Posts

Posts Likes Received

Likes ReceivedFocus Media: Disappointing Results? Wave Goodbye and Look to the Future

Hello everyone, I'm Dolphin!

On April 28th Beijing time, Focus Media released its full-year results for 2022 and the first quarter of 2023. Since the first three quarters of 2022 were already known and the performance forecast was already disclosed at the beginning of the year, we won't focus on how "terrible" the past was, but rather on how much "luck" there is in the future -- the key is to look at the future growth trends implied by the first quarter and current industry environment, and of course, more detailed operating data in the annual report may also reveal more information.

The main points are as follows:

1. Dark beginning: At the beginning of this year, Focus Media issued the earnings of 2022, which that only net profit attributable to shareholders was given -- a year-on-year decline of about 53%, it can also be used to calculate the operating pressure of Focus Media in the last three months of last year.

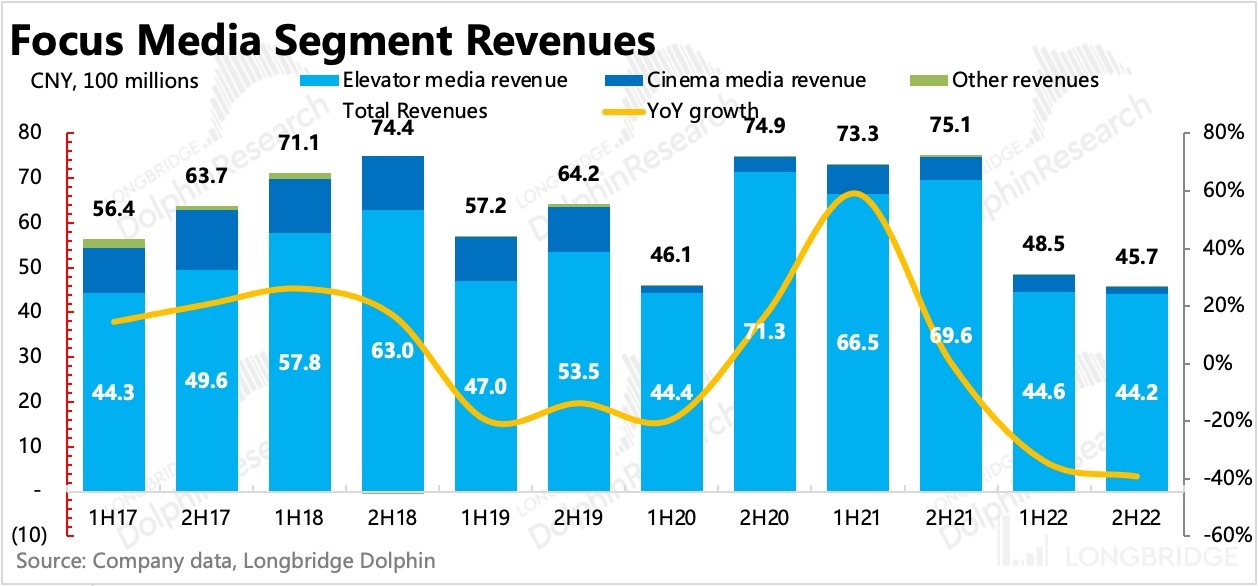

Just when the epidemic reached an adjustment stage and the market was expecting a new recovery, Focus Media was hit by another heavy blow because of a peak in infections -- its revenue accelerated by 44% to less than 2.1 billion in the fourth quarter, almost as bleak as the "darkest" second quarter of 1.9 billion.

2. Dawn has arrived: Only after passing the peak of infections did offline consumption truly begin to recover. In the first quarter, Focus Media's revenue reached 2.58 billion yuan, down 12% year-on-year, but up 25% sequentially, indicating a clear improvement in market demand.

If we roughly calculate month by month based on actual experience, the revenue in March is likely to have exceeded 1 billion yuan, which means that revenue of more than 3 billion yuan in the second quarter is not difficult.

At that time, due to the low base caused by the "darkest" second quarter of last year, coupled with the marketing atmosphere of the shopping season, it is not too exaggerated to expect an "explosive" growth.

3. Profit turnaround ahead of revenue growth: As we all know, Focus Media's costs have always been rigid (70% of costs are rent, 10% are depreciation), so when revenue declines, it will inevitably bring more brutal deterioration in financial figures, such as a 60% decline in net profit when revenue in the fourth quarter declined by 44%.

On the contrary, when revenue returns, the rebound in profit will also be considerable. But in order to make itself "resurrect" more quickly, Focus Media has not completely stood still in the bottom range of this economic cycle. It can apply for rent reduction where possible, optimize media locations that need optimizing, and lay off employees where necessary.

With 3.3 billion of cash and 4.6 billion of short-term investments, it can wait peacefully for dawn.

Therefore, even though revenue in the first quarter was still down 12%, net profit had already increased year-on-year ahead of time by 360 million yuan, cost savings were 90 million yuan, and taxes, fees, and credit impairment were 300 million yuan, which brought back the profit. After excluding non-operating income and expenses such as investment income, the decline in core operating profit also shrank from -70% in the fourth quarter to -5%.

