Some thoughts on Longbridge

$CHANGJIU HLDGS(06959.HK)

As an investor closely following the Hong Kong stock market, I have recently conducted some research and analysis on Changjiu Holdings. This company, a leader in the automotive supply chain services sector, not only demonstrates strong business capabilities and broad development prospects but also offers some investment opportunities through a series of proactive market initiatives and stable financial performance.

First, a series of recent announcements from Changjiu Holdings have impressed me.

Particularly noteworthy is the announcement on April 12 regarding the change in the board lot size, where the company reduced the board lot size from 500 shares to 100 shares. This adjustment undoubtedly lowers the entry barrier for investors, allowing more small and medium-sized investors to participate in Changjiu Holdings' investment. At the same time, this is expected to enhance the stock's liquidity and trading activity, providing strong support for a potential price increase. In recent years, some listed companies have indeed attracted more investor attention through similar adjustments, subsequently driving up their stock prices. Changjiu Holdings' move is undoubtedly a wise choice.

Some stocks that performed well after splitting their board lot sizes in recent years

Let’s look at the announcement on July 15: the number of certified car dealers on Changjiu Holdings' automotive supply chain service platform—Jiuchē GO—has exceeded 12,000! This number shocked me, as it fully demonstrates Changjiu Holdings' strong market influence and widespread recognition. With the continuous increase in certified car dealers, Changjiu Holdings' service scope will further expand, and its profitability will significantly improve. This undoubtedly lays a solid foundation for the company's future development.

Additionally, on June 12, Changjiu Holdings announced a special dividend of HK$0.43 per share, which further showcased the company's strength and sincerity. In the Hong Kong stock market, companies that genuinely return cash dividends to shareholders are rare. This move by Changjiu Holdings not only reflects the company's commitment to shareholder returns and care but also highlights its stable financial condition and proactive profit distribution policy. Such a company is undoubtedly more trustworthy and worth investing in.

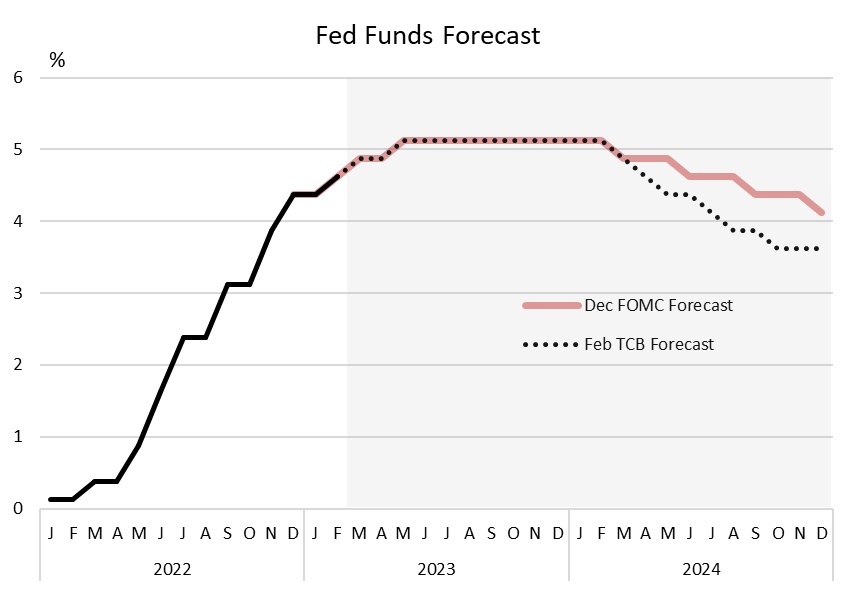

Beyond the company-level positive factors, I also see the favorable impact of the macroeconomic environment on Changjiu Holdings. With the gradual recovery of the global economy and the increasing likelihood of the Federal Reserve cutting interest rates, global market liquidity is expected to rise, and the overall upward trend in the stock market is becoming more evident. For the Hong Kong market, which is pegged to the US dollar, reduced interest rate pressure will provide a more relaxed financing environment and broader development space for many companies. Lower financing costs and improved market liquidity will help drive stock prices higher. Coupled with the long-weak Hong Kong stock market, a potential US interest rate cut could be a turning point for an upward rebound.

In summary, I believe Changjiu Holdings is a company with investment value. It holds a leading position in the automotive supply chain services sector, boasts extensive market influence, and demonstrates stable financial performance and a proactive profit distribution policy. At the same time, as the macroeconomic environment continues to improve and the market gradually warms up, Changjiu Holdings' stock price potential will be fully realized. I think the most critical point is that after Changjiu entered the MSCI index, its major shareholders did not reduce their holdings, indicating relatively high ownership concentration. This proves that major shareholders have strong confidence in the company's operations and future stock price. Of course, investing carries risks, and investors should fully understand relevant information and exercise caution before making decisions.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.