“非农次日” 纳指创九个多月最长连涨,美元脱离七周低位,油价盘中涨 2%

市場等待美聯儲主席鮑威爾等至少 9 位聯儲官員本週講話,交易員押注 12 月不加息的概率高達 90%。美股尾盤轉漲,納指自 1 月份以來首次連漲七日,道指和標普大盤連漲六日,羅素小盤股跌超 1%。OpenAI 開發者大會提振大型科技股,微軟七連漲至四個月最高,C3.ai 等 AI 概念股回調。中概指數盤初漲近 2% 跑贏大盤,最終微跌仍徘徊三週高位,拼多多、京東和阿里巴巴等 “雙 11” 概念股齊漲,理想汽車漲超 8%,鬥魚跌 10%。美元和美債收益率尾盤刷新日高,兩年與 10 年期美債收益率均漲 11 個基點,美元脱離近七週最低,離岸人民幣一度漲 200 點至 7.27 元。油價收漲,但美油仍徘徊兩個月低位,布油接近一個月最低,天氣暖和令歐美天然氣齊跌超 6%。現貨黃金尾盤刷新日低失守 1980 美元,倫敦金屬齊漲。

投資者等待美聯儲主席鮑威爾在內的至少 9 位聯儲官員本週講話。美聯儲理事庫克沒有置評貨幣政策,但警告對沖基金和貨幣市場等非銀機構可能會放大金融狀況收緊和經濟放緩的壓力。

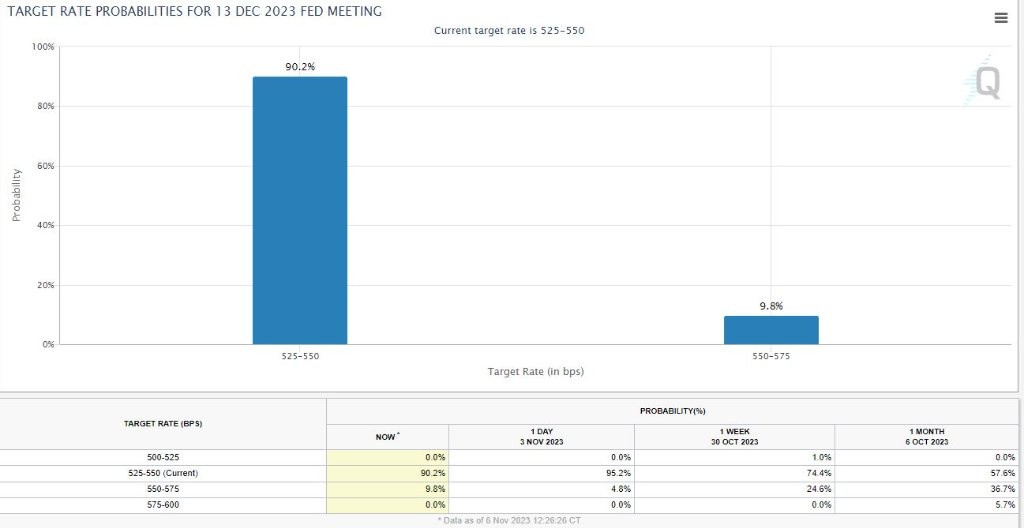

期貨交易員押注 12 月美聯儲不加息的概率高達 90%,主要因上週五的 10 月非農就業增加了對美國經濟放緩預期,或支持美聯儲結束加息週期。下個焦點是下週的 10 月 CPI 通脹數據。

但歐元區經濟衰退擔憂加劇,10 月 PMI 終值跌至 2020 年 11 月來最低,且連續五個月萎縮,服務業進一步疲軟,商業活動加速下滑,排除新冠疫情干擾後的新訂單指數創十一年最低。

市場預計美聯儲基準利率只會在明年 6 月前保持 5% 上方,明年底前或有四次 25 個基點的降息,對歐央行的明年降息預期也有 100 個基點之多,且明年 4 月開啓降息的可能性約 80%。

