Posts

Posts Likes Received

Likes ReceivedRoblox: Profits Plummet, Piercing Overvaluation

Hello everyone, I am Dolphin Research!

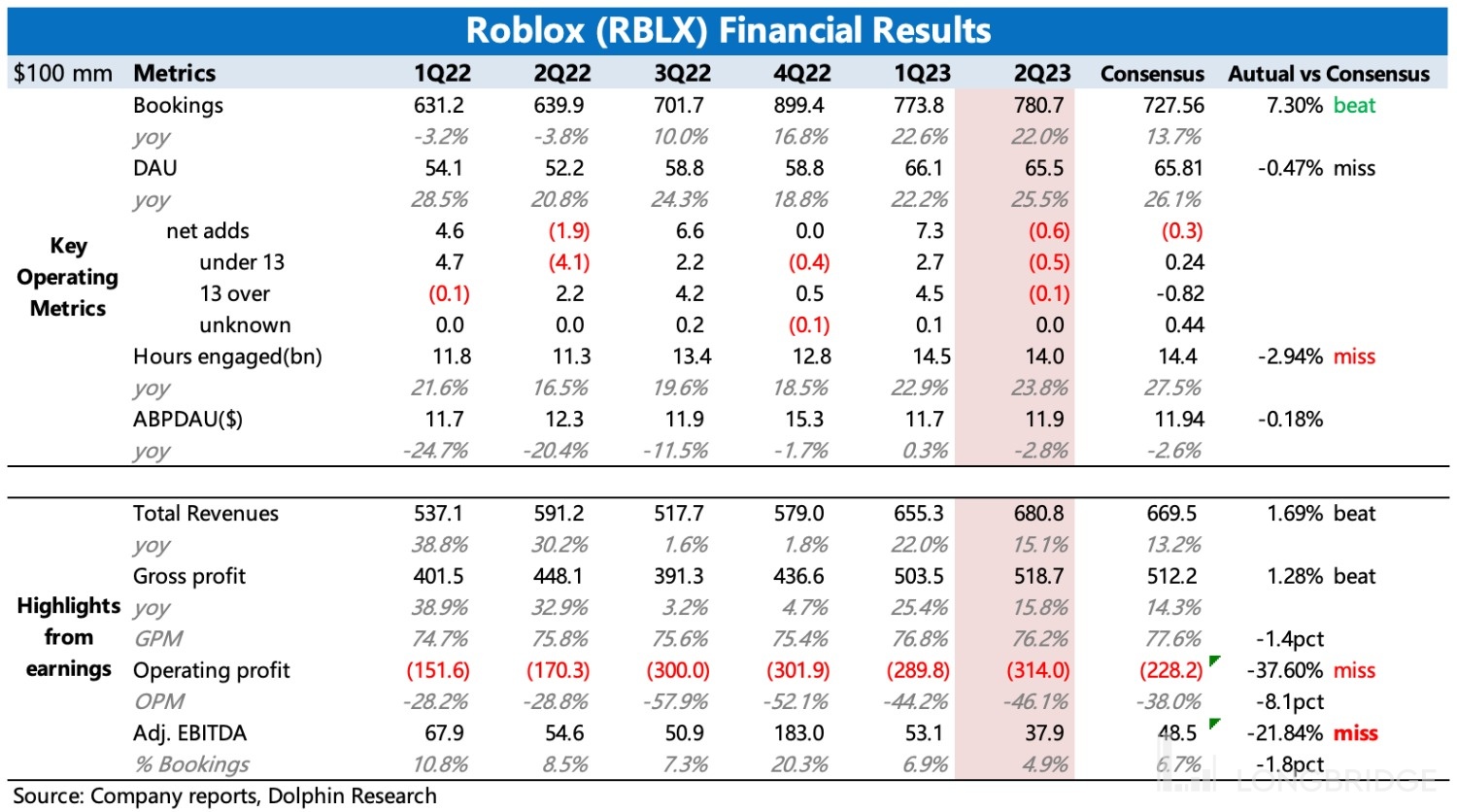

Roblox released its Q2 2023 earnings report before the US stock market opened on August 9th. Due to a significant gap between profits and market expectations, the stock price plummeted by 20% on that day.

