Double-click on 'dollar and high interest', will gold price 'hold on now, win the future'?

摩根大通指出,金價與美債實際收益率的負相關關係在降息週期更為明顯,隨着美債實際收益率和美元在明年晚些時候走勢出現逆轉,將推動金價突破 2000 美元/盎司,並在 2025 年進一步上漲。

自去年以來,受美債實際收益率走高和美元走強的壓制,國際黃金價格經歷了多番動盪。

在經歷持續上漲後,黃金價格近期回調。COMEX 黃金期貨合約 9 月下旬以來連跌九日,累計跌幅達 5.43%。但就中期而言,金價整體保持彈性,即便經歷回調,COMEX 黃金期貨合約自去年 11 月低位的累計漲幅依然有 12.47%。

摩根大通認為,自 2022 年以來,從各國央行增加購金到地緣政治因素(如週一巴以衝突推動避險買盤湧入黃金),各種催化劑幫助金價保持在較高水平。

而展望未來,小摩依舊看漲金價,認為美債實際收益率和美元在明年晚些時候的最終逆轉,將推動金價突破 2000 美元/盎司。

該行分析師 Gregory C. Shearer 在近日的一份報告中預計,金價將在 2024 年下半年達到新的高點(2024 年第四季度平均價格為 2175 美元/盎司),並在 2025 年進一步上漲。