但有歐央行票委週一警告稱,必須準備好在必要時再度加息,英國央行首席經濟學家稱該國通脹仍然太高且頑固,澳洲聯儲也可能本週二因通脹居高不下而恢復加息。

美股尾盤轉漲,納指自 1月份以來首次連漲七日,OpenAI開發者大會提振大型科技股

11 月 6 日週一,繼上週美股三大指數均創今年最佳單週漲幅之後,主要指數集體高開,不過午盤時悉數轉跌,羅素小盤股跌 1.6% 表現最差,儘管國債收益率反彈,標普科技板塊保持漲勢。

尾盤時美股重新轉漲,但小盤股維持跌逾 1%。最終道指六日連漲,站穩 3.4 萬點上方,刷新 9 月 21 日以來的六週多最高;標普大盤連漲六日,刷新 10 月 17 日以來的三週最高,與道指分別創 6 月和 7 月以來最長連漲;納指連漲七日創 1 月份以來最長週期,也創 10 月 17 日來最高。羅素小盤股止步五日連漲、脱離兩週半高位:

標普 500 指數收漲 7.64 點,漲幅 0.18%,報 4365.98 點,房地產板塊領跌大盤。道指收漲 34.54 點,漲幅 0.10%,報 34095.86 點。納指收漲 40.50 點,漲幅 0.30%,報 13518.78 點。納指 100 漲 0.4%,羅素 2000 小盤股指數跌 1.3%,“恐慌指數” VIX 微跌且仍不足 15 關口。

納指自 1 月份以來首次連漲七日,道指標普連漲六日,羅素小盤股下測 50 日均線

明星科技股午盤後漲幅擴大。元宇宙” Meta 漲 0.4%,蘋果漲 1.5%,均至三週最高,亞馬遜漲 0.8%,連漲七日至七週最高,奈飛漲 0.5% 至八週最高,微軟漲 1%,連漲七日至近四個月最高,谷歌 A 漲近 1% 收復 10 月 24 日來近半跌幅;特斯拉漲近 3% 後轉跌 2%,最終收跌 0.3%。

芯片股漲跌不一。費城半導體指數跌超 1% 後收跌 0.3%,止步四日連漲仍接近兩週半高位。英特爾微跌但徘徊七週最高,AMD 跌幅收窄至 0.5% 脱離三個月最高,英偉達漲 1.7% 至三週最高。

AI概念股回調。C3.ai 跌近 6% 脱離兩個月最高,Palantir Technologies 跌近 2% 脱離三個月最高,SoundHound.ai 跌超 3% 脱離兩週半高位,但 BigBear.ai 漲超 3%,三日連漲至一個月高位。

消息面上,特斯拉計劃在歐洲生產 2.5 萬歐元的平民版電動汽車,尚未提供時間表,其德國工廠產能計劃翻倍至每年 100 萬輛車。OpenAI 舉辦首屆開發者大會,發佈其最強 AI GPT-4 Turbo,並允許用户構建自定義版本的 ChatGPT。美國銀行看好英偉達將於 11 月 21 日發佈的三季報,預計超預期且上調業績指引。

中概指數盤初顯著跑贏美股大盤,隨後漲幅收窄。ETF KWEB 漲 2% 後收漲 0.4%,CQQQ 漲近 2%,納斯達克金龍中國指數(HXC)盤初漲近 2% 微跌,雖止步兩日連漲,仍徘徊三週高位。

納斯達克 100 成份股中,京東漲 0.6%,百度跌超 1%,拼多多漲 0.7%。其他個股中,阿里巴巴接近抹去 1.7% 的漲幅,騰訊 ADR 漲超 1%,B 站跌 1%,蔚來汽車跌超 3%,小鵬汽車漲 1.7%,理想汽車漲超 8%。盤前漲超 15% 的每日優鮮收漲 2.7%,CEO 陳少傑上月失聯的消息後鬥魚跌 10%。