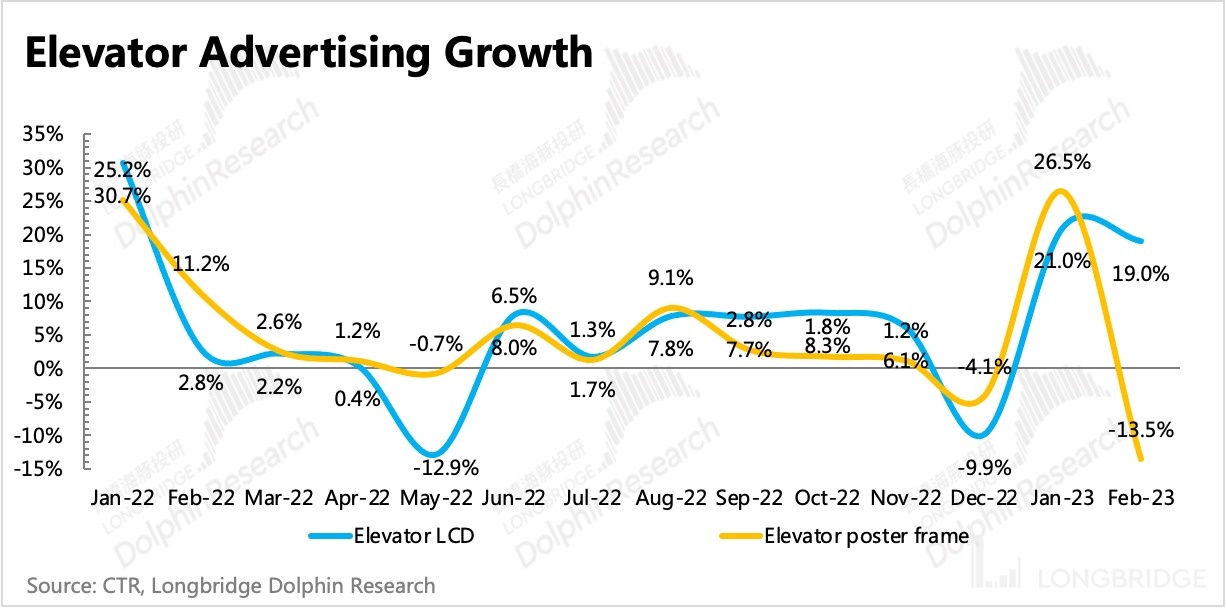

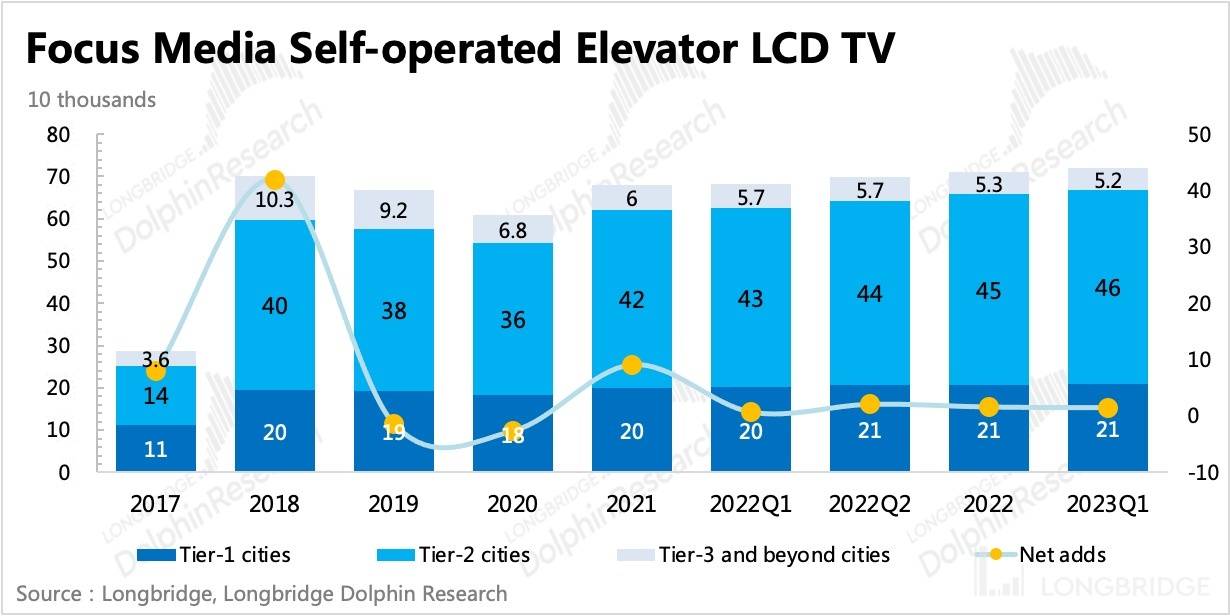

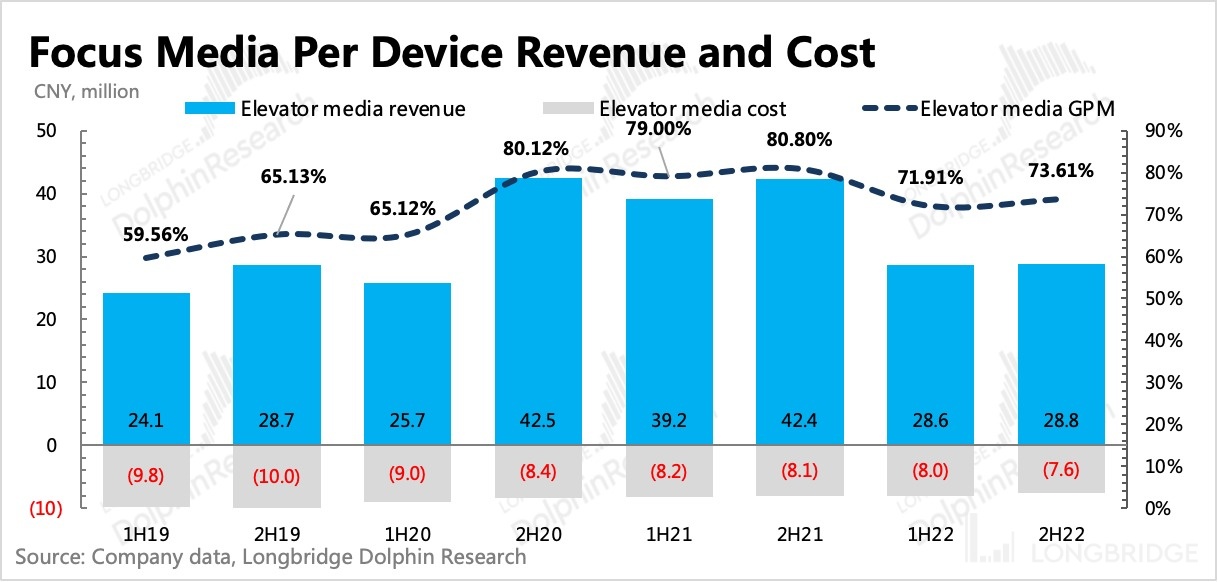

4. Profit improvement is not just about shrinking: Under the same strategy of reducing costs and increasing efficiency, different companies adopt different programs and implementation paths. Why do we say that Focus Media is not squeezing out profits by just shrinking? Last year's second half to present, Focus Media has been increasing its elevator TV media equipment, and the number of elevator posters began to expand again in the first quarter of this year. From the average gross profit margin of a single media point, the gross profit margin in the second half of last year was better than the first half, and the gross profit margin per point in 2022 was also higher than in 2020 and 2019. This indicates that Focus Media has partially optimized its overall economic model by expanding high-benefit points while closing low-benefit points.

Although there was no forecast for this year in both financial reports, the management's outlook and coping strategies for the next two years are crucial. I suggest paying attention to the performance conference calls. DolphinJun will also release the summary on the investment research user group and the Changqiao APP as soon as possible. If interested, you can add the WeChat account "dolphinR123" to join the group.

As for the key performance indicators compared to market expectations: overall, the performance in the fourth quarter was not good, and the revenue was significantly lower than the market's expectations. As for the first quarter, BBG did not collect any valid market expectations. DolphinJun believes that the revenue will be average in the first quarter, but the profit margin will be repaired to some extent.

