Posts

Posts Likes Received

Likes ReceivedProfit surges over 150%, is Focus Media turning the corner?

Hello everyone, I am Dolphin!

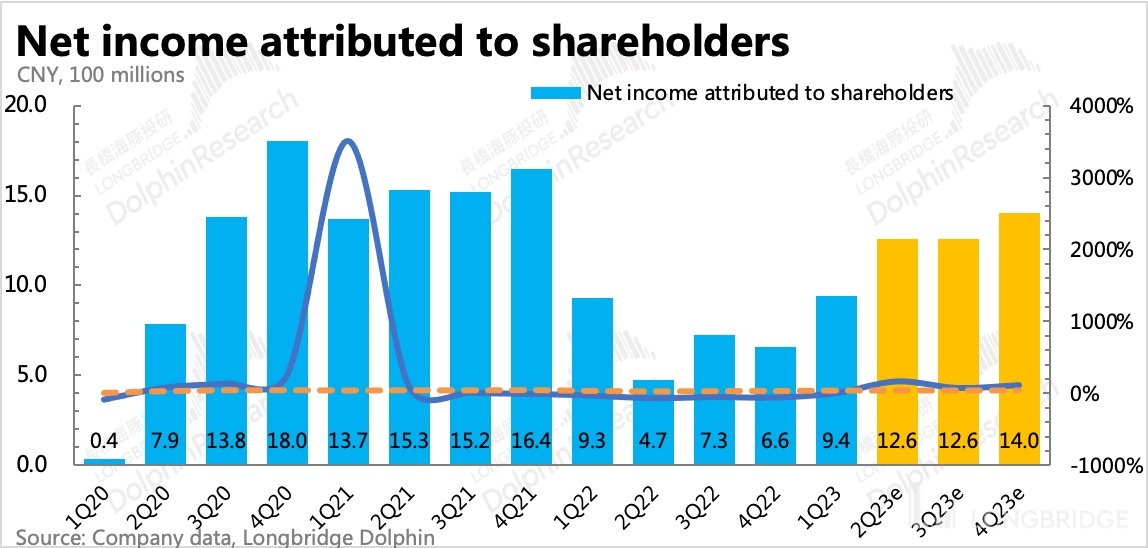

Last night, Focus Media released its performance forecast for the first half of this year: the net profit attributable to the parent company is expected to be between 2.15 billion and 2.28 billion, a year-on-year increase of 53.2% to 62.5%. Looking at the second quarter alone, net profit is expected to increase by 155% to 170% compared to the same period last year.

It is not surprising that the performance has soared year-on-year. After all, the key region for Focus Media's advertising revenue, East China, was basically locked down last year, and the flow of people in office buildings decreased significantly. The business performance of Focus Media in the first and second quarters of last year was severely affected. Therefore, the base was low, and this year's growth is naturally relatively easy.

