expected to remain steady at 4.2%, but there is an upward risk of reaching 4.3%.

【U.S. Non-Farm Employment, Source: Trading Economics】

【U.S. Unemployment Rate, Source: Trading Economics】

This year, how Trump's tariffs affect U.S. inflation, employment, and economic growth has been the most discussed topic in the market. Most economists point out that tariff policies not only struggle to bring manufacturing back but also raise price levels and increase unemployment rates—despite Trump stating that this is an economic "transition period."

The results of soft data provide ambiguous information. Data released on Tuesday (2nd) showed that U.S. April JOLTS job openings were 7.391 million, higher than the expected 7.1 million and the previous value of 7.2 million. However, the ADP employment numbers for May released on Wednesday only increased by 37,000, the lowest in two years, far below the expected 114,000 and the previous value of 62,000.

The Federal Reserve's Beige Book released on Wednesday indicated that U.S. economic activity has cooled in recent weeks, reflecting the negative impact of Trump's tariffs and policy uncertainty on the economy. Although the job market is stable, most Federal Reserve districts report that businesses are generally delaying hiring plans. Bloomberg analysts predict that non-farm employment in May is likely to be only around 90,000, not as optimistic as the widely expected 130,000. The soft international travel and reduced government travel may be key factors in the employment weakness in the leisure and hospitality sectors.

According to options data for the S&P 500 index compiled by Piper Sandler as of Tuesday's close, traders are betting that the index will fluctuate by 0.9% after the non-farm employment data is released, which would be the smallest implied volatility since February.

Against the backdrop of easing trade tensions, the S&P 500 index has rebounded over 7% since May, despite some ongoing noise.

However, the reference significance of the S&P volatility forecast may be limited following the weak ADP employment report.

Citi points out that the market's risk lies in whether the unemployment rate unexpectedly rises; if so, the stock market will reprice based on the outlook for slowing growth.

If the unemployment rate rises from 4.2% to 4.3%, it will be the highest unemployment rate since November 2021