Leapmotor: Dark Horse's Counterattack, "Little LI" is Crazy?

$LEAPMOTOR(09863.HK) Leapmotor (9863.HK) released its fourth quarter financial report for 2024 after the Hong Kong stock market closed on March 10, Beijing time. Although Leapmotor had previously issued a profit warning, the final performance was still very good, exceeding both the profit warning guidance and market expectations. Specifically:

1. Overall revenue exceeded expectations: This quarter's revenue was 13.46 billion, surpassing the 11.8 billion forecasted in Leapmotor's profit warning for the fourth quarter and the market expectation of 12.5 billion. Dolphin Research believes the main reason for the outperformance is that the revenue per vehicle exceeded market expectations, with the revenue per vehicle approximately 111,000 yuan. Despite a deterioration in the model structure, it still exceeded the market expectation of 104,000 yuan.

Dolphin Research believes this is mainly due to: ① Continuous explosive sales did not adopt a price reduction strategy to boost sales like in previous years, and discounts on the low-priced T03 model were somewhat retracted; ② The proportion of the higher-priced C11 model in the model structure increased, which somewhat offset the adverse effects of changes in the model structure; ③ Revenue from service business increased;

2. Overall gross margin finally reached double digits, setting a historical high: This quarter, the gross margin finally reached double digits at 13.3%, exceeding the market expectation of 12.1% and the implied fourth quarter gross margin of 13% in Leapmotor's profit warning, mainly due to the decline in average vehicle price being lower than market expectations and significant cost reductions this quarter.

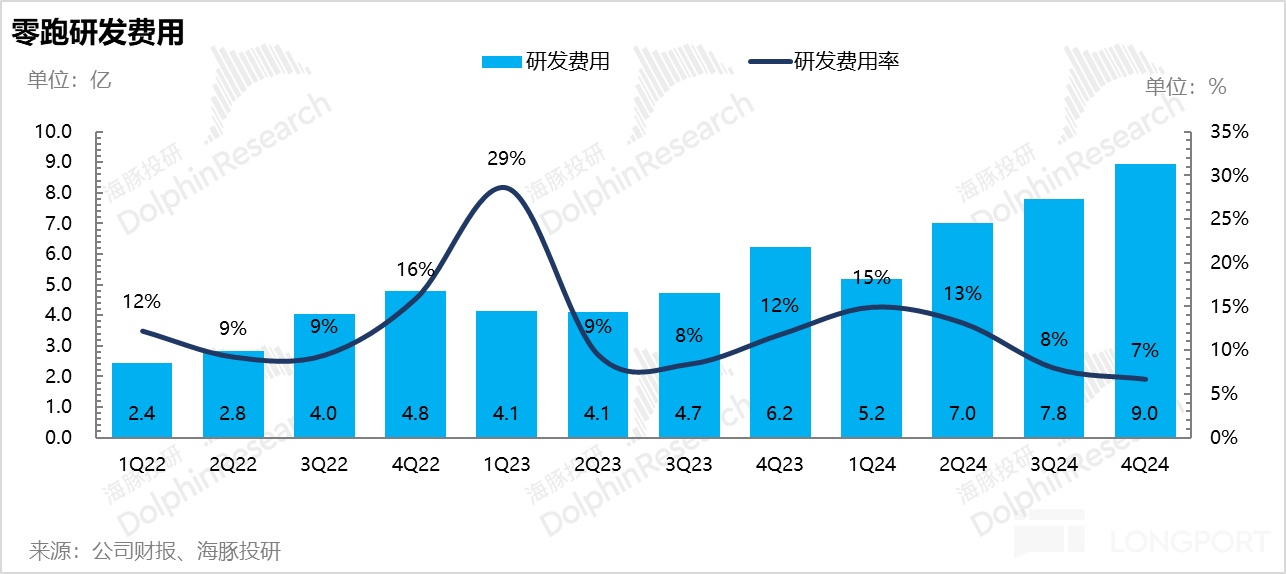

3. Net profit successfully turned positive: Although R&D expenses and sales expenses continued to grow significantly this quarter, the substantial increase in revenue and gross margin led to a successful turnaround in net profit, with a final net profit of 80 million, slightly higher than the market expectation of 70 million.