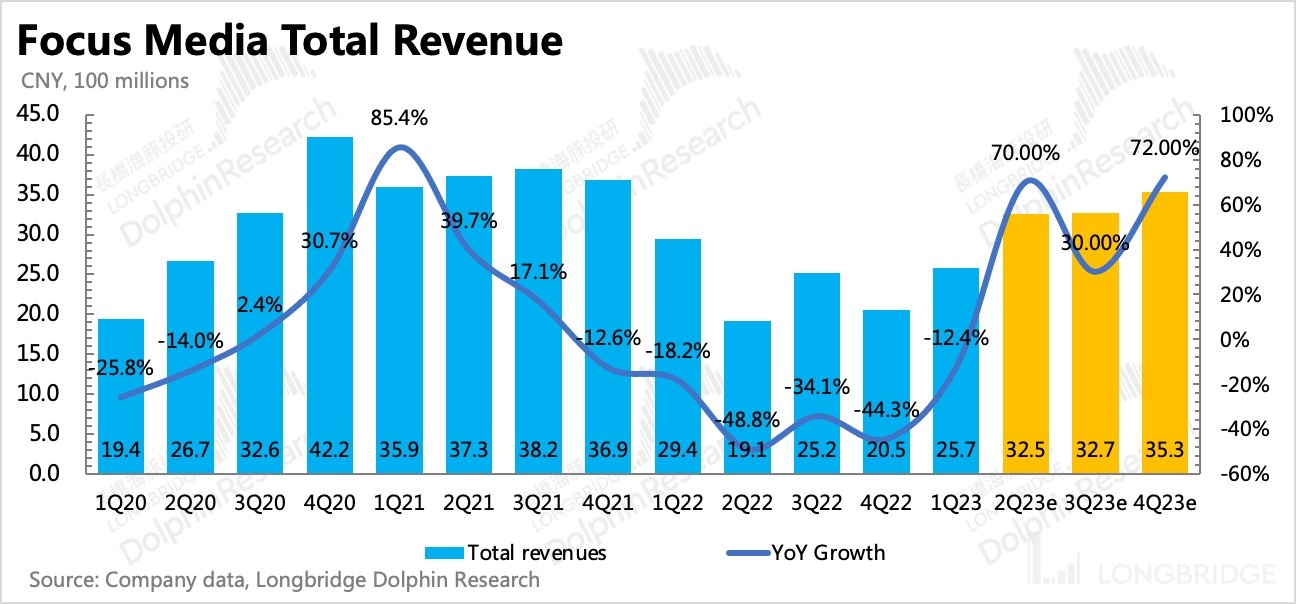

Therefore, year-on-year growth can be misleading, and marginal changes are more important. The performance forecast implies a net profit of around 1.25 billion for the second quarter, corresponding to a revenue of over 3 billion, which means a recovery to the level of the same period in 2019, but obviously lower than the level of the same period in 2021, which is within expectations of a "weak recovery".

Whether Focus Media can stabilize at 100 billion depends on whether it can achieve a profit of 5 billion for the whole year. Judging from the marginal recovery in the second quarter, there is hope, but it requires that consumer goods sales do not worsen. In addition, Focus Media announced a 10% price increase starting in July last week. If there is an overall increase of 5% in the second half of the year, it is expected that a profit of 5 billion is still achievable.

In addition, Dolphin has expectations for the growth of e-commerce advertising (intensified platform competition), new energy vehicle advertising (launch of multiple new products), and cinema advertising (summer and National Day box office) in the second half of the year, hoping to make up for the slowdown in traditional consumer goods demand.

Currently, Wind's consensus expectation of 4.7-4.8 billion does not include the latest positive impact of price increases. Judging from the performance in the first half of the year, market expectations are not high either.

As of yesterday, Focus Media's market value was just over 100 billion, which is in line with neutral expectations. Although it cannot be said to have a thick safety cushion, at least there are no visible negative news within the foreseeable range.

Of course, we still need to guard against the worst-case scenario, which is a continuous acceleration of deflation in the macro environment. In that case, Focus Media will definitely follow the consumer stocks in terms of valuation. However, at present, with the strong implementation of stable growth policies, the probability of further deterioration in consumption is relatively small.

However, Dolphin believes that this price increase after a year and a half will still bring some positive signals to the market, at least indicating that the company's judgment for the second half of the year is not pessimistic.

- Steady performance recovery, elevator media rebounds as expected

Focus Media is expected to achieve a net profit attributable to the parent company of 1.21 billion to 1.34 billion in the second quarter, a year-on-year increase of 154% to 156%, and a net profit after deducting non-recurring gains and losses of 314% to 362%. The growth rate is "amazing" given the extremely low base of last year. However, this is not considered a significant overperformance. It reflects the trend of consumer recovery not being as fast as expected, or as Jiangnanchun put it in the annual report and first quarter conference call - a "progressive recovery." It is expected that the signs of recovery will become more apparent after July.

