Looking back at the development history of Kuaishou, it can be roughly divided into the following stages:

First, in the early stage of platform development, the main business model was live streaming with tipping and commission;

Second, after 2020, Kuaishou began to focus on live-streaming e-commerce (it was also the first short-video platform to engage in live-streaming e-commerce). Since then, most of Kuaishou's business has revolved around e-commerce, such as entertainment streamers transitioning to e-commerce, and platform traffic monetization mainly relying on "internal loop" ads for e-commerce traffic diversion.

Since then, Kuaishou has entered its golden era, joining the ranks of industry leaders.

However, when evaluating the Q3 2024 financial report, the following points are worth sharing:

The market should shift its tracking and evaluation of Kuaishou from a vertical perspective as an "e-commerce company" to a comprehensive perspective as a "traffic company," recognizing the diversified digital community business model that has grown under Kuaishou's foundation of short-video and live-streaming content:

1) The latter has high elasticity and scalability. In times of unpredictable external environments, it can hedge against downward pressure through multiple business models;

2) In terms of commercialization, external-loop brand ads and paid short-drama ads can break through the commercialization ceiling under the e-commerce narrative logic, improving traffic monetization capabilities. This is key to Kuaishou's future profit margin growth.

$KUAISHOU-W(01024.HK)

In Q3 2024, stimulated by hot events like the Olympics, Kuaishou's total traffic continued to expand. As long as the commercialization reforms progress smoothly, there will be significant improvements in revenue and profits soon.

Therefore, our focus on Kuaishou lies in the "online marketing revenue" segment.

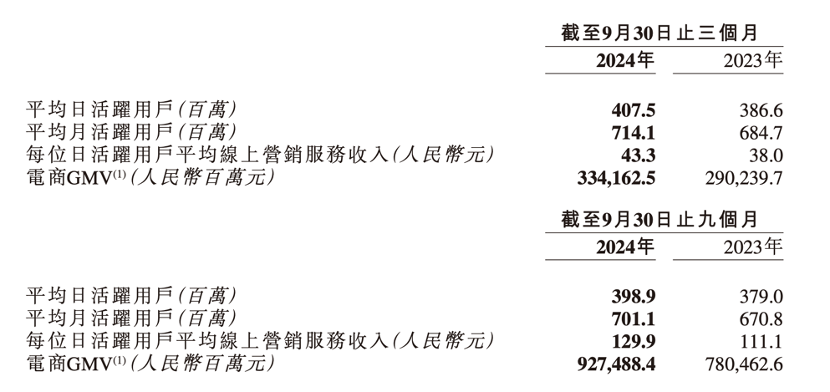

In this quarter's financial report, Kuaishou's online marketing service revenue increased by 20% year-on-year to RMB 17.6 billion, with ARPU reaching RMB 4.33 billion, while e-commerce GMV grew by 15% year-on-year. The number of monthly active merchants increased by over 40% year-on-year, and the number of monthly active merchants using traffic ads grew by more than 50% year-on-year.

After shifting its business model from live streaming to e-commerce, Kuaishou's marketing revenue growth has largely paralleled GMV growth. However, the gap in growth rates between the two began to emerge this quarter. The main reasons are:

First, Kuaishou capitalized on the trend of paid short dramas, boosting the growth of marketing spending on paid short dramas;

Second, the penetration rate of the external-loop marketing product Universal Auto X (UAX) increased across industries. Official disclosures show that clients using UAX accounted for over 30% of total external-loop marketing spending. Combined with AI, this has improved ad efficiency, giving the platform a stronger grip on commercialization;

Third, the proportion of brand ads (with higher premium capabilities) increased.

The platform's exploration in commercialization, on one hand, dilutes the risks of over-reliance on a single business (such as weak domestic demand and pressure in the retail market), and on the other hand, enhances financial imagination.

Moving forward, the market needs to reclassify Kuaishou, shifting from an e-commerce-dominated perspective to a traffic company (including but not limited to e-commerce). Subsequently, valuation models and financial statement forecasts will be adjusted accordingly. We shall wait and see.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.