However, the high R&D expenses were mainly due to ① Continuous increased investment in intelligence; ② R&D and upgrades of the new generation Leap 3.5 architecture; while the sales expenses were mainly due to ① Increased promotional expenses; ② Accelerated channel expansion, reaching more potential groups in lower-tier cities, driving significant sales growth, all of which can be understood by the market.

4. 2025 sales guidance continues to grow significantly, exceeding market expectations, while gross margin and net profit margin guidance are also good: Leapmotor guided that sales in 2025 would reach 500,000 to 600,000 units, exceeding the previous guidance of 500,000 units, with a year-on-year growth rate of 70%-104%, driven by the launch of major new products (B series + C series facelift) + continued accelerated channel expansion + significant growth in overseas sales.

The gross margin guidance remains at a double-digit level of 10%-11% when the price range of the new B series vehicles is lower than that of the C series, reflecting ① Leapmotor's strong cost control capability (reducing costs by increasing the proportion of self-research and production); ② The release of scale effects brought about by continued significant growth in sales in 2025, while Leapmotor also guided that the net profit margin would turn positive in 2025

Overall, Leapmotor delivered a good performance in the fourth quarter. Although it had issued a profit warning in advance, its actual revenue and gross margin performance still exceeded market expectations and the guidance in the profit forecast.

However, the market is more concerned about the sales plan and gross margin guidance for 2025 than the fourth-quarter performance. Similarly, the sales guidance for 2025 once again exceeded market expectations, while the gross margin and net margin maintained good guidance despite the introduction of the lower-priced B series new cars, reflecting Leapmotor's strong cost control capabilities.

Dolphin Research has repeatedly mentioned in previous analyses that Leapmotor is a company focused on solid vehicle manufacturing, with models that offer excellent cost-performance compared to competitors. However, it had previously been hindered by marketing and brand awareness issues. From Leapmotor's recent sales momentum, it appears that its brand recognition has been largely established. Dolphin Research believes that the reasons for Leapmotor's sustained high sales momentum are:

The upgrade of the trade-in policy, which is most beneficial for new energy vehicle companies like Leapmotor priced between 100,000 to 200,000 yuan;

High cost-performance of models, creating differentiated competition: Leapmotor's models possess high cost-performance (self-research and production cost reduction) + spaciousness + advantages in intelligent driving, forming differentiated competition with other car manufacturers, driving continuous hot sales of Leapmotor products.

Leapmotor's model positioning is accurate, with the proportion of SUV models continuously increasing. For example, the C16, positioned as a six-seat family SUV, is priced significantly lower than similarly positioned family SUVs like Li Auto's L6 and Huawei's M7, covering the gap in the 150,000 to 200,000 yuan family SUV market, thus forming differentiated competitiveness. At the same time, Leapmotor has introduced 800V and intelligent driving features at the 150,000 yuan price range, offering extremely high cost-performance, which still reflects strong cost control capabilities.

Regarding overseas expansion, the impact of going abroad in 2024 is still limited for Leapmotor (13,700 units), but by 2025, the impact will begin to be released (expected to contribute 50,000 to 60,000 units from overseas models). Leapmotor still possesses differentiated advantages in overseas expansion compared to other new forces: 1. It has the brand recognition and channels of Stellantis; 2. It can utilize Stellantis' overseas factories and adopt the SKD model for exports to Europe.

From Leapmotor's current valuation perspective, the P/S ratio for 2025 is between 0.8 and 0.9 times, considering:

Domestic brand recognition has been established, with the 2025 sales target exceeding market expectations and continuing to grow;

Overseas expansion will begin to ramp up in 2025;

Collaboration with FAW has begun to jointly develop new energy passenger vehicles and cooperate on components (specific details have yet to be disclosed). Dolphin Research believes that such a valuation is still not expensive.

At the recent press conference held by Leapmotor, the B10 model officially started pre-sales (mid-size SUV), with a pre-sale price of only 109,800 to 139,800 yuan, among which the B10 laser radar intelligent driving version is priced at only 129,800 yuan (the first in the country to bring the laser radar version down to the 120,000 yuan price range). Within an hour of its launch, orders reached 15,010 units, with the laser radar version accounting for over 70%, establishing its blockbuster attributes, still reflecting strong cost control capabilities behind its extreme cost-performance However, it should be noted that in the first quarter, due to the new B10 model only being launched in March and delivered in April, Leapmotor began to reduce prices and promote sales for the 2024 model series of older models. Additionally, with the national subsidies not fully implemented in all cities during January and February, it is expected that the gross margin in the first quarter may adjust compared to Q4.

