NVIDIA's Q2 earnings report falsification and inflated stock price? Wall Street analysts refute: Don't blindly believe everything you see online, guys.

社交媒体上的阴谋论者质疑,英伟达参投的 AI 初创企业 Coreweave 协助做局增厚二季度收入,更多大厂可能也合谋以抬升股价,财报多个方面看似 “疑点重重”。这背后证明多空博弈非常胶着,底层逻辑是担心 AI 泡沫一旦破裂将拉垮整个大盘。

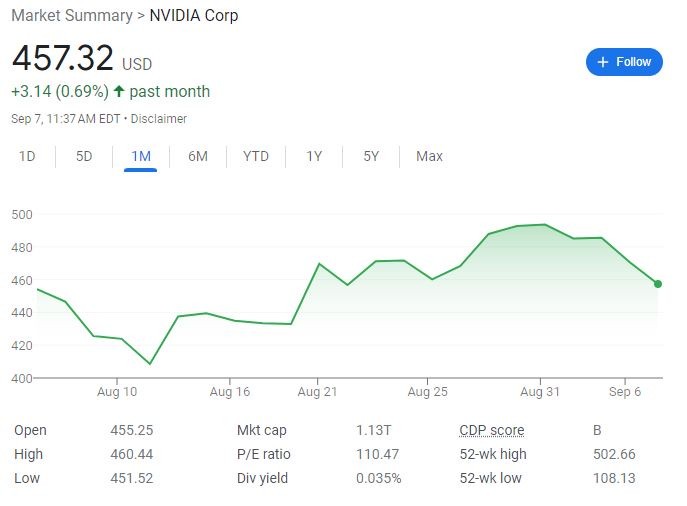

近日,有关英伟达二季度 “破纪录” 财报涉嫌造假的阴谋论正在社交媒体和投资者论坛中甚嚣尘上,令 9 月 6 日和 7 日的股价均跌约 3%,抹去 8 月 23 日盘后公布二季报以来的全部涨幅。

英伟达的不佳表现,拖累芯片行业基准——费城半导体指数周四盘初跌超 3%,其在 GPU 领域的竞争对手 AMD 一度跌近 4%,苹果、微软、谷歌等受益于 AI 热潮的大型科技股也持续低迷。

英伟达跌价的原因,除了与 “油价涨至近十个月最高,以及美国经济数据保持韧性,令市场对 11 月美联储再度加息的预期升温,进而推动美债收益率连续上涨,令股市等风险资产承压” 这一逻辑有关,针对其财报后股价创历史新高、且年内大涨逾 200% 的华尔街多空交战也尤为激烈。

英伟达成本没增加但收入同比翻倍?渠道调查显示企业并未大幅增加 AI资本支出?

据研投机构 Macrotips Trading 总结,尽管英伟达二季报远超预期并对未来收入的指引更为强劲,但人们有理由对 “可疑的披露和管理行为感到担忧”,特别是该公司直接投资支持的一家 AI 初创公司参与推动了收入增长,毛利率扩张、股票回购时机古怪和内部人士抛售也发出了危险信号。

该机构撰文称,在刚刚过去的第二季度,英伟达总收入同比翻倍增长 102% 至 135 亿美元,比分析师的预期高出 24 亿美元。其中,鉴于对支持大语言模型和生成式人工智能的 GPU 需求强劲,其数据中心收入同比增长 171%、环比增 141% 至 103 亿美元,较市场预期高出 23 亿美元:

“更令人难以置信的是,英伟达是在几乎没有增加成本的情况下实现了惊人增长,其收入成本同比仅增长了 6.8%,毛利率却达到闻所未闻的 70.1%。

英伟达还为第三季度收入制定了 160 亿美元的宏伟目标,远高于分析师预期的 125 亿美元。英伟达市值 1.2 万亿美元,以前如此巨量规模的公司季报从未以如此大的幅度超出过市场预期。

这不禁令人惊讶为何华尔街的预期完全没有押中其快速增长。按理说,超过 40 名覆盖该公司的分析师在财报前至少都用 10 种方式开展和分析过每一种可以想到的渠道检查了。

例如,在财报发布前,丹麦盛宝银行分析了主要人工智能参与者的第二季度资本支出,却没有发现有资本支出高企的迹象能表明对英伟达 GPU 需求如此强劲。”

这便令人质疑 “在生成式 AI 需求激增基础之上的英伟达数据中心收入大涨” 究竟是如何做到的。一些市场参与者马上将目光投到了英伟达支持的 AI 初创公司 Coreweave 身上。

阴谋论者质疑英伟达投资的 Coreweave协助做局增厚二季度收入,更多大厂可能也合谋!