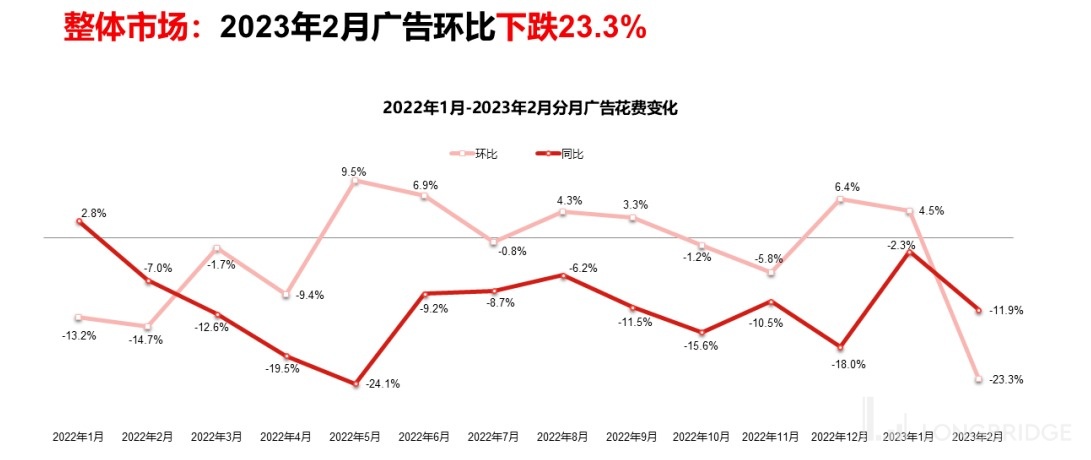

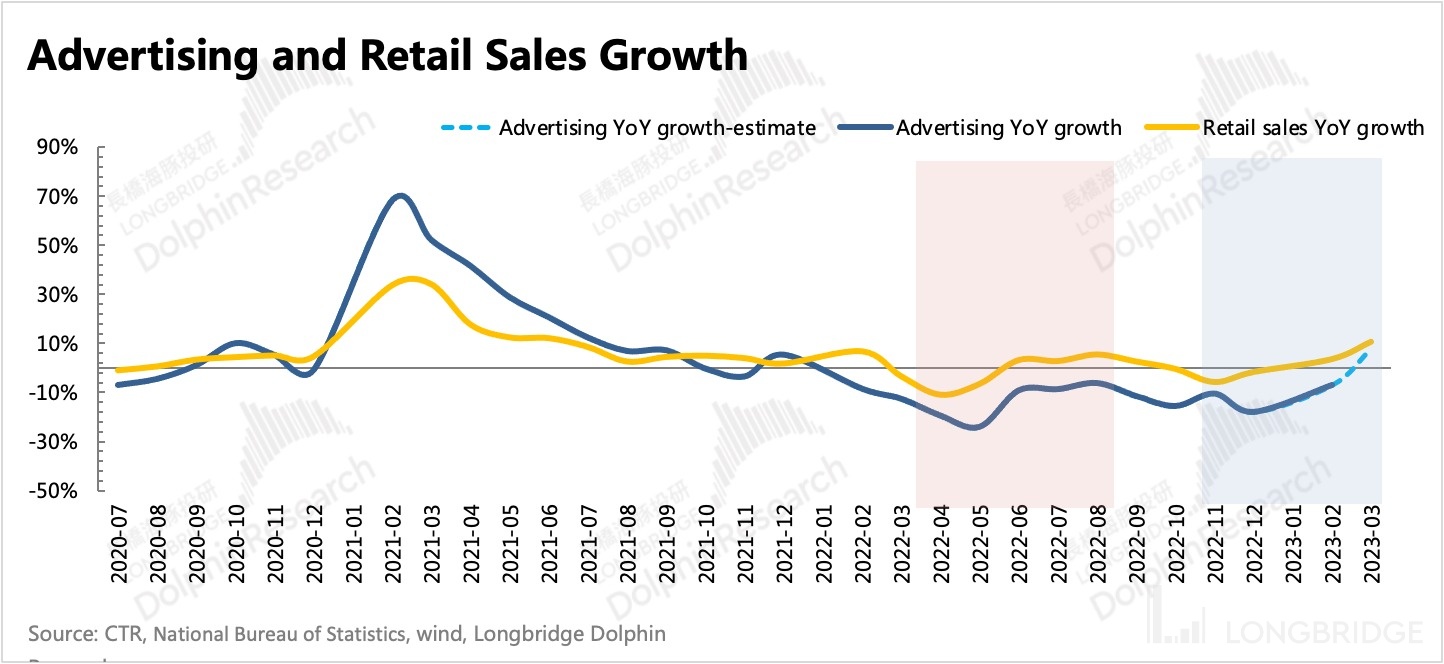

Focus Media's revenue has gone through a story of going from bad to excellent, but the market's expectations are high and have also misjudged the pace of merchant marketing budgets since the liberalization (the dividend of effect advertising will still be popular for some time), making the February advertising growth rate of CTR a vital factor in suppressing Focus Media's short-term valuation.

Whether the consumption has recovered or not is a problem surrounding the consumer industry. With a dominant market share of nearly 60%, it has become the lifeblood that affects Focus Media's expectations. DolphinJun believes that the consumption recovery is real, but the speed of merchant advertising on product promotion is just a bit slow. Slow does not mean falling behind. From the perspective of repair elasticity, we are more optimistic about the growth rate of product promotion advertising being higher than that of effect advertising this year.

In such a tough environment, Focus Media, which actively seeks improved efficiency, is expected to see not only the repair of revenue and the natural recovery of the profit margin during this year's recovery period but also to leverage its highly efficient operational capabilities to accelerate the realization of a more excellent profit margin level. From a valuation perspective, according to the consistent expectations and DolphinJun's estimation, the current market value of 93 billion corresponds to 4.5 billion net profit attributable to the mother in 2023, with a PE ratio of 20x. Looking back at the period when the performance began to take off, the market sentiment would push forward PE to a range of 25x-30x. Therefore, there is still room for the current valuation to increase. [image]: https://pub.lbkrs.com/cms/2023/0/vEa1QMJEsHUdFXjk6QQXUmi7Sg3fLBuq.jpg

Detailed interpretation of this season's financial report

1. The last hammer before dawn, revenue is worse than expected.

In the fourth quarter, Focus Media's total revenue was only 2.06 billion yuan, a year-on-year decrease of 44%. Due to the impact of the high national infection peak at the end of the year, the revenue deteriorated faster than expected, with a level of devastation almost the same as that of the second quarter.

However, because some institutions remained optimistic about the rebound of consumption after the epidemic prevention adjustment, and some institutions did not adjust their expectations in a timely manner after Focus Media issued a complete annual performance forecast at the beginning of this year, the BBG market's consensus expectations were relatively lagging behind, reflecting a "shocking gap."

However, after comparing the latest expectations of several top brokerage firms after adjustment, the revenue side is still weak, but the shocking level has been greatly reduced.

In the first quarter, Focus Media's income had already improved significantly compared to the previous quarter, but still fell by 12%. If the monthly income of the fourth quarter and the first quarter of this year are roughly estimated based on the year-on-year growth rate of CTR advertising price, changes in the mass infection cycle, and the impact of the low traffic in buildings during the Spring Festival, then the monthly income of March can reach more than 1 billion.

With this plus the second quarter itself being a shopping season, with heavy marketing atmosphere and brand marketing efforts, it is not difficult to achieve a revenue of 30-35 billion.

Considering that last year's second quarter was the quarter with the lowest single-quarter income since the epidemic, the base is low enough, so it is expected to achieve an "explosive" rebound.