銀行股指止步五日連漲。行業基準費城證交所 KBW 銀行指數(BKX)跌 0.9% 脱離六週高位,兩週前曾創 2020 年 9 月以來的三年最低。KBW 納斯達克地區銀行指數(KRX)跌 1.2% 脱離七週最高,5 月 11 日曾創 2020 年 11 月來最低。但美國資產值第三大的銀行花旗集團跌 1% 後跌幅砍半,脱離六週最高,媒體稱其考慮在幾大主要業務部門裁員至少 10%,高管裁員比例或更高。

其他變動較大的個股包括:

巴菲特旗下的伯克希爾哈撒韋公司 A 類股跌 1.4%,止步五日連漲並脱離五週高位,儘管三季度營業利潤大增 40% 至 107.6 億美元,現金儲備創紀錄新高至 1572 億美元。

美國第四大在線直播電視節目提供商 Dish Network 跌超 37%,創上市後最差表現,股價失守 4 美元至 1998 年末以來的二十五年最低,三季度每股意外虧損,營收也不及預期。

迪士尼週三財報前宣佈,在百事可樂工作 34 年且過去幾年升任 CFO 的 Hugh Johnston 將跳槽至迪士尼擔任 CFO 兼高級行政副總裁,迪士尼跌超 1% 暫離兩週高位,百事可樂基本抹去 1% 的跌幅。

媒體娛樂巨頭派拉蒙全球跌近 8% 脱離七週高位,美國銀行將評級從 “買入” 直接下調兩級至 “賣出”,稱近期不存在出售部分業務的重大機會,上週該股因三季報利好在週四和週五大漲 27%。

電動汽車電池鋰主要供應商美國雅寶公司(Albemarle)跌近 7% 至三年新低。瑞銀將評級從 “買入” 下調至 “中性”,並削減目標價超過 40%,稱未來鋰銷量增長面臨風險。

歐股普跌,僅英國股指收平。泛歐 Stoxx 600 指數收跌 0.16%,止步五日連漲,仍徘徊兩週高位,油氣板塊漲近 1% 領跑。英國中盤股指數跌超 1.3%;明晟 ACWI 全球指數連漲六個交易日。

美債收益率尾盤刷新日高,兩年與 10年期收益率均漲 11個基點,歐債收益率追漲

在上週五大跌後,美債收益率週一集體走高,對貨幣政策更敏感的兩年期美債收益率升 11 個基點至 4.94%,脱離兩個月最低,上週五曾下跌 9 個基點、上週累跌 18 個基點。

10 年期基債收益率也漲超 11 個基點至 4.67%,脱離五週半低位,上週五曾下跌 13 個基點至 4.48%、上週累跌約 29 個基點,創 3 月份以來的至少八個月最大單週跌幅。

歐債收益率也追隨美債表現而齊漲,負債較深外圍國家基準的 10 年期意債收益率漲超 13 個基點領跑。

歐元區基準的 10 年期德債收益率漲約 10 個基點,尾盤刷新日高至 2.74% 且止步七日連跌。上週五美國非農就業發佈後曾創 9 月 15 日以來七週最低 2.63%,以及五個月來最大單週跌幅。

兩年期德債收益率漲近 7 個基點。法國和西班牙 10 年期基債收益率均漲超 10 個基點。此外,兩年期英債收益率漲超 4 個基點,脱離上週五所創的近五個月最低,10 年期英債收益率漲超 9 個基基點,尾盤刷新日高至 4.38%,上週五曾創五週半最低。市場等待英國三季度 GDP 數據。

油價盤中漲約 2%後收窄,美油徘徊兩個月低位,布油接近一個月最低,歐美天然氣齊跌

沙特和俄羅斯重申縮減石油供應至年底,油價齊漲但午後漲幅收窄。WTI 12 月期貨收漲 0.31 美元,漲幅 0.38%,報 80.82 美元/桶。布倫特 1 月期貨收漲 0.29 美元,漲幅 0.34%,報 85.18 美元/桶。

