AMD 2Q25

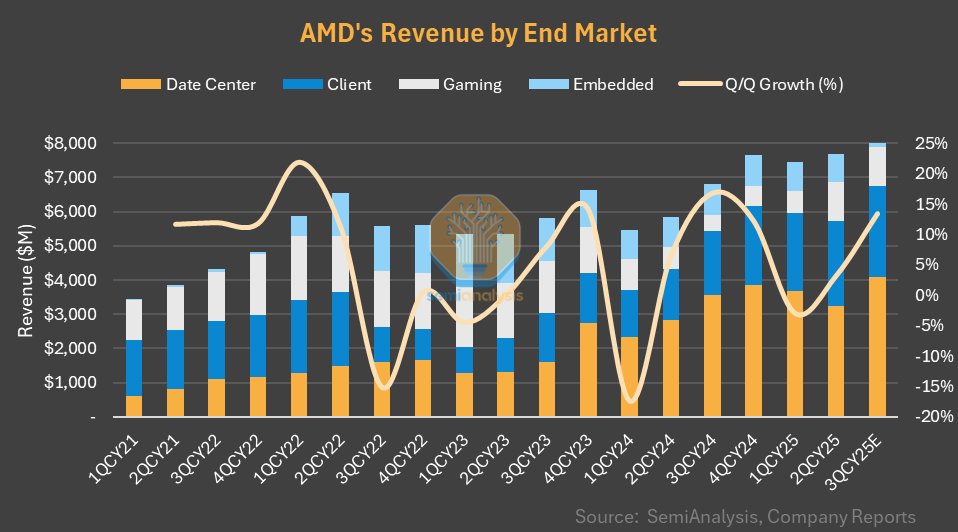

- Revenue up 3% q/q and 32% y/y to $7.7 (above mid pt guidance)- Except DC, all end markets up q/q in QJun- All-time-high quarter for PC CPU and server CPU- Export controls affected DC GPU sales; down y/y and q/q- DC revenue down 12% q/q and up 14% y/y to $3.2B; incremental revenue driven by server CPU; momentum in Cloud and Enterprise segments- Strong DD% q/q DC growth in QSep- MI35x launch and broad adoption; Oracle 27k MI355 cluster- MI400 on track for 2026 launch; high customer interest, large scale deployments; rack-scale (Helios); 72 GPU- MI308 will ship once licenses approved; 3Q guidance excludes MI308 revenue- DC GPU will resume y/y and growth in 3Q and will grow in 4Q as well- 40+ sovereign engagements- Sees a path to tens of billions of dollars of DC GPU revenue; contingent on gigawatt DCs- DC GPU still below corporate average GM; but expects it to grow over time as revenue grows and operational efficiencies kick in- MI355 to ramp quicker than MI300- MI355/400 lead times 8-9 monthsSource: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.