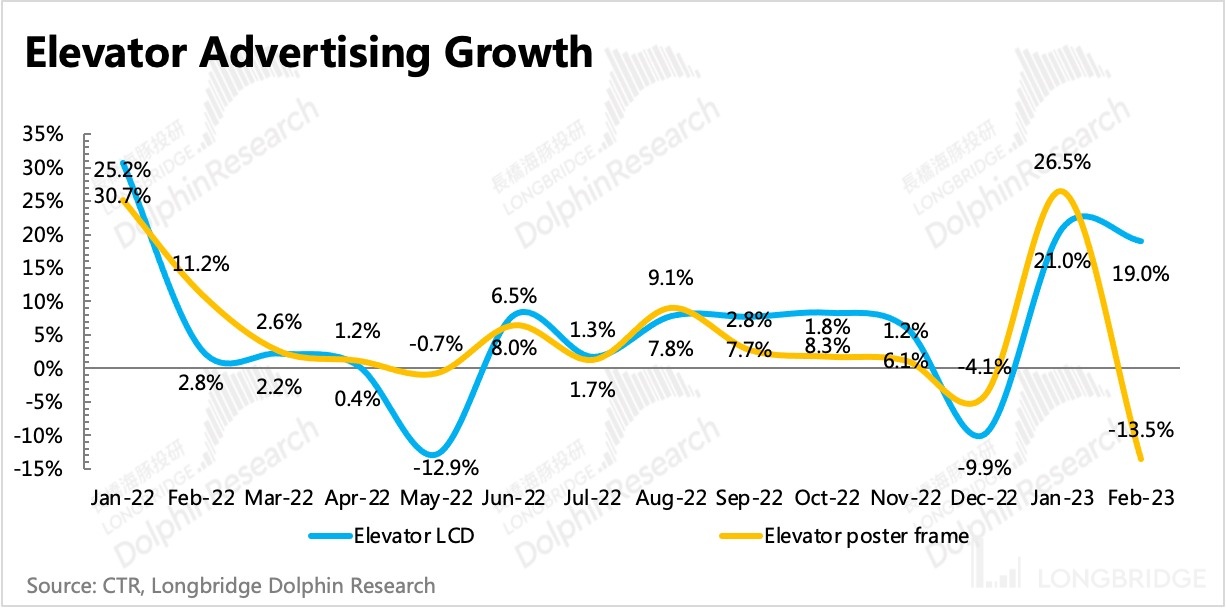

The February CTR ad growth rate came out, which scared the market because the trend of gradual recovery month by month was broken by the accelerated decline of negative 12% in February. What caused this?

Dolphin believes that the unexpected decline in February may be related to three factors:

1. It is inevitable that the slow pace of consumption recovery has a certain relationship, which is also the main reason for the poor performance of consumption in the first quarter.

2. At the same time, it is also related to the short-term excessive marketing investment before the offline travel recovery and before the Spring Festival in January. According to previous years, after the overall advertising market was hot in the 11-12th months e-commerce festival, January often enters a turning period of declining environment. However, this January's environment has a positive growth rate on a month-on-month basis, so it cannot be ruled out that companies, especially consumer product companies, have made advanced investments during the World Cup and Spring Festival effects.

3. In the early stage of economic recovery, there is still a certain dividend period for effective advertising. When the economy is in a downturn, companies will first cut brand advertising and relatively prefer effective advertising. When the economy slowly recovers, brand advertising will not immediately rebound, but will be gradually increased in budget allocation by companies during the process of economic recovery. Therefore, in February, traditional advertisements such as offline and television suffered more hits.

Against this backdrop, can advertising in the second quarter rebound as planned? Dolphin believes that the trend of recovery remains unchanged, and there is hope for a comprehensive rebound in the second quarter with the support of the shopping season.

- There is a high correlation between advertising and social zero fluctuations, and relative strong growth has already appeared in social zero in March. Therefore, Dolphin believes that advertising demand will not be too bad, and an upward repair following the degree of social zero volatility is a high probability event.

- In addition, although the performance of the advertising market is not good, ladder media has not fallen down together. With unique offline traffic, the growth rate of LCD ladder media remains strong, but elevator posters have declined along with the industry due to their lack of dynamic viewing. The trend of elevator posters being replaced by LCD is becoming increasingly evident, but due to the high replacement cost, the progress is not very fast. In recent years, Focus Media has been reducing elevator poster sites and increasing LCD TV sites.