上述文章称,有理由怀疑,英伟达直接资助的 Coreweave 公司是英伟达收入激增的背后主因。

首先,Coreweave 向英伟达等多家投资者出售了 4.21 亿美元股权,可能令英伟达对前者的购买决策产生控制权。同时,Coreweave 在 8 月初通过抵押英伟达 GPU 完成了债务融资 23 亿美元,这一数额恰恰等于包含 AI 芯片业务的英伟达数据中心二季度收入超过市场预期之规模:

“虽然这可能是完全合法的,但英伟达资助了这家初创公司,后者又通过由抵押英伟达 GPU 得到的贷款来购买了上述这批 GPU,这种做法要求英伟达理由更好地披露与其客户的关系。”

还有怀疑论者认为,向英伟达下了数十亿美元订单的 AI 科技公司 Coreweave 甚至可能都不是一家真正的公司,而是由英伟达最大股东、资管巨头贝莱德与英伟达合作创建并支持的空壳机构。

有人说,英伟达还与微软、亚马逊 AWS 和全球排名第三的大模型初创公司 Inflection 等 “大厂” 合谋做局,主要业内玩家给英伟达下了较多订单,这些订单都有问题,是为了配合英伟达做收入:

“有一个让人难以置信的理论在 X/Twitter 上越来越受到关注,认为英伟达今年的惊人财报表现是通过向虚假且不存在的客户出售假 GPU 来推动的。

一些人已经开始将这个事件与 FTX 金字塔骗局惨败进行类比,并担心这样的骗局可能会拖垮整个 AI/芯片市场。”

分析:阴谋论证明对英伟达多空博弈非常胶着,底层是担心 AI泡沫破裂拉垮整个大盘

但券商伯恩斯坦的分析师拉斯贡(Stacy Rasgon)对这种阴谋论表达了强烈的不满,本周其最新研报直言:“客户老铁们,拜托不要相信从社交媒体上随便看来的幼稚投资论点。”

对于英伟达收入同比翻倍、销售成本仅增长 7% 的怀疑观点,拉斯贡称,这是因为英伟达二季度录入的费用中包括了约 12.2 亿美元的库存准备金,这在去年二季度被算进了销售成本,“当排除这些费用时,与一年前相比,第二季度的销售成本实际上增加了约 70%,属于完全正常的范畴。”

第二个主流质疑涉及从北美最大以太坊矿工转型为 GPU 云供应商的 Coreweave,拉斯贡提醒称,该公司抵押英伟达 H100 芯片换取的是黑石集团(Blackstone)主导债务融资,不是英伟达大股东贝莱德集团(Blackrock),阴谋论的这个解读错误本身就够滑稽了,而且:

“英伟达也不需要来自 Coreweave(或其他任何人)的帮助来刺激二季度销量,英伟达的产品早都已经分配出去了。

况且,这项债务协议是在 8 月 3 日二季度完结之后宣布的,债务发行方暗示资金部署可能尚未发生。(这又如何来虚假增厚二季度英伟达的财报呢?)”

还有分析指出,8 月融资以前 Coreweave 的自有资金仅为 3.71 亿美元,这种体量的公司怎么有能力与二季度数据中心收入突破 100 亿美元的英伟达联合操作收入呢:

目前根本没有直接证据指向两者做局,唯一被人诟病的就是英伟达在产能奇缺时特别支持了自己投资的公司而已。

支持英伟达的人们普遍认为,社交媒体上流行的阴谋论只能说明一点,即目前针对英伟达的多空博弈非常胶着。其底层逻辑可能是对 “AI助推下一个科技泡沫破裂” 观点的深深恐惧与担忧。

在定量投资界知名的罗布·阿诺特(Rob Arnott)本周便称,英伟达是即将破裂的 AI 股票泡沫领头羊,被刺破后可能拖垮整个市场,英伟达今年大涨正是 “重大市场错觉” 的教科书案例:

“要记住一点,每当牛市出现在仅能推动一小部分受欢迎公司股价上涨的强大叙事中时,这些股票在未来几年可能会令人失望。2000 年科技泡沫和 2008 年金融危机后都上演了这种范式。

人工智能将改变我们的世界,这一点毋庸置疑。但英伟达的股价表明,市场认为其未来不会受到同行业新进入者,或者质疑其主导地位的监管机构的挑战,这种说法已超出了合理的现实。”

质疑英伟达二季度财报造假的人还有哪些疑虑?股票回购时机、高估值不可持续

再回到文初 Macrotips Trading 的质疑文章中,与社交媒体上刻意渲染焦虑情绪的怀疑论不同,这篇分析文深度剖析了英伟达二季度财报,并提出了几个值得人思考的观点。

首先,英伟达过去几个季度的毛利率 “扩张令人难以置信,从去年二季度的 43.5% 飞跃至今年一季度的 64.6%,并在今年二季度扩大至 70.1%,竞争对手 AMD 的毛利率却同比保持稳定:

“也许英伟达毛利率扩张,只是反映了其 GPU 在炙手可热的人工智能和生成式 AI 芯片市场中的需求量之大,客户愿意为英伟达芯片支付双倍价格,从而在不过多增加成本时将其收入翻倍。

