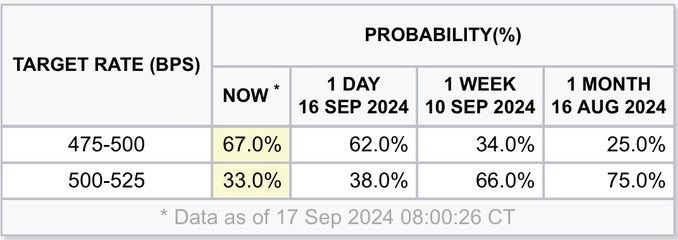

The market currently believes that the probability of the Federal Reserve cutting interest rates by 50 basis points at 2 a.m. tonight is 67%, higher than 34% a week ago.

Interest rate cuts benefit two types of assets: one is government bonds, and the other is small-cap stocks.

For specific government bond ETFs, see this article:

longportapp.cn/topics/238...

Small-cap stocks: $Vanguard Russell 2000(VTWO.US) (Small-cap stocks are sensitive to liquidity, while large-cap stocks are sensitive to fundamentals).

Whether the rate cut is 25 or 50 basis points, it's all about "waiting for the shoe to drop." The market trend is hard to predict, as the S&P 500 already hit a new intraday high last night.

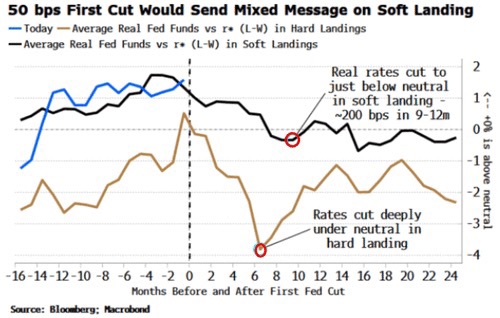

Additionally, Simon Black, a Bloomberg macro strategist, believes: A 50bp rate cut would send mixed signals about the soft landing the Fed hopes for, while also potentially accelerating liquidity issues in the repo market.

1. Judging from the actual rate cuts during hard and soft landings, an initial 50bp cut might send a counterproductive, more negative signal than expected. A 50bp cut looks more aligned with a steeper, deeper hard-landing rate-cut cycle.

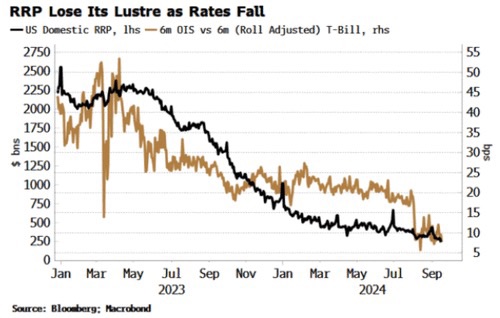

2. The RRP yield is declining relative to the 6-month Treasury bill yield. If the Fed cuts rates by 50bp this week, more liquidity will flow into bills, lowering reserve levels to uncomfortably low levels and causing repo funding issues.

$NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.