The following is a detailed analysis:

I. Gross margin in Q4 reached double digits, setting a historical high

The most concerning aspect for investors regarding Leapmotor's performance is the gross margin situation of its automotive business. However, since Leapmotor's revenue is mainly divided into ① automotive business revenue; ② service and other sales revenue, and Leapmotor does not break down these two business data quarterly, Dolphin Research analyzes it from the perspective of total revenue.

From the overall gross margin perspective, this quarter's gross margin finally reached double digits, reaching 13.3%, exceeding the market expectation of 12.1% and the implied Q4 gross margin of 13% in Leapmotor's profit forecast. This is mainly due to the decline in average vehicle price being lower than market expectations and the significant cost reduction this quarter.

From the perspective of single vehicle economics (including service business revenue):

a) Average vehicle price of 111,000 yuan, exceeding market expectation of 104,000 yuan

The average vehicle price in Q4 was 111,000 yuan, exceeding the market expectation of 104,000 yuan, but decreased by 7,000 yuan compared to the previous quarter.

This quarter, the market originally expected that due to the increased proportion of the low-priced T03 model, the average vehicle price would rebound by 2.2 percentage points, while the highest-priced C16 model decreased by 1.4 percentage points, leading to an expectation of a decline in average vehicle price by 14,000 yuan.

However, the actual average vehicle price this quarter was 111,000 yuan, which Dolphin Research believes was influenced by three main factors:

In Q4, Leapmotor was still in a state of explosive sales, with an average monthly sales volume of 40,000 vehicles. Unlike previous years, there was no price reduction for existing models to boost sales; instead, only financial interest subsidies and trade-in subsidies (for existing Leapmotor owners) were provided, which had little impact on the average vehicle price.

The proportion of the higher-priced C11 model in the product structure increased, which somewhat offset the adverse effects of changes in model structure, while the company also reduced some discounts on the low-priced T03 model.

Revenue from service business recognition increased. In the first half of the year, the company only recognized 10 million yuan in service business revenue and other income (accounting for 0.1%), while in the second half, it recognized nearly 530 million yuan (accounting for 2.3%), mainly due to the increase in vehicle ownership, extended warranties, maintenance, and value-added service income; at the same time, the company added income from warehousing services and other businesses.

b) Single vehicle cost of 97,000 yuan, down 11,000 yuan compared to the previous quarter

This is mainly due to:

The increased proportion of low-priced vehicles in the model structure, leading to a decline in overall manufacturing costs;

The release of scale effects. This quarter, Leapmotor continued to experience explosive sales, with Q4 sales reaching 120,900 vehicles, a 44% increase compared to the previous quarter, driving down the per-vehicle amortized cost.

The company continues to reduce costs through self-research and production combined with lowering component procurement costs, with the proportion of self-research and production in the C series continuing to rise, while component procurement costs have also declined (benefiting from annual reductions by suppliers).

c) Gross profit per vehicle is 15,000 yuan, a month-on-month increase of 5,000 yuan, exceeding market expectations of 13,000 yuan

Although the price per vehicle has decreased month-on-month, it still exceeds market expectations. The cost per vehicle has been reduced through the release of scale effects and continuous cost reductions from self-research and production, resulting in a month-on-month increase of 5,000 yuan in gross profit per vehicle, exceeding market expectations of 13,000 yuan.

II. Total revenue in the fourth quarter is 13.5 billion yuan, still higher than market expectations

Total revenue in the fourth quarter is 13.5 billion yuan, exceeding market expectations of 12.5 billion yuan, as well as the implied fourth-quarter revenue of 11.8 billion yuan from the profit forecast. This is partly due to the continued explosive sales of Leapmotor and partly because the decline in revenue per vehicle was lower than market expectations.

In the fourth quarter, Leapmotor delivered 121,000 vehicles, continuing a month-on-month increase of 44%, ranking among the top in delivery volume among new forces, with total annual deliveries reaching 293,700 vehicles, consistent with Dolphin Research's previous expectations, exceeding Leapmotor's initial annual sales target of 250,000 vehicles. Dolphin Research believes the reasons driving Leapmotor's continued explosive sales are as follows:

① The trade-in policy is most favorable for new energy vehicle companies priced at 100,000-200,000 yuan:

The trade-in policy has been further upgraded, with subsidies for purchasing new energy vehicles after scrapping increased from 10,000 yuan to 20,000 yuan, and the trade-in policy continues in the fourth quarter.

