New Stock News | K Cash Fintech Files for Listing on HKEX, Continuous Decline in Revenue for the Past Two Years

According to the disclosure by the Hong Kong Stock Exchange on October 6th, K Cash Financial Technology Group Limited (K Cash FinTech) has submitted an application for listing on the main board of the Hong Kong Stock Exchange. DBS Bank and Ping An Capital (Hong Kong) are the joint sponsors.

According to the information obtained from the Zhitong Finance APP, K Cash Financial Technology Group Limited (K Cash Financial Technology) has submitted an application for listing on the main board of the Hong Kong Stock Exchange, as disclosed by the Hong Kong Stock Exchange on October 6. DBS Bank and Ping An Capital (Hong Kong) are the joint sponsors.

According to the prospectus, K Cash Financial Technology is a licensed lender in Hong Kong, focusing on providing unsecured loans through financial technology and creating a convenient customer experience. The company was founded in 2006 and has been promoting creativity and innovation in its business development. In 2015, the company launched remote video teller machines, which are digital teller machines that provide loan withdrawal and repayment services. In the following years, the company continuously upgraded the functions of remote video teller machines by adopting multiple technologies. The company also launched an online loan platform, committed to maintaining high ethical standards, using advanced technology credit assessment models and risk management systems through the application of financial technology.

K Cash Financial Technology's loan products are designed to meet the needs of borrowers who have not been served due to financial difficulties, emergencies, or unexpected expenses. The company provides unsecured credit through financial technology, including loan applications, credit assessments, loan withdrawals, and repayments. The company's loan products can be divided into three categories:

-

Unsecured homeowner loans: Unsecured loans provided to Hong Kong homeowners (including Home Ownership Scheme homeowners) without the need for any collateral.

-

Personal loans: Unsecured loans provided to individuals, including "24/7 AI loans".

-

SME loans: Unsecured loans provided to small and medium-sized enterprises, usually guaranteed by the directors or shareholders of the SME borrowers.

In 2022, the market share of licensed lenders accounted for approximately 4.1% of the entire unsecured loan market in Hong Kong. In terms of the entire unsecured loan market in Hong Kong (including accredited institutions and licensed lenders) and the licensed unsecured lending market, K Cash Financial Technology's market share in 2022 was approximately 0.15% and 3.6% respectively, based on revenue. In addition, in 2022, the licensed unsecured financing market was relatively concentrated, with the top three market participants accounting for 79.2% of the overall market share based on revenue.

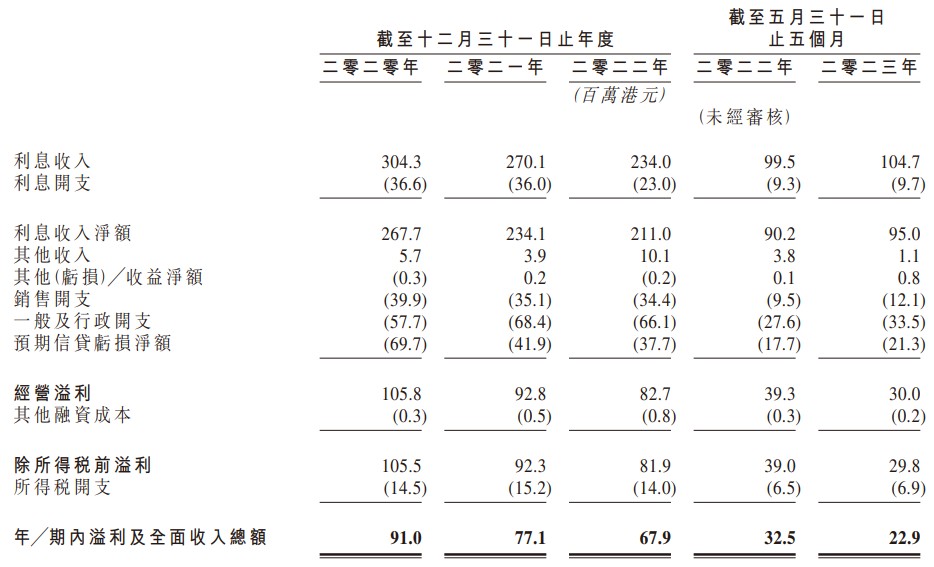

As of December 31, 2020, 2021, 2022, and May 31, 2023, K Cash Financial Technology's outstanding loans were HKD 986 million, HKD 845 million, HKD 914 million, and HKD 948 million respectively. In terms of finance, for the five months ending on May 31, 2020, 2021, 2022, and 2023, K Cash Financial Technology achieved interest income of HKD 304 million, HKD 270 million, HKD 234 million, and HKD 105 million, respectively. The net interest income was HKD 268 million, HKD 234 million, HKD 211 million, and HKD 95 million, respectively. During the same period, the total profit and comprehensive income amounted to HKD 91 million, HKD 77.1 million, HKD 67.9 million, and HKD 22.9 million.