Performance Highlights of SGX's Two STI ETFs

SGX lists two ETFs that invest in the 30 constituents of the STI – the most globally recognised benchmark index and market barometer for Singapore. The SPDR® STI ETF and Nikko AM STI ETF were launched in 2002 and 2009 respectively. In the March MTD, the turnover of both STI ETFs have surged to a total of S$237.9 million, up more than 8x YoY and nearly tripling MoM. The two ETFs, which offer a 12M dividend yield of more than 5%, have garnered YTD net inflows of S$172 million. As the STI

- SGX lists two ETFs that invest in the 30 constituents of the STI – the most globally recognised benchmark index and market barometer for Singapore. The SPDR® STI ETF and Nikko AM STI ETF were launched in 2002 and 2009 respectively.

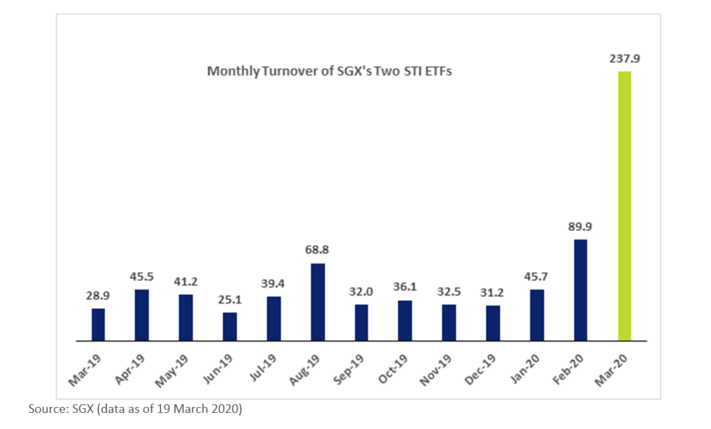

- In the March MTD, the turnover of both STI ETFs have surged to a total of S$237.9 million, up more than 8x YoY and nearly tripling MoM. The two ETFs, which offer a 12M dividend yield of more than 5%, have garnered YTD net inflows of S$172 million.

- As the STI hits multi-year lows with a YTD decline of 25%, more investors are turning to STI-tracking ETFs as a vehicle to gain instant exposure to Singapore’s top 30 blue chips. After its economy grew at a decade-low of 0.7% last year, the city-state is expected to post even slower growth in 2020 on the back of the fallout from the COVID-19 pandemic

The Straits Times Index (STI) is the most globally recognised benchmark index and market barometer for Singapore. With a history dating back to 1966, the diversified index tracks the performance of the 30 largest and most liquid companies listed on Singapore Exchange. These 30 constituents have foundations spanning three centuries and multiple sectors, while maintaining a balance between local and regional economic exposures. Currently, these 30 stocks have a combined market capitalisation of more than S$500 billion.

SGX lists two ETFs that invest in the 30 STI constituents – SPDR® STI ETF and Nikko AM STI ETF. The SPDR® STI ETF, unveiled in 2002, is managed by State Street Global Advisors, while the Nikko AM STI ETF, launched in 2009, is managed by DBS subsidiary Nikko Asset Management. Benefits of investing in the STI ETF include gaining exposure to the 30 constituents of the benchmark index through a single purchase and at a very low cost. Over the longer term, the returns can be sizeable.

The performance of an ETF is usually based on how closely it is able to track the index it is trying to replicate, and the difference – due to factors that include management fees and transaction costs – is referred to as tracking error. The SPDR STI ETF has a rolling one-year tracking error of 0.2315%, while the Nikko AM Singapore STI ETF has a three-year annualised tracking error of 0.14%, as published on their websites. Both ETFs have a policy of paying out dividends semi-annually, and the funds will deduct their fees from the dividends before distributing to investors.

As the STI hits multi-year lows with a YTD decline of 25%, an increasing number of investors are using STI-tracking ETFs as a vehicle to gain instant exposure to Singapore’s top 30 blue chips. Over the past 20 years, there have been six such occasions of large swings by the STI, driven by global market volatility, with one such occasion being the 2008 Global Financial Crisis. These swings encompassed a 37% decline from the preceding STI high, followed by a 55% rebound from that low to the recovery peak.

In the March month-to-date, the turnover of both STI ETFs have surged to a total of S$237.9 million, up more than eight-fold YoY and nearly tripling MoM. The two ETFs, which offer a 12-month dividend yield of more than 5%, have garnered YTD net inflows of S$172 million.

The tables below detail the two STI ETFs listed on SGX.

|

ETF Name |

Underlying Index |

Stock Code |

YTD Total Return (%) |

1Y Total Return (%) |

3Y Total Return (%) |

5Y Total Return (%) |

|

SPDR STI ETF |

Straits Times Index |

ES3 |

-27.7 |

-25.1 |

-6.9 |

-4.1 |

|

NIKKO AM SINGAPORE STI ETF |

Straits Times Index |

G3B |

-27.9 |

-25.3 |

-6.9 |

-4.2 |

|

ETF Name |

Underlying Index |

Stock Code |

12M Div Yld (%) |

Expense Ratio (%) |

Fund Size (S$M) |

YTD Net Inflow |

|

SPDR STI ETF |

Straits Times Index |

ES3 |

5.2 |

0.3 |

763 |

146 |

|

NIKKO AM SINGAPORE STI ETF |

Straits Times Index |

G3B |

5.1 |

0.3 |

324 |

26 |

Source: Bloomberg & SGX (data as of 19 March 2020)

2020 Growth Seen Shrinking

After its economy grew at a decade-low of 0.7% last year, Singapore is expected to post even slower growth in 2020 on the back of the fallout from the COVID-19 pandemic. Last month, the Ministry of Trade and Industry (MTI) forecast 2020 gross domestic product (GDP) growth of around 0.5%, the mid-point of a new estimated range of -0.5% to 1.5%. This was reduced from a previous projection of between 0.5% and 2.5% last November.

According to economists and analysts polled in a survey by the Monetary Authority of Singapore (MAS) released earlier this month, the Singapore economy is expected to grow 0.6% this year.

However, last week, private-sector economists from DBS Bank and Maybank Kim Eng Securities projected that domestic growth could shrink 0.5% and 0.3% respectively for the full year. They noted that the trade-reliant economy was likely to slip into a recession, given the chaos unfolding globally from the pandemic, as well as economic costs arising out of restrictions on trade, investment, consumption and travel.

The last time Singapore registered a full-year contraction of its economy was in 2001 after the dot-com bust, when GDP growth contracted by 1%.

Investing in ETFs

ETFs are investment funds listed and traded intraday on a stock exchange. The majority aim to track the performance of an index and provide access to a wide variety of markets and asset classes, including local stocks, international securities, bonds, commodities or money markets.

Each ETF gives investors access to the performance of the asset that comprises the underlying index. Investing in the ETF is also less costly if one was to build a similar portfolio by buying the individual stocks. It also provides exposure to international markets and asset classes that may be inaccessible to individual investors.

Investors can also invest in the STI ETFs using a Regular Shares Saving Plan (RSS). Click here to find out more.

To find out more about ETFs, visit www.sgx.com/etf.