The SEC's approval of the spot ETF is a blunder, as Bitcoin plunged after surging over $2,000 in just half an hour.

幣圈媒體稱 SEC 批准貝萊德的現貨比特幣 ETF 後,比特幣半小時內從 2.8 萬美元下方躥升至 3 萬美元上方,後其他媒體稱貝萊德確認為假消息,幣價半小時內跌破 2.8 萬美元。

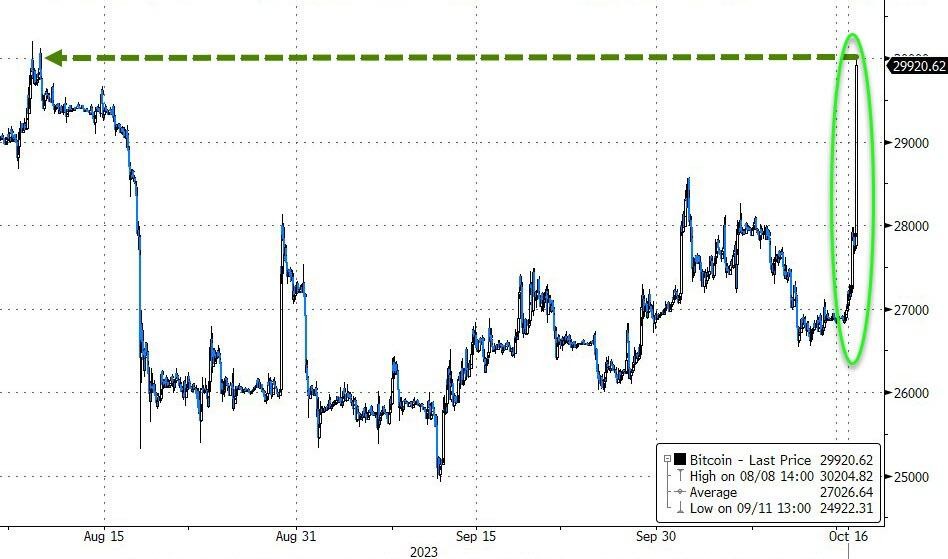

因為一則現貨 ETF 獲批的烏龍,比特幣交易價週一上躥下跳。

美東時間 10 月 16 日週一美股盤前,加密貨幣領域知名媒體 Cointelelgraph 在推特的社交媒體發了一條重磅消息:美國證監會(SEC)批准了全球最大資管機構貝萊德申請上市的現貨比特幣 ETF。

雖然消息並未得到確認,但比特幣交易價聞風而動,不到半小時內,從 2.8 萬美元下方迅速躥升至 3 萬美元上方,三個月來首次突破 3 萬美元關口,較亞市早盤下測 2.7 萬美元的日內低位暴拉超過 3000 美元、漲超 10%。

但美股開盤後,美國主流媒體福克斯的記者發帖稱,貝萊德確認,Cointelegraph 發佈的是假消息,他們的申請還在 SEC 評估中。

Cointelegraph 也編輯了此前發的帖子,在重磅消息的內容中加上了 “據報道” 一詞。

比特幣價格迅速跳水,半小時內從 3 萬美元上方一度跌破 2.8 萬美元,跌超 2000 美元、跌幅超過 7%,後雖然重上 2.8 萬美元,但最近 24 小時內漲幅收窄到 5% 以內。

Cointelegraph 此後發帖致歉,稱其發佈的帖子傳播了有感貝萊德比特幣 ETF 的不準確信息,並稱其目前正在進行內部調查,強調其致力於信息透明度,將在調查完成後三小時內向公眾分享調查結果。

若 SEC 果真批准貝萊德的 ETF 屬實,將是在今年 8 月末美國法院為比特幣現貨 ETF 上市掃清一大障礙後的重大突破。

8 月末,美國上訴法院的裁決推翻了 SEC 阻止 Grayscale 將全球最大比特幣信託基金 GBTC 轉換為比特幣 ETF 的決定。當時有分析指出,這可能為首款現貨比特幣 ETF 上市鋪平道路,貝萊德和另一華爾街巨頭富達的 ETF 申請最容易被獲批,將令更多主流機構接納加密資產。

比特幣現貨若獲批,可能是加密貨幣行業的分水嶺,因為那將讓幣圈可能吸引普通投資者幾十億美元的投資。

本週一盤中,GBTC 的交易價也大漲,美股盤初,GBTC 與比特幣的折價一度收窄到約 14%,為 2021 年來最大折價,今年初時還接近 50%。今年初以來,GBTC 累漲超過 160%,表現遠優於年內漲逾 70% 的比特幣。

上週五,SEC 拒絕就 8 月末的上訴法院裁決提出上訴。此後有媒體指出,最近幾周,GBTC 與比特幣的折價大幅收窄是因為,不少密切追蹤 GBTC 轉為比特幣現貨 ETF 進展的分析師預計,SEC 將很快批准 GBTC 的轉換申請。

有分析師新近發佈報告稱,鑑於 8 月末法院的裁決、最近比特幣現貨 ETF 的申請數量,以及 SEC 與申請方的接觸,現在這個時候,比特幣現貨 ETF 獲批似乎是不可避免的。他們還認為,市場處於釋放數十億美元價值的邊緣。