Trump "softens" on tariffs, Asian stock markets rebound collectively, yen falls below 146

Trump extends the deadline for "reciprocal tariffs" to August 1, easing market tensions temporarily. Asian stock markets rebounded on Tuesday, with the South Korean index rising more than 1.5% at one point, while European and American stock index futures fluctuated narrowly. The yen fell to a two-week low against the dollar, as the Japanese Prime Minister stated that there are still differences with the U.S. regarding tariff issues, and no agreement has been reached

Trump signed an executive order to extend the tariff suspension period to August 1, easing tensions in the global financial markets. On Tuesday, Asian stock markets rebounded significantly, with the stock markets in Japan and South Korea rising collectively. In the foreign exchange market, the euro and pound strengthened, leading to a weakening of the dollar, but the yen fell to a two-week low against the dollar.

According to CCTV News, on July 7 local time, U.S. President Trump signed an executive order to extend the so-called "reciprocal tariffs" suspension period, postponing the implementation date from July 9 to August 1. However, this is not 100% certain; reports indicate that when discussing the August 1 tariff negotiation deadline, Trump stated, the August 1 deadline is set, but not 100% certain. If any country proposes a different plan, he will be open to other ideas.

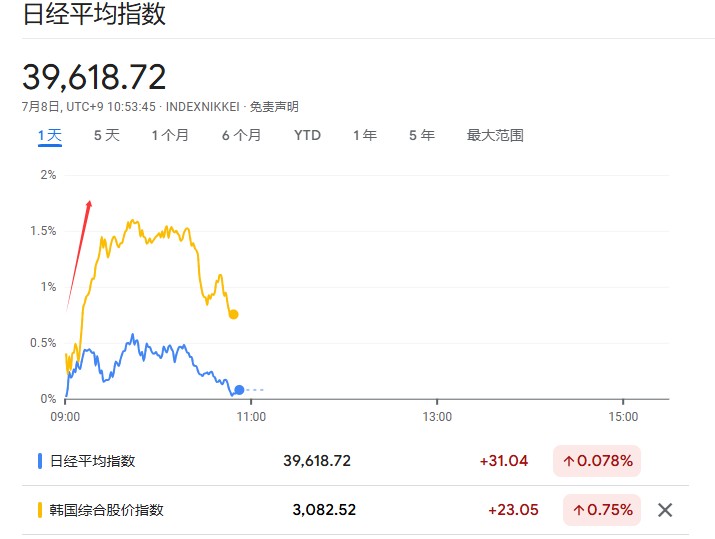

Overall, the suspension of tariff threats has relieved some pressure on the financial markets. On July 8 (Tuesday), most Asian stock markets rose, with the Hang Seng Tech Index increasing by 1%, and the South Korean Composite Index briefly rising over 1.5%, currently retreating to around 0.8%; the Nikkei 225 Index rose by 0.5% at one point but has since seen a slight decline. Major stock indices in Thailand and Vietnam also rose in tandem, while the MSCI Asia Index traded within a narrow range.

U.S. and European stock index futures fluctuated within a narrow range, with mixed results. The S&P 500 index futures fell slightly by 0.05%, while the FTSE 100 index futures rose by 0.12%.

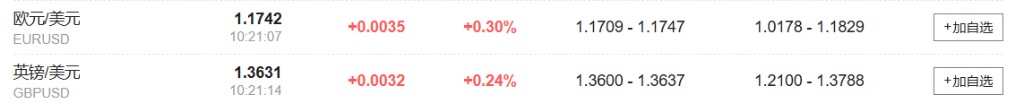

In the foreign exchange market, other currencies rebounded on Tuesday after falling on Monday. The euro rose 0.3% against the dollar to 1.1742, and the pound rose 0.24% to 1.3631. The dollar index fell by about 0.2%.