The scrapped models are approximately 13 years old, and users of scrapped models are more sensitive to price and are more inclined to choose models with lower subsidized prices, further benefiting new energy vehicle companies positioned in the 100,000-200,000 yuan range (such as Leapmotor).

② High cost-performance ratio of models, forming differentiated competition with competing models

The fourth quarter is the peak sales season for new energy vehicle companies, and Leapmotor's models have a high cost-performance ratio (cost reduction from self-research and production) + large space + advantages in intelligent driving, forming differentiated competition with other car companies, driving continuous hot sales of Leapmotor products.

Leapmotor's SUV proportion continues to rise, reaching 72% of the model structure in the fourth quarter, with the C11, C10, and C16 models being the main models of Leapmotor's SUVs, and Leapmotor has positioned its pricing based on model size.

Leapmotor's models have an extremely high cost-performance ratio compared to models in the same price range (the first in the industry to bring 800V fast charging down to the 160,000 yuan price range), and they also have a large space advantage compared to models in the same price range (for example, the C16 is positioned as a 6-seat family SUV, priced significantly lower than similarly positioned family SUVs like Li Auto's L6 and Huawei's M7, covering the gap in the 150,000-200,000 yuan family SUV market, thus forming differentiated competitiveness.

Additionally, the 2024 model year facelifted models have added intelligent driving versions, equipped with NVIDIA Orin X chips (computing power of 254 TOPS) + 1 lidar (starting price for intelligent driving versions is 165,800 yuan), with strong overall capabilities, forming differentiated competition with competing models.

③ Contribution of overseas models:

In the fourth quarter, Leapmotor officially began to expand overseas, primarily with the T03 and C10 models, with Leapmotor's total overseas sales for 2024 expected to be 13,700 vehicles. Dolphin Research estimates that Leapmotor's overseas sales in the fourth quarter are approximately 12,000 vehicles, accounting for nearly 10% of total sales

III. The annual sales target for 2025 is 500,000 to 600,000 units, higher than the previous guidance of 500,000 units, with an annual gross margin guidance of 10%-11%

Looking ahead to 2025, Leapmotor announced a sales target of 500,000 to 600,000 units during the earnings call, higher than the previous guidance of 500,000 units and the current market expectation of 450,000 units, representing a year-on-year growth of 70%-104%. Among them:

① In terms of overseas expansion, Leapmotor expects overseas sales to increase from 13,700 units in 2024 to 50,000 to 60,000 units in 2025, a year-on-year growth of 265% to 338%. Leapmotor will begin selling three models in overseas markets in 2025, including the T03 compact car, C10 SUV, and B10 SUV (to be launched overseas in the second half of the year), while sales will still primarily focus on Europe, aiming to utilize Stellantis's overseas channels to achieve around 450-500 channels in Europe and about 200 channels in the other three major regions.

② In terms of domestic sales, Leapmotor expects domestic sales to increase from 280,000 units in 2024 to 450,000 to 550,000 units in 2025 (based on an overseas sales target of 50,000 units), continuing to grow year-on-year by 61%-96%. The main growth drivers are:

(a) Expansion of the dealer network, increasing from 695 stores at the end of 2024 to 1,000 stores by mid-2025, and reaching 1,500 stores by the end of 2025;

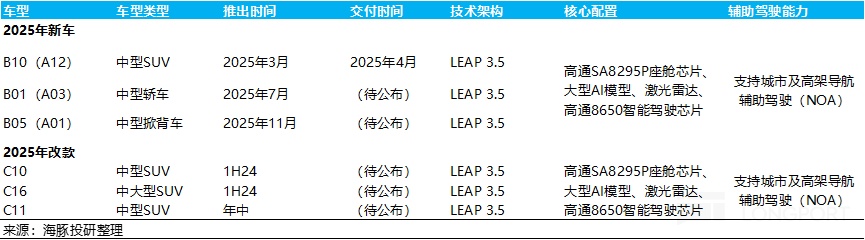

(b) Expanding the product lineup by launching the B10 (code A12) medium SUV in March, the B01 (code A03) medium sedan in June, and the B05 (code A01) medium crossover in the fourth quarter;

(c) Continued subsidies for trade-ins, which will continue to benefit Leapmotor, a company focused on launching cost-effective models this year (the main price range is between 100,000 to 200,000 yuan, with new cars mainly concentrated in the lower-priced B series compared to the price range in 2024).

