$Taiwan Semiconductor(TSM.US) is expected to lower its 2025 revenue growth guidance to around 20%. The market seems to be pricing in 15-20% growth. If the new guidance is 20-25% (low 20%), it would likely exceed expectations.

From my observation, TSMC tends to be a conservative company. For example, in Q1, they lowered their revenue guidance to the lower end of the previous range of 250-258, close to 250, while the actual result was 255. This has happened multiple times before, so I think there's a 60% chance that their actual full-year revenue will be slightly higher than the new guidance they provide tomorrow.

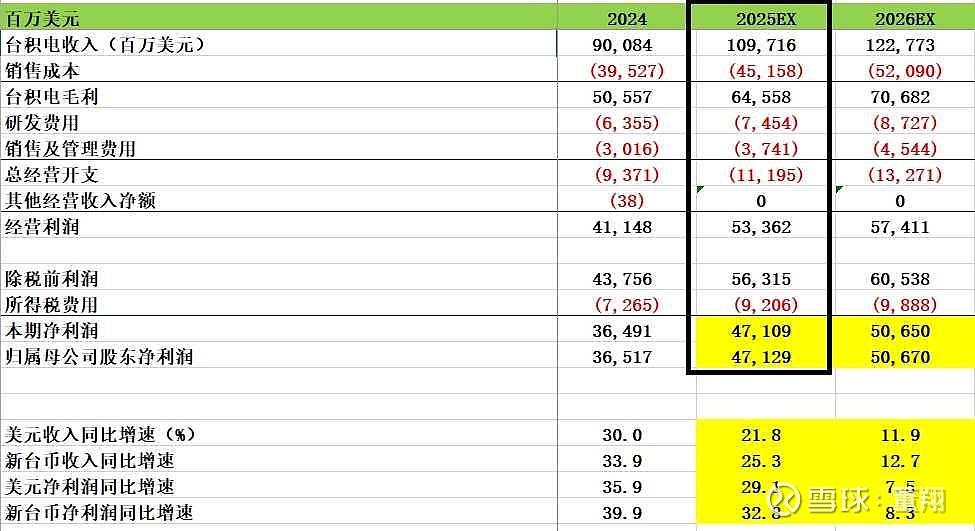

My personal view: After all the recent fluctuations, I've revised down TSMC's 2025 revenue growth forecast to 21.8% YoY, reaching $109.7 billion, with net profit growth of 29% to $47.1 billion. Note that actual results are almost always equal to or higher than management's guidance. So if the company guides for around 20%, it might actually achieve 23-24%. If they guide for 15-20%, it could be 18-21%.

Of course, to be honest, with Trump's policies and uncertain tariff impacts, there's still a lot of uncertainty. Even TSMC's management can't be entirely clear. Therefore, the company will likely provide guidance based on a wide range of scenarios, choosing a conservative estimate.

Based on my standards, revenue growth would be 21.8% to $110 billion, with net profit at $47 billion. At yesterday's closing price of $157 (market cap of $816 billion), and assuming a 4% drop tonight to $151 (market cap of $783.4 billion), the 2025 P/E would be 16.7x.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.