US stock market review on September 29: limited pullback, gold hits new high, can we still chase Apple and HOOD?

[Yesterday]

Three major indices: All rose collectively yesterday, with the overall intraday trend still opening high and closing low, a volatile market. Defensive shifts ahead of the shutdown risk led to a higher close for the Dow, with gold also affected similarly.

Shutdown: U.S. President Donald Trump met with congressional leaders at the White House on September 29 to discuss avoiding a government shutdown. The U.S. Bureau of Labor Statistics stated that if the U.S. government shuts down, the agency will suspend all operations and will not release economic data during the shutdown.

Currently, the main disagreements between the two parties focus on healthcare subsidies, immigration, and border security issues. The shutdown still affects the formula for macroeconomic data. Without guidance, expectations are key, and current expectations are generally positive.

Federal Reserve: Fed's Williams stated that monetary policy remains restrictive and still has the conditions to exert downward pressure on inflation. There is still a long way to go to achieve the 2% inflation target, and the labor market has shown significant resilience. The Fed will decide on monetary policy meeting by meeting.

In short, take it slow.

Storage: Morgan Stanley significantly raised the target prices for two storage companies. Western Digital's target price was raised from $99 to $171, and Seagate Technology's target price was also raised from $168 to $265. Western Digital is also the bank's "top pick."

As part of Western Digital's spin-off, SanDisk has a smaller market cap but high speculative sentiment. This sector is also a theme extended from AI infrastructure.

Movie Tariffs: Trump posted on social media on the 29th that he would impose a 100% tariff on all movies produced outside the U.S.

DeepSeek Price Cut: Announced that due to significant cost reductions in new model services, official API prices have been lowered accordingly. The new prices take effect now, reducing developer costs for calling DeepSeek API by over 50%.

[Today]

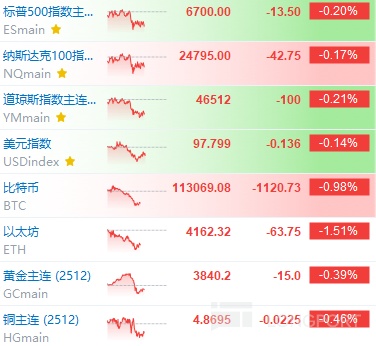

Futures slightly down, gold slightly down, crypto correcting.

Currently, the pullbacks in pre-market are mostly short-term, even for crypto, which saw larger declines, it's sentiment-driven resistance pullbacks. Tonight's overall market is still volatile, waiting to see the outcome of the shutdown.

On a side note, Goldman Sachs upgraded global stocks from "neutral" to "overweight" on Monday, noting that global economic momentum is improving over the next three months, valuations are attractive, and monetary and fiscal policy support is strengthening. Goldman pointed out that during the late-cycle slowdown phase, when recession risks are low and policy support is strong, stocks tend to perform well.

[Stocks]

Apple: JPMorgan stated that demand for the iPhone 17 series in its third week on the market is stronger than the same period last year. Delivery times for the base, Pro, and Pro Max models remain high, with average times shortening by only 2 days, much slower than last year. While the Air models performed weakly, demand for high-end models remains strong.

As a long position holder in Apple since July-August, the gains have already exceeded expectations. The rally is driven by sales performance, and with earnings landing in late October, expectations are already fully priced in. Facing resistance at previous highs and lacking strong upward catalysts, I'm leaning toward reducing positions.

HOOD: CEO Vladimir Tenev announced on X that Robinhood has aggressively entered the prediction market, where users can bet on high-profile events like elections and sports. This move drove the stock up over 12% on Monday.

Robinhood really nails retail speculative sentiment—options, crypto, betting. The expansion into this sector has significantly improved fundamentals, moving beyond pure finance into lifestyle integration, which is very effective for user base growth. With the stock hitting new highs, I'm still planning to increase my position.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.