Dolphin tried to restore the situation on the revenue side using profit forecasts:

-

Since the major cost for Focus Media is rent, which is relatively fixed on a quarterly basis unless there are significant changes in the number of locations. However, there were some rent reductions last year and in the first quarter of this year, so we aligned the second quarter's costs with the level of the second half of 2021.

-

Operating expenses, apart from sales expenses, generally tend to be stable. Therefore, the main adjustment is in sales expenses. The second quarter coincided with the return of office building traffic after the Spring Festival and the first major promotion of the 618 e-commerce festival after the epidemic. Therefore, sales expenses need to increase compared to the first quarter.

-

In the end, after all the calculations, the corresponding revenue is approximately 3.2 billion, a year-on-year growth of over 70%. However, compared to the level of revenue exceeding 3.5 billion in each quarter of 2021, it is clear that a full recovery has not yet been achieved.

Of course, this is not a problem specific to Focus Media, but rather the entire industry is in a phase of recovery:

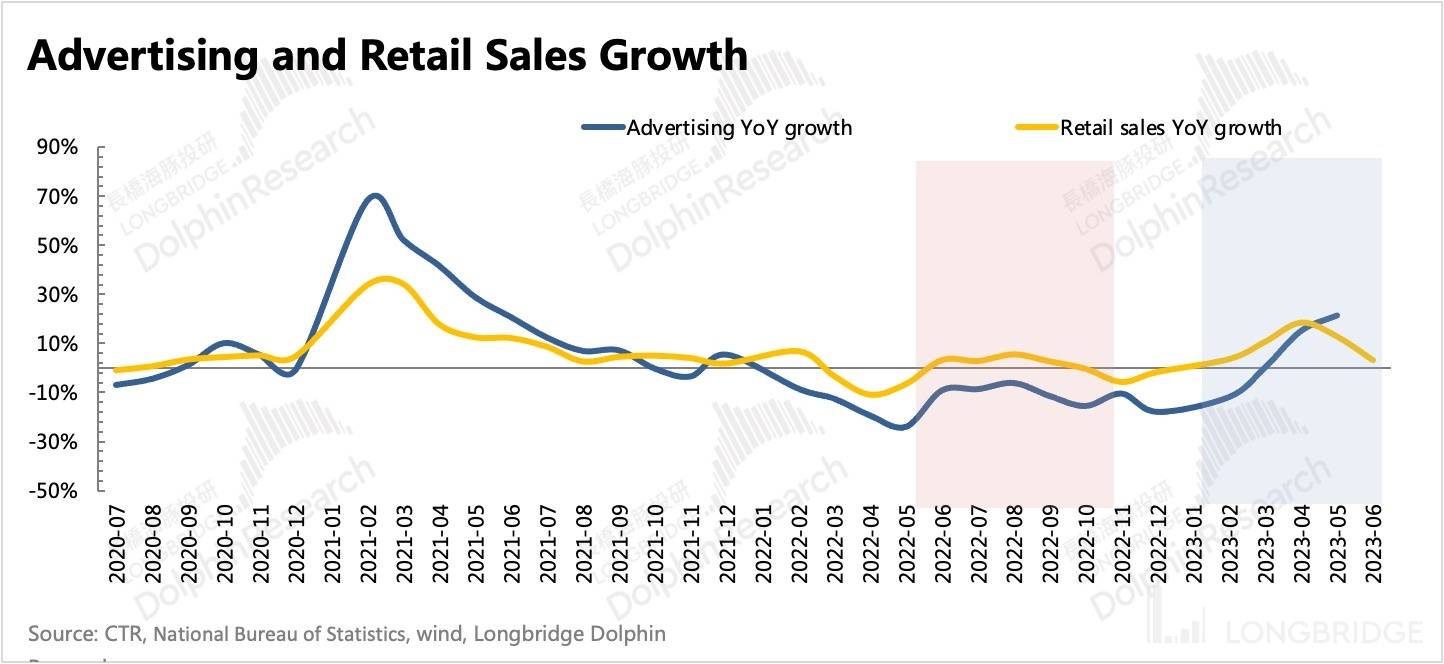

1. Overall advertising industry: The third quarter may be difficult

This year's 618 e-commerce festival consumption did not exceed expectations, and after 618, the demand for consumer goods began to decline again. The market has already anticipated a significant slowdown in June's social retail growth. In addition, the low base period from March to May has just ended. Therefore, in this situation, the period from July to September, which is traditionally a low season for advertising, is expected to be difficult. From the CTR data, it can be seen that the trend of declining advertising placements for some consumer goods (such as alcoholic beverages and dairy drinks) has not yet shown effective relief.

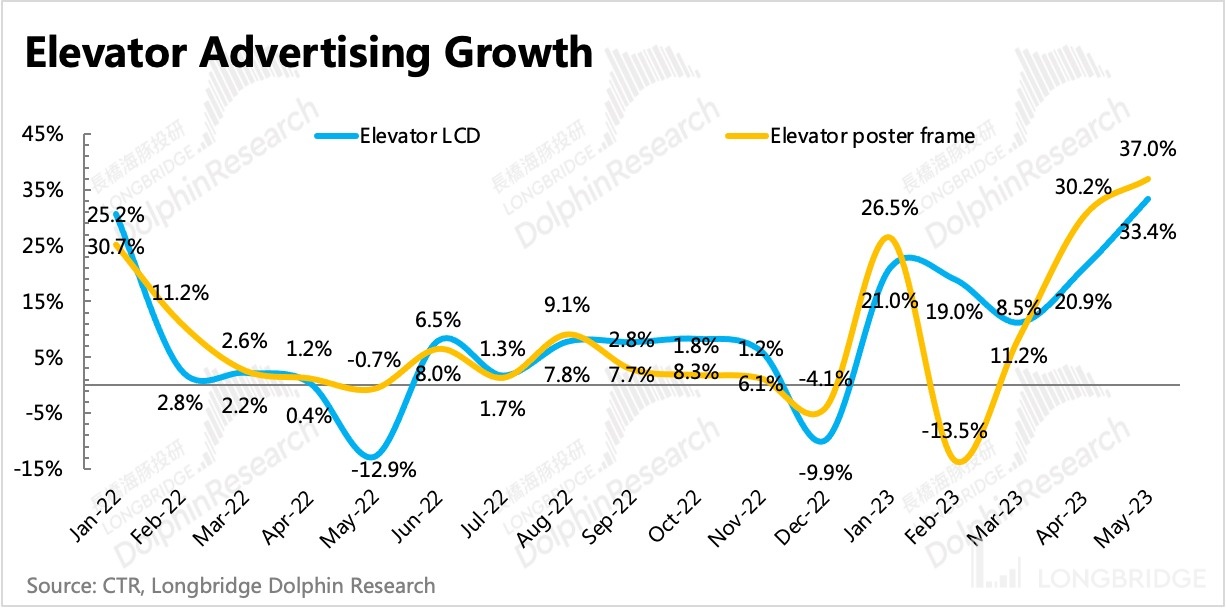

2. Elevator media accelerating recovery

Due to the lockdown during the same period last year, elevator media enjoyed the benefits of a low base period in April and May, with growth exceeding 30%.