Regarding gross margin and net margin guidance, the overall gross margin guidance for 2025 is 10%-11%, maintaining a stable double-digit level, which is basically in line with market expectations. In terms of net margin, Leapmotor guides for a positive net margin in 2025, slightly higher than the market expectation of a -1% net margin for 2025.

Although the new B series models from Leapmotor in 2025 are priced lower than the C series, the gross margin and net margin guidance still maintain a good level. Dolphin Research believes this is mainly due to:

① The newly released Leap 3.5 architecture reduces power consumption and improves cost efficiency, and Leapmotor's guidance for the B series gross margin will also be very healthy and will not hold back the performance; ② The release of scale effects brought about by high sales growth.

IV. Operating expenses continue to rise sharply, but can be understood by the market under the condition of sustained sales explosion

In terms of R&D, Leapmotor insists on comprehensive self-research. Previously, self-research focused more on electrification, but the R&D focus for 2024 will be on new models and intelligence. In 2024, new models will be launched with intelligent driving versions, successfully bringing intelligent driving down to the price range of 150,000 to 200,000 yuan. In sales, Leapmotor is still positioned as a manufacturing company, primarily using dealers, so the proportion of manufacturing personnel is the largest.

1) R&D expenditure: Used for intelligent and new model development

In the fourth quarter, Leapmotor's R&D expenses were 900 million yuan, a sequential increase of 120 million yuan, significantly exceeding market expectations of 620 million yuan.

In R&D, Leapmotor insists on comprehensive self-research. The company focuses on independently developing all key software and hardware for the core systems and electronic components of intelligent electric vehicles. The core components of the three electric systems and some controllers are self-produced, with strong vertical integration capabilities in the supply chain. Currently, the self-researched and self-manufactured portion accounts for about 60% of the BOM.

The company's R&D investment is mainly used for:

1) Continued investment in intelligence: Leapmotor is continuously increasing its investment in intelligent driving R&D. Based on the already achieved high-speed NAP and urban NAC intelligent driving functions, it focuses on the R&D of "end-to-end large model" intelligent driving and will continue to increase manpower, computing power, and equipment investment in this direction to ensure the R&D of end-to-end AI large models and mass production delivery in 2025.

The Leapmotor intelligent driving team has expanded from 500 to 600 people, continuously attracting high-level intelligent driving talent. In terms of AI computing power and data infrastructure, to ensure the R&D of end-to-end large models and mass production delivery in 2025, it has reserved over 1.5 Flops of computing power through self-investment and leasing. It plans to configure high-level intelligent driving functions based on "end-to-end large models" on the new LEAP 3.5 architecture by the end of 2025.

Leapmotor indicates that it will continue to increase investment in intelligent driving in 2025, with overall intelligent driving investment exceeding 800 million yuan (total R&D expenses in 2024 are 2.9 billion yuan), and it is expected that R&D expenses will continue to rise sharply in 2025.

2) Upgrade of the Leap 3.5 electronic architecture:

In the fourth quarter, the company is also developing the LEAP 3.5 architecture, which will debut in March 2025, continuing to enhance the overall concentration of domain control and the performance and capabilities of the vehicle. It will be the first to be equipped with the Qualcomm 8650 intelligent driving chip (switching from the original Orin X to the Qualcomm chip), along with intelligent driving hardware such as lidar. One super brain can support end-to-end high-level intelligent driving, coordinating the integration and collaboration of cabin, power, and body domain functions.

2) Sales expenses: Increased advertising and sales personnel drive a sequential increase of 140 million yuan

Leapmotor's sales expenses in the fourth quarter were 690 million yuan, a sequential increase of 140 million yuan, exceeding market expectations of 440 million yuan, mainly due to an increase in sales personnel and increased investment in advertising Leapmotor continues to adhere to the "1+N" channel development model, accelerating channel expansion and transformation, further expanding coverage in blank cities and accelerating penetration into county-level cities.

In the fourth quarter, Leapmotor net added 202 sales stores and 71 service stores, with new coverage in 60 cities. Channel expansion continued to accelerate compared to the third quarter, and channel penetration also reached more consumers with a budget of 100,000 to 200,000 yuan for purchasing cars, accelerating sales conversion.

