1) Gross Margin Exceeds Expectations

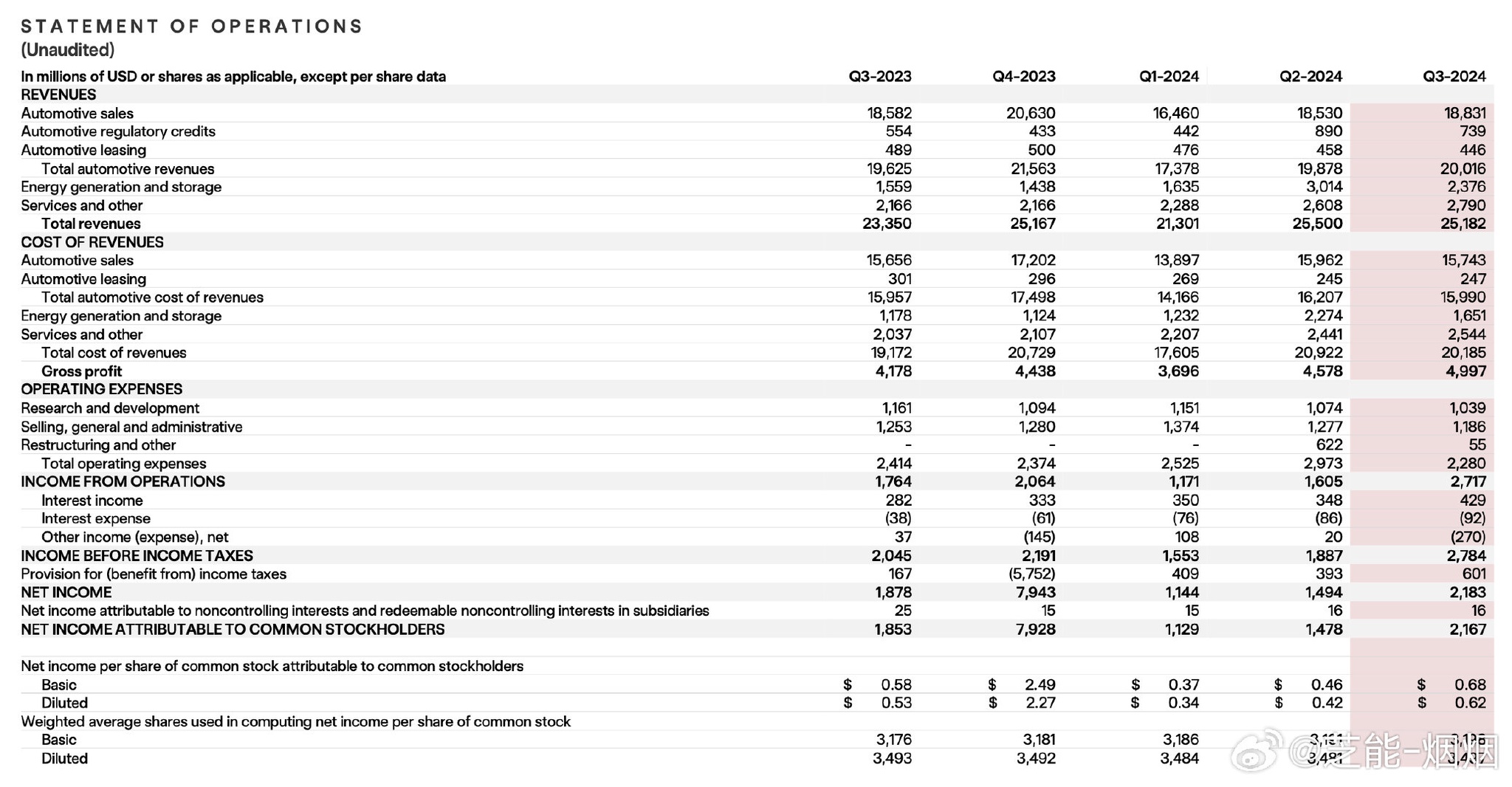

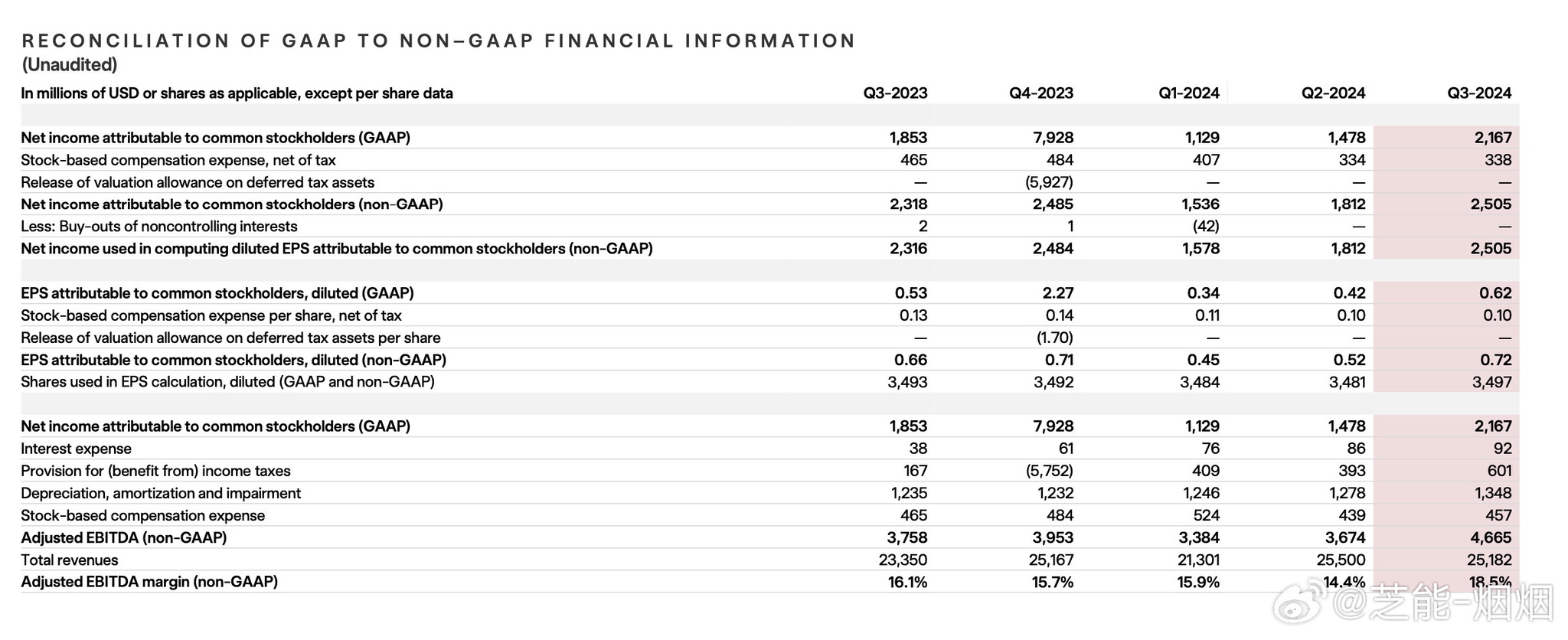

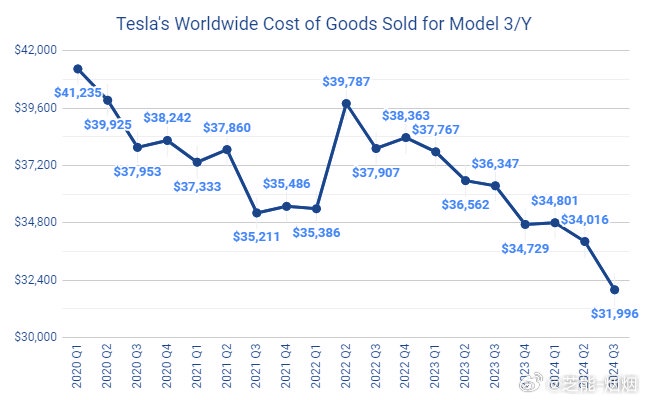

Automotive gross margin improved significantly, with 24Q3 automotive (excluding credit leasing) gross margin reaching 16.4%, far exceeding last quarter's 13.9% and surpassing market expectations, indicating a notable enhancement in profitability. As a result, the stock price rose 12% in after-hours trading.Full-year delivery guidance is clear, suggesting positive growth in 2024 deliveries, with an implied Q4 delivery target of 510,000 units. Energy business deliveries doubled in 2024, with a Q4 energy delivery target of 9GWh. The mass production timeline for the affordable vehicle is confirmed for the first half of 2025, bringing new expectations to the market. Meanwhile, FSD released V12.5, with parameters expanded fivefold, and cumulative mileage surpassing 2 billion miles. Additionally, Robotaxi testing (with safety drivers) will begin directly on Model 3/Y in 2025, demonstrating continued progress in the autonomous driving sector.2) Revenue and ProfitTotal revenue reached $25.2 billion, up 8% year-over-year. Automotive contributed $20 billion, energy $2.4 billion, and services & other $2.8 billion. GAAP operating profit was $2.7 billion, GAAP net income $2.2 billion, and non-GAAP net income $2.5 billion. Operating cash flow was $6.3 billion, free cash flow $2.7 billion, and cash & investments increased by $2.9 billion, totaling $33.6 billion, reflecting the company's strong financial position.Automotive BusinessCost and Profit Optimization: Cost reduction exceeded expectations, and the improvement in gross margin reflects success in cost control and product pricing