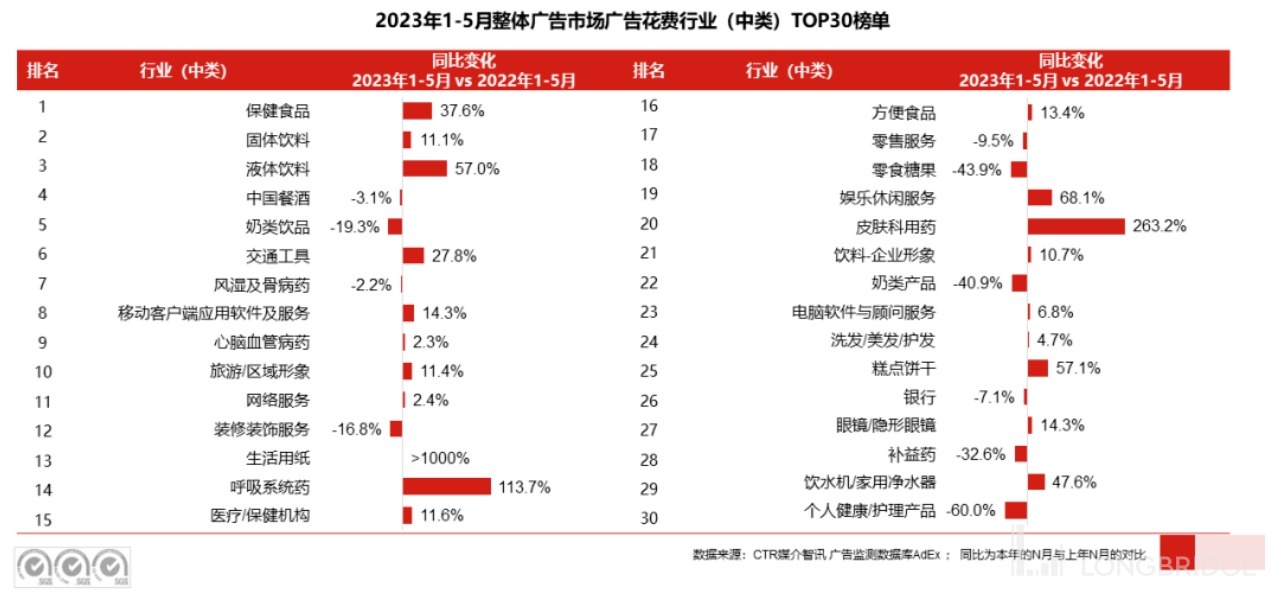

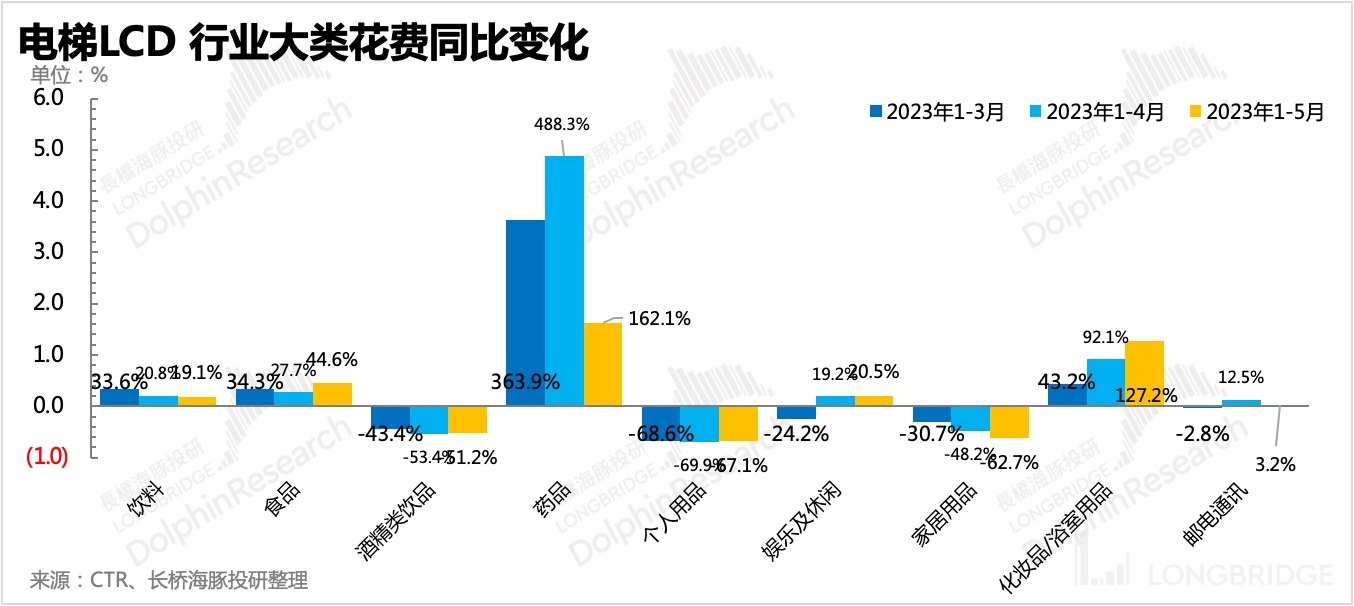

Among different major industries, the performance of advertising placements is deteriorating month by month, and other advertisements are also declining year-on-year. Other categories either show a significant slowdown in the rate of decline or have already achieved year-on-year growth.

!

Chart, Schedule description has been automatically generated

!

Chart, Schedule description has been automatically generated

It is particularly alarming that the decline in the placement of daily consumer goods may indicate a decrease in the medium to long-term growth of consumer goods, which suggests that the previous high valuation may not be sustainable.