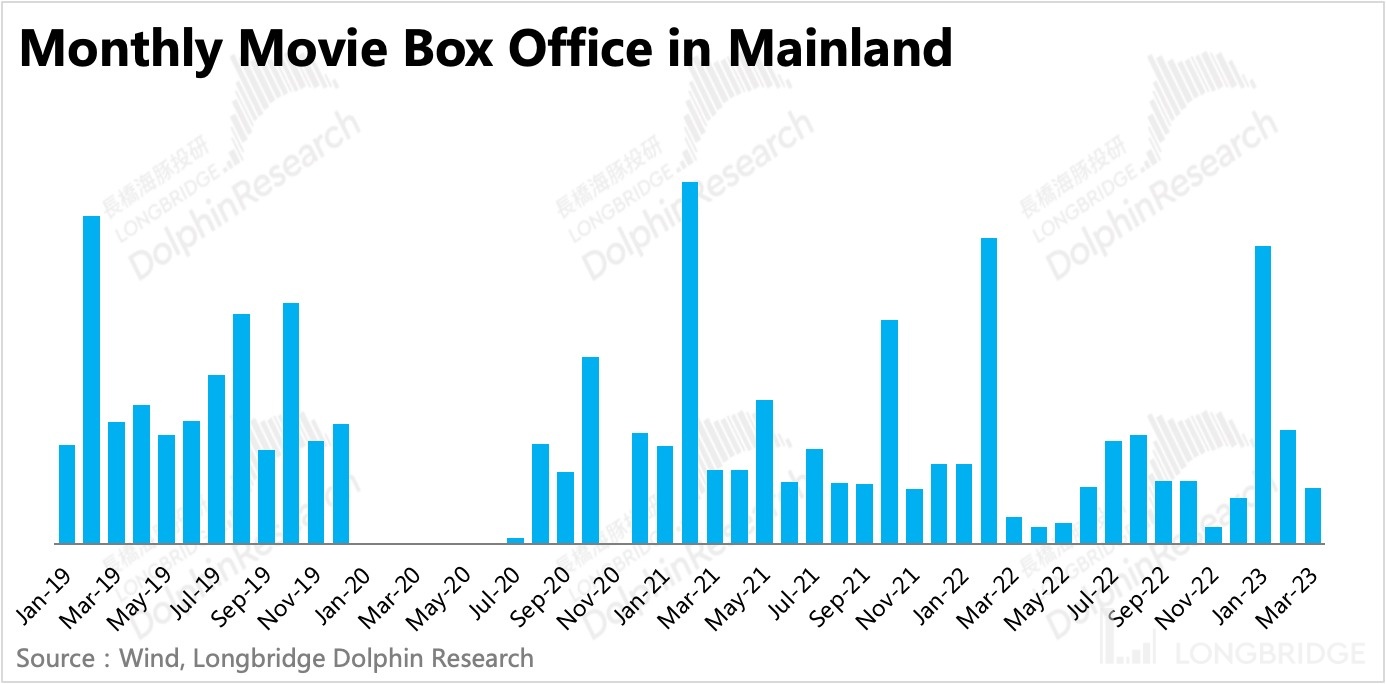

Second, cinema contributes little, but there is strong repair expectation this year.

In terms of revenue contribution, due to the poor performance of the movie market throughout 2022, ladder media revenue share further increased to 97%. However, the ladder media itself is also miserable, with only CNY 4.4 billion in revenue in the second half of the year, almost half of the peak period in the same period of 2020. Therefore, when offline economic activities return to normal this year, there is a lot of room for rebound in ladder media revenue.

Although cinema advertising accounts for a low proportion, it was very poor last year, with only CNY 146 million in the second half of the year, comparable to the first half of 2020, when national travel was restricted due to the epidemic. The bleakness of cinema advertising in 2022 was not only related to epidemic prevention policies, but also to the impact of scarce high-quality movie supply in a special year.

Therefore, as the year gradually returns to normal with orderly implementation of regulations and relaxation, the rebound in both movies and cinema advertising will be quite substantial.

During the past three years of the pandemic, Focus Media has stopped cooperating with some low-efficiency and low-traffic cinemas and screening halls. The coverage has dropped from 19,270 cinemas with 13.6 million screening halls in 2021 to only 1,680 cinemas with 12,000 screening halls in the first quarter of 2023.

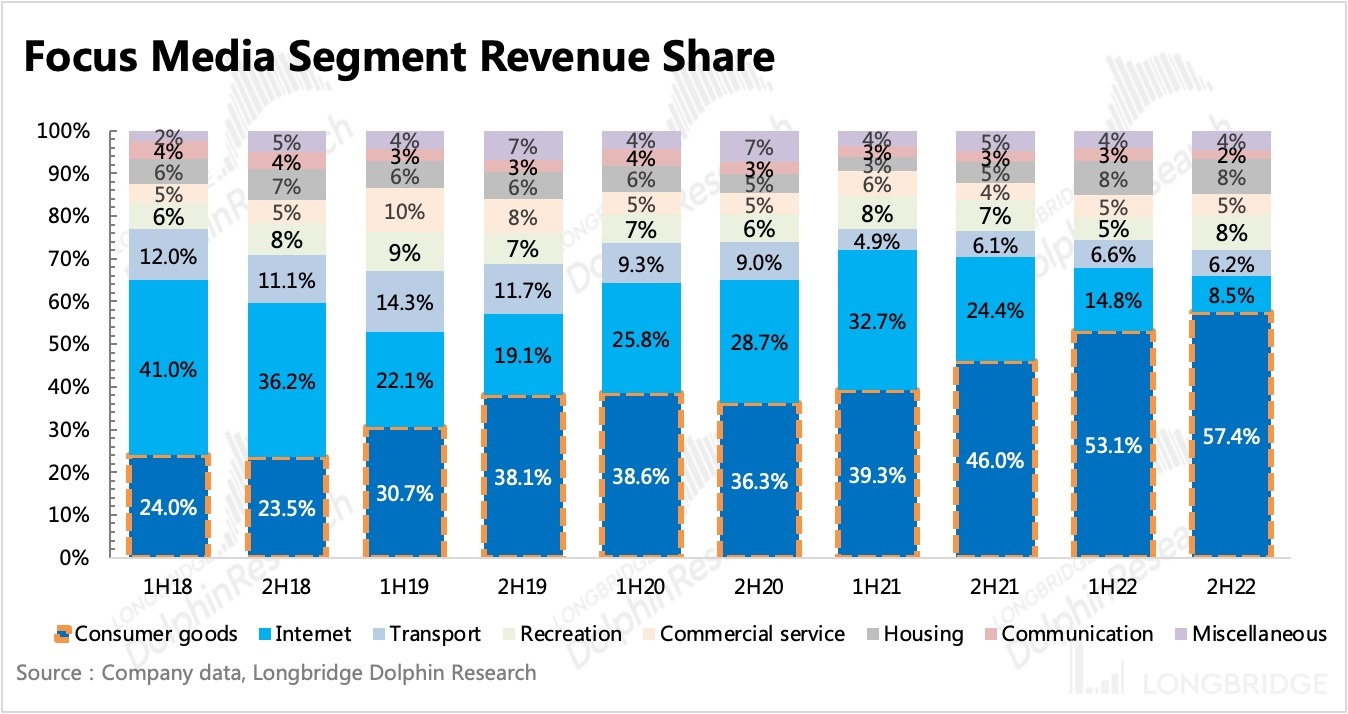

Thirdly, consumers have become the first major customer, but the internet may have already hit bottom. As Internet companies began to implement cost-cutting measures and increase efficiency last year, and continued to do so in the second half of the year, the Internet is no longer a customer segment that significantly influences Focus Media, and consumerism quickly became the primary source of revenue.