摩根大通:金價與美債實際收益率的負相關關係並不對稱

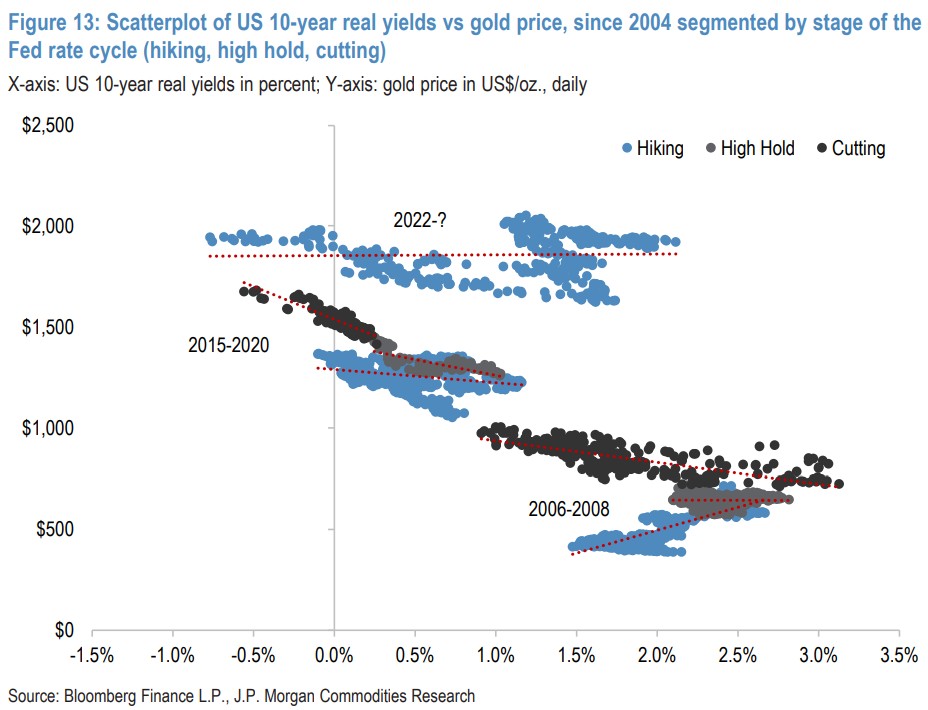

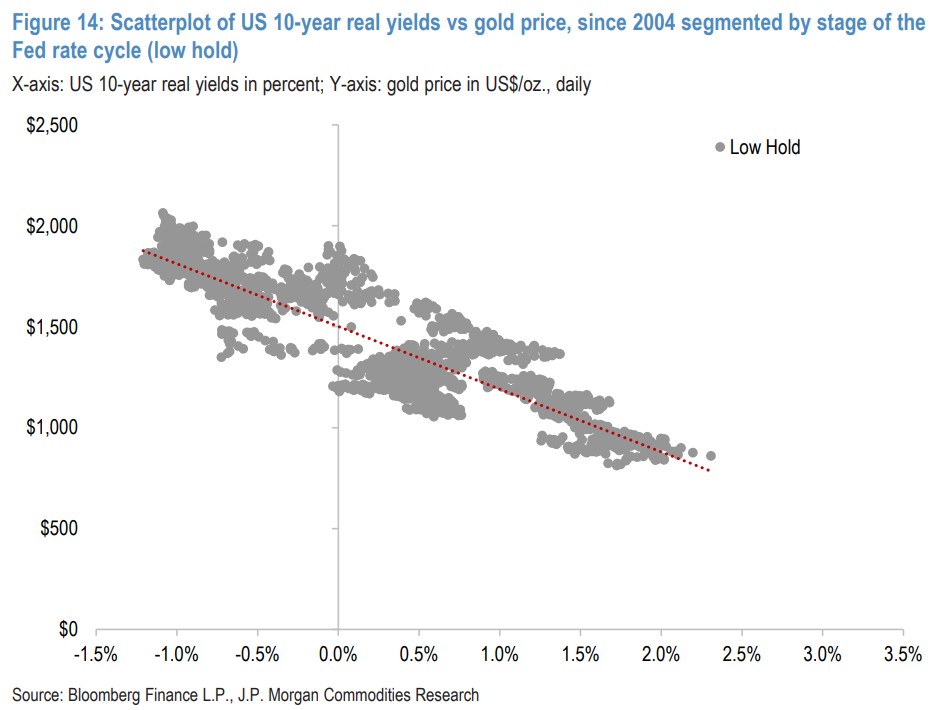

長期以來,黃金和 10 年期美債實際收益率之間保持着完美的負相關關係。

但近幾個月這種負相關關係並不明顯。自 7 月底以來,美國 10 年期國債實際收益率上升了 87 個基點(升幅 54%),上週達到了 2009 年以來的最高水平,而金價僅下跌了 5%。

小摩認為,黃金和 10 年期美債實際收益率並沒有完全脱鈎。

該行表示,從歷史上看,在美聯儲加息週期中,金價與實際收益率的負相關關係一直較弱,而在美聯儲暫停加息、降息並將利率維持在低水平時,美債收益率會下降,金價會再次走強。

報告寫道:

“在過去的三個美聯儲降息週期中,金價在美聯儲首次降息前的六個月內平均上漲了 4%,而在首次降息後的六個月內又上漲了 15%。

在後兩個降息週期(從 2007 年和 2019 年開始),當黃金與實際收益率的關係建立得很好時,在美聯儲開始降息之前(平均上漲 8%)和之後的六個月裏(平均上漲 22%),金價一直看漲。”

摩根大通認為,黃金與美債實際收益率負相關關係的不對稱,在一定程度上解釋了金價自 2022 年初以來的彈性。

預計美債收益率在更長時間內走高,但到 2024 年年中仍會出現逆轉

小摩在報告中表示,即使美聯儲 9 月發佈的利率點陣圖更為鷹派,該行經濟學家仍然預計美聯儲的加息週期已經結束,並預計美聯儲將在 2024 年降息 50 個基點(利率峯值將在 2024 年初出現,2024 年夏天會暗示降息 25 個基點)。

該行認為,市場可能會繼續討論美聯儲在 2023 年剩餘時間內再次加息的可能性,因此,該行策略師預計美債收益率將在年底前保持高位。儘管如此,該行策略師仍然預測,隨着美債收益率在美聯儲降息週期之前開始走低,這種情況將在 2024 年下半年開始改變。

摩根大通對美元的預測與美債收益率的觀點相似,即美元的強勢預計將持續到年底,然後在 2024 年上半年達到拐點。

小摩展望:金價短期保持彈性,之後將大幅走高

摩根大通認為,美債實際收益率在更長時間內走高,美元受到支撐,可能會繼續抑制金價,但預計美聯儲將維持利率不變,而由於金價與高收益率和美元走強的負相關性降低,因此金價在未來一個季度將基本保持彈性:

金價將在最近的 1880-1950 美元/盎司區間波動,在今年第四季度平均價格為 1920 美元/盎司。

換句話説,在美聯儲加息週期曲折步入尾聲,金價預計將繼續原地踏步,直到 2024 年晚些時候出現拐點。

該行預計,隨着美聯儲降息週期臨近,金價預計將最終走高,在 2024 年下半年達到新的高點(2024 年第四季度平均價格為 2175 美元/盎司),到 2025 年甚至更高,達到年平均價格 2250 美元/盎司。

報告表示:

“展望明年,由於我們預計美聯儲將接近並經歷降息週期,我們認為這將再次確立實際收益率走低作為黃金看漲的關鍵驅動因素,推動金價從保持彈性走向突破新高。”

預測準不準?還要看美國經濟和通脹

金價看漲風險:美國經濟硬着陸和美聯儲更快轉鴿

就基本預測而言,摩根大通並不認為,美國經濟會出現衰退,而是認為會温和增長,增速低於平均水平,最終導致從 2024 年第三季度開始降息。

然而,該行認為,未來一年美國經濟衰退的風險仍然很高,如果緊縮政策的滯後效應比預期更快或更有力地發揮作用,可能會對宏觀市場造成嚴重衝擊。

該行的全球市場策略師指出:

“在美聯儲過去 12 次緊縮週期中,有 7 次緊隨或伴隨着經濟衰退。在這七個週期中,美國經濟衰退平均開始於美聯儲最後一次加息後的 5-6 個月。

如果我們的經濟學家是正確的,假如 7 月標誌着美聯儲的最後一次加息,那麼與歷史平均水平相似的時間點將在今年年底左右。

如果美聯儲在經濟進一步放緩的情況下做出更迅速的鴿派反應,將給我們對 2024 年黃金的預測增加更多直接的上行風險。”

金價看跌風險:更頑固的通脹要求進一步收緊政策

通脹迴歸目標水平的最後階段可能會很困難。

摩根大通預計,自年中以來油價近 30% 的反彈不會持續或反映到核心通脹。然而,該行表示,美國頑固的核心通脹和經濟韌性可能促使美聯儲進一步收緊政策,並將結束緊縮週期的辯論延長至 2024 年。

雖然小摩仍然認為,在這種情況下,金價不會大幅回落至 2022 年底的低點,但這將繼續穩步壓低金價,使其低於該行的預期,並進一步推遲任何持續的反彈。