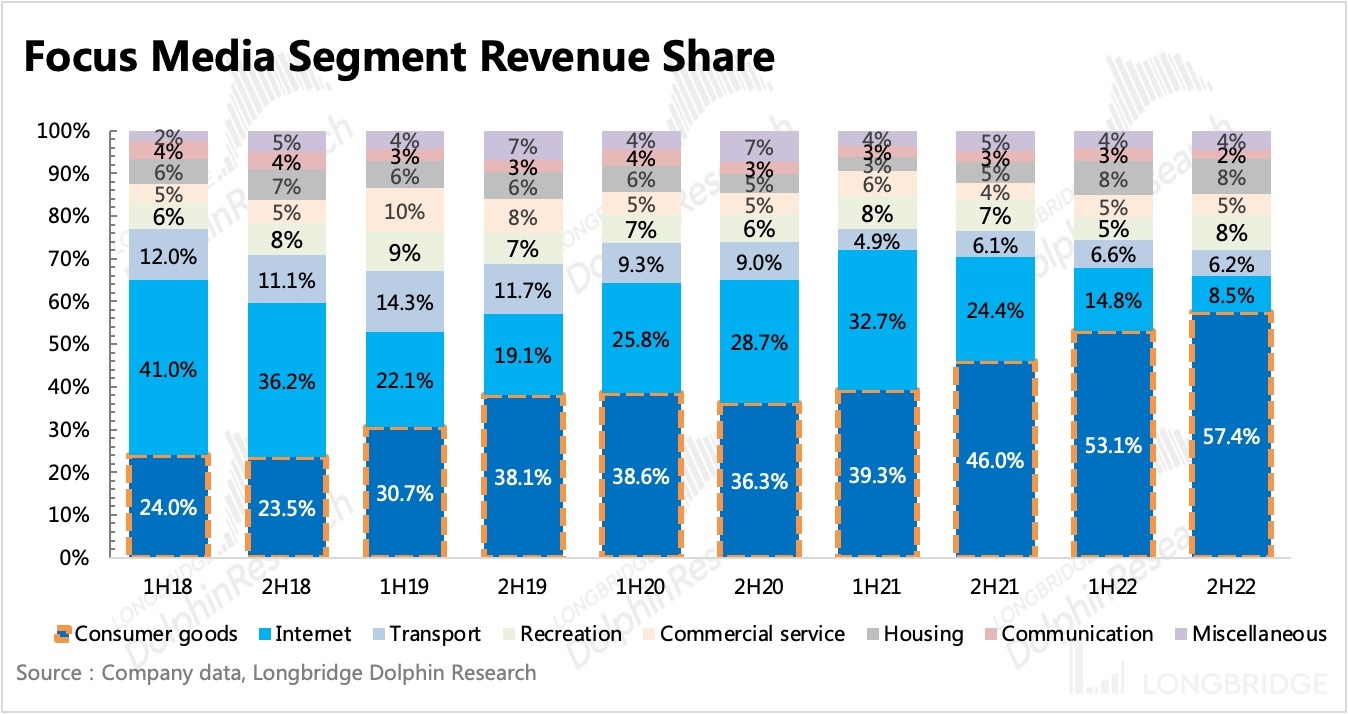

This will also affect the short-term performance and medium to long-term valuation of Focus Media. In the second half of last year, the proportion of daily consumer goods advertising revenue in Focus Media's revenue was 57.4%, and this industry has a significant impact on Focus Media's performance. The pillar of the past years, the internet industry advertising, accounted for only 8.5% of the share. But as Dolphin mentioned, this structural proportion is definitely not the normal level.

The internet industry clearly has a trend and motivation for recovery, but the trend of reducing costs and increasing efficiency has not completely dissipated in the first half of this year. On the other hand, there is already fierce competition among e-commerce platforms, so they have a demand for buying traffic from external channels.

Similarly, this year is also a period of competition among multiple new products, and the necessary brand promotion will also increase. This is also the industry with the fastest growth rate mentioned by Focus Media in the annual report conference call.

In addition, industries that were severely damaged during the epidemic also have a trend of recovery under the strong rebound in demand.

3. Cinemas "Bounce Back"