However, with the gradual end of cutting costs and increasing efficiency in the Internet industry this year and a return to a period of expansion and competition, marketing expenditures may increase again. Although it will definitely be more moderate than the extravagant spending of around 2018, it is unclear when Internet companies will stop shrinking and when their impact on Focus Media's performance will disappear.

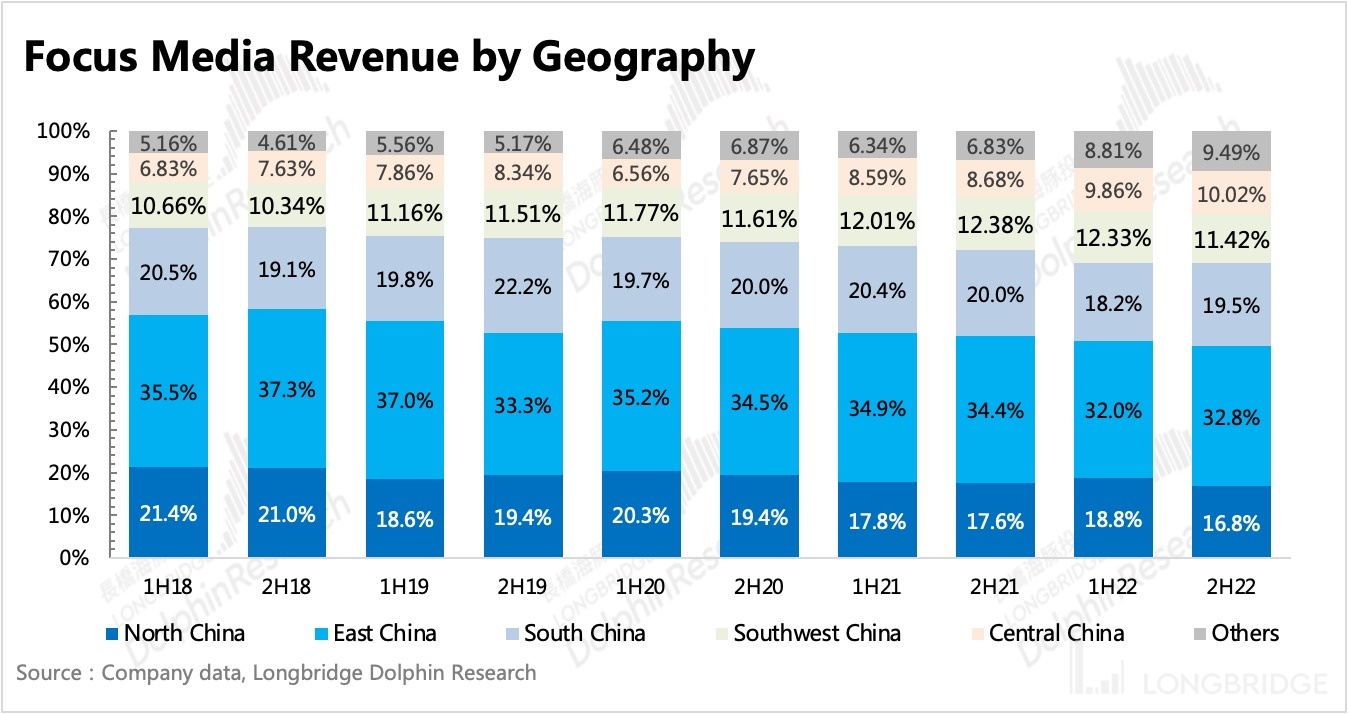

In different regions, the impact of the Shanghai epidemic was heavy in the second quarter, but the decline in the income of the Eastern region in the second half of the year was not the most significant. Currently, Focus Media still relies heavily on the contributions to revenue from the Eastern and Southern regions.