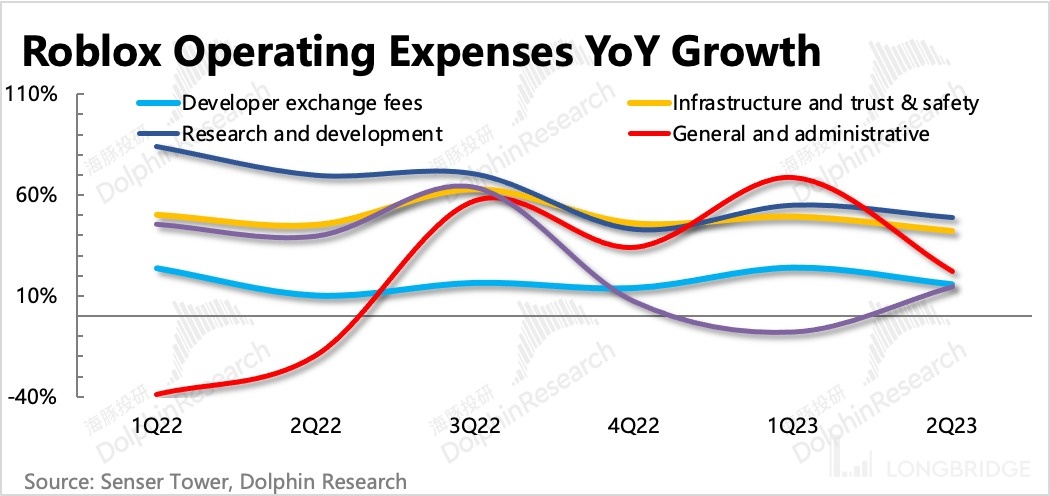

The decline in profit margin was mainly due to "unrestrained" expenses. Although there were concerns in the market about short-term costs related to AI investment before the financial report, the actual expansion of research and development expenses far exceeded expectations.

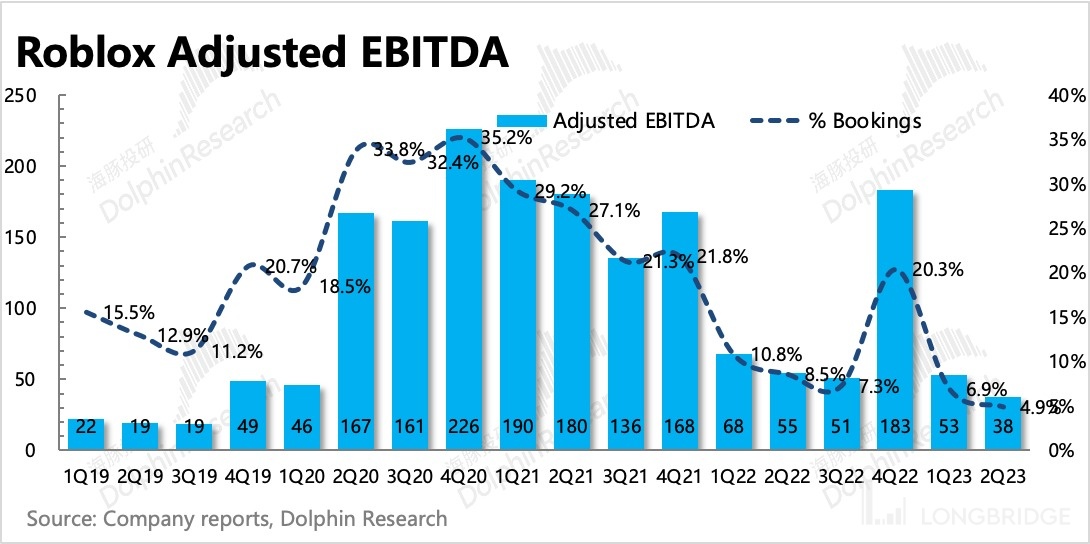

During the conference call, analysts asked the most questions about "profit margin." Although the management provided guidance that the Q4 adjusted EBITDA margin would return to double digits and would also reach double digits in 2024, the market originally had higher expectations, with the Q4 adjusted EBITDA margin expected to be as high as 18%.