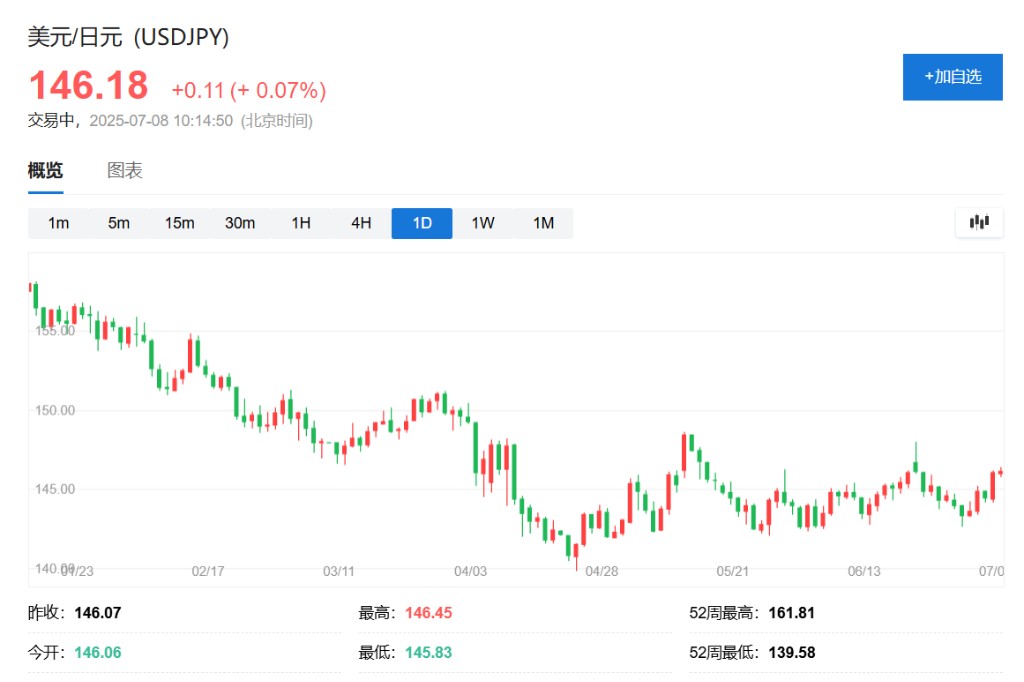

The yen and won fell about 1% overnight, and on Tuesday morning, the yen continued to be under pressure, dropping to a two-week low of 146.44 against the dollar, while the won rebounded 0.4% to 1370.20 against the dollar. According to CCTV News, Japanese Prime Minister Shigeru Ishiba held a meeting of the government’s comprehensive response headquarters to U.S. tariff measures at the Prime Minister's residence on the morning of the 8th. When discussing tariff negotiations, Ishiba stated that there are still differences between Japan and the U.S., and no agreement has been reached