strategies.Delivery Outlook: Clear full-year delivery guidance provides the market with expectations, while the implied Q4 target gives investors a basis for judging future performance.Energy BusinessRevenue and gross margin hit record highs: Revenue reached $2.4 billion, with a record gross margin of 30.5%.Capacity and Deployment Progress: Powerwall deployments set consecutive records, Lathrop Gigafactory produces 200 Megapacks weekly, and Shanghai Gigafactory is expected to begin shipments in Q1 2025.US Factories: Model 3 production increased in California, Nevada, and Texas with lower costs, Cybertruck production rose and achieved positive gross margin for the first time, and Semi factory construction is on track.China Factory: Shanghai Gigafactory produced its 3 millionth vehicle in October and exported its 1 millionth vehicle in September, with per-unit costs hitting a historic low, highlighting the factory's advantages in scale and cost control, as well as its critical role in Tesla's global strategy.Europe Factory: Berlin-Brandenburg Gigafactory reduced per-unit costs, and Model Y sales were strong in Nordic countries, indicating growing acceptance of Tesla products in Europe and improving operational efficiency.2024 vehicle deliveries are expected to grow slightly, energy storage deployments to double, and ample liquidity will support product roadmaps and expansion plans. Over time, hardware profits will synergize with AI, software, and fleet profits to accelerate growth. More affordable models are planned for production in the first half of 2025 using a hybrid platform strategy to reduce costs and increase output, while Robotaxi products will continue to innovate manufacturing strategies.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.