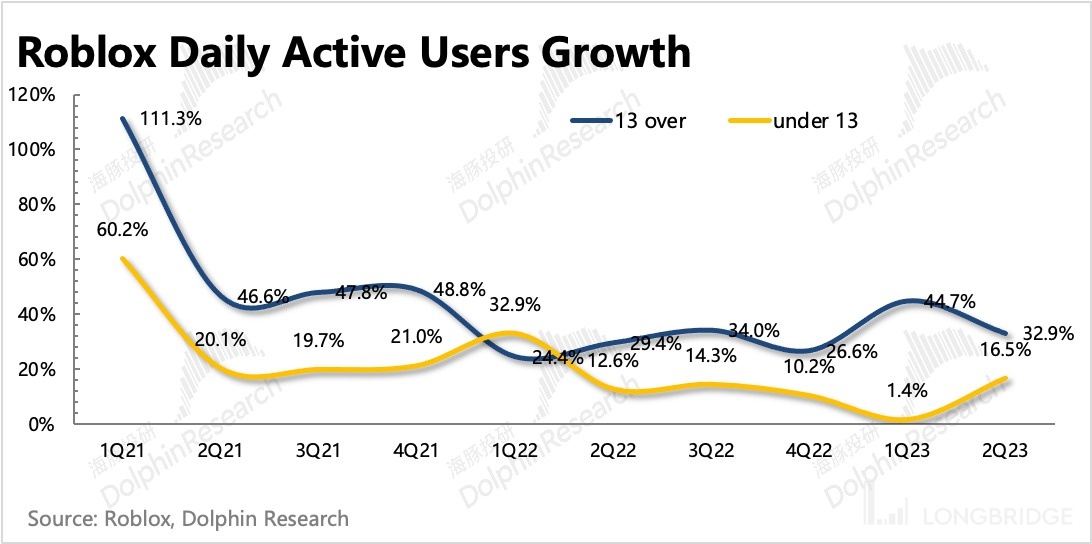

The user data for Q2 did not continue the strong performance of the previous quarter as expected, but instead showed a seasonal decline, making it difficult to salvage the dismal profit margin.

Furthermore, considering Roblox's already high valuation (or valuation support based on future growth), once the performance cannot support it, it is extremely likely to result in a double blow. After Roblox's market value dropped by 20% on that day, it quickly approached our original conservative valuation expectation (17.5 billion, $25 per share after equity dilution). Because there is no profit, the market will immediately change its attitude towards current performance during a market correction. Therefore, from a risk-reward perspective, only when the price falls to a relatively safe level is it a better entry opportunity.

Due to the expectation of a recovery in the gaming market and the potential catalyst of cooperation with Meta VR, we temporarily maintain our original assumptions about Roblox's future prospects. However, due to recent corrections in US growth stocks, those with a higher risk appetite should look for dip-buying opportunities near conservative valuations.

Interpretation of this earnings report:

1. Profits significantly below expectations

In the second quarter, Roblox's earnings report mainly fell short in terms of profit (adjusted EBITDA). The market expected Adj.EBITDA to reach $48.5 million, but the actual company only achieved $37.9 million.

The profit margin deteriorated to 4.9% compared to the previous period. Although the company provided guidance that Q4 could return to double-digit levels, Q4 is already a strong season for Roblox, and it is still lower than the market's previous expectations.

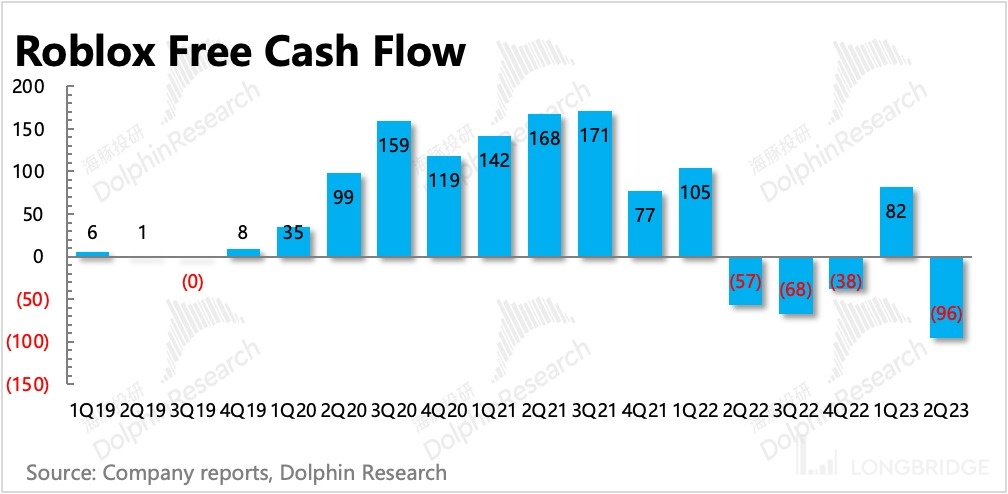

The increase in expenses in the current period is a real expenditure, so the free cash flow in the second quarter doesn't look good.

The increase in expenses in the current period is a real expenditure, so the free cash flow in the second quarter doesn't look good.