Cinema media advertising in the industry also benefited from the low base, with a year-on-year growth of 250% in April and a year-on-year growth of over 1000% in May.

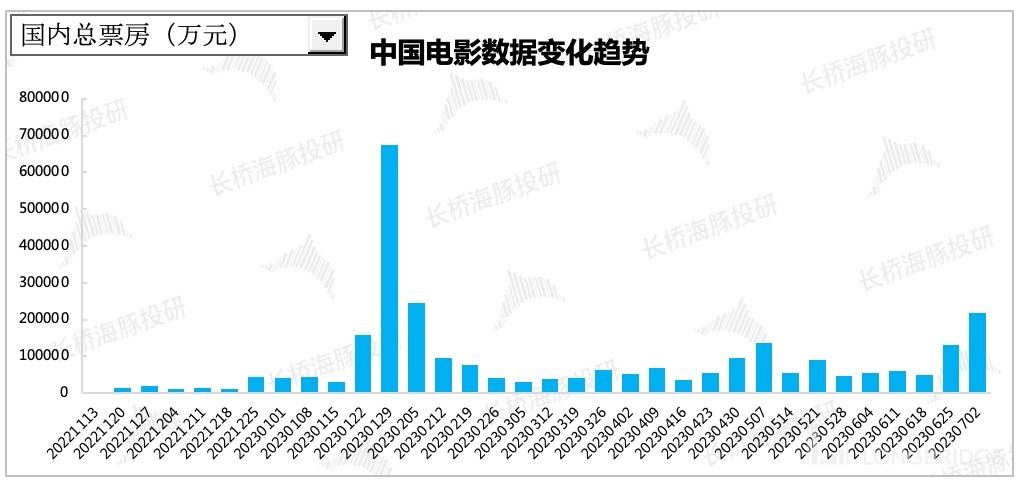

Cinema advertising is directly related to the performance of the current film schedule. In early May, due to the release of "The King's Avatar" and several imported films such as "Guardians of the Galaxy", "Fast 10", and "Spider-Man: Across the Spider-Verse", the box office had a certain increase. After entering the second half of June, due to the success of "She's Gone" and the release of several films in the summer season, such as "Eight-Sided Cage" and "I Love You!", with good box office performance, the overall box office showed a significant increase.

Among the upcoming films, there are several potential blockbusters such as "Super Family" (starring Shen Teng) and "Love" (starring Huang Bo), plus the continued popularity of "She's Gone", it is expected that the summer season will still contribute a good amount of film and television advertising revenue to Focus Media. However, overall, cinema media revenue still accounts for a small proportion, and under different expectations, it will have an impact of approximately 100 million yuan on Focus Media's quarterly revenue.