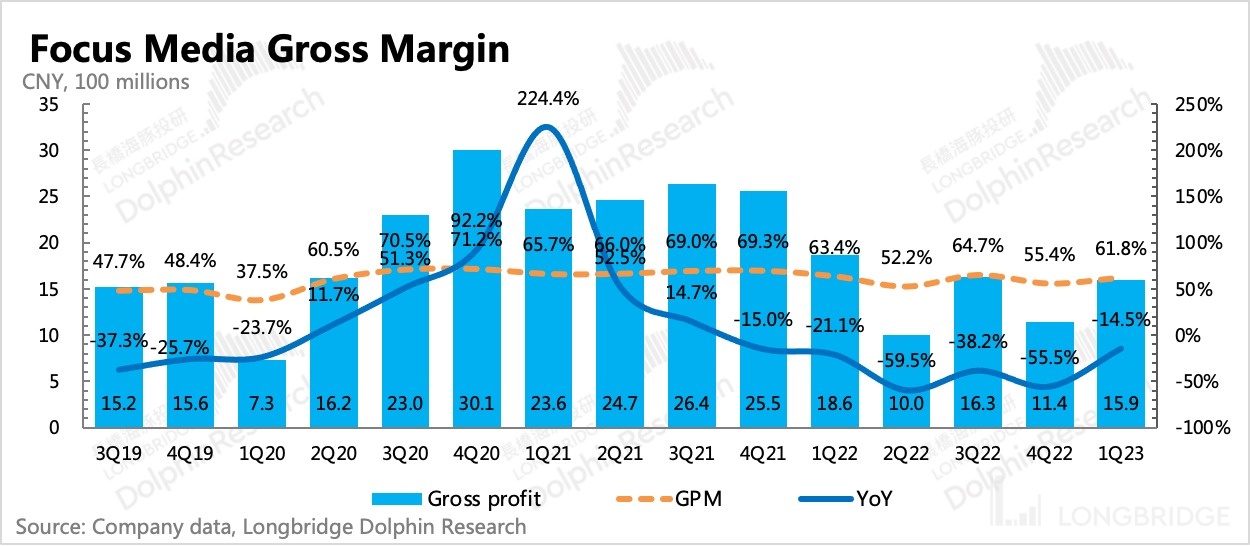

Finally, improving profits is not just about contraction, but also about repairing and expanding: Focus Media's gross profit margin fell to 55% last year due to revenue pressure, but rebounded to 62% in the first quarter after a revenue recovery. However, in the second half of last year, the average gross profit margin of individual escalator media was higher than that in the first half of the year. Even under economic pressures such as offline closures and high infection peaks, it did not return to its low level of 2020, indicating a significant improvement in the optimization of media.

In addition, there is cinema advertising. Because the industry was in a downturn, the purchase cycle was greatly reduced, and the gross profit margin was released. However, this gross profit margin is unlikely to be sustainable. The cost of Focus Media is comprised of the rent, employee salaries, equipment depreciation, and other costs of media placements, with the rent of media placements accounting for 70% of the total cost. Apart from the rental price of individual placements, the cost is also influenced by changes in the number of placements.

Since the second half of last year, the absolute value of Focus Media's operating costs has been decreasing, mainly due to the optimization of placements, including elevator and cinema media. With the resumption of expansions, there are signs of a rebound in Focus Media's costs after a year of continuous optimization.

Dolphin Jun believes that the cost situation in the fourth quarter is still lower than in 2020, already reflecting a relatively extreme state. Without any technologies or means to optimize the current costs, such as AI technology reducing content generation costs or changes in cooperation with property companies, it is difficult to expect further optimization optimistically.

The upward trend in costs in the first quarter further confirms Focus Media's trend of resumption of expansions. We expect costs to continue to rise in the remaining three quarters. However, Q1's gross profit margin also rebounded significantly to 61.8%, demonstrating the spring effect of Focus Media's income and profit.

In terms of expenses, Focus Media has also undergone operations such as layoffs and reduced promotion. Therefore, the core operating profit margin of the main business has increased by 4% compared to the previous quarter, mainly due to a 7% optimization of costs. Finally, the net profit attributable to shareholders in Q1 was 940 million yuan, which is basically in line with the guidance, an increase of 1.3% year-on-year, and the net profit margin increased to 36.6%, but there is still a gap compared to the peak.

Finally, excluding non-operating gains and losses and focusing only on the profitability of the main business, Q1 achieved a profit of 940 million yuan, a year-on-year decrease of 5.3%, and a margin of 36%. Compared to the overall net profit, the elasticity of the Q1 margin repair has decreased slightly, but the trend of the repair has not changed. [image: longbridgeapp.com]

Research on Changqiao Dolphin and "Focus Media" History:

Financial report season

October 31, 2022 "Focus Media: Going through the darkest moments, but cannot escape the fate of the cycle."

August 17, 2022 Telephone Conference "Consumer goods are resilient, and we must control costs and wait for real recovery (Summary of Focus Media 1H22 Telephone Conference)"

August 16, 2022 Financial Report Criticizing the Article "The Collapse of the Internet, Focus Media "Collapsed""

July 14, 2022 Financial Report Criticizing the Article "Profit Declined by 70% in the Second Quarter, Focus Media Knelt Again to the Performance "Pit""

April 29, 2022 Telephone Conference "March revenue fell by 45%, Focus Media is in trouble (Summary of Telephone Conference)"

April 29, 2022 Financial Report Criticizing the Article "Focus Media "Blood Flows into a River"? After a Desperate Situation Comes an Opportunity"

November 4, 2021 Financial Report Criticizing the Article "Starting from Focus Media: Expectations for Internet Advertising are worth "lowering again""

August 26, 2021 Telephone Conference "Shrinking, disappearing, and standardizing, business in the second half of the year is not easy (Focus summary)"

August 25, 2021 Financial Report Criticizing the Article "Focus Media: Seems good? Actually, it's a "big thunderstorm""

April 23, 2021 Telephone Conference "Post an incomplete summary of the Focus Media Telephone Conference" Depth

On December 21, 2023, "Warm and Cold Consumerism? The Advertising Spring That Cannot Be Stopped" (link)

On August 2, 2022, "Going into the Gold Mine Again? Is Focus Media a "Gold" or a "Pit"" (link)

On July 12, 2022, "Focus Media: The "Desperate Saburo" who Crazy Persists in Changing Fate" (link)

**Risk Disclosure and Statement of this Article: ** Disclaimer and General Disclosure of Dolphin Investment Research

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.