Amidst a chorus of bearish voices, the "50 cent" trader takes a bold bet on the "surge of the Japanese yen".

“50 美分” 認為,日本國內為將為了配合日本央行買入國債,推高日元需求;從海外來看,投資者此前借日元進行套利交易,造成了錯配,當日元開始上漲,他們將被迫大量拋售資產,日元需求激增。

關於日元未來走勢,華爾街已經 “吵翻了”,在高盛、瑞穗以及摩根大通等投行的做空聲中,曾名噪一時的 “50 美分” VIX 交易員高呼日元即將暴漲。

這位英國投資公司 Ruffer Capital 的基金經理 Jonathan Ruffer,曾因以 50 美分左右的價格買入 VIX 看漲期權進行押注,並在 2020 年 3 月美股暴跌行情中,通過操作 VIX 期權逆勢大賺 26 億美元而被稱為 “50 美分” 交易員。

10 月 16 日,Ruffer 在給投資者的最新的一封信中寫道,該公司持有日元 “大量頭寸”,並押注日元很快會暴漲:

對於貨幣而言,試圖預測方向的改變總是危險的,即使是基本面因素影響日元未來的走勢,我們的做法也是有風險的。

但我們認為,由於技術原因,日元處於超賣狀態,因此當基本面因素趨於穩定時,日元很可能會 “不可控的暴漲”。這種情況在 2008 年曾經發生過,對我們而言是有利的,我們認為今天的背景將導致與 2008 年類似的漲幅再次出現。

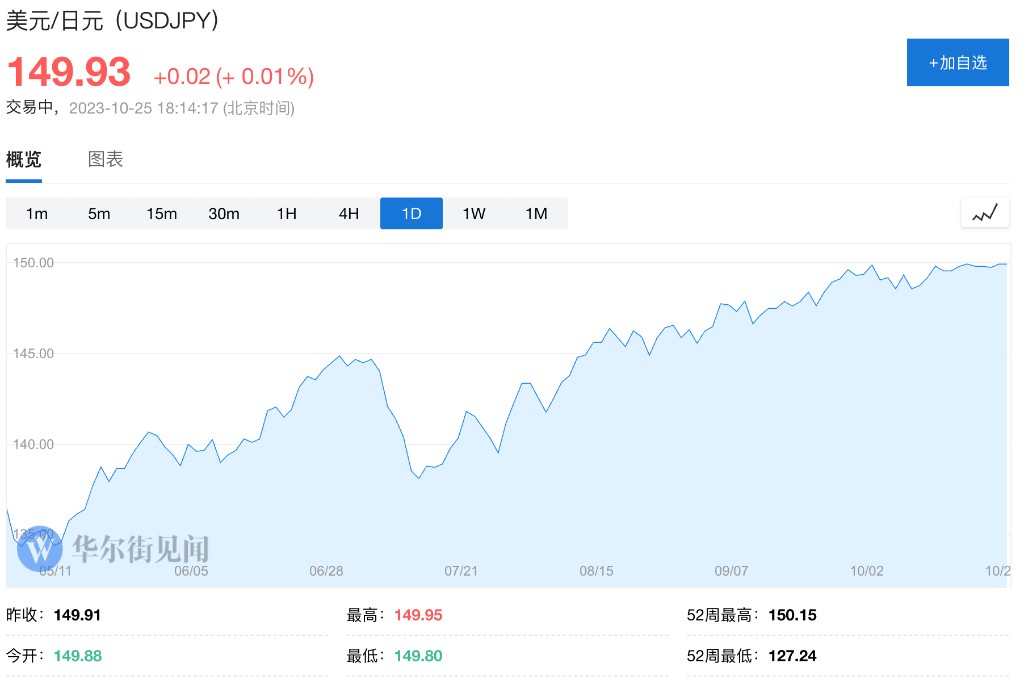

本週日元兑美元匯率短暫跌破 150 大關,由於日美利差持續擴大,日元再次遭遇下行壓力,今年以來,日元兑美元累計貶值超過 12%。

媒體稱,日元不僅是 2023 年全球主要經濟體中表現最差的貨幣,且是彭博數據追蹤的所有國家貨幣中表現最差的。

高盛、瑞穗、摩根大通和美國銀行等機構都認為,日元將繼續跌至 30 多年來的最低水平。根據 CFTC 的數據,自 2021 年初以來,對沖基金仍然大舉做空日元。

但彭博社調查的機構匯率預測中值顯示,日元兑美元明年一季度將升至 1 美元兑 140 日元,到 2024 年底將升至 130。市場對日元預測的分歧達到 7 年來最大。

華爾街見聞此前分析稱,當前華爾街的主要分歧的在於美國經濟前景對美元的影響,以及日本央行究竟何時曲線收益率曲線控制政策 (YCC)。

但 Ruffer 認為不應該從基本面的角度出發思考,他認為日本國內和國際因素將使得各類投資者不得不 “被迫” 大量買入日元,這兩大力量可能引發日元大幅反彈:

我們不認為日元升值僅僅是因為日元相對其他貨幣低估值,因為一般來説弱勢貨幣會繼續變弱。我們關注的是日本國內和國際的兩大技術力量。

第一大力量是日本國內因素。日本央行試圖壓低日本國債收益率,使其遠低於國際水平這不可持續。為解決這個問題,日本國內機構可能被迫大量買入日債,併為此拋售持有的外國債券兑換成日元,推高日元。

第二大力量是國際因素,許多海外投資者先前用日元買入了其他國家資產。這造成了日元與貨幣資產的錯配。如果未來日元開始上漲,這些投資者為了償還日元債務,可能被迫大量拋售資產兑換日元,也會推高日元。