East Selection "binds" fans with a 199 yuan offer | Insight Research

淘寶 “高開低走”,抖音大本營流量消褪,東方甄選是該出點奇招了。

離今年雙十一還有不到一個月,各大電商平台已紛紛掏出 “殺手鐧”。

天貓將 “全網最低價” 定為核心 KPI;小紅書稱投入了 “前所未有的支持”;騰訊阿里“化敵為友”,視頻號最高 60 萬流量激勵可一鍵直達淘天直播間。

顯然,今年雙十一大戰的主旋律仍圍繞着以 “最低價” 為核心的流量爭奪上,而東方甄選似乎選擇了一條與眾不同的路。

10 月 17 日,東方甄選在自營 APP 內正式上線了 199 元/年的付費會員制度。

價格高於主流電商淘寶88VIP 會員的 88 元/年和京東PLUS 會員卡的 99 元/年,但低於會員制超市山姆260 元/年、Costco 299 元/年的會員費用。

會員可享受包括百款自營品88 折、一年 12 張會員券、66 元券包入會禮等權益,東方甄選頁面介紹付費會員一年最高可節省 1.2 萬元。

看得出,東方甄選正加速為消費者建立 “自營平台” 的心智。其重心不在於普通帶貨直播間所追求的 “全網最低價”,而是類似於山姆,通過提供優質自營商品,和會員服務建立起的平台優勢。

它的價格不一定是最低的,但品質一定是經過 “甄選” 值得信賴的。

儘管這一路線與當前電商界的低價促銷風潮背道而馳,卻是東方甄選想要達成線上 “山姆” 野望的必經之路。

東方甄選急 “脱抖”

東方甄選的崛起,顛覆了我們對傳統網紅直播帶貨的認知。

當一眾抖音網紅沉浸在 “叫喊式帶貨” 時,東方甄選選擇了一條不同的道路——聚集一羣高文化素養的主播,他們不靠吆喝賣貨,而是用故事講產品。

“文化人帶貨” 的獨特標籤很快抓住了大眾的心,一時間流量口碑雙豐收。

當然東方甄選也明白不可能永遠活在一個平台。事實上,從 2022 年夏天爆火後,東方甄選就一直在為獨立電商平台做準備。6 月董宇輝爆火,8 月東方甄選就在各大應用商店上線了獨立APP。

今年,東方甄選的 “脱抖” 舉措更加激進。

一個標誌性事件是今年 7 月底抖音因違規的理由下架了東方甄選自營品直播間,這一看似強有力的打擊,反而造就了東方甄選自家 APP 4 天 GMV 破 1.1 億的高光時刻。

在抖音 “斷糧” 壓力下,東方甄選 APP 更顯平台價值,成功實現流量導入和銷售轉換。

另一個戰略性舉措就是 8 月 29 日東方甄選正式入駐淘寶直播間。

見智研究曾在《淘寶從抖音搶東方甄選》一文中詳細分析 “脱抖入淘” 的意義,不僅在於脱離對抖音流量的依賴,更是看重淘寶作為貨架電商更適合自營品銷售。

在 “不確定性” 中尋找 “確定性”

儘管東方甄選在淘寶的首秀吸引了千萬目光,但這份輝煌沒有持續太久,似有 “高開低走”。

不僅 9 月淘寶開播的多場直播流量出現斷崖式下滑,進入 10 月後,單場觀看量和 GMV 也持續在百萬量級徘徊。

同時東方甄選在主力平台抖音上的表現也不容樂觀。

根據雪球用户 “長空牧星辰” 的數據統計,9 月東方甄選在抖音和 APP 平台的總 GMV 7.23 億元,同比下降 16.2%,抖音單平台 GMV 同比下降 26.82%。

僅靠普通的帶貨已經很難吸引觀眾,哪怕是對東方甄選,觀眾新鮮感也在消褪。東方甄選在抖音直播間暗示有淘寶直播,也在觸發抖音的限流處罰。

不難看出公司現階段的處境:雖已發展出抖音、淘寶和 app 這三個帶貨平台,但業績基本盤還在抖音,而兩者競爭又合作的微妙關係還會繼續,公司進入流量瓶頸期一時間難有突破。

在這個關口,東方甄選選擇再往前走一步,果斷推出會員制度,試圖從 “不確定” 的外部環境中,尋求一個內生增長的 “確定性”。Costco 2022 年高達 54% 的會員費佔 EBIT(息税前利潤)比例,足以説明會員商業模式所藴含的巨大盈利空間。

但東方甄選與山姆、Costco 靠會員費賺錢的商業模式又有很大差異,東方甄選不設會員購物門檻,會員的核心還是在於 “提高用户黏性,增強復購率”,199 元的會員費,更像是購買一整套優惠券,這與主流平台電商唯品會、拼多多類似。

具體來看,加入東方甄選會員後,權益包括限時入會禮包、自營品會員價 88 折,以及每月 1 張共 12 張的 100 元滿減券。優惠券能激發消費者貪圖便宜的心理,為了把券用掉驅動復購,相當於每月至少購買 100 元的商品。