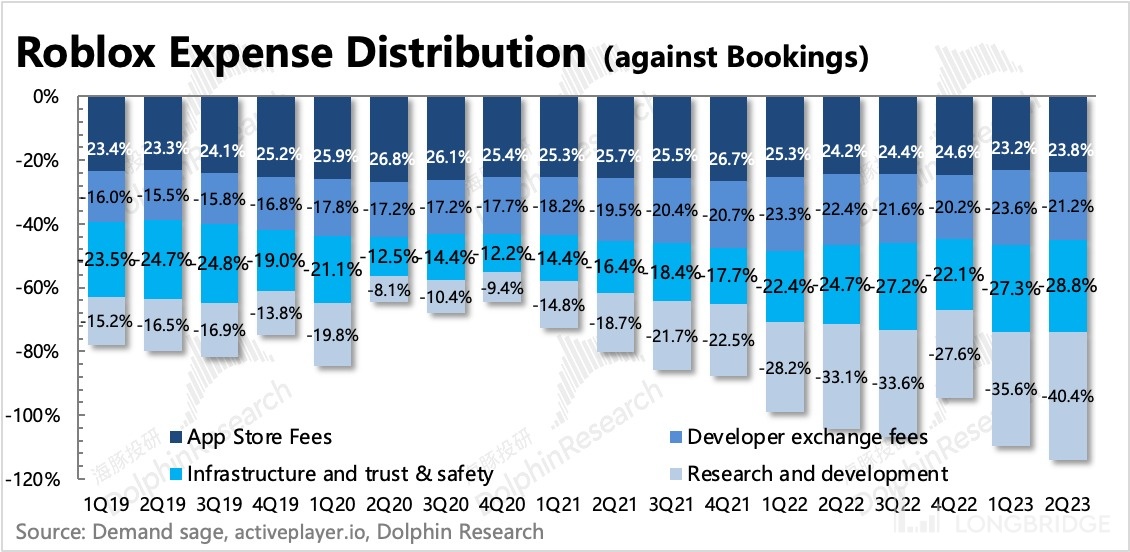

2. Excessive expenses are the main reason

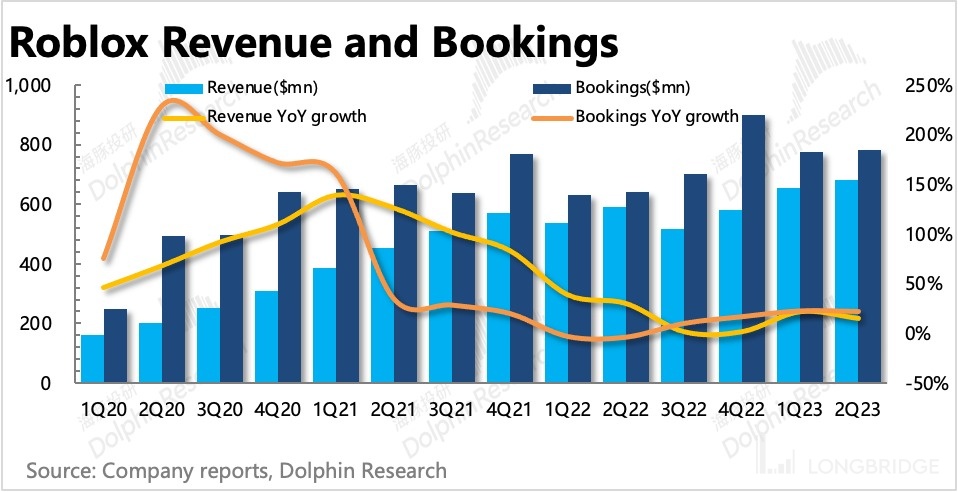

The bleak profitability in the second quarter is mainly due to higher-than-expected expenses, especially in research and development. On the revenue side, indicators such as Bookings are still relatively healthy (+22%), which is better than market expectations.

From the conference call, it can be seen that the increase in research and development expenses should be related to investments in AI. In addition, many users started using voice functions this quarter, and the platform also introduced some new features, such as animation effects. Therefore, infrastructure and security expenses have also increased significantly. The management team guided that the growth rate in Q3 will fall to 20%+, and the growth rate of infrastructure expenses will be lower than that of Bookings in the future.

3. Seasonal decline in traffic

The second quarter did not continue the strong growth of the first quarter, but instead weakened in the off-season. However, the trend has not been broken, so we can still expect further penetration in the future.

Looking at different age groups, the growth of users aged 13 and above has slowed down, but the growth rate of users under 13 has rebounded due to the low base. However, in terms of MoM, the number of active users in both age groups has declined during the off-season.

Although the market is more concerned about the expansion of users aged 13 and above, the management emphasized in the conference call that they no longer focus on the age growth of users, but rather on users of all age groups.

Looking at different regions, except for Asia, other regions have also experienced seasonal declines. However, during the conference call, Roblox specifically mentioned that countries/regions such as Japan, Germany, South Korea, Brazil, and India have shown good YoY growth, especially Japan, where DAU has doubled. 4. Core User Engagement Continues to Improve

Although the MoM active users have declined, the engagement of the remaining user base is increasing. The average participation time per person is still accelerating YoY. This is partly related to the recovery of users under the age of 13, indicating that the core user group of Roblox is still 9-13 years old. However, these users have lower spending power, so they actually bring more technical costs to Roblox.

Dolphin Research "Roblox" Historical Articles:

In-depth

July 18, 2023: "Is it Worth Betting on the Metaverse with Roblox?"

July 13, 2023: "Roblox: Can't Swallow the 'Big Pie' of the Metaverse"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.