Their views should be interpreted in reverse because they're all correct but meaningless statements.

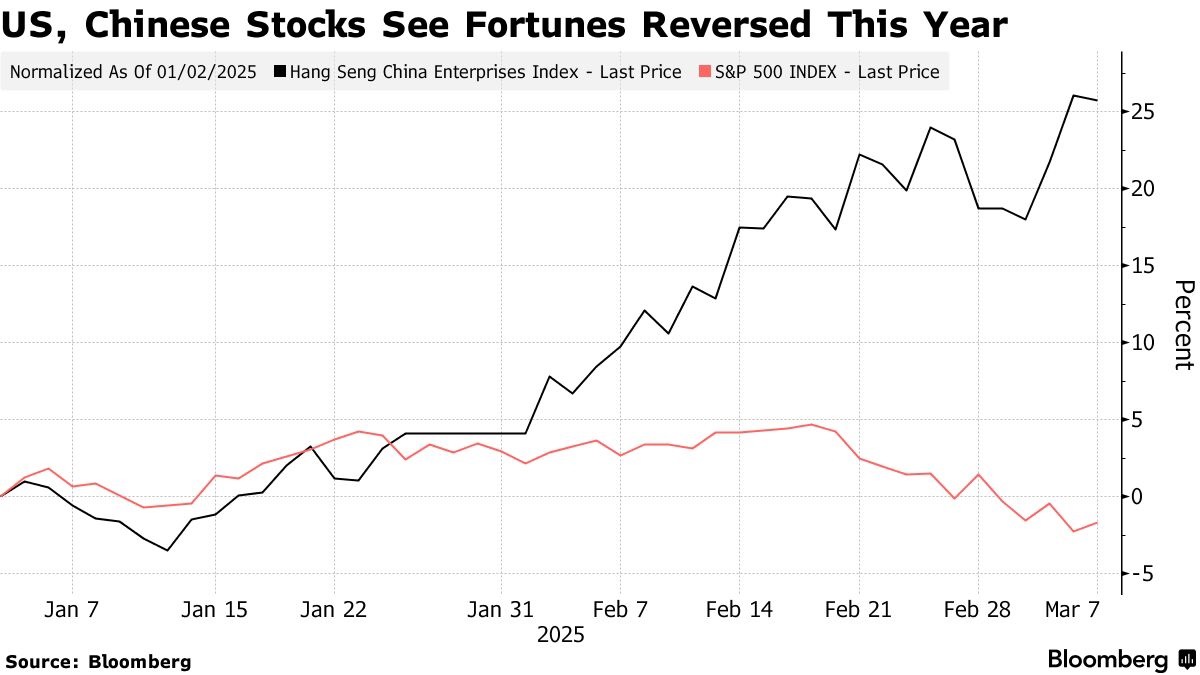

Citigroup downgraded its rating on U.S. stocks while upgrading Chinese stocks to overweight.

This is another sign of the widening divergence in outlook between the world's two largest markets. Citigroup strategists wrote in a March 10 report: "U.S. exceptionalism will at least pause in the coming months."

A team at HSBC Holdings PLC also downgraded U.S. stocks to neutral on Monday, saying they see "better opportunities elsewhere at present." Weller and his team wrote: "U.S. economic news is likely to underperform the rest of the world in coming months." They added that the neutral view on U.S. stocks applies to a three-to-six month timeframe, expecting more negative U.S. data.

Citigroup strategists wrote that Chinese stocks still appear attractive even after recent gains, citing breakthroughs in DeepSeek's AI technology, government support for the tech sector, and still cheap valuations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.