那麼優惠券的滿額就需要與某幾種復購頻率很高的商品結合起來,如一個折扣比率很高的牛肉總價在 80 元,用户再湊到 100 元減 12 元。

這就考驗東方甄選是否具備足夠數量、符合用户購買習慣的 SKU,並且這些商品相比其他平台有更高的性價比,這樣才能吸引用户為了使用券而復購。

截至 23 年 6 月,山姆會員店和 Costco 分別有 4500/3700 款 SKU,其中自營品分別有 600/334 款,佔比接近 10%。而東方甄選截止 9 月自營品數量僅為 214 款,與其他會員店相比自營 SKU 比例偏低。

如果商品 SKU 有限,不能有合適的商品滿足條件,久而久之就無法真的滿足消費者需求,會造成用户流失。

此外,對於還不太瞭解東方甄選、購買頻率不高的普通用户及新用户,199 元/年的門檻仍然較高。

這部分用户可能還停留在 “看直播為主,有時候也會買一買” 的需求,更多建立在董宇輝等主播的價值認同,而非品牌心智。為了1 個月甚至 3 個月不到一次的購買頻率而去花199 會員費,不是一筆劃算的買賣。

顯然對於東方甄選,會員的目的不在於拉新,而是提升老會員的復購率。

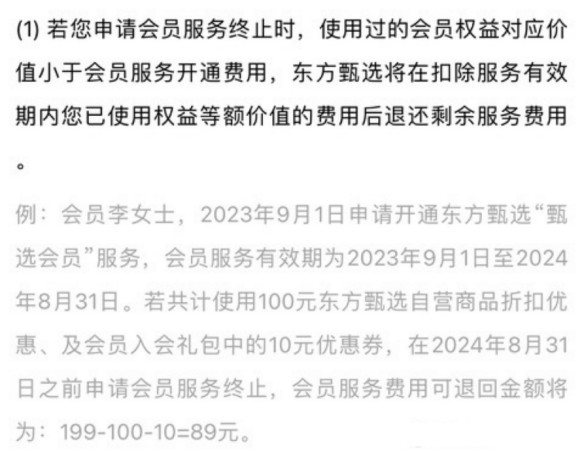

東方甄選在會員條款中同樣有不滿意退費的條款,“退會時返餘額”。這樣的設計有利於降低普通用户試用會員的門檻,增加用户試用意願。即使最終提前退會,也能收回花費,整體試用成本下降,幫東方甄選觸達更多潛在會員。

另外,部分平台會員機制存在一定 “黑箱操作”,用户加入後發現權益無法實現,想要退會時之前支付的會員費和積累的權益全部歸零,造成權益損失。

東方甄選返還餘額的做法也緩解了用户的這一顧慮。

東方甄選仍有遠路

今年以來,東方甄選推出的一系列舉措,從發力自主 APP、入駐淘寶直播到如今推出付費會員,都顯示出其從 “直播帶貨” 向 “自營電商” 轉型的明確邏輯。

東方甄選的目標顯然不是做一個流量驅動的 “帶貨網紅”,也不是像京東、淘寶那樣的 “大賣場”,而是打造一個小而精的 “線上精品商店”。

在這一宏偉藍圖中,直播慢慢成為錦上添花之事,供應鏈將成為自營業務的重中之重。

(東方甄選與山姆會員店、京東、淘天差異)

不過東方甄選相比線下會員店仍有一定侷限性,一方面線上用户不能 “逛商店”,黏性不如線下;

另一方面,會員制電商具有線上選購和送貨上門的便利,因此商品大多為小規格、小包裝、低單價,而線下會員店則是面向家庭大規格大包裝,大規模採購壓低成本毛利更高。

另外自營平台不同於直播帶貨,重心不僅是在選品以及品牌商議價上,而是對貨盤、自主定價能力、成本控制、甚至履約環節都提出了更高的要求,需要重投入,這也是東方甄選相比線下會員制超市所欠缺的地方。

東方甄選也看到了這一差距,努力補足短板。

今年 1 月它宣佈投資 1752 萬元用於自營烤腸工廠的擴建,還與順豐物流、京東物流達成合作,在北京、廣州、成都等五個城市,計劃建立 20 個自營產品倉庫。

截至 2023 年 5 月 31 日,東方甄選整體自營產品品及直播團隊人數達到 1103 人,這當中供應鏈和產品團隊規模達到 346 人。

當被見智研究問到投入供應鏈的進一步動作,截止發稿前東方甄選並未回覆。

綜上

我們能看到,東方甄選正走一條正確的路上,儘管前路道阻且長。

依託外部流量平台帶貨屬於輕資產運營,但外部流量可能只是暫時的,東方甄選正努力將流量轉化為品牌資產。

但一個自營平台,很有可能短期投入了大量資源卻看不到即時的回報,轉化效果也不如直播來得容易,但這是東方甄選必須邁出的關鍵一步。

正如董事長俞敏洪所言,“基於外部的平台所建立起來的熱鬧的商業模式,是有很強脆弱性的,要夯實長期發展的基礎,我們還有很長的路要走。”