By 2025, Leapmotor's channels will continue to grow significantly, increasing from 695 stores at the end of 2024 to 1,000 stores by mid-2025, and then to 1,500 stores by the end of 2025, supporting the achievement of high sales targets for 2025.

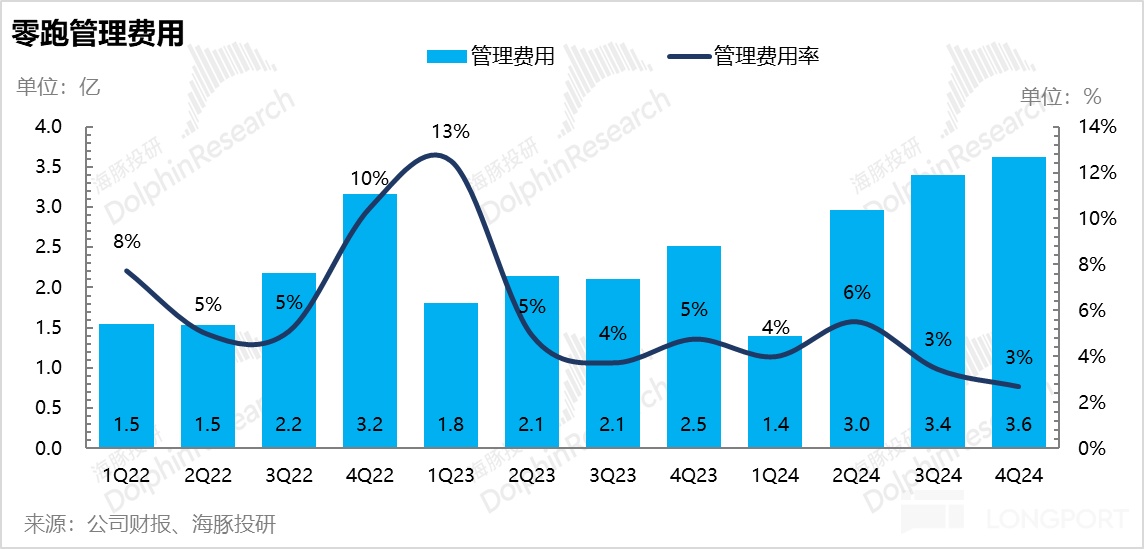

3) Management Expenses: Relatively Reasonable Control

This quarter, management expenses were 360 million yuan, an increase of 20 million yuan quarter-on-quarter, which is relatively reasonable, mainly due to the increase in administrative personnel with business expansion, as well as the increase in taxes and additional fees.

Due to a significant increase in revenue and gross margin this quarter, the operating profit has achieved breakeven (-40 million yuan, an increase of 700 million yuan quarter-on-quarter), and the net profit margin has reached 80 million yuan, successfully turning positive (one year ahead of the company's current plan), becoming the second new force to achieve breakeven.

Dolphin Research Historical Article Reference:

August 15, 2024 Financial Report Commentary "Leapmotor: Revenue and Gross Margin Both Below Expectations, Can It Reverse the Decline in Overseas Markets?"

August 16, 2024 Conference Call Minutes "Maintain 2024 Sales Target of 250,000 Units and Annual Gross Margin Target of 5%" 2024-05-17 Financial Report Review: Gross Margin "Turns Negative," Can Leapmotor "Carve" a Path Abroad?

2024-03-25 Financial Report Review: Gross Margin Continues to Rise, Can Leapmotor "Lead" in Going Abroad?

2024-03-26 Conference Call Minutes: Full-Year Gross Margin Expected to Maintain 5%-10%

2023-10-16 Financial Report Review: Gross Margin Successfully Turns Positive, Has Leapmotor Finally Started to "Cross the Life-and-Death Line"?

2023-10-17 Conference Call Minutes: Gross Margin Expectations Continue to Improve, Is the Investment Opportunity for Leapmotor Here? (Leapmotor 3Q Conference Call Minutes)

2023-08-25 Financial Report Review: Leapmotor: Gross Margin Continues to Struggle to Turn Positive, When Will the "Xiaomi of the Auto Industry" "Lead"? September 29, 2022 Deep Report “Leapmotor: After a 30% Plunge Post-IPO, Is the ‘Redmi Version of XPeng’ a Scam or a Real Opportunity?”

This article's risk disclosure and statement: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.