2. Cautiously Optimistic Outlook for the Full Year

2. Cautiously Optimistic Outlook for the Full Year

Regarding the expected revenue growth for the full year, Dolphin believes that given the low possibility of policy easing exceeding expectations, it is necessary to maintain a cautious outlook on Focus Media's annual revenue and avoid being overly optimistic.

Especially with the impact of weak demand in the consumer goods industry, marketing budgets are expected to decrease. Since consumer goods advertising contributes the most to Focus Media's revenue, it is important to track the trends in social retail and CPI. Dolphin will provide a detailed analysis of the latest macroeconomic data from China and the United States in the weekly strategy report, which can be of particular interest.

Therefore, Dolphin predicts (neutral expectation):

1. Although price increases have already been implemented in July, if consumer recovery remains weak, the expected price increases may be affected by advertising discounts, resulting in a modest recovery trend. The revenue for the third quarter is expected to be slightly lower than the second quarter's level in the e-commerce season.

2. The fourth quarter includes the Double 11 shopping festival, but due to the average performance of the 618 shopping festival, it is expected that merchants will not blindly increase their advertising spending. However, due to price increases and the low base effect, the growth rate is still expected to be relatively high.

3. In terms of costs and expenses, based on the expected expenditure level for a normal year (2021), the estimated net profit for the third quarter is around 1.26 billion, a year-on-year increase of 70%, and the net profit for the fourth quarter is 1.4 billion.

4. Based on the above expectations, the annual revenue is projected to be 12.6 billion, with a net profit attributable to shareholders of 4.9 billion, and the year-end profit margin is expected to recover to 40%. If there are additional stimulus policies that exceed expectations, a more optimistic outlook can be considered.

Overall, Focus Media's performance in the second quarter was relatively flat due to high expectations, and the potential for a more significant recovery in the future may depend on the recovery of consumer demand stimulated by policies. Before the final financial report is released, it is recommended to continue monitoring economic data, advertising rates, and the company's outlook changes during the management performance conference call.

Historical articles about Dolphin "Focus Media":

Earnings Season

May 12, 2023 Conference Call: "Progressive Recovery" Does Not Mean No Recovery, Optimistic Outlook for Q2 (Summary of Focus Media's 2022 Performance Conference)

April 29, 2023: [Focus Media: Disappointing Results? Wave Goodbye and Look to the Future](https://longportapp.com/zh-CN/topics/5592727? invite-code=)》

October 31, 2022《 Focus Media: Going through the darkest times, but unable to escape the fate of the cycle》

August 17, 2022 Telephone Conference《 Consumer goods show resilience, waiting for real recovery through cost control (Focus Media 1H22 conference call summary)》

August 16, 2022 Financial Report Review《 Internet collapse, Focus Media "crippled"》

July 14, 2022 Financial Report Review《 70% profit decline in the second quarter, Focus Media's performance falls into a "pit"》

April 29, 2022 Telephone Conference《 March revenue drops by 45%, Focus Media is struggling (conference call summary)》

April 29, 2022 Financial Report Review《 Focus Media: "Blood flows like a river"? Opportunity arises after reaching a dead end》

November 4, 2021 Financial Report Review《 Starting with Focus Media: Expectations for internet advertising are worth "lowering and lowering"》

August 26, 2021 Telephone Conference《 Shrinking, disappearing, standardizing, the second half of the year is not easy (Focus Media summary)》

August 25, 2021 Financial Report Review《 Focus Media: Looks good? Actually a "thunderstorm"》

April 23, 2021 Telephone Conference《 A fragmented Focus Media conference call summary》 2023 年 12 月 21 日《Spring Comes with Mixed Feelings? Can't Stop the Advertising》

2022 年 8 月 2 日《Into the Gold Pit Again? Is Focus Media "Gold" or "Pit"》

2022 年 7 月 12 日《Focus Media: The "Desperate Fighter" Changing Its Fate》

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.