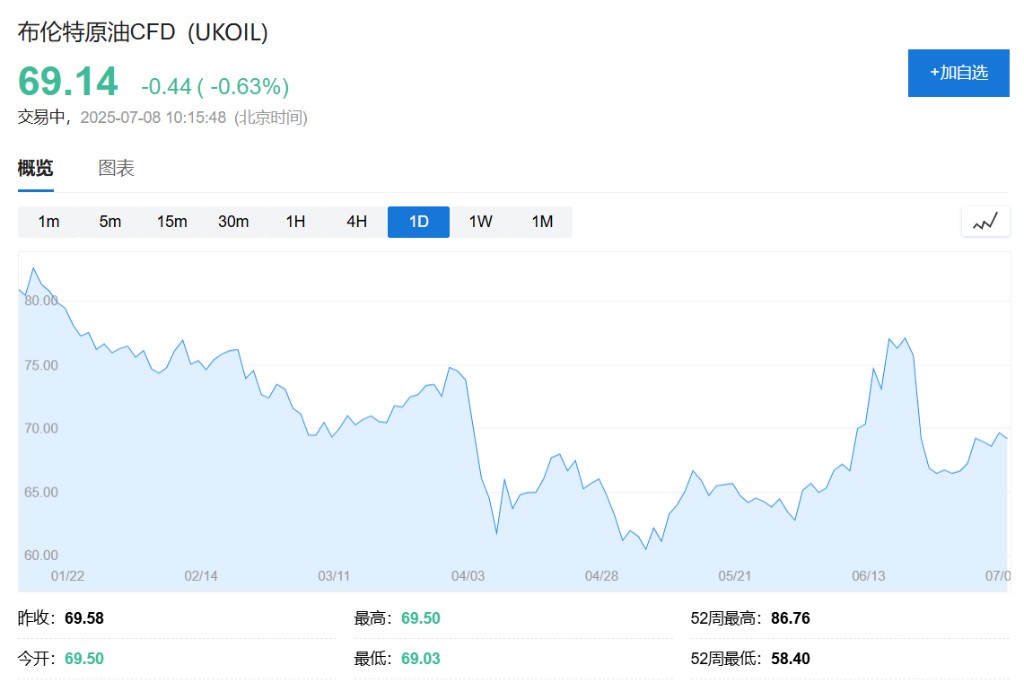

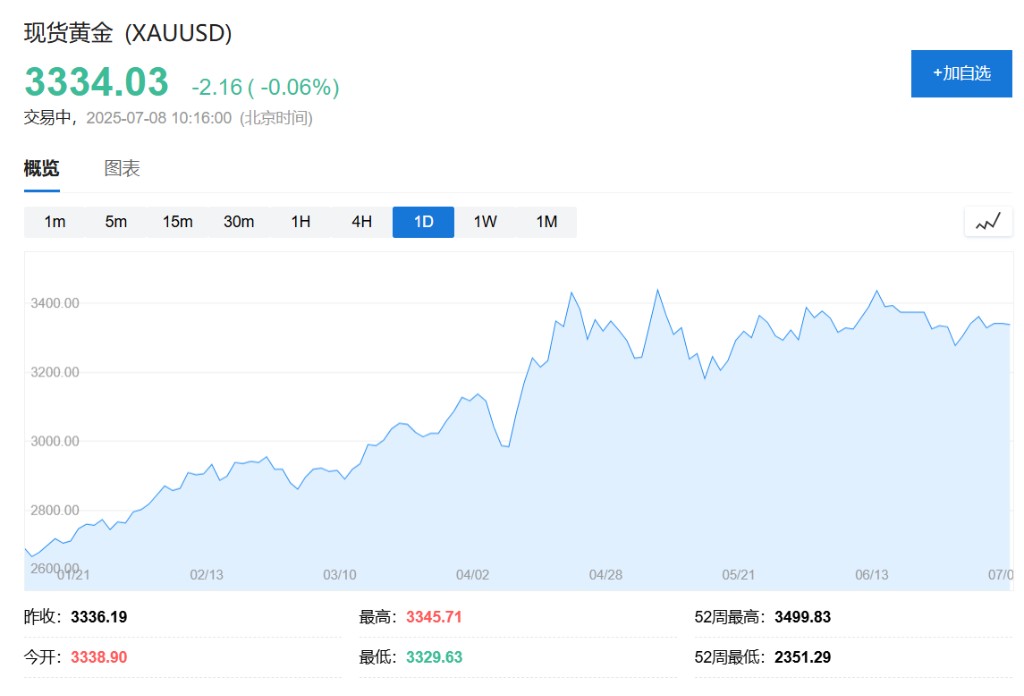

In terms of major commodities, gold remained basically stable, while oil prices fell, with Brent crude oil down 0.6%.

Trump Signals More Tariffs, Market Interprets as Negotiation Strategy

As the July 9 tariff deadline approaches, Trump issued the first batch of tariff warning letters on Monday. According to CCTV, on July 7 local time, U.S. President Trump stated that starting August 1, 2025, the U.S. will impose a 25% tariff on all products imported from Kazakhstan and Malaysia, a 30% tariff on all products imported from South Africa, and a 40% tariff on all products imported from Laos and Myanmar.

This may be another instance of "TACO," said Nick Twidale, chief market analyst at AT Global Markets, "Trump is showing inconsistency again. We will see more of this in the coming days, as the U.S. wavers in its negotiation strategy." Frederic Neumann, chief Asian economist at HSBC, also interpreted it as: "Investors are ignoring the latest tariff announcements, viewing them as a strategy to accelerate negotiations rather than a definitive conclusion on the final tariff levels."

Subsequently, Trump signed an executive order extending the tariff deferral period to August 1. However, this is not 100% certain; CCTV reported that when Trump discussed the August 1 tariff negotiation deadline, he stated that the August 1 deadline is confirmed but not 100% certain, and if any country proposes a different plan, he would be open to other ideas