但需要考虑英伟达针对许可和开发安排(License and Development Arrangement)的收入确认规则。与产品发货导致控制权转移便能确认收入的产品销售不同,数据中心收入的一部分可能来自软件许可,在软件可供客户使用时便能预先确认收入,即便客户实际付款是稍后才进行的。

这种即使尚未收到付款也能提前确认收入的政策,可以解释为什么英伟达二季度的应收账款环比跃升 30 亿美元至 71 亿美元。而且,今年二季度的应收账款还受益于客户在发票到期日之前付款的 12.5 亿美元。这些都推动英伟达的季度整体收入环比增长了 63 亿美元之多。”

第二,文章还质疑英伟达股票回购的时机。在二季度末剩余 40 亿美元此前批准回购计划有待执行的基础上,该公司董事会又批准了 250 亿美元的最新回购计划:

“英伟达管理层的选择令人费解。财报显示,一季度其没有回购任何股票,二季度以 32.8 亿美元回购了 750 万股,还于今年 7 月 31 日至 8 月 24 日期间以 9.98 亿美元回购了 200 万股。

计算可知,750 万股价值 32.8 亿美元,等于平均回购股价为 437 美元,200 万股价值 9.98 亿美元,等于平均股价 499 美元。

而在截至 7 月 30 日的英伟达财年二季度中,仅有几天交投高于 437 美元,为了令平均价格为 437 美元,这代表该公司必须在第二财季末回购股票,当时该股已经接近历史最高。同理,7 月 31 日至 8 月 24 日之间,仅 8 月 24 日当天股价超过 499 美元,代表大部分回购肯定在这一天发生。

(玄妙的是,英伟达几乎选择股价接近历史最高点时才出手回购),但大多数公司在回购股票时,都会通过较长时间内的成交量加权平均价格等计划来回购,以免过度影响股价。”

第三,该文章还质疑,在该公司不断以历史高点回购股票时,英伟达内部人士一直在加速抛售持股:

过去 6 个月中,内部人士出售了 2.34 亿美元的股票,其中 CFO 在 8 月 28 日出售 230 万美元、在 5 月 30 日出售 250 万美元,CEO 黄仁勋近期行使了股票期权将于 9 月 1 日出售 1.17 亿美元。

最后,文章称英伟达当前估值 “已高出天际”,交易价格是未来企业销售价值(Fwd EV/Sales)的高达 16.7 倍,以及滚动市盈率(trailing P/E)的 117 倍:

“即使分析师的预测正确,即英伟达可以在 2027 财年(2026 日历年)将收入增至 1110 亿美元,该公司当前 1.2 万亿美元的企业价值仍然超过 EV/销售额的 10 倍。

虽然人工智能和英伟达 GPU 很可能会改变我们所知的世界,但以未来三年预计销售额的至少 10 倍来估值英伟达,将令其泡沫甚至比 2000 年的互联网泡沫更令人震惊。

随着内部人士抛售加速,持有英伟达股票的风险似乎也在上升。我个人对持有一家估值建立在三年后预期收入 10 多倍的公司感到不舒服。我不会做空英伟达股票,但当前持有者应该卖出。”

英伟达高管和业内主流人士没有在怕:AI市场规模可达 6000亿美元,趋势毋庸置疑

但英伟达高管似乎无惧市场上的怀疑论声音。

在本周高盛举办的科技会议上,英伟达主管企业计算的副总裁达斯(Manuvir Das)预言,人工智能的长期潜在市场价值高达 6000 亿美元。

这将由 3000 亿美元的芯片和系统、1500 亿美元的生成式人工智能软件,以及 1500 亿美元的全宇宙(omniverse)企业软件构成,被英伟达提倡的 “加速计算”(accelerated computing)所助力。

达斯称,英伟达正在利用一个不可避免的行业趋势资本化,即最终企业运营将走向数字化,并以从前难以想象的方式提高效率:

“看待英伟达最简单的方式就是我们下了个大赌注(而且赌赢了),此前我们为此已经酝酿了几十年了。”

数字化基建解决方案供应商 EdgeCore 的数字基础设施战略高级副总裁 Tom Traugott 也称,人工智能热潮下,关键基础设施正在发生变化,可能会产生深远影响:

“企业们将不得不通过改进现有系统来满足对 AI 的需求,进而推动对支持数据中心向更高效 GPU 转型的英伟达芯片需求。

一家公司可能拥有 AI 芯片供分配,但下一个关键问题是他们是否拥有使这些芯片可以发挥用途的数据中心容量。人工智能正在推动数据中心建筑比以往更大、更密集。”

与网上阴谋论不同,据 FactSet 统计,在覆盖英伟达的 51 位华尔街专业分析师中,有 47 人给予 “买入” 评级,4 人评级 “持有”,无人评级卖出,平均目标价为 649.22 美元,还有 42% 的涨幅空间。