美油 WTI 最高漲 1.72 美元或漲 2.1%,日高一度升破 82 美元,但仍徘徊 8 月底以來的兩個月低位。布油最高漲 1.57 美元或漲 1.8%,一度升破 86 美元,仍徘徊 10 月 6 日以來的一個月低位。

有分析稱,沙特將維持減產 100 萬桶/日、俄羅斯將繼續削減是石油及其製品出口 30 萬桶/日,疊加美國加大對伊朗石油制裁迫在眉睫,均有利於抬升油價。但沙特和俄羅斯減產的背景是擔心經濟與需求疲軟,可能會延長減產至明年一季度,仍會觸發油價擔憂,上週油價累跌 6%。

歐洲基準的 TTF 荷蘭天然氣期貨尾盤跌超 6%,進一步遠離 50 歐元/兆瓦時整數位,創 10 月 9 日以來的四周低位;ICE 英國天然氣也跌超 6.5%,均受累於供應充足與天氣暖和。美國天然氣期貨跌超 7% 至一週新低,同樣由於暖和天氣不利於美國東海岸的取暖需求。

美聯儲加息結束押注令美元持穩,脱離近七週最低,離岸人民幣一度漲 200點至 7.27元

衡量兑六種主要貨幣的一籃子美元指數 DXY 小幅上漲並持穩於 105 上方,稍早觸及 9 月 20 日以來的近七週最低。上週三曾在 10 月 4 日來首次升破 107,但全周累跌 1.4% 創 7 月以來最大跌幅。

歐元兑美元在美股盤中轉跌,仍站穩 1.07 上方,脱離稍早的 9 月 13 日以來近八週最高。英鎊也小幅轉跌並失守 1.24,稍早創七週高位。日元兑美元重新跌向 150 大關,脱離月內高位,有分析認為 155 關口或引發日本政府救匯。離岸人民幣一度上逼 7.27 元,較上日收盤最高漲 200 點。

有分析稱,由於人們對美聯儲已經完成加息的信心增強,導致近期美債收益率迅速回落,也令美元指數跌離高位。

主流加密貨幣多數上漲。市值最大的龍頭比特幣重上 3.5 萬美元關口,徘徊去年 5 月以來的 18 個月最高。第二大的以太坊也小幅上漲並上逼 1900 美元整數位,創近四個月最高。

現貨黃金尾盤刷新日低失守 1980美元,倫敦金屬齊漲,鋅漲近 2%,鋁鎳錫均漲超 1%

美元持穩和美債收益率走高令金價承壓。COMEX 12 月黃金期貨收跌 10.60 美元,跌幅 0.53%,報 1988.60 美元/盎司,12 月期銀跌 0.22% 至 23.234 美元/盎司。

現貨黃金在美股午盤後跌幅擴大至 0.7%,刷新日低並失守 1980 美元整數位,日內跌 14 美元,抹去 10 月 26 日以來的一週多漲幅。

有分析稱,若令黃金持續站穩 2000 美元上方,或需美聯儲發出降息即將到來的更明確信號,以及投資者回歸 ETF 購買。10 月在中東衝突的避險需求推動下,金價累漲超 7%,期貨淨多頭增多。

倫敦工業基本金屬齊漲。經濟風向標 “銅博士” 漲 0.8%,倫鋁漲 1.5%,倫鋅漲 1.9%,均創 10 月初以來的五週新高。倫鉛漲 0.4% 至五週多高位,倫鎳漲 1.2%,倫錫漲 1.3%,均至月內最高。

滬鋅夜盤收漲近 1.3%,國際銅和滬銅夜盤漲 0.4%,滬鋁和滬錫漲 0.9%,滬鎳漲 0.3%。上週五上海期交所的銅庫存上漲 11% 仍徘徊一年低位,LME 庫存連漲數月後下跌,都是需求利好信號。