当下华尔街最热交易:“抄底” 美国长债

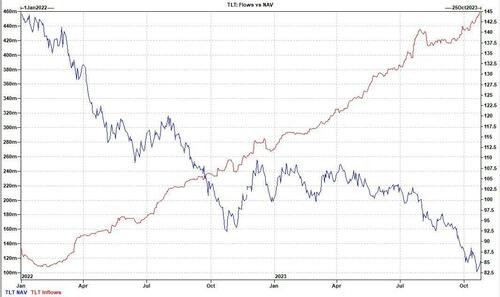

投资于长期美债的 TLT 基金吸纳资金超过任何其他固定收益 ETF,仅次于两只股票基金。

随着美债利率飙升至十多年高位,一直饱受打击的长期国债基金 “咸鱼翻身”,成为眼下华尔街最热门的投资之一。

仅周二和周三,投资者就向 iShares 20+ Year Treasury Bond ETF 增资超过 20 亿美元,使其今年迄今的总流入额达到 210 亿美元。其基金份额接近 16 年来的最低点,价值从 2020 年的峰值已经腰斩逾半,目前投资者源源不断涌入。

这只由贝莱德管理的价值约 400 亿美元的基金,简称 TLT,被动投资于长期美债,当前收益率约为 5%,与 30 年期美债相当。它吸纳的资金超过任何其他固定收益 ETF,仅次于两只股票基金。

贝莱德固定收益 ETF 全球联席主管 Steve Laipply 表示:

就在过去一周,我们开始看到资金流入,我预计这趋势会在投资者寻找收益率可能已经见顶的迹象时加速。

不仅仅是贝莱德,包括先锋、Pimco 在内的大型机构都在抄底美债。据美银统计,上周出现了自 3 月 23 日硅谷银破产以来最大的周度美债资金净流入 (92 亿美元),其中长期美债资金出现有记录以来最大净流入 (56 亿美元)。

许多投资者押注美国经济即将放缓,债券市场的阵痛已经接近尾声。他们相信,飙升的债券收益率已经推高了借贷成本,美国经济不可能继续维持高速增长。等到经济大盘放缓,就是债券触底反弹的时刻。

TLT:交易员最青睐的工具

TLT 已成为大型和小型投资者押注债券收益率路径或者简单增加长期债券敞口的关键,任何拥有券商账户的人都可以买入该基金的股份。

简单来说,该基金的规模、流动性和活跃的期权市场使其成为华尔街交易员最青睐的工具,比直接买入和卖出基础债券更为方便。

根据 Dow Jones 市场数据,TLT 的 12 个交易量最大的日子中,有 10 个出现在 9 月 20 日最后一次美联储会议之后。美联储主席鲍威尔最近暗示,长期美债收益率上行可能会叫停加息。鲍威尔将在 11 月议息会议结束后召开新闻发布会,届时市场所有目光将再次聚焦于他,以获取任何关于利率路径的线索。

然而,到目前为止,那些逢低买入 TLT 的人尚未看到回报。

近几个月,该基金吸引了大量的多头和空头博弈。根据 S3 Partners 的数据,TLT 的卖空者今年总共押注了 4.26 亿美元,该基金目前约有 10% 的份额被卖空。

胜利的时刻即将到来?

Laipply 补充说,今年 TLT 的大部分资金流入可能来自寻求通过更高收益增加固定收益敞口的投资者。

美国债市刚刚遭遇四十年一遇的熊市。自 4 月一连串地区性银行倒闭引发信贷紧缩和经济衰退预警以来,彭博美国国债指数一路下跌。与此同时,10 年期国债收益率从 4 月份的 3.25% 低点飙升至 5% 以上,30 年期美债收益率曾低至 3.5%,近日也突破 5% 的大关。

5% 左右的债息为投资者提供了自 2007 年以来最高的债券收入来源,有助于债券和股票竞争。使投资组合在风险资产承压时更具弹性。

Pendal Group 收益策略主管 Amy Xie Patrick 对媒体表示,鉴于目前的收益率,她看好债券。她认为,通胀和经济增长再次加速的可能性不大。

债券巨头 Pimco 的投资组合经理 Mike Cudzil 也对媒体表示:

收益率上升最终会减缓经济增长。我们已经做好准备,一旦经济开始放缓,就是胜利的时刻。

今年,分析师和经济学家全年都在预期经济衰退,但经济放缓一直没有出现。无情上升的收益率,惩罚了那些押注 2023 年将是 “债券年” 的固收投资者。

但随着基准美债收益率冲上 5%,债券反弹的信心开始蔓延。EPFR数据显示,在截至10月25日的七天内,每周流入美国长期主权债务基金的资金达到57亿美元,创下历史最高纪录。

长期国债是传统的避风港资产,在市场波动和地缘政治不稳定的时刻,买入债券通常被视为安全的选择。

先锋国际固定收益部门主管 Ales Koutny 认为,从纯风险回报的角度来看,配置债券,是有意义的选择:

我认为,目前债券的关键在于,当经济消息真正转向时,比如 3 月份硅谷银行动荡或经济衰退时,只有债券才能真正保护你的资本。